Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 3 Apr, 2024

By Jim O'Reilly

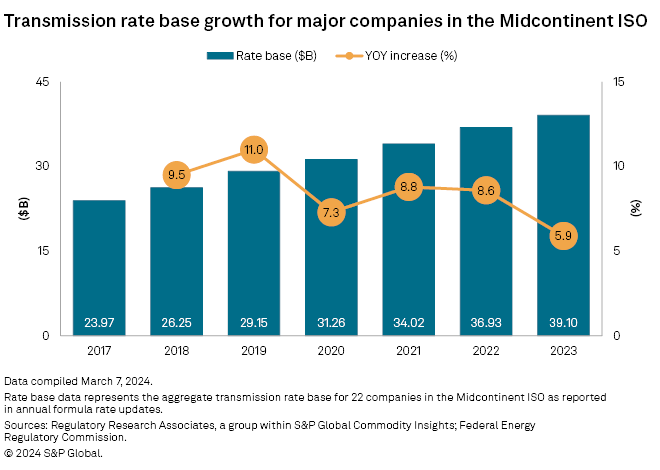

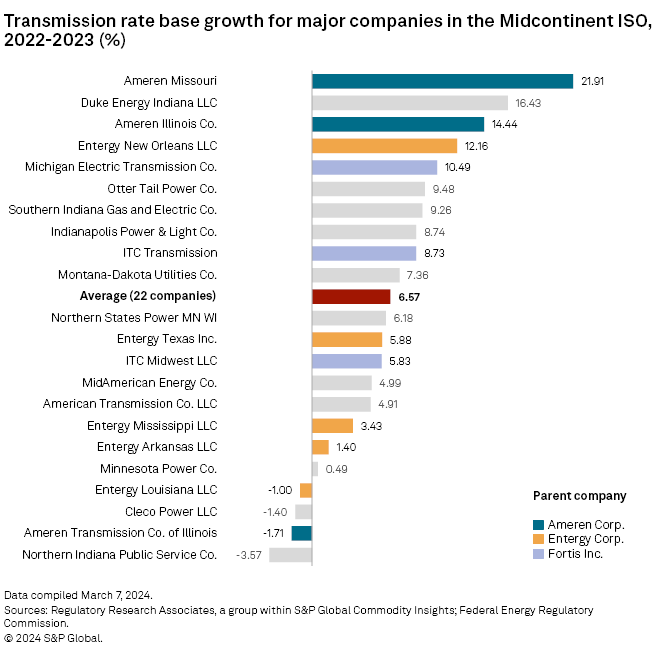

The aggregate transmission rate base for a group of 22 companies in the Midcontinent ISO rose 5.9% to $39.10 billion in 2023 from $36.93 billion in 2022, the second consecutive year of slowing growth for the group and the lowest year-over-year growth since 2018.

➤ The 5.9% growth year over year for the group of 22 companies in MISO marked a decline from the 8.6% growth for the companies in 2022 and was well below the average annual growth in the region of 9.0% since 2018. Despite slowing growth over the last two years, the 22 companies combined have added $12.85 billion in rate base since 2018, an increase of nearly 50%. Since 2015, the total rate base for the 22 companies has more than doubled, from $18.83 billion to $39.10 billion reported in 2023.

➤ Annual growth for the MISO sample companies as a group is particularly sensitive to the growth rate of the largest companies due to wide disparities in size among the 22 individual companies. Rate base values for the companies ranged from $151.8 million to $4.63 billion in 2023, and significant year-to-year increases or decreases in the growth rate for one or more of the largest companies in the group, particularly the five companies reporting a rate base of more than $3 billion, has contributed to relatively inconsistent growth year to year since 2018 for the group as a whole.

➤ The authorized return on equity (ROE) for transmission owners in MISO remains unsettled amid years of litigation at FERC and in federal court. In 2022, the US Court of Appeals for the District of Columbia Circuit vacated and remanded FERC orders issued in 2019 and 2020 that adopted a new financial methodology for determining electric ROEs after finding that the commission failed to offer a reasoned explanation for its decision. FERC's orders established a 10.02% base ROE for transmission owners in MISO, but the court's order is still pending further action by the commission.

Overview

Regulatory Research Associates annually publishes a series of transmission ratemaking analyses covering the six regional transmission organizations and independent system operators (RTOs/ISOs) in the US, in addition to a report covering 14 utilities in the West and Southeast regions of the US that are not members of an RTO/ISO. RRA also compiles the seven regional reports annually into one national report that analyzes a total of nearly 100 companies.

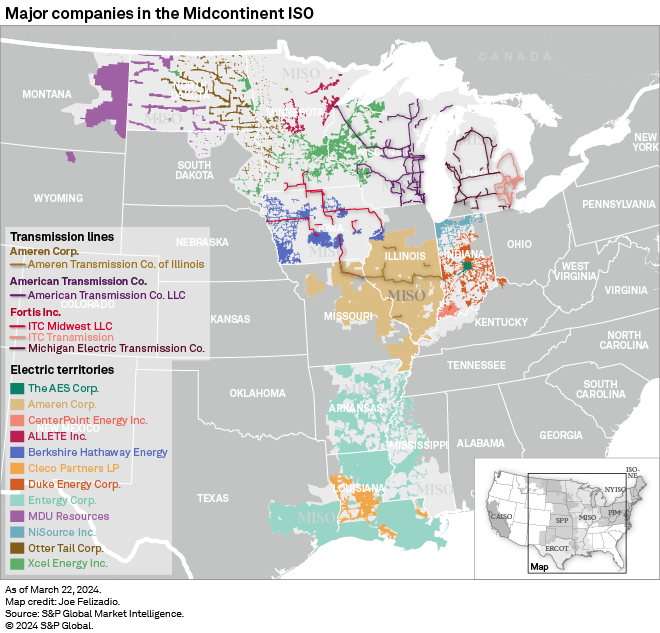

The 22 companies in this analysis consist of 17 vertically integrated utilities and five transmission-only companies (transcos), representing ultimate parent companies AES Corp., Allete Inc., Ameren Corp., American Transmission Co. LLC, Berkshire Hathaway Energy, CenterPoint Energy Inc., Cleco Partners LP, Duke Energy Corp., Entergy Corp., Fortis Inc., MDU Resources Group Inc., NiSource Inc., Otter Tail Corp. and Xcel Energy Inc.

The analysis is based on data reported by the companies in annual transmission formula rate updates filed with the Federal Energy Regulatory Commission and follows an MISO analysis published by RRA in 2023: Transmission growth slows in MISO; ROE uncertainty persists after court remand.

|

Return on equity in MISO

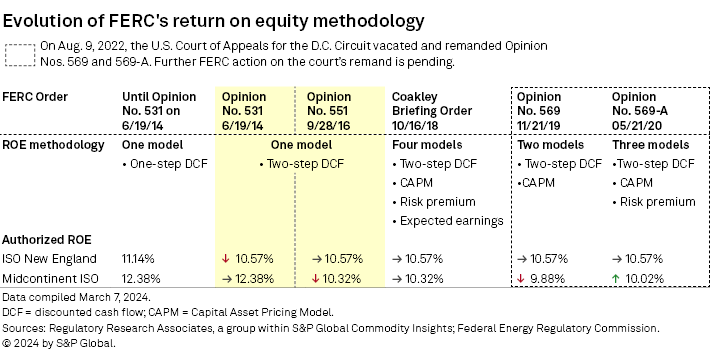

The authorized base ROE of 10.02% for companies in MISO was established by FERC in 2020 on a regionwide basis after years of litigation arising from complaints challenging the ROE for transmission owners in MISO and ISO New England.

FERC's first key order in the litigation, Opinion No. 531, was issued in 2014 in response to the first of four complaints filed between 2011 and 2016 challenging the ROE for transmission owners in ISO-NE. Opinion No. 531 represented the first significant change to the commission's ROE policy in many years and adopted a methodology that relied primarily on a two-step discounted cash flow (DCF) analysis instead of a one-step DCF analysis the commission had relied on previously. In Opinion No. 531, FERC applied the newly adopted two-step DCF methodology and lowered the ROE for transmission owners in ISO-NE to 10.57% from the previously authorized 11.14%.

FERC subsequently issued Opinion No. 551 in 2016 in response to the first of two complaints challenging the ROE for transmission owners in MISO. In Opinion No. 551, the commission again applied the new two-step DCF methodology and lowered the ROE for transmission owners in MISO to 10.32% from 12.38%.

In 2018, after Opinion No. 531 in the ISO-NE proceedings was vacated and remanded by the US Court of Appeals for the DC Circuit, FERC proposed using a four-model methodology to establish ROEs in the ISO-NE and MISO proceedings. The proposed four-model approach gives equal weight to the two-step DCF analysis, the Capital Asset Pricing Model (CAPM), the expected earnings model and the risk premium model.

In 2019, the commission issued Opinion No. 569 in the MISO proceedings and abandoned its proposed four-model approach, instead adopting a two-model approach giving equal weight to the DCF and CAPM analyses. FERC rejected the use of both the risk premium model and expected earnings analysis in Opinion No. 569, finding that "on balance, the expected earnings and risk premium models would not improve our ROE determinations sufficiently to justify using those models, in light of their flaws and the potential inaccuracies and complexity that they could introduce into our ROE analyses." FERC applied the two-model methodology in Opinion No. 569 and lowered the ROE for transmission owners in MISO again to 9.88% from 10.32%.

In 2020, just six months after issuing Opinion No. 569, FERC abruptly revised its methodology again, adopting a three-model approach in Opinion No. 569-A in the MISO proceedings. The commission retained the DCF and CAPM analyses and revived the risk premium model that the commission had specifically rejected in Opinion No. 569. FERC applied the new three-model methodology in Opinion No. 569-A and increased the ROE for transmission owners in MISO to 10.02% from the 9.88% ROE approved in Opinion No. 569.

|

FERC's orders in the MISO proceedings were appealed to the DC Circuit, and on Aug. 9, 2022, the court vacated and remanded the commission's orders. The court found that FERC acted arbitrarily and capriciously by failing to provide a reasoned explanation for reviving the risk premium model and adopting a three-model approach to establish the ROE for MISO: DC Circuit ruling gives FERC new chance to establish durable transmission ROEs. The court's remand is pending further FERC action.

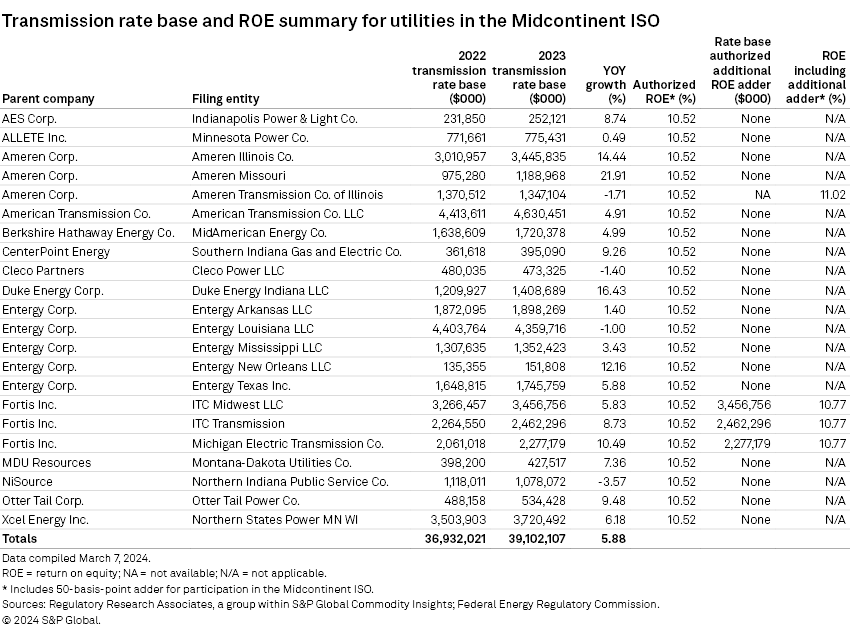

Apart from the base ROE of 10.02%, FERC has authorized a 50-basis-point ROE adder for the companies in MISO for participating in an RTO/ISO. The commission has also authorized an additional ROE incentive adder of 25 basis points for Fortis' three transco subsidiaries and a 50-basis-point adder for Ameren Transmission Co. of Illinois (ATXI) for the company's investment in the Mark Twain Transmission Project in northeast Missouri.

Regional growth

The 5.9% increase in rate base for the 22-company MISO group from 2022 to 2023 was a decline from the 8.6% growth recorded in the prior year and the lowest annual growth for the group since 2018. The lower growth in 2023 was due primarily to the slow growth recorded by many of the largest companies in the group, while many of the smallest companies in the group recorded the highest growth year over year.

Entergy's low 1.5% year-over-year growth was a significant factor in the slowing growth for the group as a whole in 2023, as strong growth recorded by Entergy was a significant factor in the 11.0% growth recorded by the group in 2019. From 2018 to 2019, all five subsidiaries of Entergy recorded double-digit growth, and the aggregate rate base for the company rose 19.1% from $5.82 billion to $6.93 billion: Entergy operating companies drive 11% transmission rate base growth in MISO.

Similarly, 5.7% growth in aggregate rate base for the Entergy companies from 2019 to 2020 was a significant factor in the lower growth of 7.3% year over year for the 22-company group as a whole: Transmission rate base growth slows in MISO; FERC revises ROE twice in 6 months.

|

Parent companies

The aggregate rate base for Ameren's three subsidiaries in MISO, consisting of two operating utilities and one transco, rose 11.7% to $5.98 billion in 2023 from $5.36 billion in 2022 compared to 10.5% from 2021 to 2022. Strong increases at the company's two operating utilities drove Ameren's growth, while its transco recorded a decline in rate base from 2022 to 2023.

The aggregate rate base for Entergy's five subsidiaries in MISO rose only 1.5% to $9.51 billion in 2023 from $9.37 billion in 2022, continuing a two-year decline from the 16.4% growth observed from 2020 to 2021 and the 9.8% growth from 2021 to 2022 for the same companies.

For the three transco subsidiaries of Fortis in MISO, the aggregate rate base increased 8% to $8.20 billion in 2023 from $7.59 billion in 2022, slightly above the growth of 7.7% recorded by the three companies from 2021 to 2022.

The accompanying table highlights the individual MISO companies listed by parent company analyzed in this update, their reported transmission rate base for 2022 and 2023, their base ROE, and any additional ROE incentive adders where applicable.

|

Refer to the linked data tables for transmission rate base, authorized ROEs and other ratemaking parameters from 2017 through 2023 for the MISO companies by parent company and an appendix containing rate base data for the same companies from 2011 through 2023 as available.

Individual companies

Ranking the individual 22 companies in MISO by year-over-year growth, only five companies in the group recorded double-digit growth in 2023. In 2022, nine companies in the MISO group recorded double-digit growth year over year.

Ameren's two operating utilities in the group, Ameren Missouri, doing business as Union Electric Co., and Ameren Illinois Co., posted year-over-year growth of 21.9% and 14.4%, respectively, and recorded the highest and third-highest growth in 2023 among all 22 companies.

Duke Energy's only subsidiary in MISO, Duke Energy Indiana LLC (DEI), recorded very strong growth year over year. DEI reported a $1.41 billion rate base in 2023, a 16.4% increase from $1.21 billion in 2022.

Entergy's smallest subsidiary and the smallest company in the MISO analysis, Entergy New Orleans LLC (ENO), also recorded strong growth year over year, but the company's 12.2% increase represented a rate base increase of only $16.5 million. Notably, year-over-year growth for the four smallest companies in the 22-company group — ENO, AES Corp. subsidiary Indianapolis Power and Light, CenterPoint subsidiary Southern Indiana Gas and Electric Co. and MDU Resources subsidiary Montana-Dakota Utilities Co. — was higher than the 6.57% average growth of the 22 MISO companies.

Conversely, the four largest companies in the group — American Transmission Co., Entergy Louisiana LLC, Northern States Power Co. and ITC Midwest LLC — all recorded year-over-year growth lower than the 22-company average.

Entergy Louisiana, Entergy's largest subsidiary, represents nearly 46% of the parent company's total transmission rate base and reported a lower rate base in 2023 than in 2022. Entergy Arkansas LLC, Entergy Mississippi LLC and Entergy Texas Inc. recorded lower growth than the 22-company group's 6.57% average.

|

Entergy may be well-positioned to turn around the company's recent slow growth. Entergy Louisiana's $107 million Mud Lake to Big Lake Transmission Project was completed in late 2023 and is likely not fully reflected in the rate base reported in the company's formula rate update filed in 2023. RRA's latest capital expenditures report noted that Entergy forecast transmission capital expenditures of $565 million in 2023. The company also forecast annual transmission capital expenditures of approximately $1.28 billion each year from 2024 through 2026: Utility capex poised for new heights in 2024, 2025.

Only one of the five transcos in the group, Fortis subsidiary Michigan Electric Transmission Co. LLC (METC), recorded double-digit growth in 2023. METC's rate base increased 10.5% to $2.28 billion in 2023 from $2.06 billion in 2022. Of the other four transcos, International Transmission Co. (ITC Transmission) recorded higher growth year over year than the 22-company group average, while American Transmission Co., ITC Midwest and ATXI recorded lower growth than the group's average.

RRA's analysis and the MISO companies

Given the complexities inherent in determining a company's rate base from an outside perspective, the RRA analyses, with very limited exceptions, include transmission rate base only for those companies that report such data in their initial annual updates under a formula-based rate framework. The initial formula rate updates filed by the companies may not reflect subsequent revisions or true-ups.

RRA first published this analysis of utilities in MISO in 2015. The first report compiled five years of rate base and other data — 2015 data and four years of historical data. RRA has subsequently published annual updates to that first report for a total historical data set covering 13 full years from 2011 through 2023, where available.

The first MISO report included 18 companies for 2011 and 2012. During those years, Entergy employed a systemwide transmission rate and Entergy Services LLC filed systemwide transmission data in annual formula rate updates for Entergy's six operating companies at the time.

Upon Entergy's integration into MISO in 2013, the company began calculating a transmission rate and rate base separately for each of the six Entergy operating companies, and Entergy Services no longer filed systemwide updates on behalf of the operating companies. For the years 2013 through 2015, RRA's analysis reflected the net gain of five companies, or 23 companies total.

In 2015, Entergy Gulf States Louisiana LLC's Louisiana operations were combined into Entergy Louisiana, resulting in the current roster of 22 companies in MISO from 2016 to the present.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

Joe Felizadio contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.