Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Jun, 2024

The rate of growth in US excess and surplus lines premium volume continued to slow in 2023, but the market's importance to the property and casualty sector has never been higher, according to an analysis by S&P Global Market Intelligence.

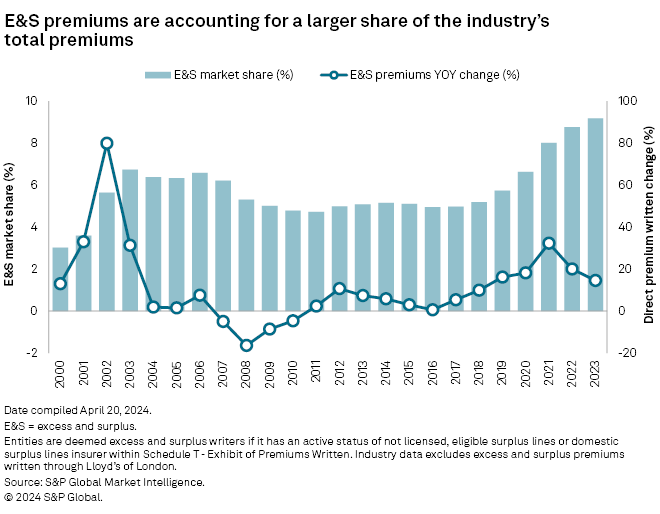

➤ S&P Global Market Intelligence's 2024 US Excess & Surplus Insurance Market Report finds that the growth rate of US excess and surplus (E&S) direct premiums rose 14.5% in 2023, down from the peak year-over-year increase of 32.3% in 2021 and 20.1% in 2022. The US E&S market now constitutes 9.2% of the country's total direct premiums written in 2023, up from the 5.2% market share for 2018. For more discussion on what we consider to be E&S business, please see the methodology note at the end of this article.

➤ A combination of three commercial property lines and homeowners insurance direct premiums surged to $27.44 billion in 2023, a year-over-year increase of roughly 41%. This marks the fifth straight year that aggregate premiums in the property lines have grown by at least 20%, with the 25.1% increase in 2020 being the previous high. Rising reinsurance costs and limited appetite among admitted carriers to write business in catastrophe-prone states drove premium dollars into the E&S property market in 2023.

➤ The aggregated premiums in several liability lines, consisting of the as-reported lines of product, medical professional liability and "other," grew by only 4.2% in 2023, the first time in five years the total liability lines did not grow by double digits. The combined liability lines reported $45.40 billion in direct premiums, equating to roughly half (52.5%) of the total US E&S direct premiums in 2023.

The US-domiciled E&S market increased 14.5% in 2023, down from the peak year-over-year increase of 32.3% in 2021 and 20.1% in 2022. E&S direct premiums written totaled $86.47 billion during the most recent year compared to $75.51 billion in 2022. The bulk of E&S premiums in 2023 were written within various liability or casualty coverages (52.5%), several property lines of business (31.7%) and commercial auto (5.4%).

The largest individual writer of E&S business in 2023 was Berkshire Hathaway Inc. with its reported $8.39 billion in direct premiums, followed by American International Group Inc. and Fairfax Financial Holdings Limited with $4.96 billion and $4.04 billion, respectively.

In total, E&S premiums constituted 9.2% of the country's total direct premiums written in 2023, compared to 8.8% in the prior year and 5.2% at the end of 2018.

Property lines

The property E&S market has seen material growth in recent years as the admitted insurance market has pulled back or exited markets that have the potential for high catastrophe losses due to wildfires and hurricanes.

Timothy Turner, president of wholesale E&S-focused distributor Ryan Specialty Holdings Inc., noted during its year-end 2023 earnings call that a combination of higher loss activity, higher reinsurance costs and retentions of risk, persistent inflation and ongoing focus on insurance to value make for a challenging property market, which is driving premium dollars into the E&S market.

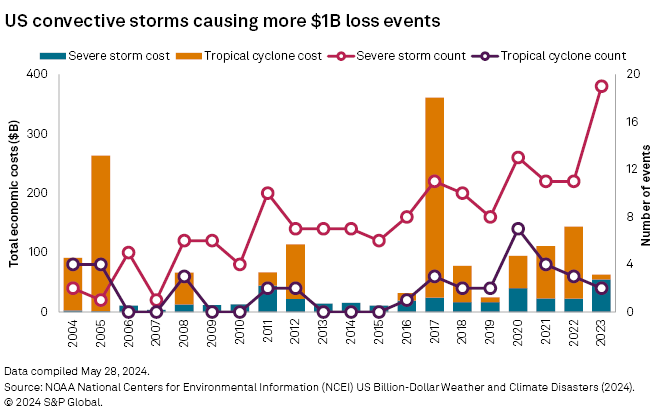

Turner believes premiums transferring into the specialty market will remain there due to "heightened frequency and severity of property losses, particularly in coastal areas, and more recently in the Midwest."

The number of hurricanes or tropical cyclones is less frequent; however, they have fueled outsized losses compared to more numerous convective severe storms the industry has faced in recent years. According to the National Oceanic and Atmospheric Administration's National Center for Environmental Information, the number of economic losses from severe storms that exceeded $1 billion has been trending higher in recent years. NOAA reported a record high number of those storms at 19 with $55 billion in economic losses in 2023.

For our state-specific analysis, we combined commercial property (fire, allied lines and commercial multi-peril (non-liability)) and homeowners line of business into a total property rollup, as several of the commercial business lines include personal property risks.

While the statutory data does not allow differentiation between commercial or personal risks within the data, it is apparent that the E&S market is taking on an outside role within the property business lines in certain states.

Three states have seen their share of the E&S premiums against the total property market grow by more than 8 percentage points since 2018. South Carolina is up 9.0 percentage points to 19.4% of the market. California rose 8.8 percentage points and now stands at 14.2% in the state, while Louisiana grew 8.3 percentage points, making E&S premiums 22.7% of the total property market in 2023. Louisiana has the largest share of E&S premiums to the state's total in the nation, closely followed by Florida.

E&S premiums accounted for 21.1% of the property lines direct premiums written in Florida in 2023, up 7.1 percentage points from 2018. The E&S figures exclude its state-backed insurer of last resort, Citizens Property Insurance Corp., the largest property insurer in the state, as the company is licensed to do business in the state.

In total, the US E&S property direct premiums grew to $27.44 billion in 2023, a year-over-year increase of roughly 41%, which marks the fifth straight year that aggregate premiums in the property lines have grown by at least 20%. The five-year period's previous high was set in 2020 with a 25.1% year-over-year increase.

E&S premiums now account for 11.1% of the nation's total property premiums, almost double its share of the market in 2018.

Berkshire was the market leader in 2023 with $4.08 billion in total direct premiums written across the four individual business lines. It was the only company to be ranked within the top three largest writers in each of the separate lines of business.

Liability lines

The four combined as-reported liability lines of business accounted for roughly half the total of E&S premiums in 2023. In aggregate, the liability lines reported $45.40 billion in direct premiums during the year, up 4.2% from the prior year's total. For the first time in five years, the total liability lines, consisting of the as-reported lines of product, medical professional and "other" liability, year-over-year premiums did not grow by double digits in 2023.

Overall, the aggregated E&S liability business lines premiums accounted for roughly 35% of the collective market share of total premiums written within the lines in 2023, an increase of less than 1 percentage point from the prior year and up 9.0 percentage points from 2018.

The change in year-over-year premiums varies greatly among the various business lines, with other liability (claims-made) the only line reporting lower premiums than the previous year. The premiums in the business line were $14.70 billion in 2023, a decrease from $15.78 billion in the prior year. On the other hand, other liability (occurrence) grew 11.6% in 2023 to $25.29 billion. Among the four casualty lines, this was the only line that grew by double digits during the year.

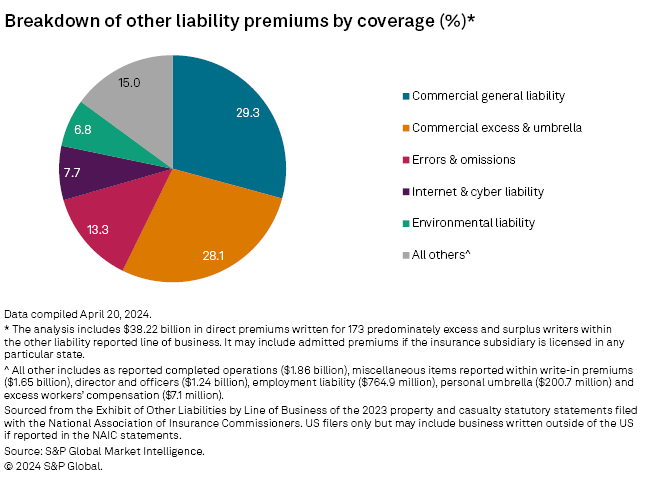

The other liability business lines reported within regulatory statements include numerous subtypes of insurance such as directors and officers, completed operations, errors and omissions, environmental liability, commercial excess, and umbrella. A new Exhibit of Other Liabilities by Line of Business will now provide a breakout of direct premiums written and direct paid and unpaid losses to offer greater details into a reported business line that covers a diverse set of risks.

A review of 173 predominately US E&S subsidiaries reported $38.22 billion in reported premiums in the other liability business line. The total may include admitted premiums if the insurance subsidiary is licensed in any specific state. The largest share was in commercial general liability, which accounted for roughly 29.3% of the reported total. This was followed by commercial excess and umbrella at 28.1%, errors and omissions at 13.3%, and internet and cyber liability at 7.7%.

Among the remaining two liability lines, medical professional liability E&S direct premiums grew to $3.21 billion in 2023, an increase of 6.9% from the previous year. E&S premiums accounted for 26.3% of the total medical professional liability market in 2023.

Product liability E&S direct premiums grew 3.1% year over year in 2023, pushing its business line premiums to $2.20 billion. Among the four reported liability lines, product liability E&S premiums had the largest market share, which was 42.4% of the total market in 2023.

Methodology

E&S results are derived from an S&P Global Market Intelligence template that scans Schedule T of annual and quarterly statutory statements for individual entities to identify those companies that list their status as "not licensed," "eligible surplus lines" or "domestic surplus lines insurer." They exclude those entities whose active status in a particular geography shows as "licensed or chartered," "non-domiciled risk-retention group," or "qualified or accredited reinsurer."

Data is limited to US filers and excludes so-called alien surplus lines insurers.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.