Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Feb, 2022

Introduction

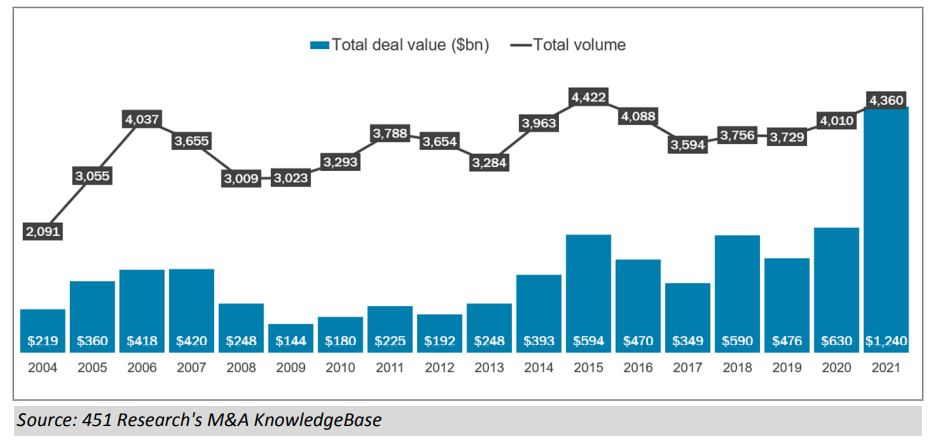

Buoyed by record spending by every type of shopper, the value of tech deals announced last year topped the $1-trillion-dollar threshold for the first time in history, according to 451 Research's M&A KnowledgeBase. Hitting that previously unimaginable level – with spending measured out to 13 digits, an order of magnitude above the measly hundreds of billions of dollars – required acquirers to look through the (still-lingering) pandemic and pay valuations in 2021 that were more than twice as rich as any year in the M&A KnowledgeBase. They stepped up and did just that.

Recent Annual Tech M&A Activity

Increasingly confident vendors of all stripes, cash-rich buyout firms and even unproven-but-popular special purpose acquisition companies (SPACs) all came together to push the total value of 2021's tech transactions to $1.2 trillion. Our data shows that topped the total from the two previous years combined. In last year's record-shattering shopping spree, everyone was bidding high and bidding often.

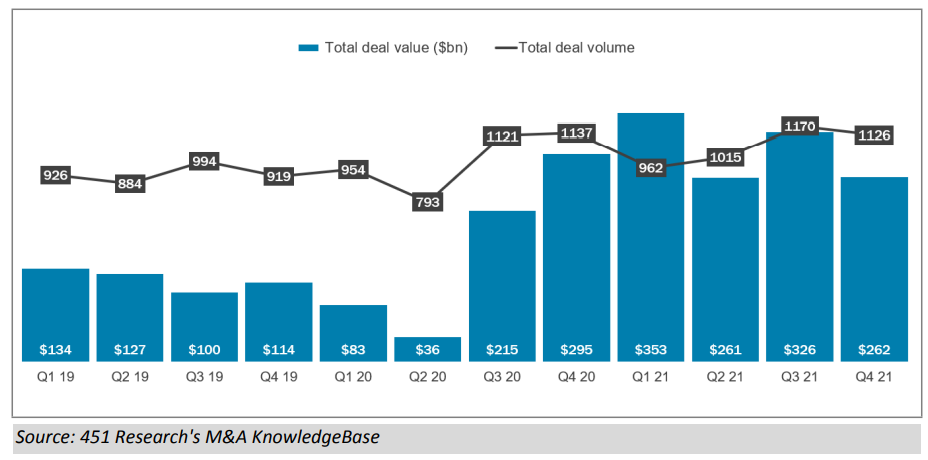

Recent Quarterly Tech M&A Activity

Not only was last year's activity consistent across all buying groups, it was also consistent throughout the year. The robust spending was sustained, without the peak-and-valley pattern typically seen in M&A markets.

Our data indicates that the aggregate value of tech deals topped $250bn in every single quarter of 2021. (There was a time – not too long ago – when a quarter-trillion dollars of M&A spending would have been a pretty big full-year total.)

All six of the largest spending quarters in the 20-year history of the M&A KnowledgeBase have come since mid-2020, when the world started its fitful recovery from the initial COVID-19 outbreak.

Where do we go from here?

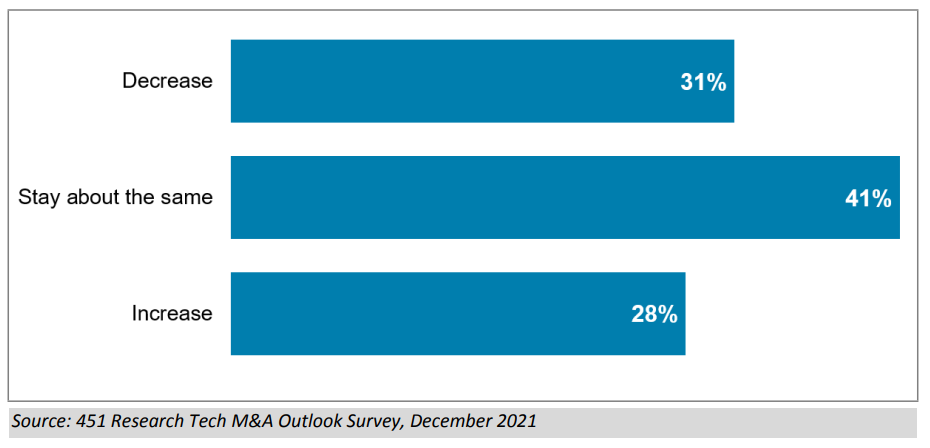

Most of the trends that drove last year's record-smashing performance appear likely to continue in 2022. In a late-December survey by 451 Research of some of the tech industry's busiest buyers and their silver-tongued advisers, two-thirds of respondents forecast that this year would either match or even top the frenzied rate from 2021. This year is shaping up – once again – to be one for the ages.

Forecast Change in Tech M&A in 2022 vs. 2021

In our just-concluded 451 Research Tech M&A Outlook Survey, a plurality of respondents (41%) predicted that 2021's historic acquisition pace would continue in 2022, with the remaining M&A professionals roughly split on their outlook for the coming year. They were ever-so-slightly more likely to project a downtick in acquisitions (31%) in 2022 than a further increase (28%) from last year's blowout.

That narrowly negative view goes against the typical optimistic responses we have received in more than a decade of surveying tech M&A professionals. It isn't uncommon for twice (or even three times) as many of survey respondents to forecast an acceleration rather than a slowdown in the coming year.

Of course, none of those previous forecasts were coming after a year like we just had. And it's worth noting that the outlook for 2022 goes against the typical pattern. Historically, activity recedes after a surge. According to the M&A KnowledgeBase, the value of deals in the years immediately following previous records in 2007 and 2015 dropped 39% and 20%, respectively. Reversion to the mean can be a powerful force in markets. However, even that isn't enough to curtail tech's urge to merge in the coming year.

DOWNLOAD THE FULL REPORT

Webinar