As we celebrate the 20th anniversary of the S&P 500 Dividend Aristocrats on May 2, 2025, we take this opportunity to delve into this prestigious index, which has become well-known to market participants worldwide. The S&P 500 Dividend Aristocrats index tracks companies within the S&P 500 that have consistently raised their dividends for at least 25 consecutive years, indicating financial stability and disciplined growth. In honor of this milestone, this paper will highlight 20 “fun facts” that illustrate the unique characteristics, performance and constituents of the index. Join us as we reflect on two decades of financial excellence and uncover the history behind these dividend stalwarts.

1. The first published use of the term “S&P Dividend Aristocrats.” S&P Dow Jones Indices (S&P DJI) first used the term “Dividend Aristocrats” in the early 1980s in a weekly advisory publication called “The Outlook.” This publication originally featured a list of securities that had consistently

raised their dividends for a minimum of 10 consecutive years, accompanied by detailed analysis, commentary and future projections.

In late 2002, during the challenging period following the 2000 Tech Bubble burst, a pivotal change was implemented to extend the requirement to 25 consecutive years of dividend increases. This adjustment aimed to ensure that companies could withstand economic downturns and prolonged bear markets. The intention was to establish a list of robust companies that have proven their ability to endure tough financial times, with dividends serving as a key indicator of resilience and success.

The first iteration of the S&P Dividend Aristocrats list was released in January 2003, showcasing S&P 500 companies that had maintained their dividend payments for 25 years. The list rose in popularity, particularly as dividends became more in vogue after Microsoft announced its first dividend in January 2003, coinciding with the recovery from the 2000-2002 bear market. Eventually, the S&P 500 Dividend Aristocrats index, as it is recognized today, was officially launched on May 2, 2005.

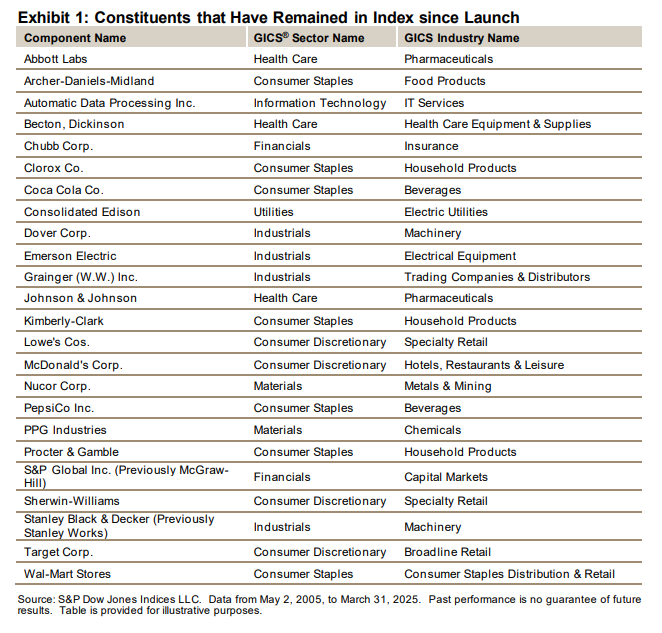

2. Nearly half of the original constituents continue to be members of the index. Since its launch on May 2, 2005, 24 of the original 57 constituents have remained in the index (see Exhibit 1).

3. Among the remaining “founding” members, Sherwin-Williams has emerged as the top performer. Among the 24 stocks mentioned, Sherwin-Williams has distinguished itself as the top performer since May 2, 2005, posting a return of 2,981% with dividends reinvested. That’s good enough for a greater than 30x return over those 20 years.

According to the company’s 150th anniversary book, Sherwin-Williams was founded in 1866 when Henry Sherwin chose to invest his life savings in the paint industry. The guiding principle established by Henry Sherwin and his partner Edward Williams was, “What is worth doing is worth doing well.”