KEY HIGHLIGHTS

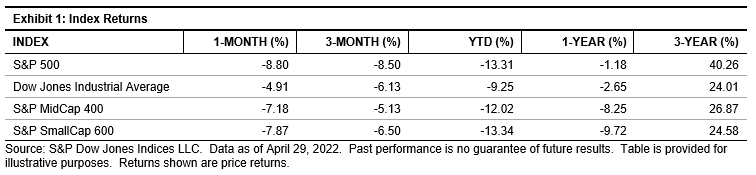

- The S&P 500® was down 8.80% in April, bringing its YTD return to -13.31%.

- The Dow Jones Industrial Average® lost 4.91% for the month and was down 9.25% YTD.

- The S&P MidCap 400® dropped 7.18% for the month, bringing its YTD return to -12.02%.

- The S&P SmallCap 600® was off 7.87% in April and had a YTD return of -13.34%.

MARKET SNAPSHOT

April showers (i.e., the Russia-Ukraine conflict, inflation, interest rates, continued labor shortages, supply chain issues, and politics) did not bring flowers, but rather brought U.S. equities down for the month. The S&P 500 traded in a high/low range of 11.38%, compared with the pre-COVID-19 historical monthly average of 6.86%. The index posted an 8.80% decline for the month (4,131.93 compared with last month's 4,530.41), ending the month with its worst one-day return (-3.63%) since June 11, 2020 (-5.89%), and in correction territory; it was also down 13.86% from its Jan. 3, 2022, opening day closing high of 4,798.56 and replaced the recent low set on March 8, 2022 (of 4,170.70), with the index at -13.31% YTD.

Meanwhile, the mask mandate was lifted for domestic flights, but it was still in effect for the New York City subway. While the debate (and legal battles) on masks has continued, the Street appeared fully unmasked when it came to predictions regarding the U.S. Fed's dot plot: (i) no dots became a 0.25% interest rate increase, then 0.50% as the month went on, with 0.75% just a mention (for now); (ii) transient became irrational inflation, which became signs of peaking; and (iii) diving into a hard landing became a 2023 recession, and then employment, money and wealth may let us skirt (or limit) it. Typically, with so many views you would expect one of them to be right, but given all the uncertainty, looking beyond the short term may be easier—as long as you have liquidity and cash flow (an untaxed portfolio is not a cash account).

As for market fundamentals: earnings and sales for Q1 2022 so far have beaten estimates and were up year-over-year (8.5% and 11.9%, respectively), but they were down from the record Q4 2021 numbers (-9.3% and -3.8%, respectively). Significant EPS impact due to share count reduction for the Q1 2022 period was 17.8% of the reported issues, compared with 14.9% in Q4 2021, 5.8% in Q1 2021, and 24.9% in Q1 2019. Operating margins for Q1 2021 remained high, coming in at 12.64%, down from 13.41% in Q4 2021 (the average from 1993 was 8.21%, and the record is 13.54% in Q2 2021). Forward guidance, however, has been an issue as the economy has started to slow down.

Sales are the bigger concern, and the ability to pass along cost increases appears to be showing signs of consumer fatigue (Q1 2022 operating margins remain high at 12.64%, but are expected to decline; the historical average is 8.21%). Dividends continue on a slow upward trend, with few decreases and measured increases. Interest rates, as measured by the U.S. 10-year Treasury Bond, continue to flirt with 3%, while they are moving faster for the average 30-year mortgage rate, which was up over 200 bps from year-end 2021 (to 5.37% from 3.06%), and that cost is before the higher mortgage amounts due to higher home prices (up 20.2% year-over-year in February 2022). The impact on housing has been a slowing of sales, but demand remains high as supply is low, as higher home prices and interest rates are expected to reduce the demand, and eventually prices.

While Biden continued to send military equipment to Ukraine, Washington took a back seat, as no one wanted to speak of spending programs or taxes. Florida became the political center, as it passed a bill that would prohibit "classroom discussion about sexual orientation or gender identity." Several corporations, including Walt Disney (DIS) openly opposed the bill. The Florida legislature then passed a bill repealing Disney's special tax status, which was used in 1967 to attract Disney to the state.

On and off "peace" talks continued between Russia and Ukraine, as some progress was seen, with Ukraine proposing a "neutral status" and U.S. markets reacting positively. After an incomplete northern invasion of Ukraine, Russian forces regrouped (creating a temporary lull in the conflict), and then launched an incursion into eastern Ukraine (Donbas). The U.S. continued to send military aid, as the latest reports of war atrocities included mass graves (near Mariupol). Ukraine Prime Minister Shmyhal said rebuilding Ukraine would cost USD 600 billion (2020 GDP was USD 156 billion). U.S. Secretary of State Blinken and Secretary of Defense Austin went to Kyiv, Ukraine and met with President Zelenskyy. Russia said it had stopped gas flows to Bulgaria and Poland after they declined Russia's demand to pay in rubles.

Oil closed at USD 104.13 (it had reached USD 130.50 this year) and was up 38.1% YTD (USD 75.40), as EIA all-grade gasoline was up 24.8% (USD 4.211 from year-end 2021's USD 3.375; it reached USD 4.414 in March 2022). From year-end 2020, oil was up 115% (USD 48.42 per barrel), as gasoline was up 80.7% (USD 2.330 a gallon). For 2021, the EIA reported that the makeup of gasoline costs was 53.6% from crude oil, 16.4% from federal and state taxes, 15.6% from distribution and marketing, and 14.4% from refining costs and profits.