Introduction

The iBoxx Tadawul SAR Government Sukuk & Bond Index was launched in 2020 in collaboration with the Saudi Stock Exchange (Tadawul) to track the performance of Saudi Arabian riyal (SAR) denominated domestic government bonds, including sukuk issued by Saudi Arabia. The index seeks to track SAR-denominated fixed coupon bonds that have an amount outstanding of at least SAR 100 million. As the Saudi government continues to enhance the accessibility and infrastructure of its domestic debt market through various initiatives such as the Primary Dealers Program, the index, which combines Tadawul’s market data with iBoxx indexing capabilities, provides transparency for the market and could serve as a market benchmark for domestic and international investors.

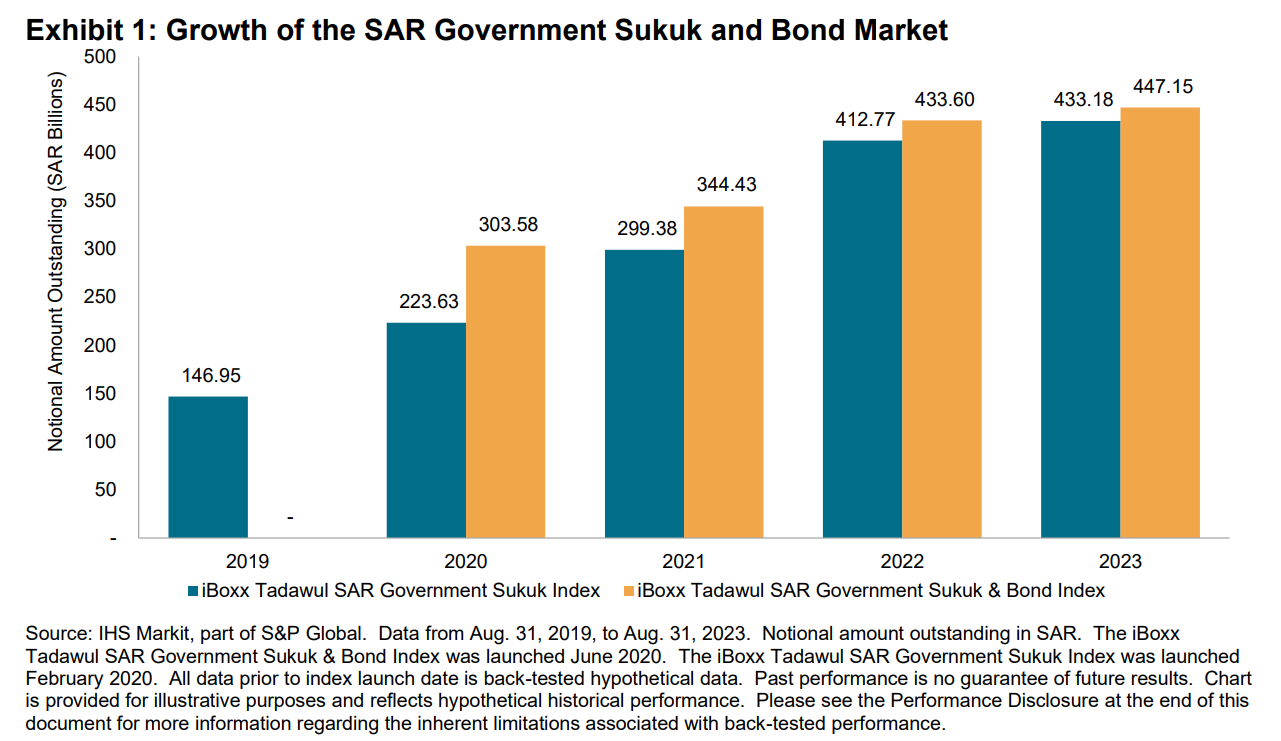

Evolution of the Market

At launch, the index had a significant portion of conventional debt in addition to sukuk. It started out with 22 bonds (SAR 79.50 billion in amount outstanding, or 35% of the total) and gradually reduced to 7 bonds as of August 2023 (SAR 13.96 billion, or 3% of the total outstanding). The portion of bonds within the iBoxx Tadawul SAR Government Sukuk & Bond Index has shrunk as the demand for Shariah-compliant instruments for domestic Islamic banks’ liquidity management purposes has favored sukuk over conventional bond issuances.

The Saudi Arabia domestic government sukuk market, as represented by the iBoxx Tadawul SAR Government Sukuk Index in Exhibit 1, has been growing steadily over the past few years, with most of the expansion occurring between 2019 and 2022, cementing the Saudi government’s position as the largest sovereign sukuk issuer globally. Due to market volatility, interest rate changes and a surge in crude oil prices in 2022, Saudi Arabia, the largest oil exporting country in the world, has reduced its domestic debt issuances since 2022. Since the index's inception (June 30, 2019), the number of sukuk has increased from 29 to 50 and the total notional outstanding has increased from SAR 146.95 billion to SAR 433.18 billion.