Introduction

Launched in 2005, the iBoxx Asian Bond Fund (ABF) Pan-Asia is the official benchmark for the Asian Bond Fund 2 (ABF2) initiative of the Executives’ Meeting of East Asia-Pacific (EMEAP) central banks. The initiative was set up to promote the development of local currency bond markets in the region through investments into nine passive local currency bond funds. One of the key objectives of the ABF2 initiative was to provide a cost-effective means of accessing local bond markets to encourage market participation, including the attraction of foreign investment into the region. Another goal of the initiative was to raise investor awareness of the (then) relatively new asset class—and general interest in Asian bonds.

As an index with limited exposure to credit risk, the iBoxx ABF Pan-Asia is made up of local currency-denominated sovereign and sub-sovereign debt from eight Asian markets, namely China, Hong Kong, Indonesia, Malaysia, Singapore, South Korea, Thailand and the Philippines.

Since inception, the index and the underlying markets have undergone significant changes. In this paper, we will highlight some of the key developments and provide insights into notable changes in the index methodology since its launch in 2005. We will also take a closer look at the performance and demand for Asian local currency bonds in recent years, as well as how Asian bonds could benefit investors in a diversified global portfolio.

Sign up to receive updates via email

Sign Up

Market Development

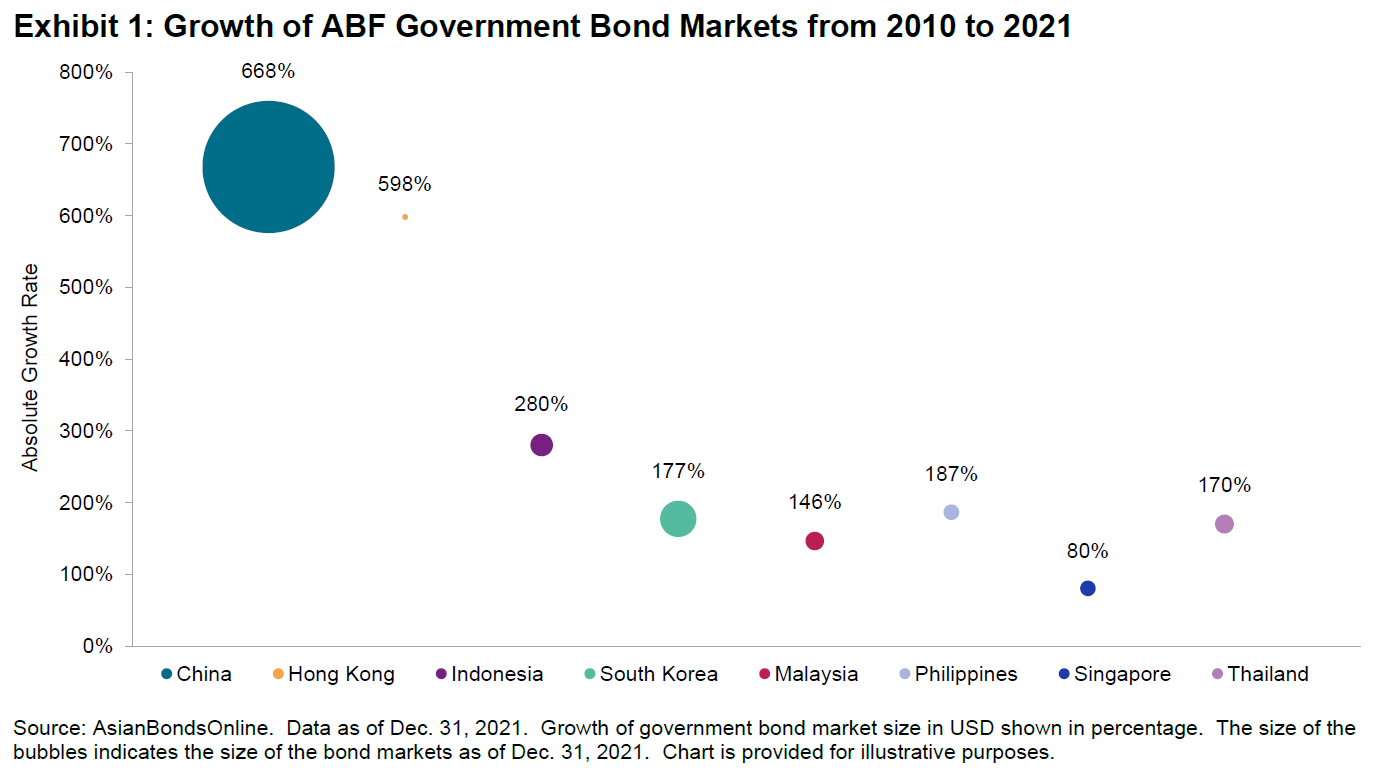

The size of the local government bond markets in the iBoxx ABF Pan-Asia grew at a compound annual growth rate (CAGR) of 16.2% since 2010. Growth rates between individual bond markets differed, which underscored the disparity across the iBoxx ABF Pan-Asia economies in terms of their development, financial reform, trade dependency and market maturity, as well as the supply and demand of local government debt.

As shown in Exhibit 1, among the eight markets in the index, China registered the fastest growth rate (668%) over the 12-year period ending Dec. 31, 2021, while Singapore logged the slowest growth, at 80%. In the same period, the Hong Kong government bond market expanded at a pace of 598%, but it still remained the smallest in U.S. dollar terms among the ABF markets. Notably, after growing at a CAGR of 9.2% as compared with Singapore’s 5.0% over the same time span, the size of the Philippines government bond market (USD 159.0 billion) marginally exceeded that of Singapore (USD 158.9 billion) as of Dec. 31, 2021.