Current Landscape

The understanding of Asian credit has experienced some changes over recent years. The traditional view of Asian credit has largely been U.S. dollar bonds from Asian issuers outside Japan. This was also how most investment and risk teams were set up in the region. Teams that were set up to manage the broader Asia-Pacific (APAC) markets—which include Australia, New Zealand and Japan—only existed within a few organizations.

Today, there is much more acceptance of an APAC viewpoint. This change was driven by a couple of factors—namely the unfolding of the real estate crisis in China, which had a profound impact on the Asian high yield market, as well as the need for greater geographical diversification within the Asian credit space. For context, as of Feb. 29, 2024, the weight of USD bonds with exposure to China was around 40.3% in the Asia ex-Japan market, as represented by the iBoxx USD Asia ex-Japan. The same exposure drops to 26.7% in the context of APAC, as represented by the iBoxx USD Asia-Pacific.

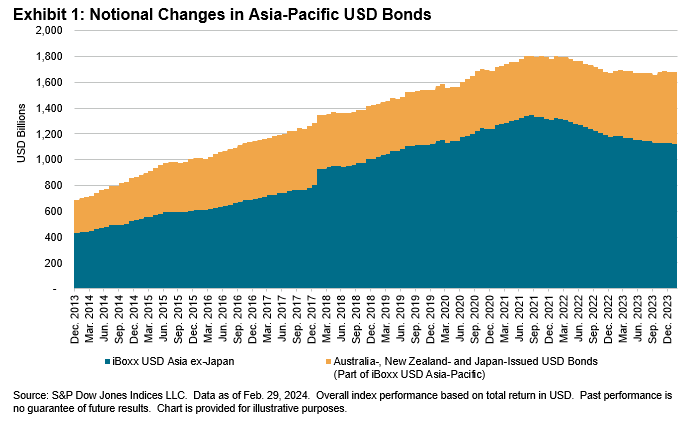

Over the course of 2022 and 2023, the total notional of Chinese USD bonds in the iBoxx USD Asia-Pacific dropped more than 30%, largely due to defaults from Chinese real estate issuers and debt refinancing moving onshore or to the dim sum bond market. Meanwhile, APAC USD bonds issued outside of China painted a different picture.

Over the same period, non-China APAC USD bonds increased by 8.8%. Despite the uptick, overall growth in the segment slowed to more than one-half of the level seen in 2020 and 2021. On top of the tightening of monetary policy in the U.S. driven by higher inflation in 2022—making issuing new bonds much more expensive—uncertain economic conditions also resulted in companies being less willing to take risks, and thus reduced borrowing for business expansions.

As seen in Exhibit 1, the notional of Asian credit bonds (as measured by the iBoxx USD Asia ex-Japan) grew substantially over the past 10 years, despite the recent slowdown. From Dec. 31, 2013, to Feb. 29, 2024, it saw an (absolute) increase of 262.2%, slightly larger than the 245.8% increase in the broader APAC markets, as measured by the iBoxx USD Asia-Pacific.