Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 27 Jun, 2024

By Greg Zwakman, Alexander Johnston, Melissa Incera, and Yulitza Peraza

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

In 2023, the generative AI software market experienced a surge of interest and funding prompted by the popular reception of publicly available conversational chatbots using large language models. This report maps funding data from S&P Global Market Insight to the 398 generative AI vendors contained in 451 Research's Generative AI Market Monitor & Forecast, digging into some of the key trends that underlie the investment spike.

According to our recent Generative AI Market Monitor & Forecast, the market for generative AI models and software is expected to exceed $52 billion by 2028. Currently, the market's growth is being propped up by investor spending due to the expense of getting new players to the point of being able to commercialize. About 18 months since the debut of ChatGPT, we are beginning to see the market stabilize. A closer look reveals the beginnings of a shift away from foundation models, with investors now embracing AI-enabling technologies, and application providers offering the modalities enterprises are actively adopting. Seed rounds are slowing as the landscape matures and new entries decelerate. Moreover, investment attention is gradually shifting from North America to other regions, notably with prominent Chinese tech firms making significant investments in nascent generative AI startups.

Generative startup funding surged in 2023

The release of ChatGPT in late November 2022 brought with it an explosion of interest from the public, media and investors. Many generative AI startups that preexisted this release were able to ride the wave of interest to see significant capital injections. German startup Aleph Alpha had achieved just over $30 million in funding since its 2019 incorporation prior to the release of ChatGPT. In 2023, it announced a $500 million series B. Similarly, foundation model developer Anthropic, which had a post-money valuation of $3.5 billion in April 2022, saw its valuation rise to $15.8 billion by the start of 2024.

Even software players in related spaces that were able to articulate the benefits of integrating generative AI saw a lift. Enterprise search player Glean, for instance, which had raised just over $50 million since its founding in 2019, raised another $300 million between two rounds in 2022 and 2023, the last at a $2.2 billion valuation.

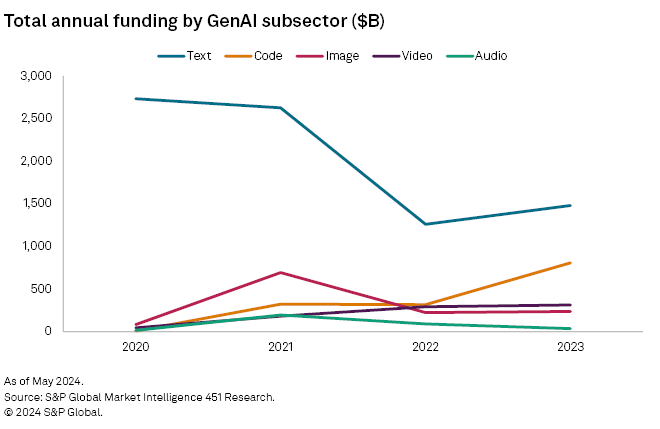

The generative AI trend also brought with it new clusters of startups, many initially focusing on text, and later on image generation. Some of these emerged with significant capital under their belts. Foundation model provider Mistral AI, founded by former employees of Meta Platforms Inc. and Alphabet Inc. in 2023, raised over $400 million in the year of its incorporation. Total funding for the generative AI software vendors in our Market Monitor report for 2023 was over $25 billion. As illustrated by the mammoth $10 billion backing commitment that OpenAI LLC saw from Microsoft Corp., that spending has not been distributed equally.

North America sees most private investment in GenAI startups

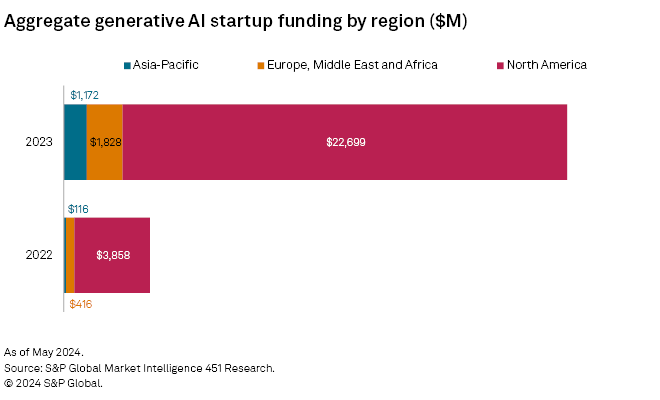

North America-headquartered generative AI software vendors captured over $25 billion in funding in 2023, or 88% of global funding tracked for the year. This lopsided distribution is notable, even after accounting for the relative size and maturity of the vendor ecosystem across regions.

Of the vendors tracked by our Market Monitor, companies headquartered in North America make up 57% of the total count and are estimated to have produced 64% of aggregate revenue in 2023. The established presence of institutional investors, corporate venture funds and angel investors, alongside a robust research and networking ecosystem in the region, has made all the difference in propelling North American startups to a position of early dominance.

In particular, China is seeing a growing generative AI vendor space, following the first sanctioned release of generative AI chatbots to the public. Shengshu Technology, AIsphere, Deeplang AI, Zhipu AI, SenseTime, 01.AI, Baichuan Intelligence and ZMO.ai are just a sample of Chinese generative AI startups that have emerged. Many are seeing funding from the largest Chinese technology companies, as illustrated by Baichuan raising $300 million in October 2023 from investors that included Alibaba Group Holding Ltd. and Tencent Holdings Ltd. Ant Group has similarly made sizable investments in foundation model provider Beijing Dark Side of the Moon Technology, and video generator AIsphere Technology in 2024.

Segment focus starts to shift

The lion's share of investment (almost two-thirds of the total to date) has been channeled into foundation models, which makes sense given how cash-intensive they are to develop, as well as the presumption that these would be the big winners of the AI movement. However, within this category, lumpiness prevails. OpenAI alone makes up half of the segment's total funding, while the top three funded pure-play startups taken together — OpenAI, Anthropic and Inflection.ai (since gutted by Microsoft) — make up 90%. Strategic backers especially have helped prop up these jaw-dropping figures because many of their commitments come not in cash but in computing resources.

Data suggests that as we move further from ChatGPT's initial release, other software categories are increasing their share. Last year, text and code generation both saw a notable uptick in capital raised, in keeping with what our data shows are types of use cases and generation modes that organizations are already adopting. According to our AI & Machine Learning, Use Cases 2024 survey, text generation has been the most rapidly adopted modality of generative AI, with 92% of organizations that have generative AI in production actively using it or planning to adopt it in the next 12 months.

Startups that fall outside the definition of our Market Monitor & Forecast, but are AI-enabling, are also capturing a growing share of funding as the impetus turns to how to support generative AI in production. For instance, Scale AI, a company that labels data for training AI models, raised a $1 billion series F round in May at a $13.8 billion valuation with backing from Amazon.com Inc., Intel Corp.'s Intel Capital, NVIDIA Corp. and Meta. The largest technology financing round this year has involved AI infrastructure provider Coreweave, which in May raised a $7.5 billion debt financing facility (rumored to have used its NVIDIA assets as collateral) to scale its datacenter presence.

Soaring angels

Generally, these startups have broad investor appeal. Headline-grabbing rounds have been driven by established strategic and institutional backers alike, as they actively hunt for promising ventures. Strikingly, an analysis of the 350 investors contributing to generative AI software funding rounds last year shows that 27% were high net worth individuals.

This trend underlines that many tech founders are sitting on unprecedented sums of cash, as well as the value they bring as advisers. Just as strategic backers bring research and go-to-market support, in many cases, these backers offer a robust understanding of the technology, its use cases and (more importantly) how to effectively bring it to market.

Some of the more prolific angel investors include co-founder of Dropbox Arash Ferdowsi, co-founder of Oculus VR and Scaleform Brendan Iribe, co-founder of Color Genomics Elad Gil, founder of Cruise Kyle Vogt, former CEO of GitHub Nat Friedman, co-founder and CEO of Datadog Inc. Olivier Pomel, and co-founder of Notion Simon Last. Unnamed executives from a wide range of companies including Google, X, Deutsche Bank, Goldman Sachs Group Inc., VMware, Tinder, OpenAI and Synk are also cited in press releases.

A maturing vendor landscape

About three-quarters of the funding rounds documented in 2021 and 2022 constituted initial or seed rounds. In 2023, this figure fell substantively to 46%. In part, this change reflects that many prominent generative AI startups, due to the high costs associated with training large models, have seen accelerated funding curves, engaging in multiple rounds within a 12-month period. Text-to-speech company ElevenLabs, for instance, went from pre-seed funding to series B in almost exactly 12 months. It also reflects the growing maturity of the vendor landscape, with startups founded in 2021 and 2022 successfully putting down roots.

Additionally, we note that, generally, the number of rounds in GenAI has started to drop, as investors show more pragmatism in capital placement amid fears of an AI bubble, and potentially also due to a perceived lack of white space for new entrants to compete with incumbents. Many investors wanted to invest in generative AI software but have chosen to back a single provider rather than spread their bets. The majority of investors in 2023 (84%) contributed to just a solitary round for the calendar year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.