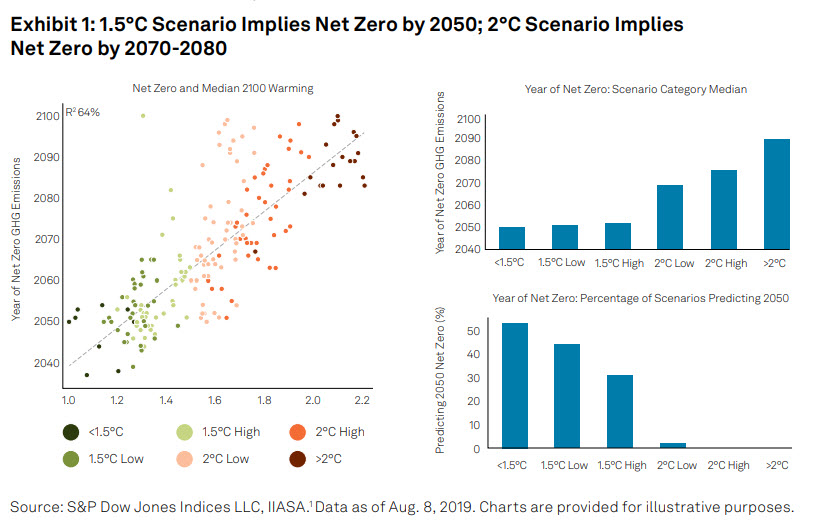

Typically, low-carbon indices have largely seen relative decarbonizations— improvements against the underlying index—but not Paris Agreement-aligned absolutely sustainable strategies. To be aligned with the Paris Agreement (i.e., a net zero scenario) and absolutely sustainable with regards to greenhouse gas (GHG) emissions, a strategy must align with a specified GHG emissions reduction pathway. To reach net zero by 2050, scientific consensus explains that 1.5°C scenarios would likely help to meet this goal, while 2°C scenarios would most likely reach net zero closer to 2070-2080 (see Exhibit 1).

While net zero alignment may be a key target, it isn’t the only climate or ESG concern faced by investors. The changing climate potentially exposes us to transition and physical risks, while other broader ESG factors may be ethically desirable, financially material, or both. Many of these ESG factors are uncorrelated, which can make it difficult to understand what the real goal is for a multifaceted ESG investing strategy. The question then becomes: how best to align with a targeted climate scenario and can this be done alongside other ESG objectives?