Key Highlights

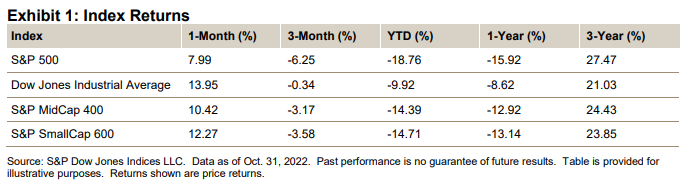

- The S&P 500® was up 7.99% in October, bringing its YTD return to -18.76%.

- The Dow Jones Industrial Average® gained 13.95% for the month and was down 9.92% YTD.

- The S&P MidCap 400® increased 10.42% for the month, bringing its YTD return to -14.39%.

- The S&P SmallCap 600® was up 12.27% in October and had a YTD return of -14.71%.

Sign up to receive updates via email

Sign Up

Market Snapshot

The S&P 500 recovered in October, posting a broad gain (7.99% for the month, but still down 18.76% YTD), as earnings came in better than expected. Not that earnings were good, but the expectations had been much worse, so the 69% beat rate (191 of the 276 reported), which is

near the two-thirds historical average, helped. Also helping was some poor economic data (CPI year-over-year at 8.2%, PPI at 8.5%), which spurred hopes that the Fed may ease off the increases (or gave indications that it would in its Nov. 2, 2022, commentary), after next week's

expected 0.75% increase (with most still expecting a 0.50% increase in December).

Additionally, flows helped, as the U.S. was seen as a more secure (and warming) climate for investment, and September's 9.34% fall appeared to attract some bargain hunters.

Higher product and living costs dominated the news and moods (as materials and labor costs posted earnings reports and guidance); the issue is expected to have a probable impact on the U.S. mid-term election (Nov. 8, 2022). Election news increased, as specific political-outcome portfolios (and public polls) pointed to a Republican House win, and supported a win for Republicans in the Senate as well, which would result in a split government (Republican Congress and Democratic executive branch), with Republicans controlling more states (governorships). Any variance from the expected would need to be reflected in the market level.

Retail earnings reports are scheduled to start next week, giving a clearer picture of where consumers are spending, along with guidance for the holiday season. Friday's job report may also have a market impact.

The expectation is for a continuation of volatility, as the market continues to reevaluate when the Fed will ease on its increases, with more expecting clear indications from its Dec. 13-14, 2022, meeting (Dec. 14, 2:30 p.m. conference call) than its Nov. 1-2, 2022, meeting (Nov. 2, 2:30 p.m. conference call).

Historically, the S&P 500 gains 57.4% of the time for October, with an average gain of 4.18% for the up months, a 4.67% average decrease for the down months and an overall average increase of 0.46%. For October 2022, the index was up 7.99%. In the forward November month, historically, the index posts gains 60.6% of the time, with an average gain of 4.00% for the up months, a 4.16% average decrease for the down months and an overall average increase of 0.83%.

The S&P 500 closed at 3,871.98, up 7.99% (8.10% with dividends) from last month's close of 3,585.62, when it was down 9.34% (-9.21%) from the prior month's close of 3,955.00 (-4.24%, -4.08%). The three-month period posted a loss of 6.25% (-5.86%), the YTD return was

-18.76% (-17.70%) and the one-year return was -15.92% (-14.61%), with the index down 19.28% (-18.23%) from its Jan. 3, 2022, closing high, and was up 14.35% (19.45%) from its pre-COVID-19 Feb. 19, 2020, closing high. The Dow® ended the month at 32,732.95, up 13.95% (14.07% with dividends) from last month's close of 28,725.51, when it was down 8.84% (-8.76%) from the prior month's close of 31,510.43 (-4.06%, -3.72%). Key index marks were down 19.28% (-18.23%) from Jan. 3, 2022, and up 14.35% (18.44%) from its pre-COVID-19 Feb. 19, 2020, closing high. The Dow was down 11.05% from its Jan. 4, 2022, closing high (of 36,799.65). The three-month return was 1.04% (1.41%), the YTD return was -9.92% (-8.71%) and the one-year return was -8.62% (-6.89%).