- About Ratings

- Research & Insights

- Sectors

- Regulatory

- Products & Benefits

- Events

enJs

Authors: Gavin Gunning, Emmanuel Volland, Alexandre Birry

Key Takeaways

Banks' recent stabilizing will likely continue, with our rating outlooks now largely mirroring the distribution seen just before the pandemic.

Economic disruption from COVID-19 on corporates and households will continue to be a key risk for banks.

Nine of the top 20 banking systems should recover to pre-COVID-19 levels of financial strength by 2022; the rest won't recover until 2023 or beyond.

The global banking sector is clawing its way back to normalcy. Authorities' strong support for households and corporates over the course of COVID-19 has clearly helped banks. Lenders were also well positioned going into the pandemic, after banks bolstered their capital, provisioning, funding, and liquidity buffers in the wake of the global financial crisis. S&P Global Ratings expects normalization to be the dominant theme of the next 12 months, as rebounding economies, vaccinations, and state measures help banks bounce back much more quickly than was conceivable in the dark days of 2020.

A snapshot of our ratings and outlook distributions reveals how banks are recovering from COVID-19. Our net negative outlook for the global banking sector improved to 1% in June 2021 from 31% in October 2020. As at June 25, 2021, about 13% of bank outlooks were negative. This is significantly lower than October 2020 when about one-third of rating outlooks on banks were negative. About 75% of rating outlooks on banks are now stable (up from about 65% in October 2020), with about 12% now positive (compared with 2% in October 2020). Our confidence is increasing that this stabilizing trend--while inching along--will persist. We note also that some revision of outlooks to stable were accompanied by rating downgrades (see chart 1).

Chart 1

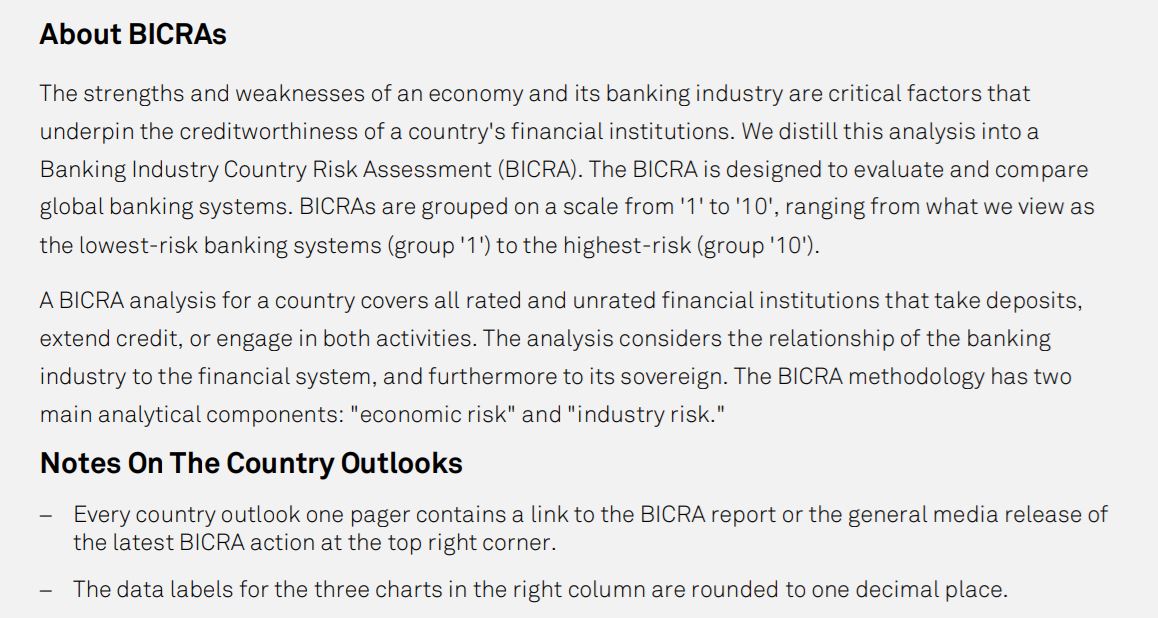

Our Banking Industry Country Risk Assessments (BICRAs) are likewise pointing toward more stable trends. BICRAs are a key input into bank ratings and establish the anchor for bank ratings in each jurisdiction in which they were assigned. During the full onset of COVID19 between March 2020 and December 2020, our BICRAs or the economic trends or industry trends implicit in our BICRA analysis were negatively revised over 40 times across the 86 banking jurisdictions globally where we rate banks. By contrast, between Jan. 1, 2021, and June 30, 2021, we made five negative revisions of BICRAs or trends, but 14 revisions to positive from stable, or to stable from negative (see chart 2).

Chart 2

We see less downside risk now than compared with six to nine months ago, as economies rebound, vaccinations kick in, and banks feel the effects of state intervention. With no vaccine in October 2020, we believed at the time that 2021 could be a very difficult year for banks. State intervention on behalf of corporates and households--including significant fiscal and monetary policy support--is working and banks have benefited.

Withdrawal of support is inevitable and is well underway in many jurisdictions. Our base case is that the global banking sector will continue to slowly stabilize as the economic rebound gains momentum and as support is gradually withdrawn. Should a re-intensification of risks occur, more support from authorities for the real economy would be required. This in turn would help banks maintain a stabilizing trajectory. Strategies and tactics to combat COVID-19 vary enormously across banking jurisdictions. This includes the progress with vaccination campaigns that affects a range of factors, particularly trade and travel

While trends are progressively improving for banks, the pandemic has caused a significant increase in bank credit losses. In some cases, banking sectors will take years to restore their financial strength back to pre-COVID levels of 2019. The playing field is uneven. In some banking jurisdictions, especially in developed markets, our loss expectations looking out to 2021 and 2022 are notably lower compared with our views 12 months ago. By contrast, financial strength in some emerging markets may be more vulnerable

Our recent European bank rating actions broadly reflect our global views. On June 24, 2021, we announced that we had reviewed our ratings on about 60 major European banking groups, revising the rating outlooks on many to stable from negative. We now see the asset quality challenge as manageable as risks hitting banks ease, and that capitalization will likely remain robust. In a smaller number of cases we downgraded banks.

Several key points are noteworthy:

– Stabilizing bank credit in Europe, a low-profit banking region (somewhat similar to Japan) that may be a bellwether for the move toward ratings stability elsewhere in a postvaccination world, particularly in developed banking jurisdictions. Indeed, this trend is already underway

– Our ratings are forward-looking and our base case for most European banks is that bank credit will continue to progressively stabilize. This also covers our view on institutions in the U.S., Australia, and other developed markets where we have recently revised rating outlooks to stable or positive.

– The challenge for many banks, however, where outlooks have recently reverted to stable, is solidification at the current rating level. While not our base case, an intensification of risk factors (see key risks section) could cause negative trends to reemerge. Financial strength in the global banking sector is at a delicate stage while entities wait for a full economic recovery. Banks will also need to make significant structural changes to adapt to a postvaccination world.

– We note a recent re-intensification of economic risks in New Zealand, a country by global standards barely affected by COVID-19. In New Zealand, economic trends recently reverted to negative from stable because of soaring house prices. Instructive is that this action reversed our previous move of economic trends to stable, from negative, only a few months prior.

We now have a negative outlook bias globally for banks of about 1%. Currently about 13% of banks globally are on negative outlook (see chart 1) which is well down from 31% in October 2020. We query whether, over the next 12 months, this 13% level will decline much further.This is because there typically is a small percentage of banks persistently on negative outlook because of idiosyncratic factors not driven by economic or credit factors (such as by mergers and acquisitions). Also, there may be some rigidity in negative outlooks related to banks having difficulty shaking off the effects of COVID or other negative factors. Outlooks also may remain volatile across the global banking sector, with the economic recovery in the early stages, vaccine rollout varying greatly by jurisdiction, and with an uncertain pathway associated with COVID variants.

Our latest forward estimates for credit losses reflect our view that the banking sector recovery will take time. Globally, we forecast that even out to year-end 2022, bank credit losses will remain materially elevated above pre-COVID-19 levels in some jurisdictions (see chart 3). The notable exception is North America, where recovery should be slightly better than pre-pandemic levels by year-end 2021, and Latin America, for which we anticipate normalization be to better than pre-pandemic levels by year-end 2022.

In the U.S. the early recognition of credit losses as well as the positive effects on asset quality from the strong economic recovery is driving credit losses lower. Brazil will likely drive a fast recovery in credit losses in Latin America in 2022. This due to Brazil's high provisioning coverage prior to the pandemic, robust loan-loss provisions raised in 2020, healthy margins that helps banks recognize loan losses sooner, and the short-term nature of loans in the country. The loan portfolio mix has shifted over the past years toward less risky lending. We expect loan losses as a percentage of loans in 2022 to be lower than historical levels.

We have revised downward our expectations for global credit losses to about US$1.6 trillion in 2021-2022, from about US$1.8 trillion. Our tempered views on forward credit losses is consistent with recent emerging stable rating outlook trends (see "A Little More Clarity, A Little Less Gloom: An Update On Our Bank Credit Loss Forecasts," published July 15, 2021, on RatingsDirect).

Chart 3

We retain our view that the recovery of banking jurisdictions globally to pre-COVID-19 levels will be gradual. For 11 of the top 20 banking jurisdictions we estimate that a return to pre-COVID-19 levels of financial strength won't occur until 2023 or beyond. For the other nine, we estimate that recovery may occur by year-end 2022 (see chart 4).

For the U.S., the U.K. and Australia, recovery is emerging sooner than we had anticipated in the fourth quarter of 2020. We now believe these banking jurisdictions will join the "earlyexiter" banking jurisdictions, with recovery to pre-COVID-19 2019 financial strength in 2022. We retain our view that recovery for Canada, Singapore, Hong Kong, South Korea, China, and Saudi Arabia will also likely occur in 2022.

Numerous other banking jurisdictions continue to be on track to recover to pre-COVID -19 levels by 2023. This group includes Brazil, France, Germany, Indonesia, Italy, Japan, Russia, and Spain. Meanwhile, the Indian, Mexican, and South African banking systems may take a bit longer to recover. Equally, we note that trends in the South African banking system improved in 2021 after an extremely difficult 2020.

Compared with economic recovery, the banking sector recovery will take longer. There is an inevitable lag effect on banks' credit profiles as household and corporate borrowers recover from the pandemic. Banks need time to work through their asset quality difficulties. While bank profitability will unquestionably remain muted in the continuing ultra-low interest rate environment, lenders are better capitalized, more liquid, and less leveraged compared with where they were in 2009 (the other significant recent downturn affecting banks globally).

Chart 4

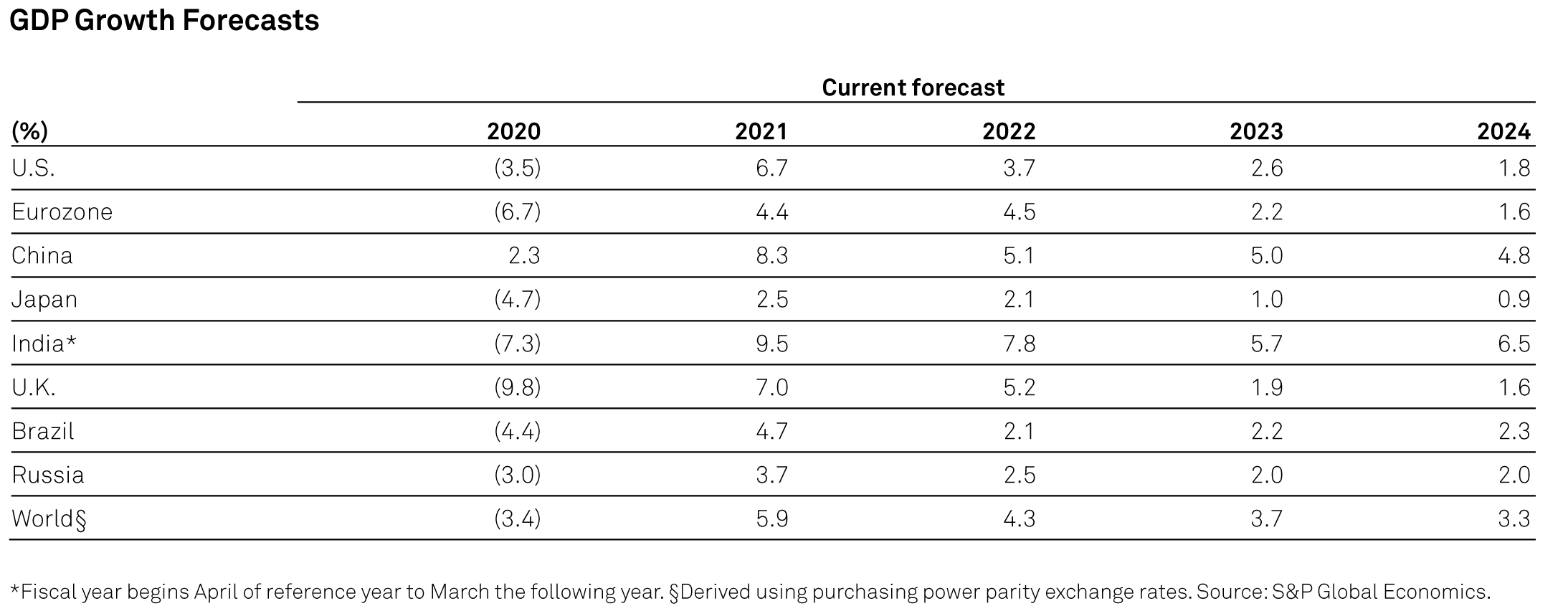

The credit narrative for COVID-19 has morphed over the past six months from the number of infections to the number of vaccinations and variants. We are assessing the implications of this for banks. Economic disruptions for households and corporates should ease as the economic recovery takes hold (see table 1). This should drive the trend for ratings outlooks on banks to move to stable from negative.

Greater confidence in an enduring bank stabilization will only be likely when the distribution of vaccines is widespread, particularly as new and more contagious variants break out. Emerging market banking systems are vulnerable. Vaccinations (see chart 5) are playing catch-up to high infection rates (see chart 6) in some emerging markets, often due to limited government and health resources. COVID cases continues to vary significantly across countries (see chart 6).

Table 1

Chart 5

Chart 6

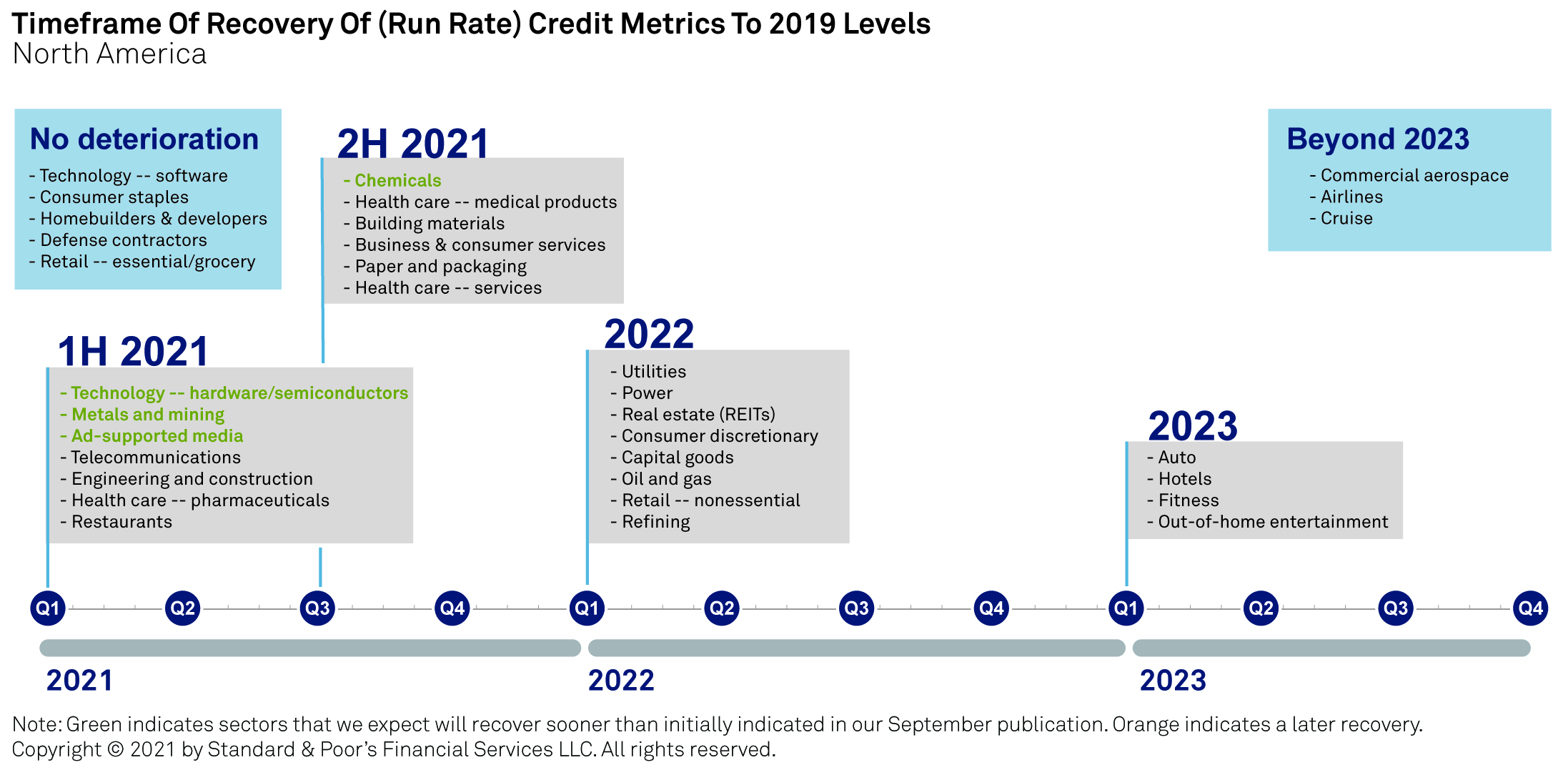

Higher leverage and insolvencies remain a key risk for banks. Some corporate sectors have experienced no credit deterioration, such as grocery and essential retail, and technologysoftware, while other corporate sectors are recovering sooner than previously expected. Still other sectors, however, such as autos, hotels and airlines won't likely recover until 2023 or beyond (see chart 7, which shows the timeframe of recovery for North American corporates, and "COVID-19 Heat Map: Pent-Up Demand And Supply Shortages Further Improve Recovery Prospects For Credit Quality," June 8, 2021). Slowly recovering sectors will constrain the recovery of banks' credit metrics. This is particularly true for markets where banks have a high exposure to vulnerable sectors.

Chart 7

COVID-19 triggered a spike in corporate defaults, and these strains will linger. Our base case is that corporate default rates will fall from their COVID-19 peak (see chart 8). However, problematic corporate lending and other exposure will likely continue to strain banks' asset quality metrics. We assume that the U.S. trailing 12-month speculative-grade corporate default rate--which spiked in 2020 and in the first quarter of 2021--to decline to 4% by March 2022, from 6.3% in March of this year (see chart 8). In Europe, we forecast this rate to fall to 5.3% in March 2022, from 6.1% in March 2021.

Chart 8

Also problematic for banks may be the spike in corporate and government sector leverage. With debt levels at or near record highs, some corporates and governments remain vulnerable to credit deterioration and defaults if income recovers more slowly than expected. This is especially if interest rates rise (see "Global Credit Conditions: Reopening, Reflation, Reset," June 30, 2021). For corporates, debt-to-EBITDA ratios have spiked because of the pandemic, while EBITDA growth has plummeted in relation to debt growth (see charts 9 and 10; and "Global Debt Leverage: Spreads, Costs Shocks May Double Rate Of Loss-Making," June 22, 2021).

Sovereigns have ramped up debt to manage the effects of the pandemic. Sovereign borrowings have been significant (see chart 11, and "Sovereign Debt 2021: Global Borrowing Will Stay High To Spur Economic Recovery," March 1, 2021). Higher sovereign borrowings may limit sovereigns' capacity to provide extraordinary support to private sector commercial banks, in the event such support were ever required. If significant COVID waves hit a particular jurisdiction, the government may have less capacity to support corporates and households. This could hit the credit standing of banks. Further, the perpetuation of the low rates environment is not good for banks' earnings. Interest margins in many jurisdictions are already razor thin.

Chart 9

Chart 10

Chart 11

While our base case is that the surge in inflation will be transitory, we see a risk that central banks may be forced to tighten monetary policy sooner than they are signaling. It could be difficult for central banks to normalize credit conditions without triggering excessive market volatility. Central banks are contending with a delicate balancing act. They must support economies as they recover from the pandemic. At the same time, they must plan for an eventual normalization in credit conditions in a way that doesn't cause market disruption.

Significant market disruption tends to hurt borrowers as well as banks. A progressive, predictable normalization of interest rates is reflected in our base case of gradually stabilizing bank credit. Steadily higher interest rates would improve banks' interest margins. Banks should be able to manage the effect of higher rates on asset quality, but this may require extra provisioning.

However, a rapid and volatile market repricing or inflation shock would damage weaker corporates, and create difficulties in emerging markets, especially for entities reliant on external financing. An escalation of these risks may hurt banks, Rates are already on the rise in some emerging market banking systems, including Brazil, Mexico, and Russia. Our economic trends assessment on all three of these jurisdictions, however, is currently stable.

Volatile repricing would likewise hit derivatives markets. A rapid volatile market repricing shock would likewise hit interest rate and foreign exchange derivatives markets; these markets are dominated by banks. In this scenario we are watching for banks that are more highly exposed, or are less able to manage risks.

Volatile repricing would likewise hit derivatives markets. A rapid volatile market repricing shock would likewise hit interest rate and foreign exchange derivatives markets; these markets are dominated by banks. In this scenario we are watching for banks that are more highly exposed, or are less able to manage risks.

Ultra-low interest rates are hitting bank profits and raises questions about their business models. Profitability has always varied significantly across banking jurisdictions. In recent years, including well before the onset of the pandemic, profit trends were generally higher in some developed Asian markets (ex-Japan) and North America, and lower in Japan and Western Europe. The issue is not new, but lower rates in response to the pandemic have amplified the effects.

A swath of recent rating actions highlights strains in banks' profits, and in the robustness of their business models. In June 2021, we reflected heightened competitive pressures in a range of European jurisdictions. We reflected this in negatively revised views of industry risk, a bank's business position assessment, or both, in Germany, France, Ireland, Italy, and Spain. An improved view of systemwide funding mitigated the rating effect for Ireland, Italy, and Spain.

Persistent, endemic low profitability is a challenge for some banking systems. An amalgam of underlying factors, in addition to low rates, are in play. These include extreme competition in some jurisdictions, the difficulty of cutting costs when most of the excess has already been stripped off, and the cost of digitalization.

Digital transformation can help banks to cut costs and improve profits, but this requires substantial upfront investment. Traditional banks are often encumbered by outdated technologies and the need to maintain a physical footprint. Further, traditional commercial banks must contend with the threat from virtual banks and other entrants eager to exploit niches, and often at a low cost compared with traditional banks.

Some recent technological innovations may have a profound effect on banks' business models. Central bank digital currencies are under development in an increasing number of jurisdictions. We believe that central banks will likely lean toward a model where banks and other financial intermediaries continue to play a strong intermediation role, rather than one managed by the central banks themselves.

Despite a downturn, most banks' property exposure appears manageable at current rating levels. We retain our view, however, that borrower repayment moratoriums, forbearance by landlords in some jurisdictions, renegotiation of borrower arrangements by banks, and record low interest rates may be masking underlying asset quality problems in property. Growing vaccination numbers, and the strong economic rebound mitigate these issues, to an extent.

In commercial real estate (CRE), behavioral shifts in working arrangements could further hit demand. stressing valuations and cash flows, with repercussions for banks' asset quality. Still, we believe exposure to CRE debt is manageable for most banking systems. In the U.S., banks' median exposure to CRE is around 19% of loans, for Europe this metric is around 7% (for the largest banks), while for Asia-Pacific the average proportion of CRE assets in banks' loan books was less than 15% in 2020. For Latin America, lending and exposure to construction (including CRE) in the Mexican and Brazilian banking systems--the two largest economies in the region--have been limited, representing about 8% and 5% of total loans, respectively.

Residential real estate represents a material share of many banks' loan books and house prices have been increasing strongly in many banking jurisdictions. Low interest rates are fueling housing price increases. In some jurisdictions that house price increases are contributing to economic imbalances that may hit bank credit.

A case in point is our recent action in New Zealand where--on June 25, 2021--we revised our BICRA economic trend to negative from stable mainly due to strong house price growth. While house price growth in New Zealand has been exceptionally strong, our action in New Zealand could point to the possibility of negative changes in other jurisdictions where it becomes challenging to reconcile house price increases with ongoing banking sector stability.

Watching brief on exposures of banks to other asset classes. Housing is far from the only asset class where market prices are spiking in some jurisdictions. It’s just that most traditional commercial banks typically have large exposures to residential property. Equally, banks with meaningful direct exposures, or high customer exposures, to other asset classes where market valuations are toppy--such as equities--will be more vulnerable to a negative step-change in market prices.

Follow the below link to access the full report, including all 86 country banking outlooks:

For our slidedeck summarizing the key risks and trends facing banks globally and regionally, follow this link: