Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Sep, 2021

Highlights

Differences and Similarities in the Credit Risk Assessment of a Non-Financial Corporation via a Probability of Default and a Scoring Model

Introduction

Since the introduction of Altman’s Z-score for US corporations in 1968,[1] there has been a proliferation of statistical models that combine financial ratios and socioeconomic/ macroeconomic factors with advanced mathematical techniques to estimate the creditworthiness of publicly listed or privately held companies in a simplified, quick, automated and scalable way.

Fundamentals-based credit risk models usually come in two flavors, depending on the asset class they aim to cover: (1) Probability of Default (PD) models that are trained and calibrated on default flags and are useful for small and medium-sized enterprises (SMEs), and (2) Scoring models that utilize the rankings of an established credit rating agency to estimate a credit score for low-default asset classes, such as high-revenue corporations or insurance companies.

At S&P Global Market Intelligence, we offer both types of statistical models: PD Model Fundamentals (PDFN) and CreditModelTM (CM). PDFN is a PD model that covers publicly listed and privately owned corporations and banks, with no revenue and asset size limitation. CM is a scoring model trained on S&P Global Ratings, covering publicly listed and privately owned corporations, banks and insurance companies, with more than $25m USD in total revenue and $100m in total assets respectively.[2]

PDFN and CM overlap in their coverage of medium and large corporations with more than $25m in revenue (banks over $100m in assets) and, in certain instances, can (and will) provide divergent credit risk assessments for the same company, with a difference of several credit score notches at times.

This should be no surprise, given that we are comparing the assessment from two different families of models (PD versus scoring models) that were trained on different datasets (default flags versus S&P Global Ratings’ ratings), and are characterized by a different analytical “DNA”. The risk assessment is medium-term for PD models, with a stability of circa one-year time horizon, and long-term for scoring models trained on ratings, with a stability of three to five years for investment-grade scores and two to three years for non-investment grade scores.

In the next sections, we will perform an in-depth analysis on the output of CM 3.0 and PDFN 2.0 for non-financial corporations in North America where weak credit scores are provided:

Drivers of differences between CM and PDFN credit risk assessment

S&P Global Market Intelligence Credit Analytics suite provides access to CM and PDFN, analytics, pre-calculated scores and benchmarks combined with workflow tools that are integrated with S&P Capital IQ platform data.

As part of this suite, the absolute contribution is a powerful tool to conduct an empirical analysis of these differences:

Common financial traits of distressed companies, using different statistical models

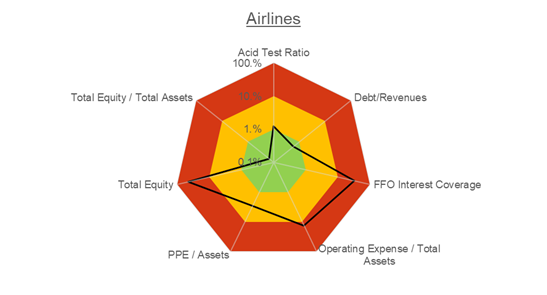

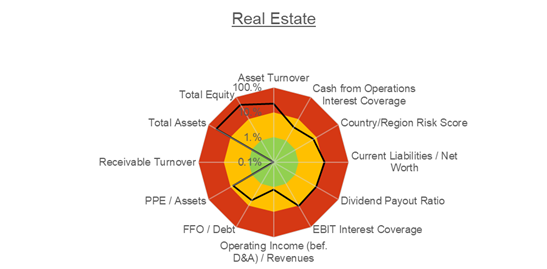

Using the S&P Capital IQ platform screening tools, it is possible to quickly extract all non-financial corporations that have a pre-calculated output from either CM 3.0 or PDFN 2.0 during the last 15+ years. For sake of simplicity, and to improve comparability, this analysis focuses on non-financial companies domiciled in North America (US and Canada only), and excludes the Airlines and Real Estate industries, which are treated as separate sub-models in CM 3.0.

CM analysis

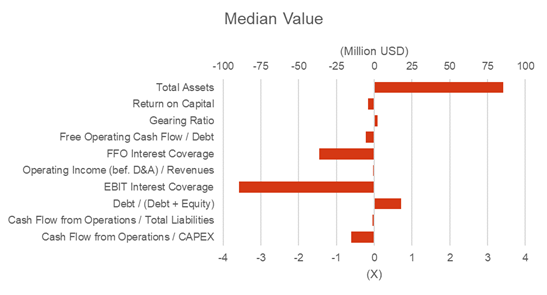

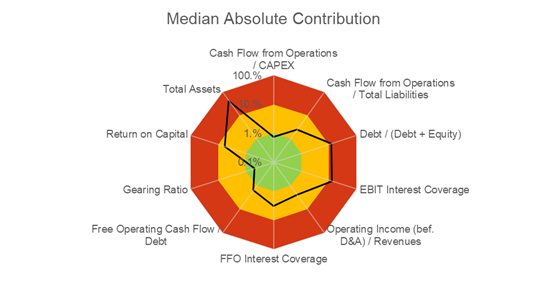

Figure 1 shows the median value and median absolute contribution of each model input for companies that have a CM 3.0 score worse than ‘b-’ between 2005 and 2020. Within this period, there are 2.7k non-financial companies meeting the criteria in the Credit Analytics pre-scored database.

Figure 1: Median value and median absolute contribution for North American companies with CM 3.0 score worse than ‘b-’, 2005-2020 (2.7k companies)

Source: S&P Global Market Intelligence, data as of July 30, 2021. For illustrative purposes only.

Note: Since these statistics are calculated independently, the median absolute contribution values do not necessarily correspond to the contributions of median values. Moreover, the median absolute contributions do not necessarily add up to 100%; the absolute contributions are meant to add up to 100% only at the individual observation level.

At first glance, the companies that receive a CM 3.0 score worse than ‘b-’ tend to have:

These conclusions do not change materially if we analyze the data by year, consistent with the fact that the model weights certain drivers more heavily than others.

Absolute contribution can be used to quickly identify the main drivers of such low credit scores. By simply looking at the red area where the absolute contribution is higher than 10%, it is easy to find the following:

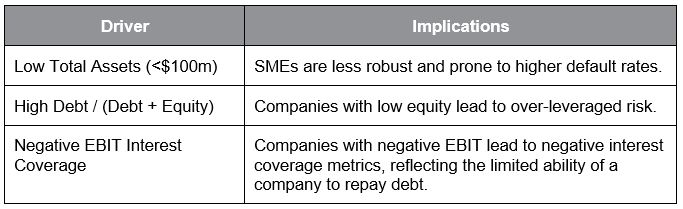

Table 1: Main drivers for North American companies with CM 3.0 score worse than ‘b-’

Source: S&P Global Market Intelligence, as of July 30, 2021. For illustrative purposes only.

The statistical dominance of Total Assets, EBIT Interest Coverage and Debt / (Debt + Equity) shall not come as a surprise. CM 3.0 is a statistical model that was trained on S&P Global Ratings’ ratings and uses socio-economic factors and company financials to generate credit scores that statistically align with S&P Global Ratings’ ratings. Looking at the whole universe of North American companies rated by S&P Global Ratings as of the end of 2020, only less than 1% has Total Assets < $100m.[3] Even if we widen the group and look at the North American companies with Total Assets < $300m, there are only five cases with negative EBIT Interest Coverage rated “B-” or better by S&P Global Ratings. In fact, these five cases are all rated in “B” category.[4] Finally, circa 50% of the cases with Total Assets < $300m and Debt / (Debt + Equity) > 0.7 have a rating of “B- or worse”. Thus, CM 3.0 is consistent with the empirical observations from S&P Global Ratings’ rated universe.

Please, refer to the Appendix for the median absolute contribution of model inputs for companies with a worse than ‘b-’ CM 3.0 score operating outside North America.

PDFN analysis

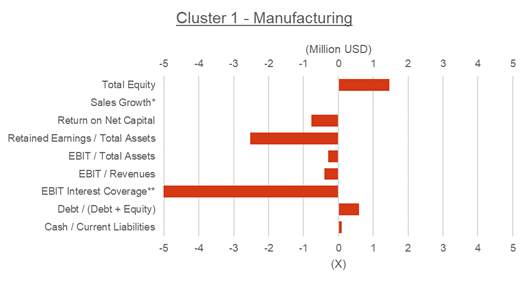

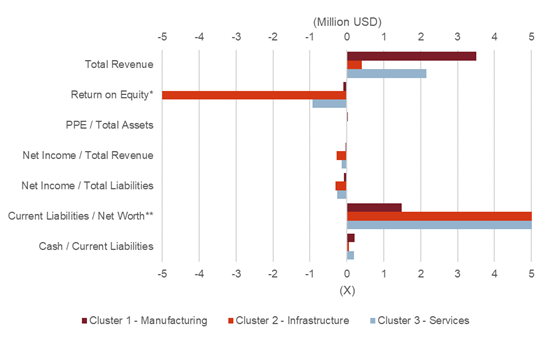

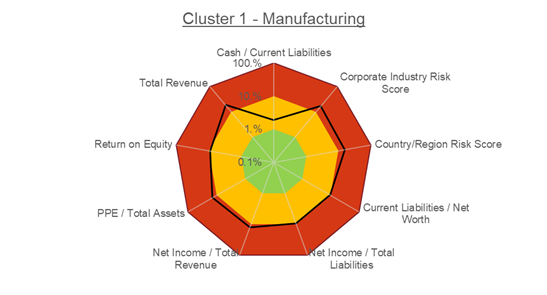

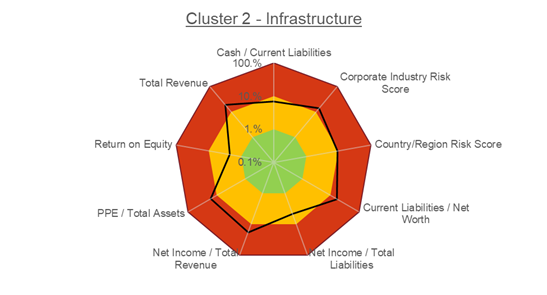

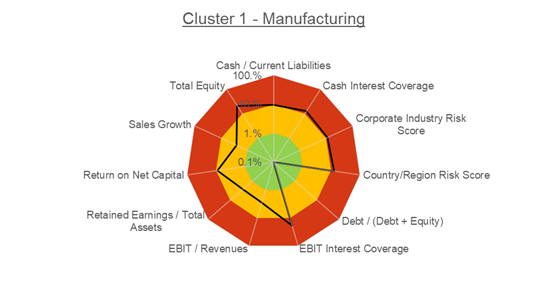

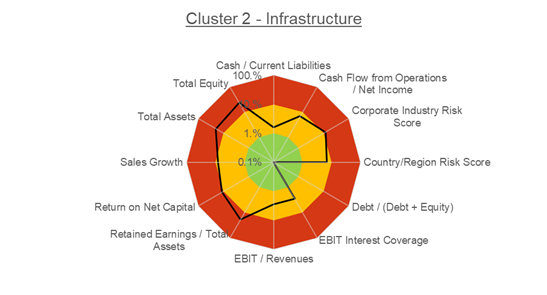

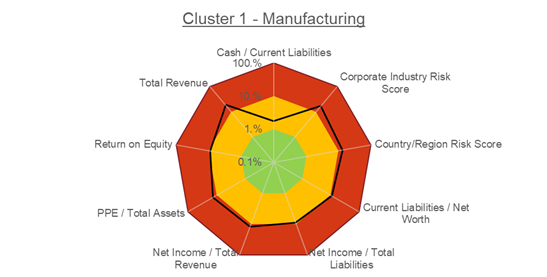

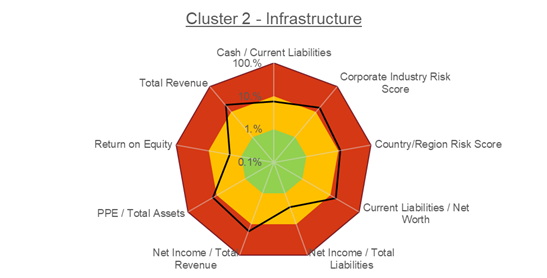

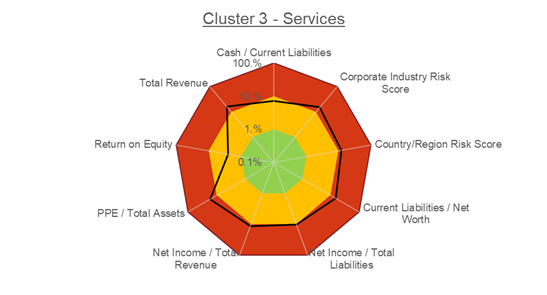

Figures 2, 3, 4 and 5 show the median value and median absolute contribution of each model input for non-financial companies that have a PDFN 2.0 mapped score worse than ‘b-’ between 2005 and 2020. Within this time period, there are 11k public companies and 59k private companies meeting the criteria in the Credit Analytics pre-scored database, divided across the three core industry clusters.

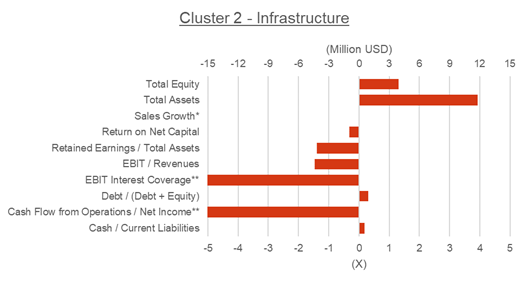

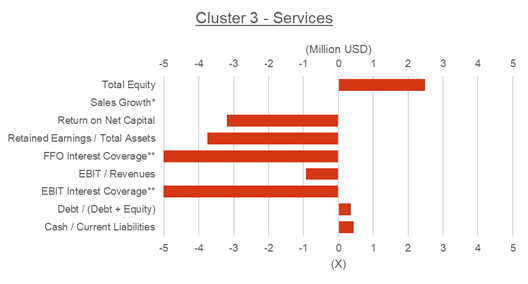

Figure 2: Median value for public North American companies with PDFN 2.0 score worse than ‘b-’, 2005-2020 (11k companies)

*Sales Growth is set to 0 when Total Revenue of prior year is unavailable.

**Median value < −5.

Source: S&P Global Market Intelligence, data as of July 30, 2021. For illustrative purposes only.

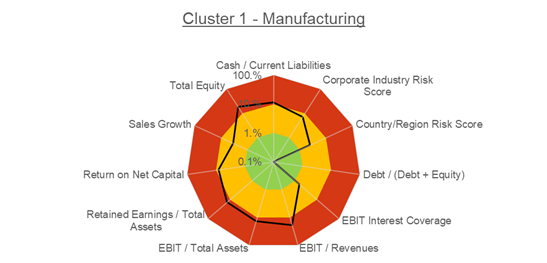

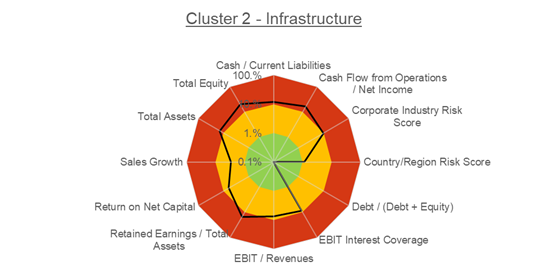

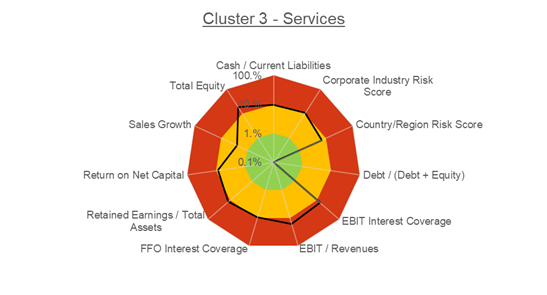

Figure 3: Median absolute contribution for public North American companies with PDFN 2.0 score worse than ‘b-’, 2005-2020 (11k companies)

Source: S&P Global Market Intelligence, data as of July 30, 2021. For illustrative purposes only.

Note: Since these statistics are calculated independently, the median absolute contribution values do not necessarily correspond to the contributions of median values. Moreover, the median absolute contributions do not necessarily add up to 100%; the absolute contributions are meant to add up to 100% only at the individual observation level.

Figure 4: Median value for private North American companies with PDFN 2.0 score worse than ‘b-’, 2005-2020 (59k companies)

*Median value < −5.

**Median value >5.

Source: S&P Global Market Intelligence, data as of July 30, 2021. For illustrative purposes only.

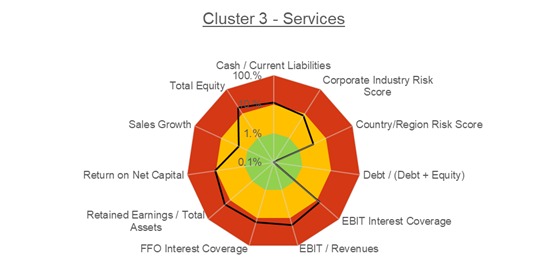

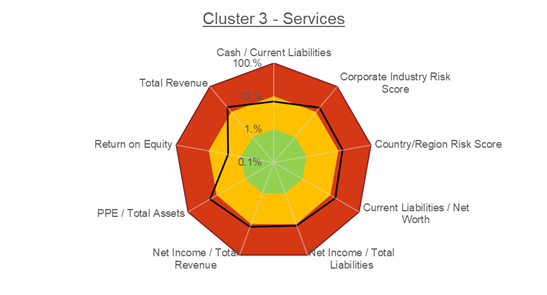

Figure 5: Median absolute contribution for private North American companies with PDFN 2.0 score worse than ‘b-’, 2005-2020 (59k companies)

Source: S&P Global Market Intelligence, data as of July 30, 2021. For illustrative purposes only.

Note: Since these statistics are calculated independently, the median absolute contribution values do not necessarily correspond to the contributions of median values. Moreover, the median absolute contributions do not necessarily add up to 100%; the absolute contributions are meant to add up to 100% only at the individual observation level.

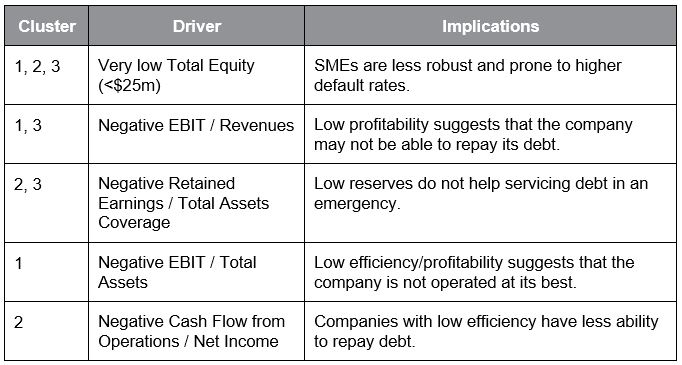

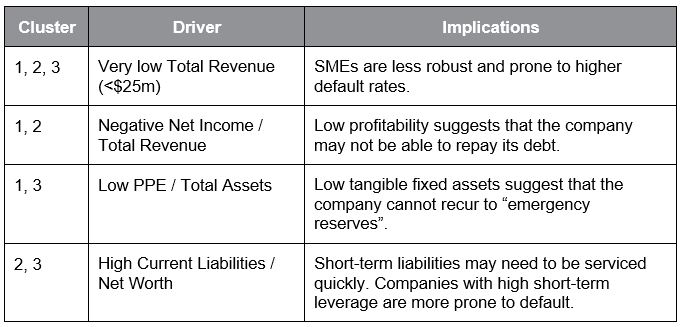

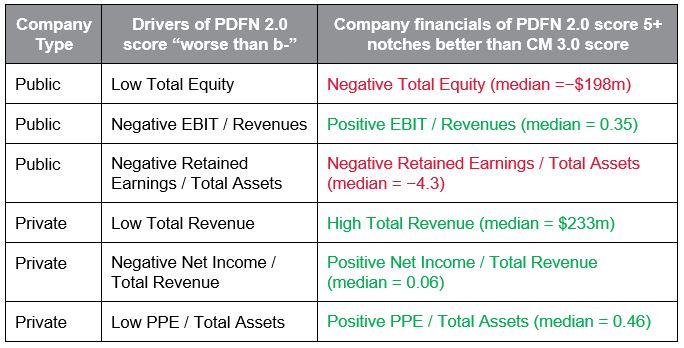

By looking at the radar chart of median absolute contribution, the three main financial drivers of poor PDFN 2.0 scores for each industry cluster are the following:

Table 2: Main drivers for public North American companies with PDFN 2.0 score worse than ‘b-’

Source: S&P Global Market Intelligence, as of July 30, 2021. For illustrative purposes only.

Table 3: Main drivers for private North American companies with PDFN 2.0 score worse than ‘b-’

Source: S&P Global Market Intelligence, as of July 30, 2021. For illustrative purposes only.

Please, refer to the Appendix for the median absolute contribution of model inputs for companies with a worse than ‘b-’ PDFN 2.0 score operating outside North America.

Convergence/Divergence of company scores generated by CM and PDFN

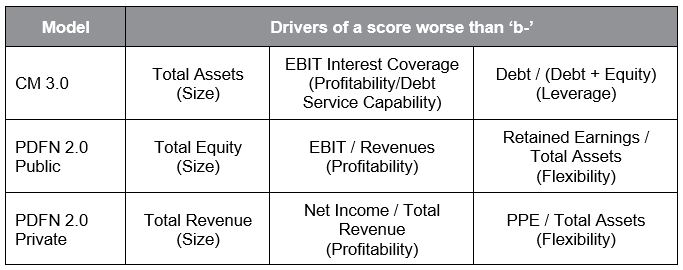

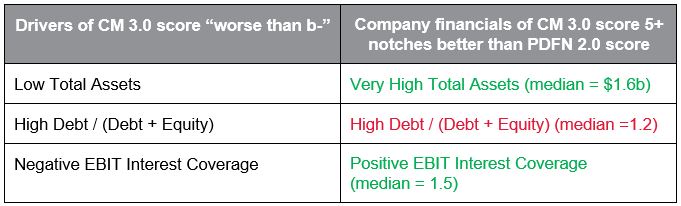

Leveraging the information provided by the absolute contribution, it is possible to identify the main drivers of weak credit risk assessment under each family of models. For example, for non-financial companies domiciled in North America, the three common drivers of a score worse than ‘b-’ are:

Table 4: Main Drivers of weak credit assessment for North American non-financial companies

Source: S&P Global Market Intelligence, as of July 30, 2021. For illustrative purposes only.

While size, profitability and financial leverage/flexibility are the main drivers in all instances, there are subtle differences that play an important role in driving model outputs, which sometimes lead to marked differences between the models, as discussed below.

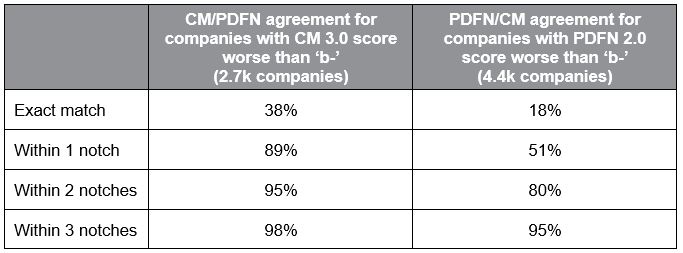

The following analysis focuses on the common sub-set of North American companies that are scored by both models between 2005 and 2020, and have a score worse than ‘b-’ in CM 3.0 (2.7k companies) or in PDFN 2.0 (4.4k companies). Table 5 shows the model agreement in the two cases.

Table 5: Agreement between CM 3.0 and PDFN 2.0 credit assessment

Source: S&P Global Market Intelligence, as of July 30, 2021. For illustrative purposes only.

Both models produce outputs within one notch of each other in most of the cases analyzed. Overall, there are less than 2% (5%) of cases where PDFN 2.0 (CM 3.0) assigns a score differing by more than three notches from the worse than ‘b-’ score of CM 3.0 (PDFN 2.0).

The broad agreement between the two models, despite the different financial inputs and training, reflects the analytical strength of both approaches to assess credit risk and identify weak companies.

At the same time, the different approaches and financial inputs might determine different assessments for companies with financial profiles that present both strong and weak drivers in the same statement.

Looking in more detail at the cases where model disagreements are sizable:

By inspecting the median model input values of this subset of companies, it is evident why CM 3.0 assigns a much better score than PDFN 2.0.

Table 6: North American companies with PDFN 2.0 score worse than ‘b-’ and CM 3.0 score 5+ notches better (46 companies)

Source: S&P Global Market Intelligence, as of July 30, 2021. For illustrative purposes only.

Improvements in size and debt service capability variables (highlighted in green) cause CM 3.0 to generate much better scores, up to ‘a+’. This also offsets the impact of higher leverage variable, i.e., Debt / (Debt + Equity).

For PDFN 2.0, similar considerations apply. Some major drivers of the worse than ‘b-’ score now get a better actual value (highlighted in green), as summarized below.

Table 7: North American companies with CM 3.0 score worse than ‘b-’ and PDFN 2.0 score 5+ notches better (43 companies)

Source: S&P Global Market Intelligence, as of July 30, 2021. For illustrative purposes only.

A holistic approach to measuring credit risk

While both CM and PDFN are very strong tools to perform credit risk assessments, each model tends to focus on a selection of financial items that are optimized for the training and model objectives, i.e., statistically match an S&P Global Rating versus calculate a PD.

To mitigate the necessary assumptions applied by any given statistical model, it is recommended to combine multiple analytics that measure credit risk from different angles of the financial statement.

APPENDIX

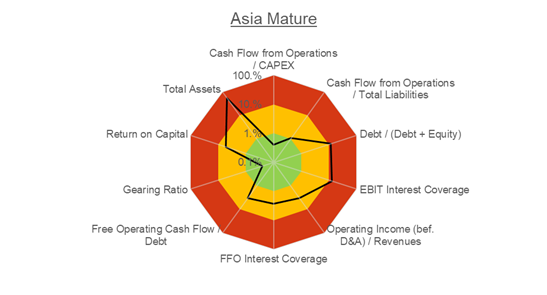

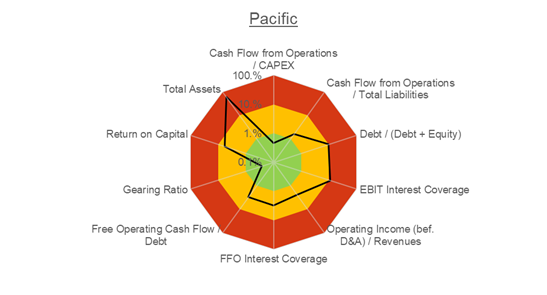

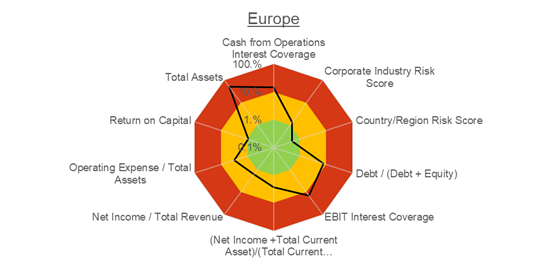

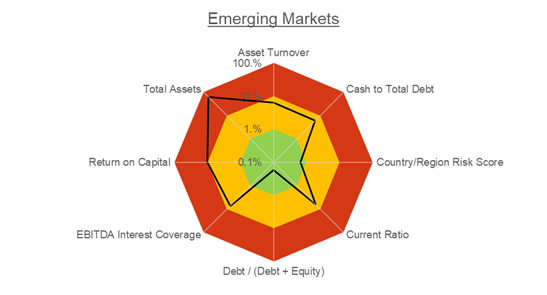

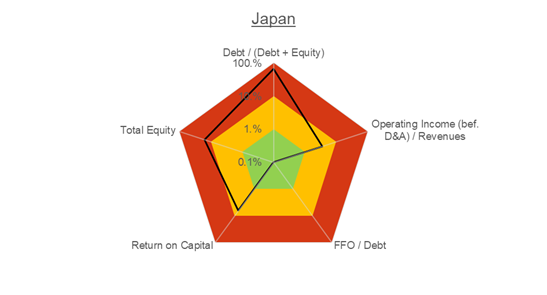

Figure 6: Median absolute contribution for companies in regions outside North America with CM 3.0 score worse than ‘b-’, 2005-2020

Source: S&P Global Market Intelligence, data as of July 30, 2021. For illustrative purposes only.

Figure 7: Median absolute contribution for public companies in regions outside North America with PDFN 2.0 score worse than ‘b-’, 2020

Source: S&P Global Market Intelligence, data as of July 30, 2021. For illustrative purposes only.

Figure 8: Median absolute contribution for private companies in regions outside North America with PDFN 2.0 score worse than ‘b-’, 2020

[1] Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The journal of finance, 23(4), 589-609.

[2] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

[3] Referring to the Long-term Foreign Currency Issuer Credit Rating sourced from S&P Capital IQ Platform, as of July 30, 2021.

[4] Including B+, B and B-.

[5] The assigned score is never above “a+”, in this dataset.

Theme