S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Feb, 2023

By Tim Zawacki

The modernization of healthcare delivery accelerated during the COVID-19 pandemic as medical providers and patients sought alternatives to traditional in-person visits for routine care. High levels of consumer satisfaction and the elimination of key structural barriers favor the continued expansion of telemedicine even as virus-related restrictions have eased.

A recent survey conducted by 451 Research, a part of S&P Global, finds that the vast majority of respondents who have tried telemedicine are either somewhat or very likely to use it again. The survey also found that telemedicine had been covered in whole or in part by many respondents' health insurance plans.

To that point, provisions of the Consolidated Appropriations Act of 2023, the omnibus spending package that passed Congress at the end of 2022, extend temporary pandemic measures that broadened telemedicine accessibility for Medicare members for an additional two years. It also calls for comprehensive reporting on the use of telemedicine and its impact in reducing emergency room visits and hospitalizations among other things.

The potential for telemedicine to enhance convenience for consumers, improve outcomes and reduce costs could be especially critical for all participants in the healthcare system at a time when medical inflation continues to rise and questions persist about the long-term effects on morbidity of delayed and deferred care.

Expanding access

Appreciation of telemedicine's utility by private health insurers and their members predated the pandemic, but it was only after the onset of COVID-19 that it became broadly available for Medicare recipients.

Individual and group Medicare business constituted 30.1% of total U.S. accident and health direct premiums earned in 2021 with UnitedHealth Group Inc., Humana Inc., CVS Health Corp., Elevance Health Inc. and Centene Corp. ranking as the largest private writers.

The Centers for Medicare and Medicaid Services, or CMS, issued emergency guidance in March 2020 that expanded telemedicine flexibility. The Coronavirus Aid, Relief, and Economic Security, or CARES, Act enabled this flexibility through the duration of the COVID-19 public health emergency. Among other things, the legislation broadened the use of telemedicine beyond beneficiaries in rural or medically underserved areas and allowed for services to be provided at home as opposed to inside a healthcare facility.

The U.S. Department of Health and Human Services' Office of Health Policy observed a 63-fold increase in Medicare fee-for-service telemedicine visits between 2019 and 2020.

The omnibus legislation provides for the detachment of the temporary telemedicine flexibility from the public health emergency, which is scheduled to expire in April. It now will expire at year-end 2024 unless the public health emergency remains in place on that date. It also includes language extending similar flexibility to the U.S. Department of Veterans Affairs, noting that the number of telemedicine appointments offered to veterans increased by 1,831% during a 12-month period that ended in January 2021.

Utilization varies by generation

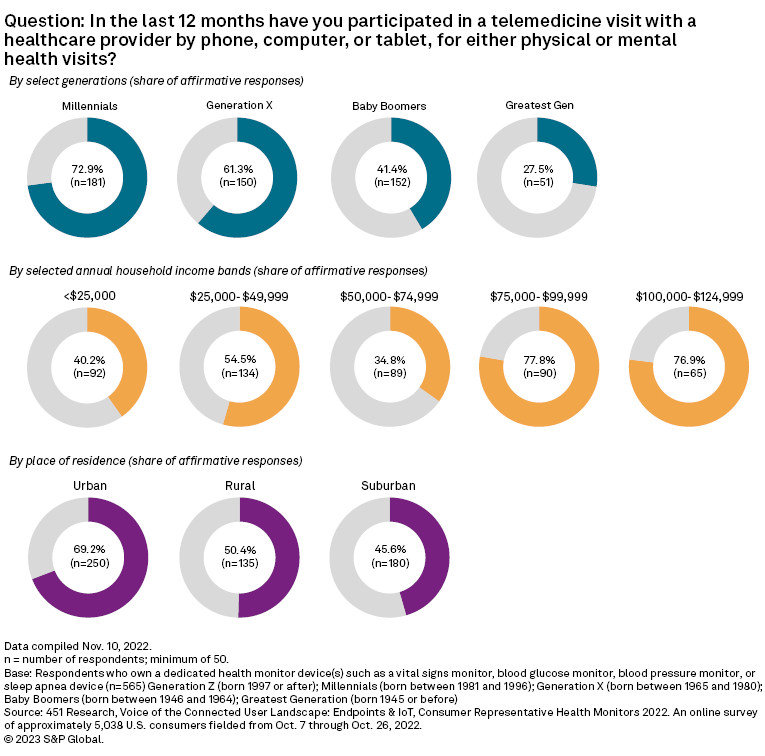

Despite the tremendous expansion in telemedicine facilitated by pandemic-era rulemaking, results from the 451 Research survey suggest plenty of room for upside among those who are or will soon be eligible for Medicare.

Only 27.5% of survey respondents in the greatest generation, which includes those born in 1945 and prior, said they had participated in a telemedicine visit with a healthcare provider during the previous 12 months. Among baby boomers, which is defined as those born between 1946 and 1964, 41.4% said that they had done so. This contrasts with respondents in younger generations, where a substantial majority said they had engaged in a telemedicine visit and the overall result of 57% across all age groups.

The survey found a range of primary reasons for telemedicine visits, including for a physical exam or to address a medical concern (31.0% of responses), the treatment of a chronic medical condition (22.6%), mental health or counseling (18.9%), to refill a prescription (14.9%), and a pre- or post-hospitalization or surgery check (8.7%).

Respondents across all but the millennial generation indicated that they still prefer in-person visits to telemedicine, but the vast majority of those who have participated in a telemedicine visit in the past 12 months said that they were likely to be repeat customers. Among all respondents, 67.8% said they were "very" likely and 24.5% indicated that they were "somewhat" likely to use telemedicine services again.

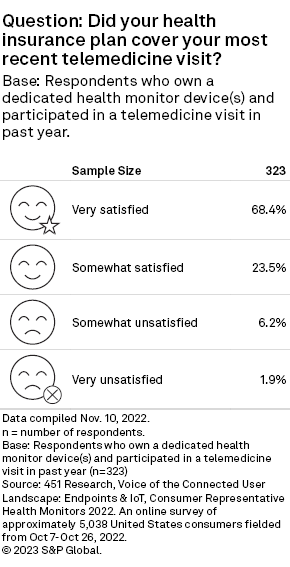

Telemedicine satisfaction levels also were high across generations and the population as a whole, with 68.4% saying that they were "very" satisfied and another 23.5% indicating that they were "somewhat" satisfied.

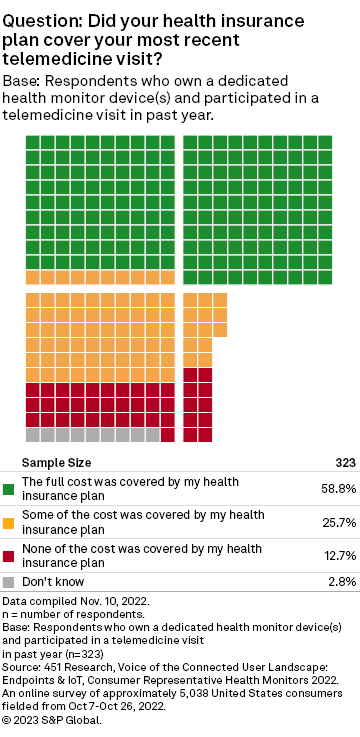

Cost and convenience of access represent two factors that could also favor repeat visits. The survey found that only 12.7% of respondents said that none of the cost of their telemedicine visit was covered by their insurance plan with 58.8% and 25.7%, respectively, saying that their insurance covered "all" or "some" of the cost.

The survey showed the use of a range of technologies to engage with the telemedicine provider. Videoconferencing through a personal computer accounted for 36.8% of responses, followed by videoconference via mobile phone or tablet (35.6%) and voice via landline or mobile phone (26.6%).

The minimum CMS requirements for telemedicine services include audio and video equipment that permits two-way, real-time interactive communication between the patient and distant site. The use of audio-only equipment has been temporarily permitted during the pandemic.

Methodology

Results reflect responses to 451 Research's Voice of the Connected User Landscape: Endpoints & IoT, Health Monitors 2022, an online survey of approximately 5,038 U.S. consumers fielded from Oct. 7, 2022, through Oct. 26, 2022. Responses to the question on telemedicine utilization was limited to those who own one or more dedicated health monitor devices such as a vital sign monitor, blood glucose monitor, blood pressure monitor, or sleep apnea device (number of responses=565). Responses to the remaining telemedicine questions were limited to those who own a health monitor device and had participated in a telemedicine visit in the past year (n=323).

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.