Executive Summary

Volatility-controlled indices (VCIs), also known as risk control indices, are commonly used as index account options within index-linked annuities. The goal of the indices is to provide exposure to an underlying index while realizing a volatility level close to a target.

The most common components of a VCI are an equity component and a theoretical cash component. VCIs dynamically allocate between these components in an effort to realize the target volatility level. Allocation in in the index context refers to the weight attributed to each asset class within the index.

As a general principle, when market volatility is higher than the target volatility level of the index, the index will allocate away from equity to the cash component to dampen volatility. On the other hand, when market volatility is lower than the target, the index can allocate more than 100% to the underlying index component, which is referred to as leverage.

The ability to either move index component weighting below or above 100% helps the index as it seeks to maintain a target volatility level.

What Is the Impact of the Target Volatility Level?

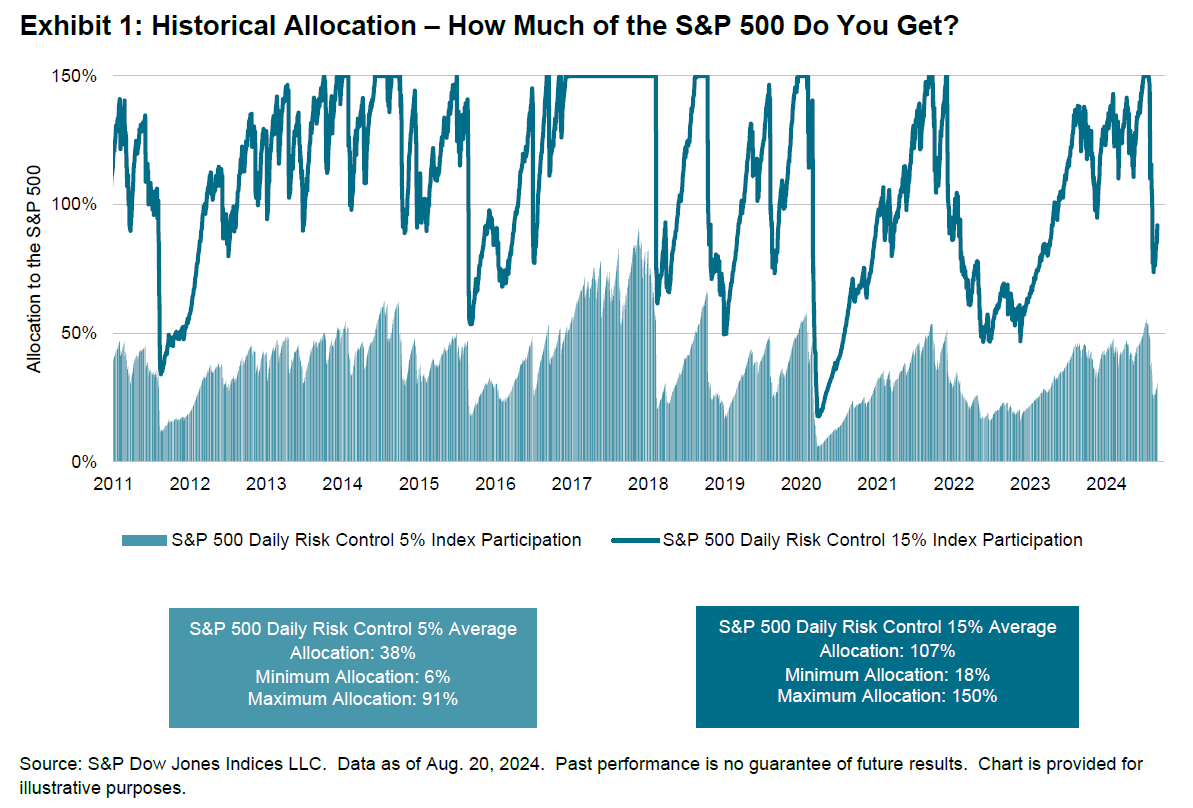

VCIs are offered in a wide range of target volatility levels, which affects exposure levels to the underlying equity component. To understand these effects, we will look at an example using the S&P 500® Daily Risk Control 5% Index and the S&P 500 Daily Risk Control 15% Index, which have target volatility levels of 5% and 15%, respectively.

These indices have the same methodology, so the difference in target volatility levels provides an illustration of the impact of this level. Please note that these outcomes are not guaranteed but are included for general illustrative purposes.

Each index has the same underlying equity component of the S&P 500, which has a standard deviation of just above 15% over the past 50 years.