Introduction

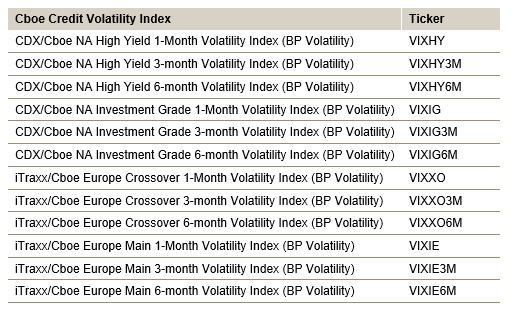

The Credit VIX Indices are a new set of benchmarks that seek to measure the expected volatility of credit spreads in North America and Europe over the next one, three and six months. These indices use a modified methodology based on the Cboe® Volatility Index® (VIX) applied to swaptions based on S&P Dow Jones Indices’ (S&P DJI) iTraxx and CDX indices, European-style credit default swap index options, aggregating prices across different maturities and strike prices. The result is a number representing expected volatility over different Credit VIX tenors.

The four most liquid of S&P DJI’s CDS indices underlie the Credit VIX Indices: the CDX® North American High Yield Index (CDX.NA.HY), CDX® North American Investment Grade Index (CDX.NA.IG), iTraxx® Europe Main Index (iTraxx Europe) and the iTraxx® Europe Crossover Index (iTraxx Crossover). The CDX.NA.IG/CDX.NA.HY and iTraxx Europe/iTraxx Crossover indices, each seek to track baskets of CDS in the North American and European investment grade and high yield markets, respectively. These indices are highly liquid, with large trading volumes and tight bid-offer spreads. They are also transparent, widely followed and provide broad coverage of key market segments, while focusing on pure credit risk, as opposed to corporate bonds, which include an interest rate component. This makes these indices a good starting point for the Credit VIX Indices, which aim to measure market expectations of future credit volatility.

The Credit VIX Indices provide a unique perspective on the credit markets. Unlike other credit risk measures, such as CDS spreads, the Credit VIX Indices are forward looking in that they are designed to take into account the market's expectations of future volatility. This makes the Credit VIX Indices potentially a valuable tool for market participants who want to identify market dislocations, hedge credit risk and make informed investment decisions.

Exhibit 1 shows the back-tested historical levels of the one-month Credit VIX Indices across the investment grade and high yield markets in North America and Europe. Due to the greater credit risk inherent in the high yield indices, the reactions of the VIXHY and VIXXO indices to some of the key events in credit markets is relatively more pronounced.

How to Read the Credit VIX

The Credit VIX indices are intended to provide an annualized expected volatility number for the underlying CDS index spread changes in bps. The Credit VIX index levels can be used to calculate the expected range of the underlying CDS index spread changes over the respective Credit VIX tenors of one, three and six months.

As an illustration of a theoretical calculation of the iTraxx/Cboe Europe Main 1-Month Volatility Index, assuming a VIXIE level of 30 bps and the iTraxx Europe Main Index spread of about 75 bps on a given day, the index methodology measures the market’s expectation of the spread range of iTraxx Europe Main Index over the next one month to be roughly between bps and bps. The division of the VIXIE level by the square root of 12 is used to convert the annualized VIXIE level to a monthly expected volatility number.