EXECUTIVE SUMMARY

The Fourth Industrial Revolution will be driven by renewable energy, and in the context of energy transition, hydrogen could play a vital role. According to the International Energy Agency (IEA), to achieve net zero emissions by 2050, an investment of USD 1.2 trillion in low-carbon hydrogen supply and use would be required. The hydrogen council projected a USD 2.5 trillion global hydrogen market by 2050. The U.S. Department of Energy projected an estimated USD 750 billion annual revenue and a cumulative 3.4 million jobs created by 2050 under the hydrogen economy. Leveraging advanced machine learning and natural language processing technology, S&P Dow Jones Indices launched the S&P Kensho Hydrogen Economy Index, which is designed to track companies involved in the hydrogen economy, including companies focused on the production, transportation, and storage of hydrogen. In this paper, we will introduce the hydrogen economy, and how we measure the opportunity from it through an indexing approach.

Sign up to receive updates via email

Sign Up

INTRODUCTION

Hydrogen is the simplest and smallest element in the periodic table. It is also the most abundant chemical substance in the universe, constituting roughly 75% of all normal matter. On Earth, hydrogen is mostly found in molecular forms such as water and organic compounds. Like electricity, hydrogen is also secondary energy. Hydrogen can be produced from water; when molecular hydrogen and oxygen are combined and react, the process generates energy, and either water or hydrogen peroxide is produced. The heating value of the process is 141.80 MJ/kg, which is 3 times the heat value of diesel (44.80 MJ/kg), and 4.3 times the heat value of coal (32.50 MJ/kg). Unlike burning diesel or coal, the combustion process of hydrogen generates zero carbon emissions. If we can reduce or eliminate the carbon emission in the hydrogen production process, it could be a clean, efficient, and sustainable energy source that would likely play an essential role in the decarbonization movement of the next few decades.

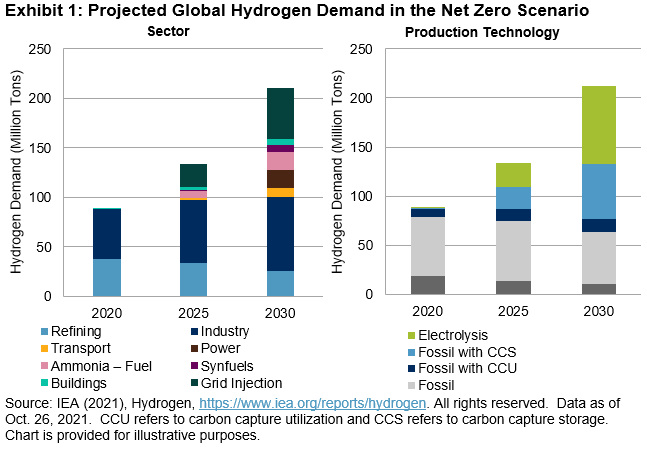

Professor John Bockris came up with the term “hydrogen economy” in his speech at the General Motors Technical Center in 1970. However, the process of establishing a hydrogen economy has historically been slow and challenging, primarily due to the large scale of infrastructural investment required and high hydrogen production costs. As of 2020, the global demand for hydrogen was about 70 million tons (see Exhibit 1). Almost all this demand was for refining and industrial use, such as decreasing sulfur content in diesel fuel and production of ammonia and methane. In the future, hydrogen can replace natural gas to provide heat for buildings, and be used for oil refinement, cement production, and steelmaking in the industrial sector. It can serve as an alternative to fossil fuel for vehicles such as buses, trains, ships, and even airplanes. In addition, hydrogen can be used as a storage of low-cost, excess renewable electricity, which could support the integration of renewable electricity systems. Under the net zero by 2050 scenario, global hydrogen demand could almost triple by 2030, reaching over 200 million tons (see Exhibit 1).

On the production side, currently, hydrogen is produced mainly from fossil fuels (gray hydrogen), resulting in close to 900 million tons of CO2 emissions per year. Under the net zero scenario, the growth of hydrogen demand would be supplied by the production of blue hydrogen and green hydrogen (see Exhibit 1).