Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 8 Jun, 2022

By Kelly Morgan and Filippo Bonanno

Walt Disney Co. reported mixed results for its fiscal third quarter ended July 1 as a reduction in streaming losses was paired with continued declines in the traditional TV business.

The Aug. 9 earnings release came one day after Disney announced a partnership with PENN Entertainment Inc. to use the ESPN brand for an online sportsbook in a deal estimated to be valued at about $2 billion.

➤ Disney's traditional media business remains challenged by declining subscribers and a soft advertising market. Operating income from Disney's linear networks fell $580 million in the three months ended July 1 amid increased programming expenses and revenue declines.

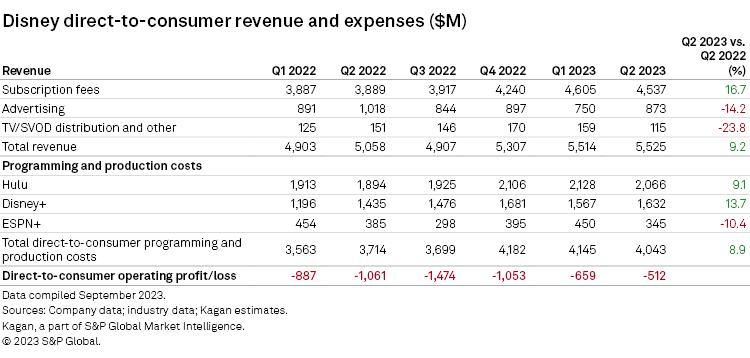

➤ Direct-to-consumer revenue grew by 9.2% to $5.53 billion, with subscription revenue gains more than offsetting a decline in advertising revenue. Disney's streaming division reported an operating loss of $512 million, extending a run of narrowing quarterly losses.

➤ Disney is searching for strategic partners to help bring the flagship ESPN channel direct-to-consumer as the company hopes to amplify the technology and content of the offering.

Disney is one of the biggest media companies in the world, with a wide range of products and services that span both traditional media and the emerging digital space. Total combined revenue across Disney's two main segments — media and entertainment distribution, and parks, experiences and products — came to $22.33 billion for the quarter, up 3.8% on an annual basis. Many of Disney's less diversified peers in the TV programming industry posted revenue declines in the same period, the second calendar quarter.

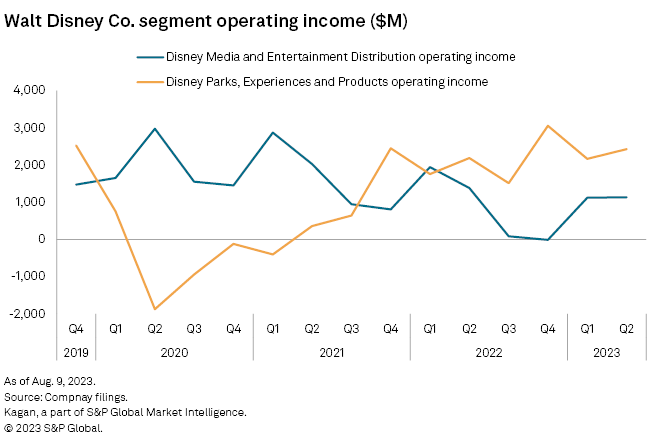

Results at Disney's two main reporting segments moved in opposite directions. Revenue at the media and entertainment distribution segment fell by 0.8% annually as losses related to streaming investments continued to weigh on the business, while the parks and products segment reported a 12.6% jump as it continued to bounce back from pandemic-related declines.

Operating income for the media and entertainment distribution segment fell 17.9% year over year to $1.13 billion, while parks and products reported a 10.9% gain to $2.43 billion.

Media and entertainment distribution

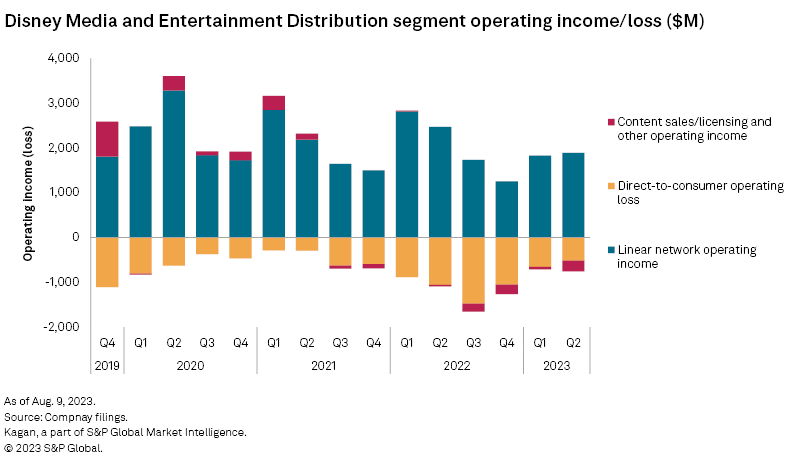

The media and entertainment distribution segment generated 62.7% of total company revenue in the quarter but only 31.9% of total operating income. Within this segment, the linear networks business was the only profitable division, generating $1.89 billion in operating income.

The linear networks business was not identified as a future growth vehicle by executives, however. Speaking on the company's earnings call, CEO Bob Iger predicted that the company's film studios, parks business and streaming would "drive the greatest growth and value creation" over the next five years.

On the revenue side, the direct-to-consumer segment was the only part of the media and entertainment division to report growth, up 9.2%. Both linear networks and content sales and licensing saw declines. The media and entertainment distribution segment reported a 0.8% year-over-year decline in revenue overall.

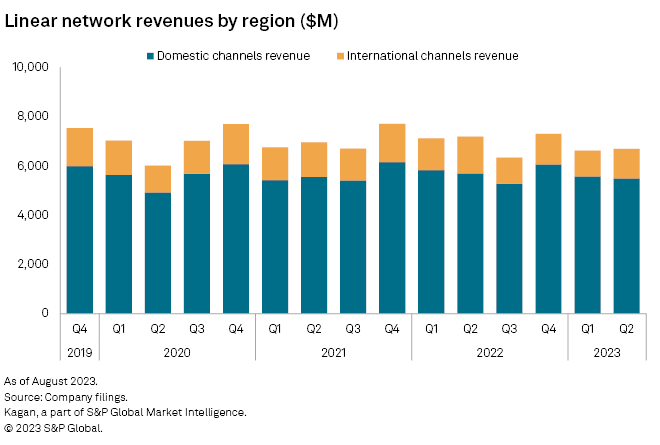

Disney's transition from linear networks toward streaming is highlighted by the direct-to-consumer segment's growing share of revenue in recent years. Linear networks accounted for 46.8% of the media and entertainment segment's revenue in the most recent quarter, down from 59.6% in late 2020.

Direct-to-consumer

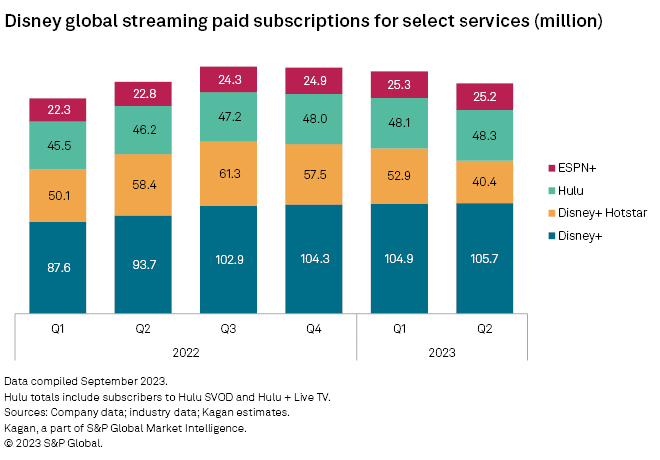

Subscriber totals across the company's primary streaming services painted a mixed picture. Disney+ and Hulu subscribers edged up slightly on a sequential basis, while ESPN+ was roughly flat. Meanwhile, the subscriber freefall for Disney+ Hotstar continued in the wake of the service losing streaming rights to Indian Premier League matches. Disney+ Hotstar shed 12.5 million paid subscribers sequentially, to 40.4 million subscribers. That compares to a high of 61.3 million subscribers less than a year ago.

The company's domestic Disney+ subscriber base in the US and Canada contracted by about 300,000 subs sequentially to reach 46.0 million. Company executives also disclosed metrics on the adoption of the ad-supported Disney+ tier for the first-time. Disney+ ad-tier subscribers totaled 3.3 million as of July 1, accounting for about 8% of the service's estimated 41.3 million US subscribers. About 40% of new subscribers to Disney+ opted for the ad-supported offering, which launched in the US in December 2022. Disney plans to extend the ad-supported offering to Canada, the UK and other select European markets beginning Nov. 1, 2023.

Disney also disclosed plans for streaming price hikes for its ad-free Disney+ and Hulu offerings in October. Both streaming services will raise prices by $3 per month, to $13.99 for the ad-free Disney+ and $17.99 for the ad-free Hulu. Pricing for the ad-supported tiers of both streaming platforms will remain unchanged at $7.99/month.

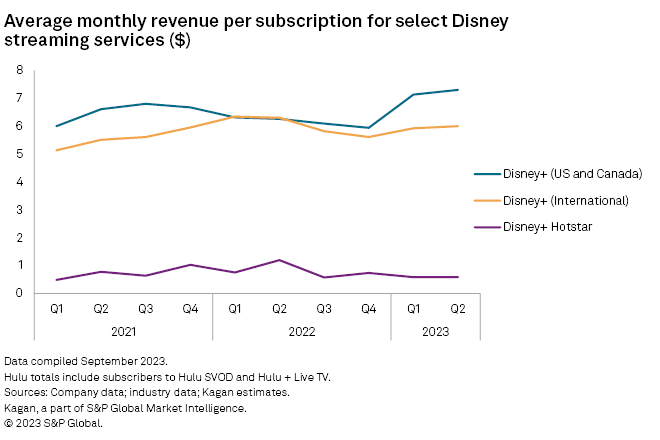

After launching Disney+ at a very low price point, the company is now moving aggressively to improve its average revenue per subscriber and chart a course for profitability at Disney+ some time in 2024, per company guidance.

Unlike some rival streaming operators who have relied on heavily discounted wholesale deals and partnerships in international markets to grow subscribers, Disney's average monthly revenue per subscription rates for domestic and international Disney+ subscribers have generally been on par since early 2021. Monetization for domestic Disney+ subscribers jumped noticeably in the first quarter of 2023 after the company launched its US ad-tier and raised prices on ad-free viewers. Similar gains are likely in late 2023 and early 2024 after the most recently announced price increases go into effect. While the precipitous decline in Disney+ Hotstar subscribers looks alarming on the surface, low monetization levels for Disney+ Hotstar mean the revenue impact to the company has been minimal.

Top-line revenue growth for Disney's direct-to-consumer operations grew by 9.2% on an annual basis to reach $5.53 billion in the calendar second quarter. A 16.7% year over year jump in subscription revenue, which accounted for a majority of total direct-to-consumer revenue, easily offset a 14.2% decline in advertising revenue.

Programming and production costs continued to grow for Hulu and Disney+, but the streaming division made headway for the third straight quarter in reducing its overall operating loss, which came to $512 million. That compared to a $1.06 billion operating loss incurred a year earlier.

Linear networks

Disney's linear networks business — comprised of its fleet of domestic cable networks, the ABC (US) broadcast network, its owned-and-operated TV stations, and international TV channels — has been challenged in recent years due to subscriber declines and weakness in the advertising market.

CEO Iger has expressed interest in unloading some of Disney's linear assets and taking ESPN direct-to-consumer. "Taking our ESPN flagship channels direct-to-consumer is not a matter of if, but when," the executive said on the company's earnings call. As part of the transition of ESPN to a direct-to-consumer product, Disney is seeking out a strategic partnership to enhance the offering's distribution, technology, marketing and content. There seem to be a variety of potential partners to make this happen, although some companies like Comcast Corp. and Warner Bros. Discovery Inc. have indicated a lack of interest.

ESPN's linear ratings grew in the most recent quarter, generating 10% growth in domestic sports advertising revenue for linear and addressable ads. ESPN ad revenue increased by 4% but is pacing down in the current quarter. The sports network operator also will be negatively impacted by the absence of Big Ten college football in the fall. In total, Disney's domestic cable ad revenue was up 0.7% in the quarter while broadcast revenue fell 18.9%.

Disney's linear networks are heavily invested in marquee sports rights, which influence the division's operating metrics. The company's new long-term deals with the NFL and college conferences such as the SEC for the rights to football games are kicking in this year. As a result of these rising costs, operating income at the domestic channels fell 14.2% in the quarter. Disney's international channels posted their first operating loss of $87 million in the quarter. The decline was driven by a 30.5% drop in advertising revenue and an unfavorable foreign exchange impact.

Content sales/licensing and other revenue

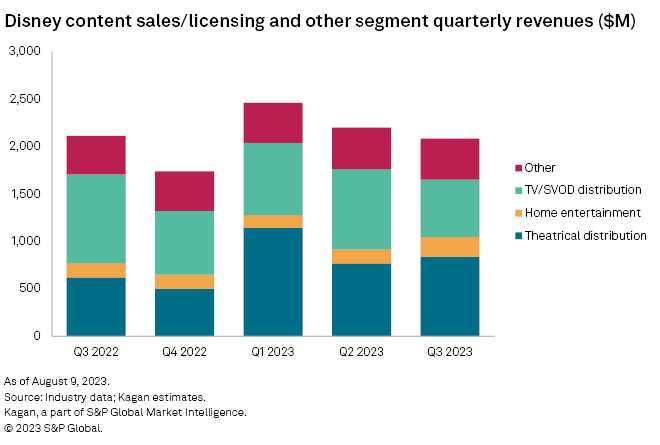

Revenue for Disney's content sales and licensing segment fell 1.4% year over year to $2.08 billion. Theatrical distribution revenue increased 35.2% to $838.0 million thanks to four big-budget summer releases in May and June. Home entertainment revenue gained 40.3% to $209.0 million thanks to high unit sales from "Avatar: The Way of Water," according to Disney's Form 10-Q filing. Other revenue grew 6.2% to $430.0 million.

The growth in those three areas was weighed down by a 35.4% drop in TV/SVOD distribution revenue, which fell to $605.0 million. Disney cited "lower sales volumes of episodic television and film content" as the reason for the decline.

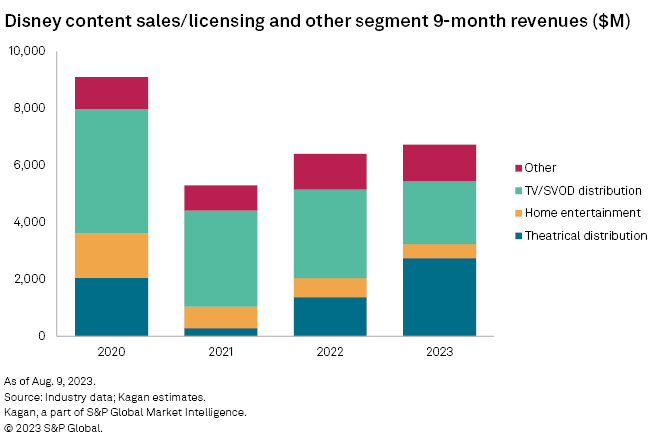

The segment's results looked more positive for the first nine months of the fiscal year, with total content sales and licensing revenue up 5.1% to $6.74 billion. Theatrical revenue accounted for the largest portion of this total, at about $2.75 billion or nearly twice the $1.37 billion reported for the first nine months of fiscal 2022. TV/SVOD revenue fell 28.9% to $2.21 billion in the first nine months of fiscal 2023. Home entertainment revenue was down 26.9% to $492.0 million.

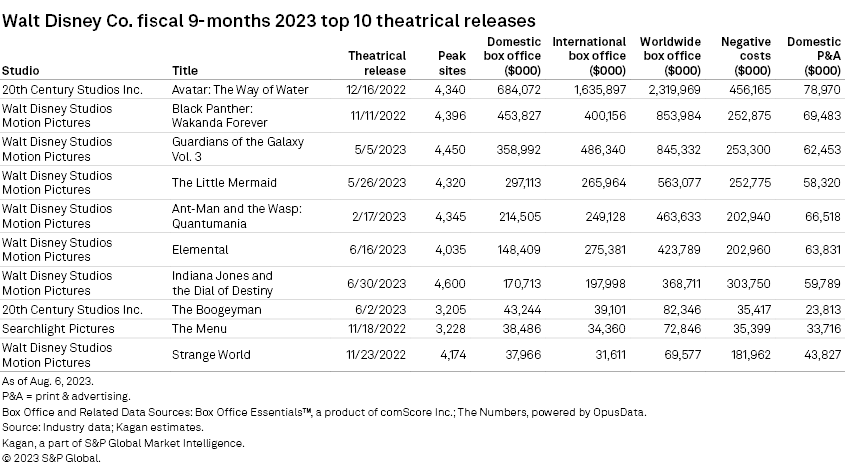

Disney released 15 films in theaters through its various studios in the first nine months of its fiscal year, with seven of those coming in the third fiscal quarter. The company's top fiscal third-quarter release was "Guardians of the Galaxy Vol. 3," which had grossed nearly $359.0 million domestically and $486.3 million internationally for a combined $845.3 million in worldwide box office through Aug. 6, 2023.

Other key fiscal third quarter releases for Disney were "The Little Mermaid" ($563.1 million worldwide), "Elemental" ($423.8 million worldwide) and "Indiana Jones and the Dial of Destiny" ($368.7 million worldwide). "Avatar: The Way of Water" was Disney's highest-grossing film of the fiscal year to date, claiming nearly $2.32 billion worldwide. The film had grossed $684.1 million domestically and close to $1.64 billion internationally.

Disney's top 10 fiscal 2023 film releases to date have grossed nearly $2.45 billion domestically and $3.62 billion internationally, for a combined $6.06 billion in worldwide box office gross.

Disney parks, experiences and products

The parks, experiences and products segment grew overall behind the continuing recovery of Disney's international parks from COVID-19 restrictions and strong sailing from its cruise line business. Domestic parks and resorts were a mixed bag, with tough comparisons to the prior-year period for Walt Disney World Resort. Results at Disneyland Resort were up modestly. Declines in merchandise sales of several top franchises resulted in drops in revenues and operating income from consumer products.

The international parks segment recorded a 94% rise in revenues to $1.53 billion, leading to $428 million in operating income. That reversed a $64 million operating loss in the year-earlier period.

Interim CFO Kevin Lansberry said all of Disney's international venues registered gains in its third fiscal quarter, with Shanghai Disney Resort setting the pace as the park was open for the entire period, versus just three days in the prior-year period due to pandemic-related closures.

Higher operating results at Hong Kong Disneyland Resort were tied to guest spending growth, stemming largely from more expensive tickets, improved attendance and more occupied room nights, partially offset by increased costs driven by inflation. Hong Kong Disneyland Resort benefited from the park being open for 72 days in the recently completed quarter, versus 18 in the comparable 2022 period.

Domestically, Disney parks tallied a 4% increase in revenues to $5.65 billion, but operating income receded 13% to $1.44 billion, a total that reflected a $100 million accelerated depreciation charge related to the upcoming Sept. 30 closure of the Star Wars: Galactic Starcruiser at Disney World Resort. However, the operating income measure was up 24% versus pre-pandemic results in the fiscal 2019 period.

The Disney World venue turned in a softer performance, relative to its successful 50th anniversary celebration in the prior year. CEO Bob Iger also noted that post-COVID pent-up demand continues to level off in Florida, as local tax data shows evidence of slowdowns in several major Florida tourism markets. The strong dollar is expected to continue tamping down international visitation to the state.

At Disneyland Resort, higher attendance and increased guest spending were largely offset by inflationary costs. Guest spending growth was linked to higher average ticket prices.

Meanwhile, Disney's Cruise Line recorded strong revenue and operating income growth in the fiscal third quarter. Iger said fourth fiscal-quarter booked occupancy is at 98% for its five ships. The Disney fleet will expand by two in fiscal 2025 and add another ship in fiscal 2026.

Consumer products revenues decreased 3% to $1.15 billion, as operating slipped 6% to $561 million. Management attributed the downturn to lower revenue stemming from merchandise sales based on Star Wars, Toy Story and Avengers.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.