Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 15 May, 2023

In a special election scheduled for May 6, voters in El Paso, Texas, will consider an ordinance known as Proposition K that would establish a climate change policy for the city that includes a renewable portfolio standard. Proposition K would also authorize the City Council to pursue the acquisition and municipalization of investor-owned electric utility El Paso Electric Co.

El Paso Electric (EPE) has indicated that it will oppose efforts to municipalize its operations in the city. Following a transaction that closed in July 2020, EPE is owned by Sun Jupiter Holdings LLC, which has ties to J.P. Morgan Investment Management Inc.

➤ The renewable portfolio standard incorporated in the ordinance is much more aggressive than the statewide statutory standard currently in place but is consistent with goals EPE has set for itself.

➤ Municipalization can be a long and convoluted process, particularly when the utility owner is not on board. If approved, it would likely be several years before the change of control could take effect.

➤ As Regulatory Research Associates understands, the potential transaction would be subject to Public Utility Commission of Texas review as it would represent a change of control of the utilities' operations in the state, and areas outside of the city limits would remain under the PUC's purview. Federal regulatory authorities would also need to weigh in. It is less certain whether the New Mexico Public Regulation Commission (PRC) would need to review the transaction.

➤ The provisions of the ordinance are severable; the energy transition provisions would remain intact even if the municipalization is blocked.

Proposition K would amend the city of El Paso's Home Rule Charter. In Texas, a home rule city may do anything authorized by its charter that is not specifically prohibited or preempted by the Texas Constitution or state or federal law. By comparison, a general law city has no charter and may only exercise those powers that are specifically granted or implied by statute.

Proposition K establishes robust renewable portfolio standard

The measure calls for the city to "employ all available methods to require" that 80% of energy used within the city is sourced from renewables by 2030 and 100% is sourced from renewables by 2045. The ordinance is rather open-ended and does not specify how the standard will be implemented, who will be responsible for compliance, whether there will be a penalty mechanism for failure to achieve the goal, or if the purchase of renewable energy credits may be used to offset noncompliance.

A climate department, under the leadership of a climate director, would implement the policy outlined in the ordinance. The climate director would be mandated to do the following:

– Produce a plan for the city to achieve its renewable energy goals that includes consideration of public transportation, solar power generation at municipal facilities, and energy efficiency of city buildings.

– Prepare a climate impact statement prior to any City Council vote affecting the climate policy.

– Report to the City Council annually on climate impacts for the city of El Paso, looking at all emissions generated within the city limits.

– Create an annual goal for the creation of climate jobs.

– Establish an annual solar generation plan that encourages the development of rooftop solar.

– Develop annual climate disaster mitigation and preparedness plans.

– Investigate and report on the feasibility of converting EPE to a municipal utility.

A nonsalaried Climate Commission consisting of nine members designated by the City Council will oversee the above initiatives.

EPE has characterized Proposition K as unnecessary, noting that as part of a strategic planning initiative, the company announced initiatives designed to increase the use of renewables and improve reliability simultaneously. To meet these goals, the company is constructing a 228-MW gas-fired generation unit at its existing Newman Power Plant site. The plant, known as Newman East CT (Newman Unit 6), is expected to come online in June.

In addition, EPE indicates that it plans to purchase energy and capacity from a 100-MW solar facility to be constructed in Santa Teresa, NM; a 100-MW solar facility combined with 50 MW of battery storage to be constructed in Otero County, NM; and a 50-MW stand-alone battery storage facility to be constructed in Canutillo, Texas. EPE has also said it plans to implement new technologies and customer programs, including advanced metering systems, predictive maintenance technology, electric vehicle infrastructure and more self-service customer tools.

More recently, EPE announced its VISION 2045 campaign, under which EPE plans to produce 715 MW of renewable energy by 2026, with a goal to achieve 80% carbon-free energy by 2035 in pursuit of a 100-by-2045 goal. The company also cited its Texas Community Solar Program, which allows customers to reduce their carbon footprint by receiving the majority of their energy from EPE's solar facilities.

Existing statewide renewable portfolio requirements less stringent than city's goals

In 1999, in conjunction with the implementation of retail competition for generation in Electric Reliability Council of Texas Inc., the Legislature enacted a goal requiring 2,000 MW of renewable generation capacity to be installed by 2009 and established a renewable energy credit trading program.

In 2005, the Legislature expanded the goal for renewable energy to 5,880 MW by 2015, set an "aspirational" goal of 10,000 MW of renewable generating capacity by 2025 and set a target of 500 MW of nonwind renewable generating capacity. Just within ERCOT, which accounts for about 90% of the electricity sold in the state, combined operating and planned solar and wind projects aggregate to about 150 GW. Solar and wind generation served 28% of the load across the region in 2021 and 30% in 2022.

Municipalization to likely take years to complete

EPE opposes the municipalization proposal. According to EPE, the proposal would create two utilities: one that would serve customers within the El Paso city limits and another that would serve those EPE customers outside of El Paso in both Texas and New Mexico. EPE questions how customers in El Paso would be served, given that the majority of the company's generation assets are outside the city. EPE contends that oversight by the city of a small municipal utility with limited generation assets could result in higher rates as well as uncertainty around the provision of safe and reliable service.

Since the municipalization would not be consensual, the city would be forced to acquire the targeted assets through a condemnation proceeding. The related valuation of the assets to be acquired would likely be drawn out and contentious. Sun Jupiter paid $4.37 billion when it purchased EPE in 2020, at which time the company had total assets valued at $3.846 billion, according to S&P Global Market Intelligence data. According to local press reports, EPE has valued its assets at approximately $8 billion, and a study by the El Paso Chamber of Commerce estimated the cost at $9 billion.

There are already large cities within Texas that operate municipal utilities, including Austin and San Antonio; those municipal electric utilities were formed in the 1940s and 1890s, respectively.

The PUC does not regulate municipal utilities. In fact, in Texas, the cities grant the franchises to serve the utilities and have "original jurisdiction" to set distribution rates within the confines of the city. The PUC has original jurisdiction over unincorporated areas outside of the city limits that are part of the utility's service territory and appellate jurisdiction over the area within the city limits, meaning that the companies can appeal a rate order by a city or cities to the PUC. In practice, cities have generally ceded original jurisdiction to the PUC and then intervene in the relevant cases before the PUC.

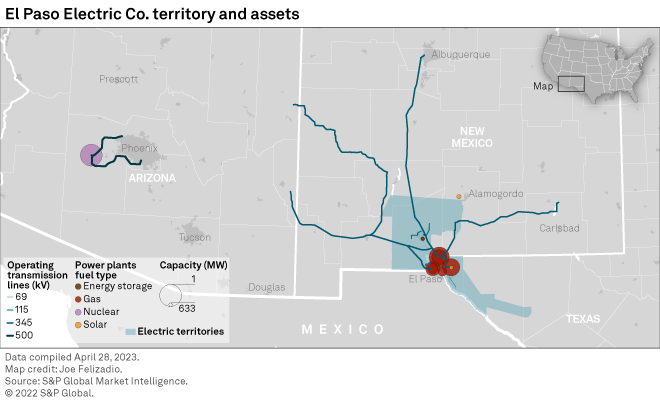

EPE is a vertically integrated regional electric utility providing generation, transmission and distribution service to approximately 500,000 retail and wholesale customers in a 10,000-square-mile area of the Rio Grande Valley in West Texas and southern New Mexico. EPE's operations and rates within Texas are subject to oversight by the Texas PUC. The city of El Paso intervenes as a stakeholder in rate and other proceedings before the PUC. EPE's most recent rate case was decided in September 2022 when the commission authorized the company a $33 million rate increase following a settlement among the parties, including the city. The agreement and order authorized EPE a 9.35% return on equity; the agreement and order did not specify an authorized rate base value, but the company had identified a $2.044 billion jurisdictional rate base in its filing.

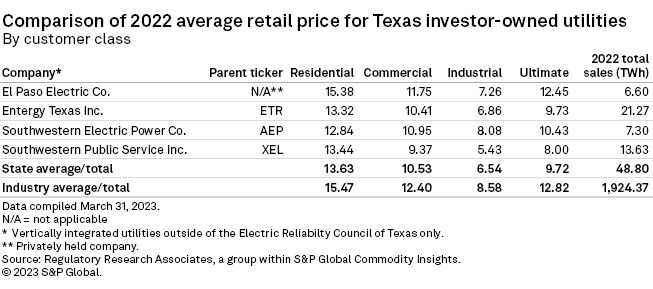

Based on data for 2022 released by the US Energy Information Administration, the prices paid by EPE customers are, for the most part, higher than they are for customers of other vertically integrated utilities in Texas but are below nationwide averages.

City's acquisition of EPE's assets to be subject to review by PUC, others

Several sections of state law could be brought to bear, but it appears that Section 39 of the Public Utility Regulatory Act would be most relevant.

Section 39 requires any electric utility or transmission and distribution utility operating in the state to report and obtain approval of the commission before closing of any transaction in which the utility will be merged or consolidated with another electric utility or transmission and distribution utility, at least 50% of the stock of the utility will be transferred or sold, or a controlling interest or operational control of the utility will be transferred to a third party.

To approve a transaction under Section 39, the PUC must find that the transaction is in the public interest, after considering whether the transaction will adversely affect the reliability or cost of service of the electric utility.

In reaching its determination, the commission is to consider the reasonable value of the property, facilities or securities to be acquired, disposed of, merged, transferred or consolidated as well as determine whether the public utility will receive consideration equal to the reasonable value of the assets when it sells, leases or transfers assets. The PUC must also consider whether the transaction will adversely affect the health or safety of customers or employees, result in the transfer of jobs of citizens of the state to workers domiciled outside the state, or result in a decline of service. If the commission finds that a transaction is not in the public interest, the commission may take action to remediate any related excess costs or other detrimental impacts.

The PUC has imposed stringent standards on mergers. In approving the 2020 transaction through which Sun Jupiter acquired EPE, the PUC required rate credits to ensure that customers benefitted from the transaction and secured commitments from the company with respect to environmental, social and governance program funding, local control and workforce continuity, board of directors' composition, renewable resource funding, customer service, and ring-fencing/corporate governance. Among the corporate governance commitments, the new owners agreed to maintain ownership for at least 10 years post-closing. The provisions were outlined in a settlement reached by most of the major stakeholders. The city of El Paso was among the signatories to that agreement, and it is unclear how that would impact the city's ability to acquire a portion of the EPE's assets.

It is also unclear what, if any, post-close conditions the PUC would be able to impose since it would be essentially giving up jurisdiction over the acquired assets.

The 2020 transaction was also subject to review by the Federal Energy Regulatory Commission, the Nuclear Regulatory Commission, the Federal Communications Commission and the New Mexico PRC. Presumably, the federal authorities would need to sign off on a municipalization.

Approval by New Mexico PRC may or may not be required

Similar to the federal authorities, whether or not PRC review is required may hinge on which of EPE's assets the city targets for acquisition, since the municipal utility would not provide service within New Mexico. An argument could be made that the transaction could impact New Mexico ratepayers indirectly, thus requiring PRC approval.

New Mexico statutes with respect to utility acquisitions state that a transaction is to be approved unless the commission finds it to be unlawful or inconsistent with the public interest. The PRC has identified four principal factors it must consider when reviewing a proposed merger or acquisition: (1) whether the transaction provides benefits to utility customers; (2) whether the PRC's jurisdiction will be preserved; (3) whether the quality of service will be diminished; and (4) whether the transaction will result in the improper subsidization of non-utility activities.

The PRC has not historically been particularly restrictive when it comes to merger reviews. In approving the 2020 acquisition of EPE by Sun Jupiter, the PRC adopted a settlement that included the issuance of rate credits to New Mexico jurisdictional ratepayers and the companies' agreement to fund $100 million of economic development activities in EPE's service territory, $20 million of which would be allocated to New Mexico jurisdictional operations over 20 years, beginning in 2020. Other key provisions specified in the adopted settlement included restrictions on utility dividend payments and a requirement to restructure EPE's board of directors.

According to press reports, the mayor of Las Cruces, one of the New Mexico cities served by EPE, opposes the El Paso municipalization effort due to concerns that it could mean higher costs for New Mexico customers. Notably, Las Cruces launched its own efforts to condemn and acquire EPE's assets in the 1990s to form a municipal utility. After a lengthy court battle to gain the right to do so, the city ultimately abandoned its plans due to financing costs.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.