S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Jun, 2024

So far, it has been hardware companies that have boomed as the hype for generative AI drives tangible performance lifts. For investors, software has been a harder sell. Players here have a more nuanced story to tell about how GenAI will not only be disruptive or transformative to existing business but also accretive. A recent round of earnings calls showcased where some of the largest players in tech are gaining traction and how they are managing market expectations as the conversation — and pressure — shifts to the application layer.

Our Generative AI Market Monitor & Forecast report indicates that the GenAI software market will likely grow more than tenfold in the next four years to over $50 billion by 2028. Everyone is eager to get there — or at least to see the path. However, it continues to be an elusive task for tech incumbents to show demonstrable lifts so early in this game, apart from increased demand for infrastructure. A number of core use cases have emerged, namely with business-to-business workflows and AI-powered assistants, which are starting to drive returns. However, most are initially focused on infusing GenAI into existing products, where the market's willingness to pay remains a gray zone.

By the numbers

Although AI traction is overwhelmingly happening at the infrastructure layers, recent earnings calls showed some signs that software suites are gaining speed.

– Microsoft Corp.'s CFO revealed that Copilot is Microsoft's fastest-growing suite in history and suggested prioritizing the growth of Copilot at the expense of growth in Azure, highlighting the importance of gaining an early share in the intelligent assistant market.

– International Business Machines Corp. said it has accumulated a $1 billion book of business related to watsonx and GenAI, led by consulting.

– Google Cloud revenue jumped 28% year over year compared with 15% growth overall, and executives cited strong growth in Google Workspace, where it has been integrating AI features powered by its large language model, Gemini.

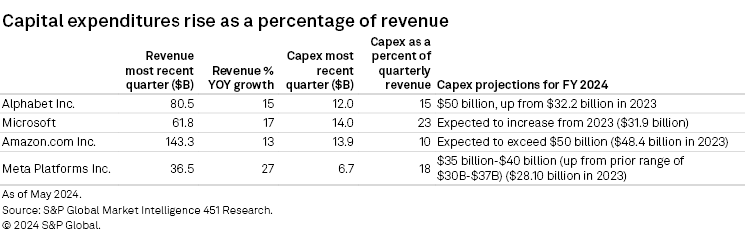

This momentum is happening against the backdrop of soaring capital expenditure. Microsoft, for instance, spent $14 billion here this past quarter, a figure that represents a year-over-year increase of 79% and nearly one-fourth of its total first-quarter revenue. Cloud capacity limitations help justify the increased spending to some degree. Mostly, it adds pressure to open new avenues to growth. Looking again at Microsoft in this past quarter, its top-line revenue grew at the same rate (17%) as in the corresponding quarter of 2023 despite having invested over $30 billion in capex in the last 12 months.

The trouble for software is that the opportunity with GenAI (apart from where it can be infused into existing services) remains nebulous and ill-defined. No company was criticized for this more than Meta Platforms Inc., which, lacking an infrastructure moat, failed to articulate a reason to be spending so lavishly apart from "[W]e want to be the leading AI company." Google's search-generated experiences effort is expected to open opportunities down the road as the search market expands, but it is largely defensive. Amazon.com Inc., meanwhile, projected that most of the revenue growth from GenAI is still 10-20 years away.

It follows that most of the GenAI-driven growth in software thus far has come from categories that are "AI-enabling," setting the stage for organization-tailored applications and automation. For instance, Salesforce Inc. in the last quarter reported its Data Cloud product to be its fastest-growing product ever, as AI has driven a need for robust data and metadata frameworks. For Alphabet Inc.'s Google and Amazon, it has been Vertex and Bedrock that play that role as organizations dabble with GenAI application development.

AI assistants pave the way in net-new business opportunities

A consistent bright spot was the opportunity with AI-powered assistants, which nearly all providers advocated for because they offer extended capabilities on existing products that can be monetized today. At their most basic, these assistants may aid in searching and managing unstructured data, yet they are quickly advancing in their ability to manage and automate fundamental workflows, making them relevant across various industries and use cases. Pricing has also been aggressive here, given the following productivity benefits they claim to bring:

– Amazon announced the general availability of its GenAI-powered Q agent only hours before its quarterly earnings call. Amazon is charging $20 per user per month for Amazon Q Business and $19 per user per month for Amazon Q Developer.

– Google's CFO reported that growth in its Workspace product suite has been primarily driven by increases in average revenue per seat and contributions from AI (although concrete figures were not disclosed). Gemini Advanced is priced at $20 per user per month, while AI meetings and messaging will be priced at $10 per user per month.

– In addition to the comments above regarding Copilot's adoption rates, Microsoft also cited increased usage intensity from early adopters, including a nearly 50% increase in the number of Copilot-assisted interactions per user in Teams.

There is fuzziness, however, about the market's willingness to pay. While Microsoft publicly lists Copilot services at $30 per user per month, it is unlikely to be seeing that much in practice. Proving this point, in its first-quarter 2024 earnings call, S&P Global Inc. announced that it had built its own generative AI assistant internally at a cost of $1 per user per month. Increasingly, we believe competitive providers will embed GenAI capabilities out of the box or charge only incremental computing costs to their users rather than monetizing on generative capabilities directly (for example, Grammarly).

Indirect upside in advertising and commerce

Companies with consumer-facing channels (Meta, Google, Amazon) also pointed to how they are infusing generative AI capabilities into their existing tools for advertising and retail use cases. Asset creation is one side of this coin, with vendors bringing in rich media generation capabilities to help retailers generate copy, imagery and video content more efficiently. There is also focus on enhancing the impact of marketing campaigns, bringing large language models into workflows to connect with consumers more effectively.

– Amazon launched a new GenAI tool that enables sellers to provide a URL to their own website and automatically create product detail pages on Amazon.

– Google has embedded its Gemini models in Performance Max, citing how advertisers using asset generation are 63% more likely to publish a campaign with good or excellent ad strength with a direct (6%) lift in conversions.

– Meta highlighted how revenue through its two AI-powered tools, Advantage+ shopping and Advantage+ app campaigns, had more than doubled since 2023. Earlier this month, it announced new generative image tools to help advertisers create high-quality assets with a few simple prompts.

Here again, providers encounter the issue of how much the market is willing to pay. Meta was the most explicit that it is not yet directly monetizing its GenAI capabilities for retailers, even as the cost of revenue is rising from infrastructure demands. Likewise, Google is not charging for the use of Gemini or its other GenAI tools in PMX; rather, these are added capabilities within its performance-based pricing model. Instead, company leaders emphasized the indirect benefits, such as improved results and customer return on investment, which could theoretically expand their potential market and lead to higher overall spending. Other competitors, such as Adobe Inc., appear to be opting for the paid route for both AI assistants and access to generative models for these use cases, although pricing is not publicly available.

Services offer early inroads

It bears mentioning that at such an early stage in the adoption curve, services are playing a key role in supporting the software realm. Pure-play software-as-a-service providers, including enterprise search platform LucidWorks and newcomers such as code generation company Invoke.ai, have been leaning in here, both developing professional services arms to win early revenue and handhold organizations through the complexities of GenAI rollouts.

Demonstrating this, IBM highlighted its cumulative $1 billion book of business for GenAI, which skews heavily toward consulting. While the nature of these services varies — SaaS professional services tend to focus more on straightforward customizations and integrations, in contrast to IBM's emphasis on bespoke models and application development — it underscores the high support needs even for the most straightforward implementations of GenAI applications. Per IBM's CFO, the consulting business related to GenAI in the first quarter alone was double the total of the previous year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.