Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Aug, 2024

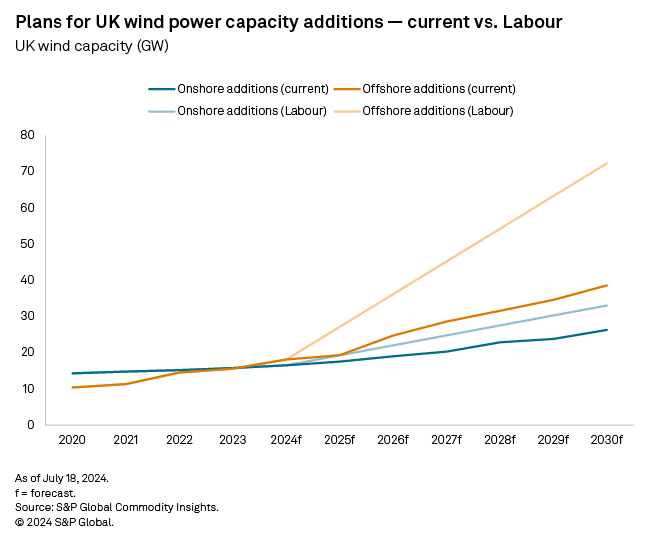

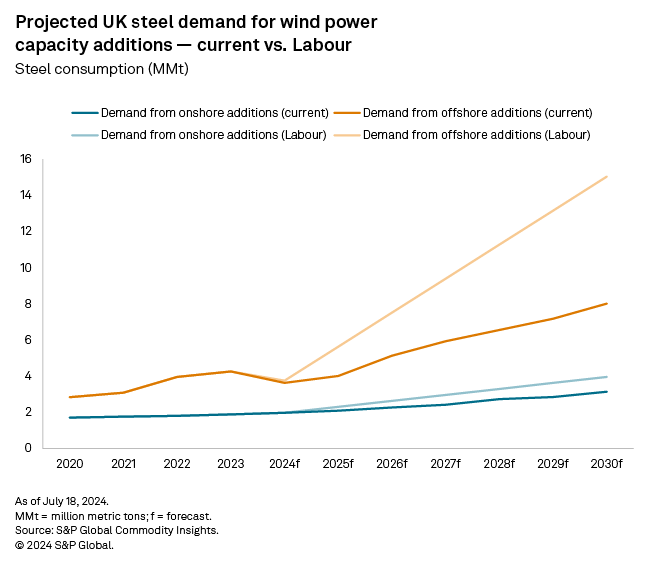

The UK's demand for steel in the form of wind turbines could grow by an additional 26.6 million metric tons by 2030 if the recently elected Labour Party government realizes the country's ambitious wind capacity targets, calculations by S&P Global Commodity Insights show.

➤ The UK could require about 72.9 MMt of steel to meet increased wind turbine demand in 2030.

➤ Some of the UK's forecast rise in steel demand could satisfy China's steel producers instead if wind farm developers source cheaper, China-produced wind turbines.

➤ European steel demand remains weak overall, with little chance of recovery without production cuts this summer.

The new UK chancellor (treasurer), Rachel Reeves, acted quickly to change earlier guidance on where onshore wind in England could be built, with immediate effect July 8. Residents had objected to planning permission for wind turbines in the past, but the new guidance aims to prevent this resistance.

The chancellor is also considering bringing onshore wind back under the Nationally Significant Infrastructure Projects, the government's streamlining process for major infrastructure planning. This would mean decisions on large onshore wind farms would be made nationally rather than locally, potentially speeding up approvals and effectively ignoring local opposition.

The move could lift the UK's steel demand for onshore wind over the next five years to 16.5 MMt from 13.5 MMt and for offshore wind to 56.4 MMt from 32.9 MMt. This would help reach 72.9 MMt in 2030, up from an estimated 46.3 MMt in 2024.

The government plans to finance its green energy ambitions by raising £1.2 billion per year from a "windfall tax on oil and gas giants" and a further £3.5 billion per year from borrowing, according to Labour's manifesto.

The model assumes an average onshore wind turbine size of 5 GW and an offshore one of 14.5 GW. Steel makes up 20% of turbine mass for onshore wind and 90% for offshore wind, with more steel used in offshore turbine foundations.

Some of the future turbines installed in the UK could come from suppliers in China, namely Ming Yang Smart Energy Group Ltd., which is offering high-capacity models for about 30% less in terms of cost than the largest turbine available for buying in Europe.

German clean energy asset manager Luxcara GmbH signed a preferred turbine supplier agreement with Ming Yang for 16 wind turbines of 18.5-MW capacity at its Waterkant offshore wind project in the North Sea on July 6 instead of European producers Siemens Ltd. and Vestas Wind Systems A/S. If this trend continues and extends to the UK, a significant portion of the country's wind turbine-derived steel demand could benefit China's steel producers rather than those in the UK or the rest of Europe.

European steel demand unlikely to pick up during summer slowdown

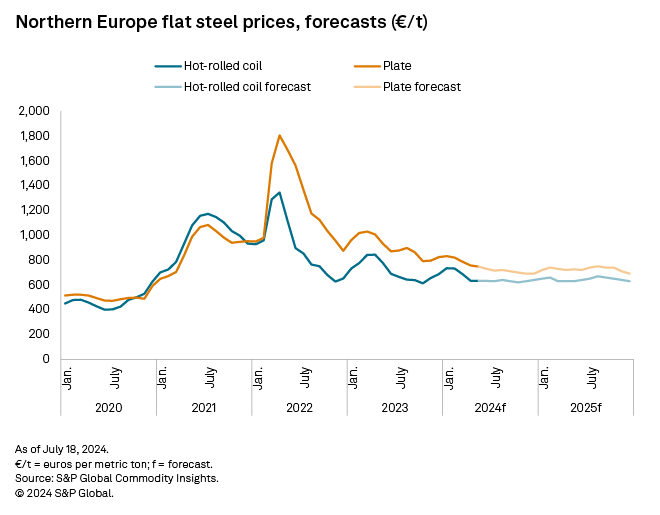

European steel prices will likely remain at suppressed levels in July and August as steelmakers maintain strong production levels in the face of tepid demand, despite an estimated 10.6% of European steelmaking capacity currently offline.

We have lowered our Northern Europe hot-rolled coil price forecast for the second half of 2024 to €632/MMt from €680/MMt, resulting in a forecast average of €654/MMt for full year 2024. We forecast the heavy plate price in Northern Europe will average $704/MMt for the remainder of the year, averaging $741/MMt for 2024.

Steel mill capacity utilization rates across Europe were flat at 71.4% year over year in May as firmer output in France, Belgium and Poland offset weaker production in Germany and Italy. We estimate known steel capacity cuts to stand at 21.9 MMt per year across seven European countries, with further cuts amounting to 6.9 MMt per year set to begin later in 2024 in the UK and Germany.

Our capacity utilization estimate assumes a maximum theoretical annual crude steel production capacity of 207.5 MMt/y among European countries that report to the World Steel Association.

Additionally, there was disappointing news in the latest manufacturing data. The HCOB Germany Manufacturing purchasing managers' index (PMI), compiled by S&P Global, fell to a two-month low of 43.5 points in June due to a drop in new orders and output. The HCOB Eurozone Manufacturing PMI — a monthly measure of the overall health of eurozone factories and compiled by S&P Global — in June was also at a two-month low, but worryingly, the manufacturing output sub-index fell to a six-month low.

Earlier, we forecast steel prices to receive a short-term uptick from the European Commission's new 15% cap on any individual country selling into the "steel safeguard - category 1" tariff quota amount, commonly known as the "other country" quota. The price upturn was short-lived, however, although the trade protectionist measures are likely to result in more expensive imported material, as opposed to supporting domestically produced steel.

Platts Northern European hot-rolled coil is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is a division of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Some links may require a subscription.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.