- About Ratings

- Research & Insights

- Sectors

- Regulatory

- Products & Benefits

- Events

enJs

Published: May 4, 2020

Extended coronavirus-containment measures are pushing the world into the deepest recession since the Great Depression. Although we expect the drop in economic activity to be sharp but fairly short, the path to recovery remains very uncertain.

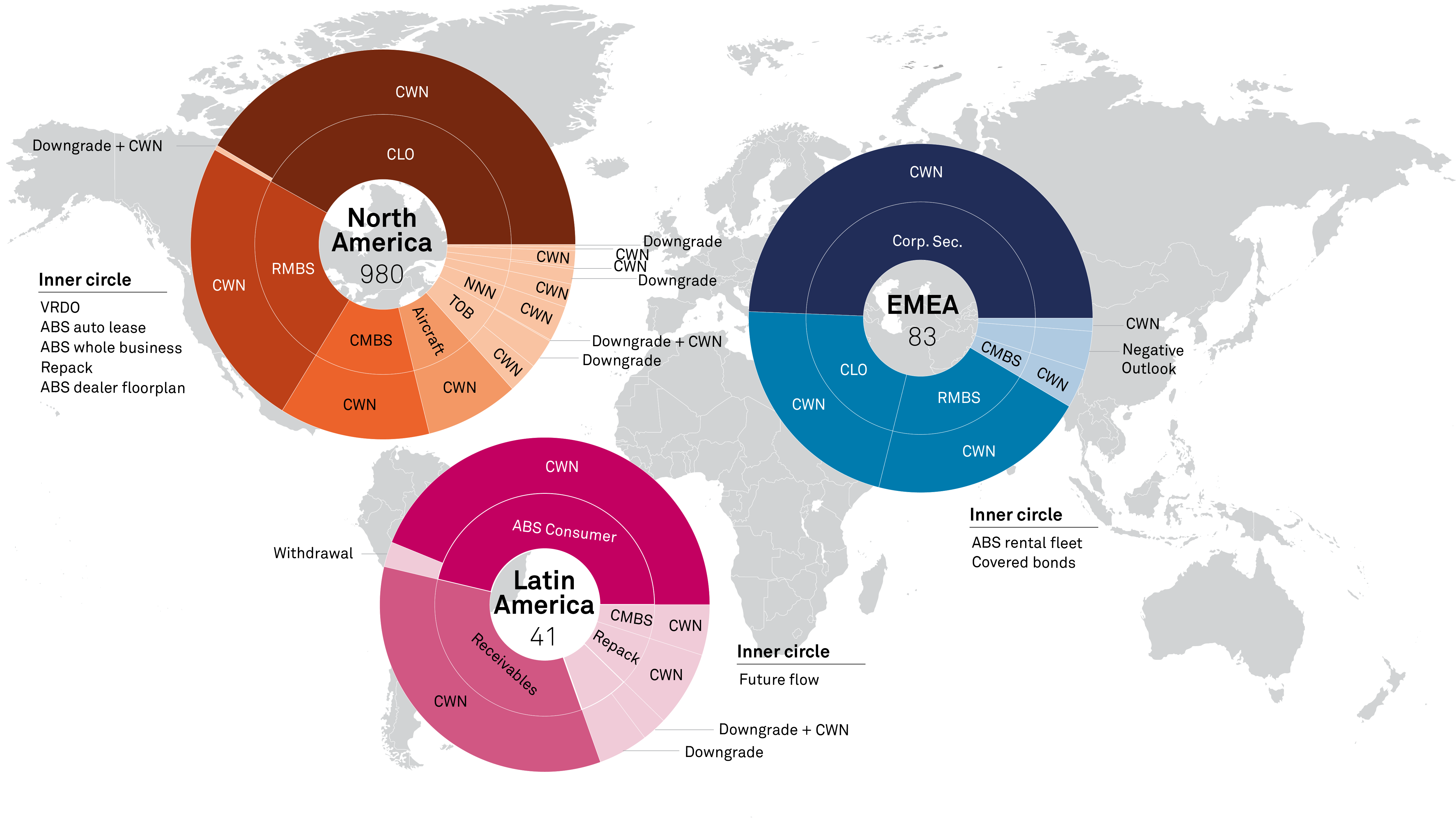

So far this year, we have taken 1,190 structured finance rating actions due to the impact of the COVID-19 pandemic and/or the decline in oil and gas prices.

In a hypothetical adverse stress scenario, characterized by a slower and weaker economic recovery, we would expect a significant increase in the risk of the downgrade and defaults, even for investment-grade securities.

The combination of COVID-19 and a sharp decline in oil prices has resulted in a reduction in obligor credit quality within CLO portfolios, and is putting pressure on lower mezzanine and subordinate tranche ratings.

Our main areas of focus in both U.S. and CMBS are the lodging and retail sectors, although there may be some other pockets of weakness.

Daily Deaths Of Confirmed COVID-19 Cases (10-Day Rolling Average)

Source: European Centre for Disease Prevention and Control. Data as of May 10, 2020.

Recession

We now see global GDP falling by 2.4% this year, with the U.S. and eurozone contracting by 5.2% and 7.3%, respectively.

Policy response

Central banks and governments have deployed large fiscal and monetary policy packages to help workers and companies bridge the gap to recovery.

Recovery contours

Infection curves are flattening and the focus has turned to the recovery. Its length and pace will depend on the combination of health and economic policy, the response of people and firms, and the condition of the labor market and small and midsize enterprises.

Global GDP Growth Forecasts, 2019-2022

Sources: S&P Global Economics and Oxford Economics. Global Credit Conditions: Rising Credit Pressures Amid Deeper Recession, Uncertain Recovery Path, April 22, 2020.

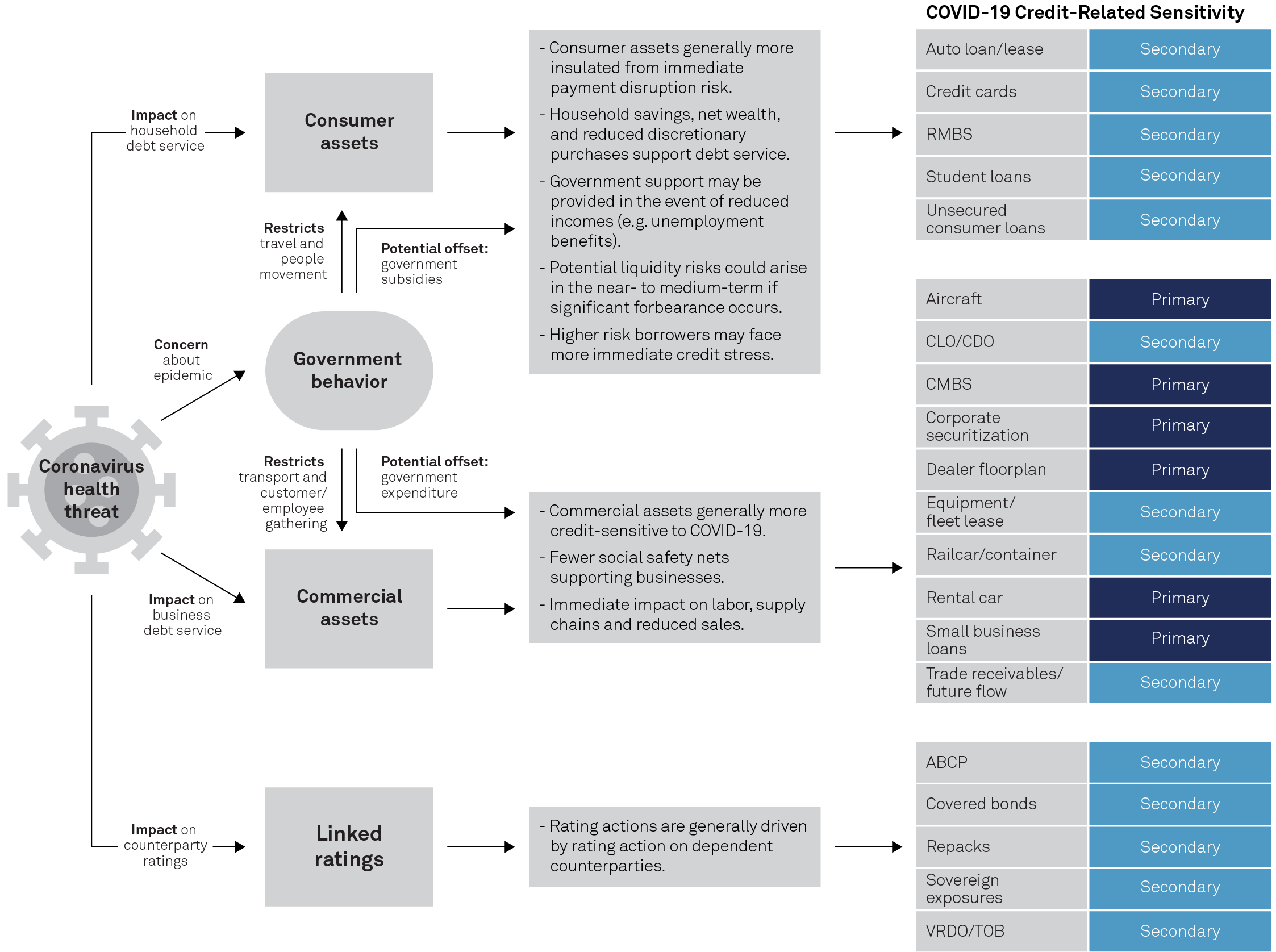

Note: This measures the expected credit-related sensitivity of securitized asset performance attributed to COVID-19. Primary exposure results from demand dropping because of fears of health and safety of potential customers. Secondary exposure includes asset performance deteriorating due to declining GDP or increasing unemployment, which is initially caused by COVID-19.

Source: S&P Global Ratings. European ABS And RMBS: Assessing The Credit Effects Of COVID-19, March 30, 2020.

Structured Finance Rating Actions Through May 8, 2020

CWN--CreditWatch negative. CLO--Collateralized loan obligation. RMBS--Residential mortgage-backed securities. VRDO--Variable rate demand obligation. ABS--Asset-backed securities. CMBS--Commercial mortgage-backed securities. TOB--Tender option bond. NNN--Triple net lease ABS. Corp. Sec.--Corporate securitizations.

Source: S&P Global Ratings. COVID-19 Activity In Global Structured Finance For The Week Ending May 8, 2020, May 14, 2020.

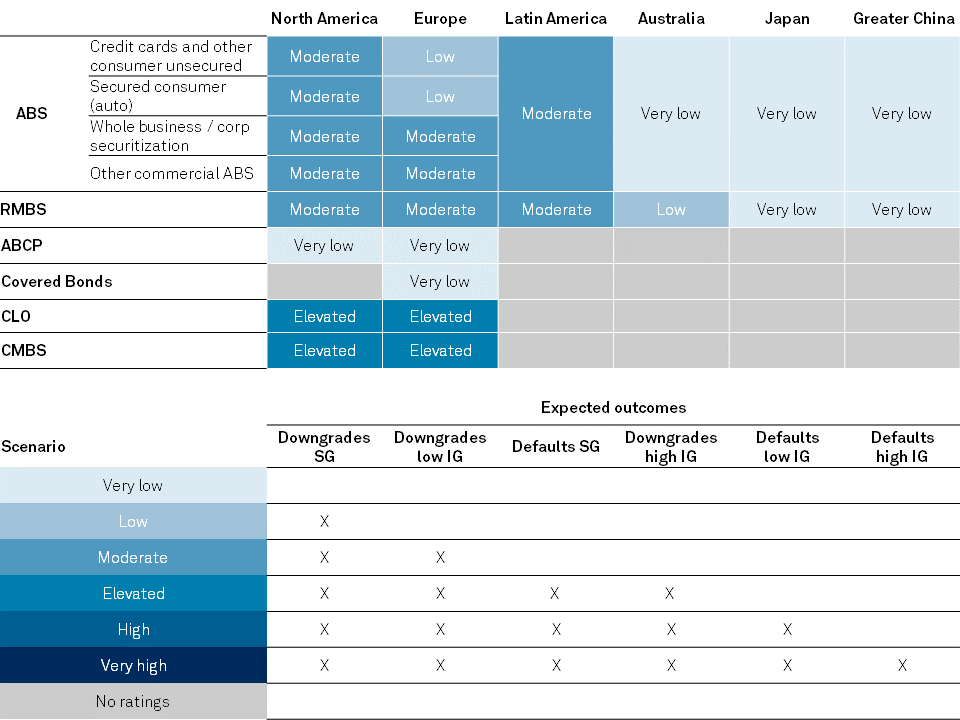

Given our most recent global economic forecasts, we believe that downgrade and default risks for most structured finance sectors and regions would be limited to speculative-grade classes.

CLOs, CMBS, some RMBS, and certain ABS sectors merit a closer look.

These results are consistent with the results of a stress test that we undertook recently to estimate the impact of a potential market downturn (see: “When The Cycle Turns: How Would Global Structured Finance Fare In A Downturn?,” published on Sept. 4, 2019).

Expected Performance Under The Base-Case Scenario

IG--Investment grade. SG--Speculative grade.

Source: S&P Global Ratings.

We consider three possible output paths relative to the pre-COVID-19 path.

We undertook a stress test to estimate the effect of a hypothetical slower and weaker economic recovery on structured finance ratings (path C).

We have assumed negativerating actions oncertainfinancial institutions and sovereign ratings.

Stylized COVID-19 Recovery Scenarios

Source: S&P Global Economics. COVID-19 Deals A Larger, Longer Hit To Global GDP, April 16, 2020.

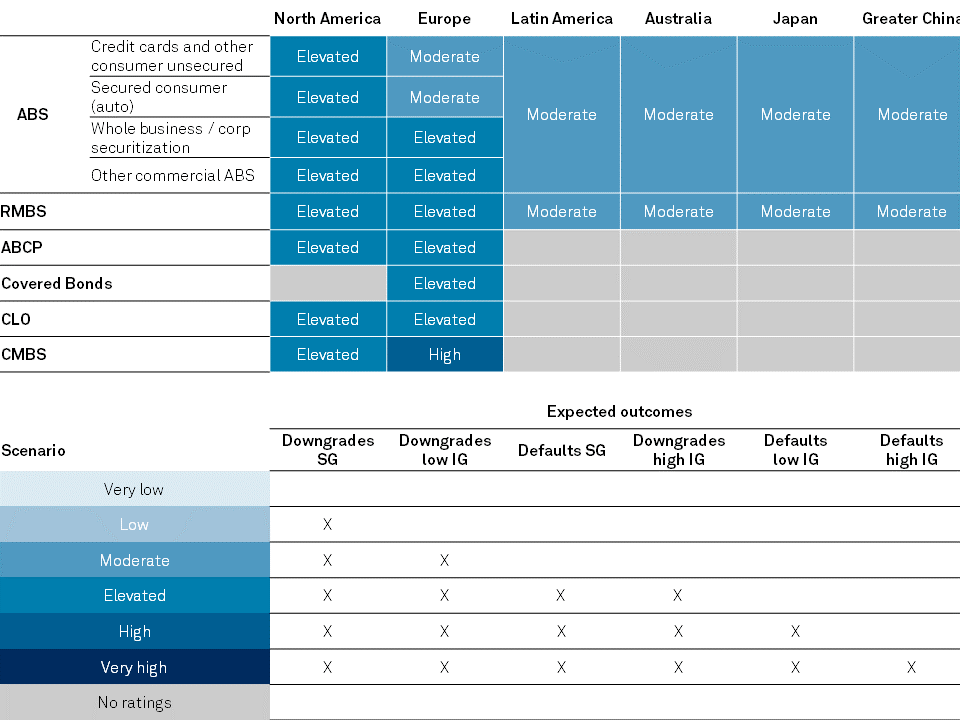

In a hypothetical adverse stress scenario, we expect that downgrades and defaults could also affect investment-grade securities.

U.S. and European CLOs, CMBS, certain ABS sectors and some RMBS would be more at risk.

Rating actions on financial institutions could put pressure on credit-linked securities such as ABCP and covered bonds.

Sovereign downgrades could also put pressure on some ratings in the European periphery.

Expected Performance Under The Hypothetical Scenario

IG--Investment grade. SG--Speculative grade.

Source: S&P Global Ratings.

Leveraged loan market challenges existed before COVID-19, including high leverage ratios, EBITDA add-backs, and a preponderance of covenant-lite loans.

The combination of COVID-19 and a sharp decline in oil prices has led to numerous corporate downgrades. This has worsened obligor credit quality in both U.S. and European portfolios, with increased exposures to obligors rated ‘B-’ and in the ‘CCC’ category.

These changes are already constraining CLO ratings, especially for lower mezzanine and subordinate tranches.

'CCC' Rating Curve Has Increased But Is Flattening For Now

Source: S&P Global Ratings.

Demand in the global lodging industry has already rapidly declined, resulting in severe hits to occupancy, average daily room rate, and revenue per available room.

The effects of COVID-19 have exacerbated existing issues in the retail sector and continue to present a major threat to retail property owners, as the closures of shopping centers and social isolation requirements are significantly denting their tenants' revenues.

The highest increases in U.S. delinquency and grace rates are for the retail and lodging sectors.

While The U.S. CMBS Delinquency Rate Increased By Just 24 Basis Points In April...

Source: U.S. CMBS Delinquency Rates Saved By Grace With Modest Increase Of 24 Basis Points, May 12, 2020.

...The Grace Rate Increase Indicates A Looming Concern For The Upcoming Months

Source: U.S. CMBS Delinquency Rates Saved By Grace With Modest Increase Of 24 Basis Points, May 12, 2020.

COVID-19 Activity In Global Structured Finance For The Week Ending May 8, 2020, May 14, 2020

U.S. CMBS Delinquency Rates Saved By Grace With Modest Increase Of 24 Basis Points, May 12, 2020

European CMBS: Assessing The Liquidity Risks Caused By COVID-19, May 6, 2020

How COVID-19 Changed The European CLO Market In 60 Days, May 6, 2020

COVID-19 Credit Update: Latin American Structured Finance Begins To Feel the Pandemic’s Effects, April 29, 2020

Scenario Analysis: How Credit Distress Due To COVID-19 Could Affect U.S. CLO Ratings, April 24, 2020

Global Credit Conditions: Rising Credit Pressures Amid Deeper Recession, Uncertain Recovery Path, April 22, 2020

Economic Research: COVID-19 Deals A Larger, Longer Hit To Global GDP, April 16, 2020

European ABS And RMBS: Assessing The Credit Effects Of COVID-19, March 30, 2020

When The Cycle Turns: How Would Global Structured Finance Fare In A Downturn? , September 4, 2019

S&P Global Ratings acknowledges a high degree of uncertainty about the rate of spread and peak of the coronavirus outbreak. Some government authorities estimate the pandemic will peak about midyear, and we are using this assumption in assessing the economic and credit implications. We believe the measures adopted to contain COVID-19 have pushed the global economy into recession (see our macroeconomic and credit updates here: www.spglobal.com/ratings). As the situation evolves, we will update our assumptions and estimates accordingly.