Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 17, 2025

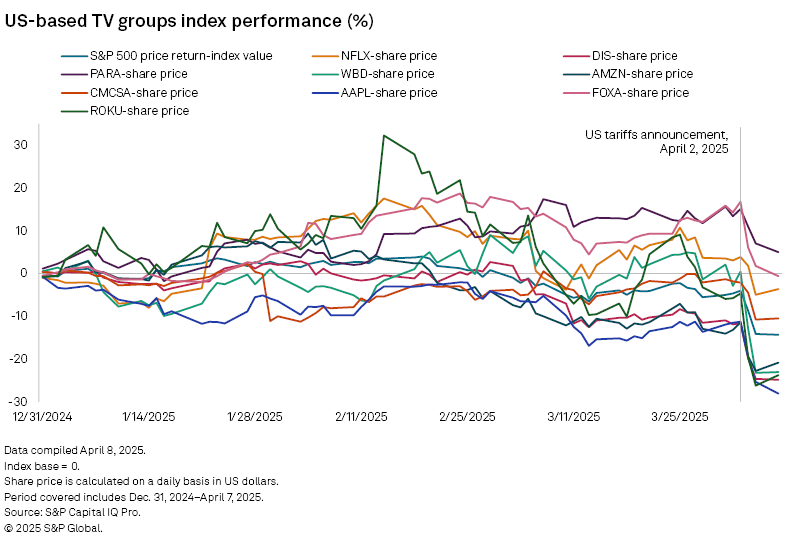

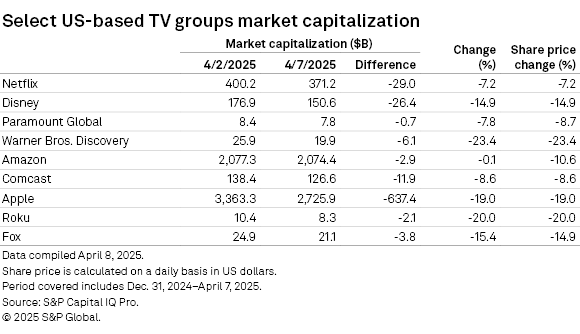

Investors sold shares of major US-based media and technology groups that operate in the TV sector following the US government's announcement of an array of additional tariffs on goods imported into the US. S&P Global Market Intelligence Kagan estimates that the industry has lost $720 billion since April 2 when a host of new tariffs were unveiled, with the S&P 500 (SPX) index — which tracks the top 500 publicly traded firms in the US based on market capitalization — down by 14.3% year-to-date.

Paramount Global and Warner Bros. Discovery Inc. have lost a combined $6.7 billion in market capitalization since April 2, with their share prices down by 8.7% and 23.4%, respectively. Netflix Inc., which surpassed 301 million subscribers at the end of 2024, has since seen its stock marginally drop 2.6% year-to-date, losing $29.0 billion in value over the past week. While big media firms are not directly impacted by increased tariffs on imports, any subsequent slowdown in consumer spending could jeopardize subscription and advertising business lines as well as theme park attendance and film distribution revenue.

Apple Inc.'s sell-off that began the past week has seen $637.4 billion of its market capitalization wiped out, equal to 17% of its value at the end of 2024. The iPhone and Macbook maker is exposed to tariffs via its production lines in Southeast Asia. Amazon.com Inc. appears to have fared better than some of its counterparts due to its diverse business lines that include retail, advertising, cloud computing, consumer tech and B2B solutions. Its stock has fallen over 20% since the start of the year and was sitting above $175 on April 7.

The video entertainment industry has tried to gauge the potential impact of tariffs on its value chain. Most streamers have adopted a hybrid revenue model that includes earning fees from subscriptions as well as from selling ad inventory. These tariffs are set to take effect on April 9 and range from 10% for goods from the United Kingdom, Brazil, and Australia to 46% on imports from Vietnam, with EU countries at 20%. China will see tariffs up to 104%. These rates are subject to change and are as of publication.

The prices of devices like smart TVs, set-top boxes and streaming media players (SMPs) in the US will be affected by imports from China and other Asian countries. Furthermore, an increase in inflation may reduce consumers' disposable income and weaken their confidence. As a result, households might either cancel their subscriptions or opt for more affordable ad-supported plans to save money. Additionally, if a recession occurs, advertisers may cut back on their spending, which would negatively affect companies that depend heavily on advertising revenue, both online and linear broadcast.

The Trump administration, backed by the Motion Picture Association (MPA), the Directors Guild of America (DGA) and the International Alliance of Theatrical Stage Employees (IATSE), has already brought up the EU Digital Services Act, the UK's Ofcom Media Act 2024 and EU's Audiovisual Media Services Directive (AVMSD). The latter, also adopted by the UK, demands that EU-originated works comprise at least 30% of a service's catalog as well as gives each country the right to impose levies to help fund local audiovisual productions. Italy, France and Spain are some of the countries that have successfully imposed such taxes. The US considers such measures could hurt American companies by increasing costs, diminishing competitiveness and stunting growth.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Economics of Networks is a regular feature from S&P Global Market Intelligence Kagan.