Background

S&P Dow Jones Indices (S&P DJI), the world’s largest provider of financial market indices, was engaged by PenSam, the Danish labor market pension fund, to develop a solution that corrected portfolio construction concerns that it had with its existing climate benchmark. S&P DJI was able to develop a solution that considered:

- A science-based IPCC approach to portfolio decarbonization using Scope 1+2+3 carbon emissions data

- Optimizer capabilities that would limit unwanted risks (including tracking error, active sector/industry deviation and stock concentration)

- Bespoke ESG criteria provided by the client

- Increased exposure to companies with revenues aligned to climate opportunities

To implement the index solution, S&P DJI developed a new bespoke index framework under our beS&P® capability, which brings new, client-driven index concepts to life.

A Simple Approach to Achieving Net-Zero

The index methodology developed for PenSam follows a customized version of the S&P Carbon Budget Index (CBI) Series, which was launched by S&P DJI in 2022. The methodology is based on the concept paper, “Net- Zero Carbon Portfolio Alignment”, which makes the case for the cost of delay. The paper references the Intergovernmental Panel on Climate Change’s (IPCC)

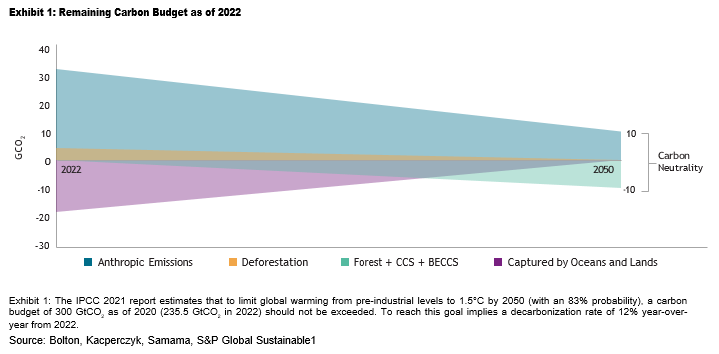

argument that limiting global warming from pre-industrial levels to 1.5°C with an 83% probability by 2050 means that the planet has a remaining carbon budget of 300 GtCO2 as of 2020.3 In 2022, this implies a reduction in the volume of CO2 by 12% year-over-year in order to achieve this goal. This approach may be mirrored in a diversified index by observing the carbon footprint of companies every year;

if companies are able to reduce their footprint in-line with this goal, then the index weights may remain the same— however, for cases in which corporates, not individually but overall, fail to achieve the required targets, the index will be reweighted such that the carbon ownership will still be reduced by 12%. As the carbon budget shrinks with time, if investors delay action and companies do not reduce emissions accordingly, then the required 12%

decarbonization will become 20% in 2025, and 47% in 2028. Despite the rapidly depleting carbon budget, the S&P CBI methodology offers a high level of flexibility by allowing custom decarbonization pathways that cater to clients’ initial and final carbon reduction goals. For example, the index designed for PenSam applies an initial 70% carbon reduction that is followed by a 7% year-over-year reduction compatible with the 2024 Vintage4 model. Furthermore, there is a floor to the reduction level, as there will always be emissions in 2050 that will then have to be captured.