Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 18 May, 2021

By Kevin Murphy

Highlights

We attribute recent low discovery rates to two primary issues: the time between a discovery hole and the point at which growth in its reserves and resources defines it as a major discovery; and an industry trend away from spending on grassroots exploration projects.

While Latin America was the top location for discoveries in the past 10 years, the 26.3 Mt of copper found is significantly lower than any other decade since 1990.

Our recent research on the long-term copper supply pipeline determined that even if projects with a low probability of advancing through to production come online, copper demand will exceed mined production by 2028.

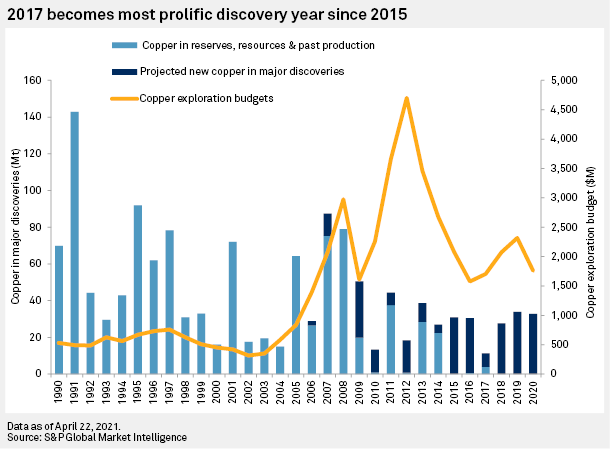

This year’s analysis of major copper discoveries has identified 229 copper deposits discovered over the 1990-2020 period, containing 1.12 billion tonnes of copper in reserves, resources and past production. Of these, only three were found in the past five years. While this is up from only one identified for the period in our 2020 analysis, the 4.6 million tonnes in the three deposits is well below the total discovered in most years. This, combined with no discoveries allocated yet to 2018-20, means that the downward trend in rate and size of major discoveries over the past decade continues.

Although the amount of copper in major discoveries has increased by 46 Mt since 2020, much of the increase is at older discoveries made in the 1990s, which have increased by 26.7 Mt year over year. This is a direct result of companies shifting more of their exploration budgets towards known deposits and existing mines, a trend identified in our Corporate Exploration Strategies study.

As we conduct our discoveries analysis on an annual basis, we are able to view how discoveries change over time. While the total amount of copper in major discoveries increased by 46 Mt year over year in 2021, the bulk of the change was resource growth at existing discoveries. Less than 6 Mt came from newly added discoveries, and of that only 3.9 Mt was in recent years.

While it is a testament to the quality of the deposits discovered in the 1990s that new copper continues to be added to their endowment, the lackluster performance of recent years is concerning. We attribute recent low discovery rates to two primary issues: the time between a discovery hole and the point at which growth in its reserves and resources defines it as a major discovery; and an industry trend away from spending on grassroots exploration projects.

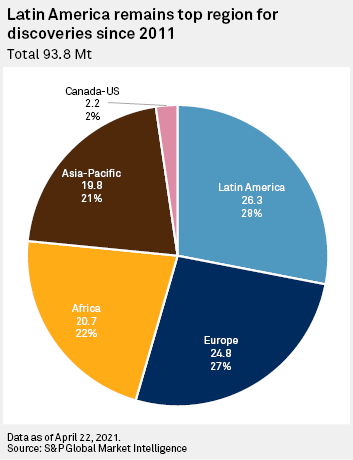

Latin America remains top region for discoveries

Hosting many of the world's largest copper mines and accounting for about 40% of global mined copper production in 2020, Latin America is unsurprisingly the primary location for copper exploration, attracting more than one-third of copper budgets over the past two decades. This significant effort, mostly focused on Chile and Peru, has resulted in over half of the global discovered copper since 1990 being found in the region. Chile and Peru alone account for 82% of the 604.6 Mt discovered in Latin America and 44% of the global total found since 1990.

While Latin America was the top location for discoveries in the past 10 years, the 26.3 Mt of copper found is significantly lower than any other decade since 1990. Conversely, the discovery rate in Africa and Europe has increased significantly in the past 10 years, together accounting for half of the copper discovered since 2011. This is primarily due to Ivanhoe Mines' 2014 discovery of the 18.9-Mt Kakula deposit in Democratic Republic of Congo and Freeport-McMoRan's 2011 discovery of the 23.3-Mt Timok deposit in Serbia.

Although the Canada-US region is not historically prolific for copper discoveries, they have been unusually sparse over the past decade, with only one major copper discovery identified. This trend is unlikely to change anytime soon, as there have been only 17 copper-containing deposits with initial resources in North America over the past five years, only three of which had more than 100,000 tonnes of copper. Only one is considered a major discovery, GT Gold's 2017 discovery of the 2.2-Mt Saddle deposit in British Columbia.

Medium-term pipeline at risk

Our recent research on the long-term copper supply pipeline determined that even if projects with a low probability of advancing through to production come online, copper demand will exceed mined production by 2028, although refined supply deficits are expected to start in 2021. A significant amount of work will be required to advance the world's major deposits to production between 2027 and 2030. Of the 229 major discoveries included in this analysis, 146 are not yet in production, including 114 yet to complete feasibility studies. Just 11 have finalized construction plans and begun development.

This is insufficient not only to meet demand increases but to offset production decreases at existing operations. Significant investment of time and money will be required of the industry within the next several years to ensure that the projects in the pipeline meet this medium-term supply pinch.

Like our content? Subscribe to receive our monthly Essential Metals & Mining Insights newsletter delivered directly into your inbox.

Blog

Event

Products & Offerings

Segment