S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Sep, 2024

By Dan Lowrey

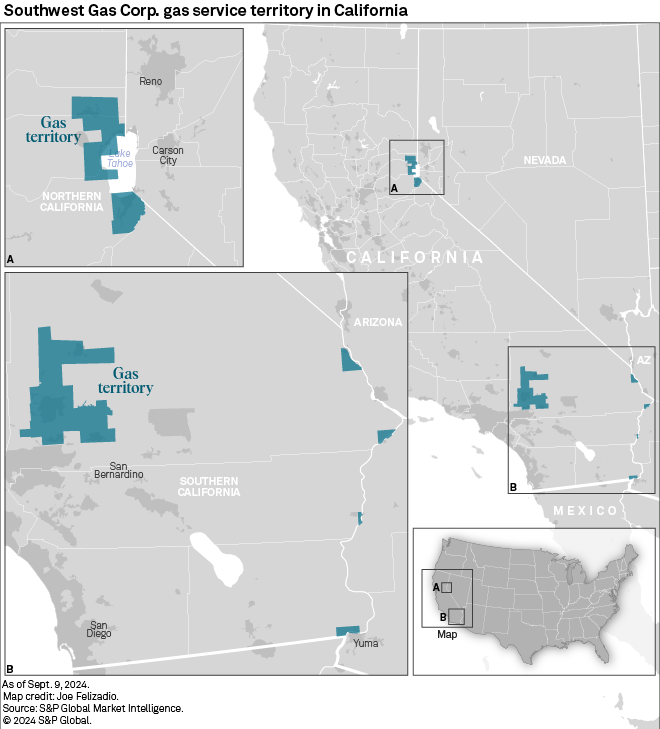

Southwest Gas Corp. filed an application with the California Public Utilities Commission to increase gas base rates across its Southern California, Northern California and South Lake Tahoe territories to recover costs it has incurred and will incur to own and operate the facilities used to maintain and provide safe and reliable natural gas service to customers. The company requested increases in the 2026 test year and post-test year increases in 2027–2030.

A procedural schedule has not been established in the case, but the company requested the commission issue a final decision by December 2025.

➤ Southwest Gas filed an application Sept. 6 with the California Public Utilities Commission to increase gas base rates by more than $70 million combined across its three service territories between 2026 and 2030. The company indicates that the increases are needed to help it recover costs for providing safe and reliable gas service to customers.

➤ The company's request is premised upon an authorized 11.35% return on equity (ROE), significantly exceeding national averages tracked by Regulatory Research Associates. It is also 135 basis points higher than the 10.00% ROE the company is authorized in California.

➤ RRA views the regulatory climate for energy utilities in California as somewhat more constructive than average from an investor viewpoint. Full electric and gas revenue decoupling mechanisms have been in place for many years. Gas utilities employ automatic cost recovery mechanisms, and large customers have utilized transportation-only tariffs for many years.

For the test year ending Dec. 31, 2026, Southwest Gas is seeking a $38.5 million increase in its Southern California territory, premised upon an 11.35% ROE (50% of capital structure) and a 7.74% overall return on rate base valued at $467.1 million. Southwest Gas is seeking a $62,810 increase in its Northern California territory, premised upon an 11.35% return on equity (50% of capital structure) and a 7.85% overall return on rate base valued at $139.7 million for a test year ending Dec. 31, 2026. And for its South Lake Tahoe service territory, Southwest Gas is seeking a $10.2 million gas rate increase, premised upon an 11.35% return on equity (50% of capital structure) and a 7.85% overall return on rate base valued at $113.6 million for a test year ending Dec. 31, 2026.

The requested 11.35% equity return is significantly above prevailing national averages. According to data gathered by RRA, the average ROE authorized gas utilities in cases decided during the first half of 2024 was 9.83%, slightly higher than the 9.64% average for cases decided during full year 2023.

Looking at the 43 cases decided during the 12 months ended June 30, 2024, in which an ROE was authorized and was observed by RRA, the average authorized gas ROE was 9.68%, and the median was 9.65%. For a chronological listing of the major energy rate case decisions issued during 2023 and historical summary data going back to 1990, see RRA's latest Rate Case Decisions Quarterly Update.

Southwest Gas indicated that it estimated its 11.35% ROE after considering the results of three analytical approaches applied to a utility proxy group of six natural gas distribution companies, including the discounted cash flow model, the risk premium model and the capital asset pricing model. Additionally, Southwest Gas' cost of capital witness applied these three models to a non-price-regulated proxy group. Further, to reflect Southwest Gas' specific risks, the witness "adjusted the indicated common equity cost rate model results upward by 0.20% and 0.15% to reflect the Company's greater relative business risk and lower bond rating, as compared to the Utility Proxy Group, respectively, as well as a 0.12% adjustment to account for flotation costs."

Post-test year increases

Southwest Gas seeks to continue its post-test year mechanism for annual changes to rates and charges for gas service, effective Jan. 1, 2027, and each Jan. 1 thereafter through 2030.

For its Southern California territory, Southwest Gas is seeking rate increases of $5.5 million in 2027, $1.7 million in 2028, $3.8 million in 2029 and $3.9 million in 2030. For its Northern California territory, SW Gas is seeking rate increases of $861,809 in 2027, $885,509 in 2028, $909,860 in 2029 and $934,881 in 2030. For its South Lake Tahoe territory, SW Gas is seeking rate increases of $707,495 in 2027, $726,951 in 2028, $746,942 in 2029 and $767,484 in 2030.

Southwest Gas indicates that the rate increases are needed for the "provision of natural gas service in California at just and reasonable levels to provide Southwest Gas a realistic opportunity to earn a fair and reasonable rate of return on its investment."

The company also proposes to continue its suite of conservation and energy efficiency programs, which were approved in its previous rate case and designed to help customers conserve energy and save on energy costs. The company also seeks to continue an automatic trigger mechanism and adjustment for excess accumulated deferred income taxes as previously approved.

Southwest Gas is a Southwest Gas Holdings Inc. subsidiary that operates in Arizona, California and Nevada. It serves 206,000 California customers.

Previous rate case

Southwest Gas' last rate case concluded March 25, 2021, when the PUC voted to approve a settlement agreement authorizing the company a rate increase in two of its three operating regions. Rates went into effect retroactively as of Jan. 1, 2021.

The adopted settlement authorized Southwest Gas' Southern California rate jurisdiction to increase base rates by $3 million, based upon a 10% ROE (52% of capital structure) and a 7.11% return on a rate base valued at $285.7 million.

The adopted settlement afforded Southwest Gas' Northern California rate jurisdiction with no revenue increase, a 10% ROE (52% of capital structure) and a 7.44% return on a rate base valued at about $93 million. It also afforded Southwest Gas' South Lake Tahoe rate jurisdiction with a $3.4 million base rate increase, a 10% ROE (52% of capital structure) and a 7.44% return on a rate base valued at $56.8 million. All three instances assume a test year ending Dec. 31.

The settlement also continued the post-test-year ratemaking mechanism approved in earlier PUC decisions, but annual revenues will be adjusted by 2.75% in each of the jurisdictions to recover increases in expenses and capital expenditures in the 2022–25 post-test-year period.

Calif. regulatory environment

RRA accords California energy regulation an Average/1 ranking, reflecting RRA's view that recent uncertainty regarding wildfire risk has abated in the wake of several measures implemented by the legislature and PUC to insulate utilities from the related liabilities. Such liabilities associated with lawsuits emerging after devastating wildfire seasons in 2017 and 2018 drove PG&E Corp. to file for bankruptcy protection in January 2019. The company emerged from bankruptcy protection July 1, 2020.

The more traditional aspects of the California regulatory paradigm are relatively constructive for investors. The state operates under a largely traditional vertically integrated electric regulatory framework, with direct access available for customers of the large electric utilities, subject to certain load caps. Equity return authorizations for major energy utilities are established utilizing the above-described cost-of-capital mechanisms, and recent ROE authorizations have been above the industry averages when established. Full electric and gas revenue decoupling mechanisms have been in place for many years. In addition, certain segments of utility operations are subject to performance-based ratemaking mechanisms. A process is in place for the review and preapproval of major infrastructure projects that provide certainty with respect to rate recognition of the investments. Gas utilities employ automatic cost recovery mechanisms, and large customers have utilized transportation-only tariffs for many years.

For additional detail concerning RRA's regulatory rankings, refer to the most recent State Regulatory Evaluations Quarterly report.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.