Introduction

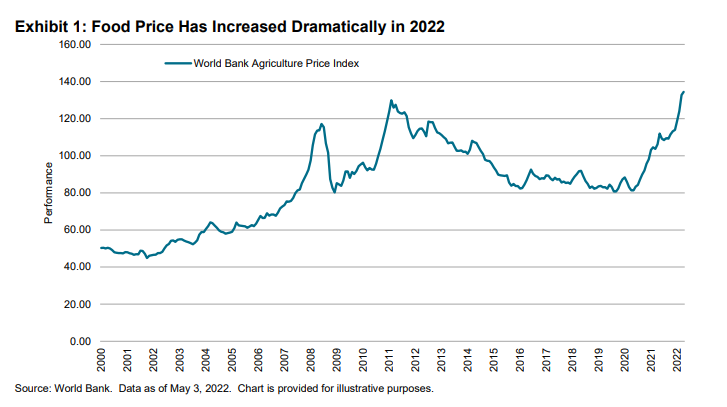

Agriculture is the foundation of our society. It provides food to support human’s daily nutrition needs and is the main source of raw materials such as cotton, wood and leather that are critical to major industries in the economy. The United Nations (UN) has set “end hunger, achieve food security and improved nutrition and promote sustainable agriculture” as a global policy in its Sustainable Development Goals. By 2050, the global population is estimated to grow to 9.6 billion, demanding at least a 70% increase in food supply. While the growing population is driving demand for agricultural products, climate change, geopolitical risk and water scarcity are threatening the global food supply chain. Most recently, the Russia-Ukraine conflict has cast immediate damage to global food supply, causing a food price increase in 2022. Since 2020, the World Bank Agriculture Price Index has increased by 52% (see Exhibit 1).

Australia is a major producer of many agricultural products, including wheat, wool and beef. Its agribusiness is a vital contributor to the domestic economy, and Australia itself is a key export country in the global market. The diversified climate and soil conditions in Australia can sustain a wide range of agricultural businesses including livestock, crops, fruit and vegetables, fisheries, and forest (see Exhibit 2). More than half of the land and about one-quarter of the water in Australia are used in the agriculture industry. Of the agricultural production, 70% is exported to other countries, accounting for 12% of Australia’s export earnings in 2020-2021. In 2020, Australia’s sheep meat export ranked first, and its beef export ranked second in the world.