Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jun, 2016 | 12:00

Highlights

VNQ pulled in $2.56 billion of new money in the first five months of the year.

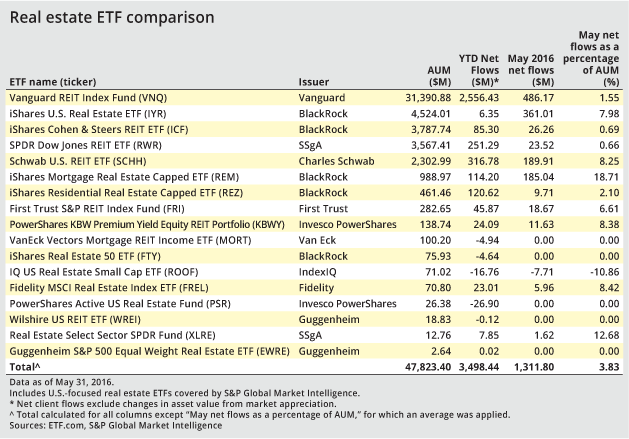

Demand for U.S. real estate securities accelerated in May, as exchange-traded funds focused on the sector gathered $1.31 billion of new money, up from US$510.4 million in April. The popularity of REIT ETFs persisted last month even as health care and information technology ETFs had net client withdrawals.

While real estate securities are underweighted in many actively managed mutual funds ahead of the pending GICS sector elevation of REITs, passively managed securities providing exposure to the segment had $47.82 billion in assets at the end of May, boosted by $3.50 billion of net inflows in the first five months.

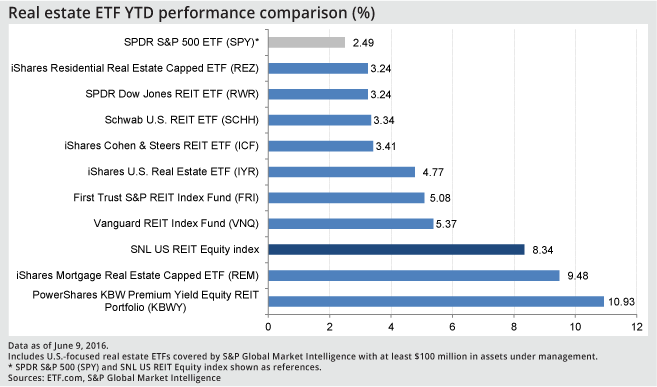

Vanguard REIT Index ETF (VNQ) remains the largest of these ETFs, at $31.39 billion, aided by $486 million of monthly inflows. Relative to the SPDR S&P 500 (SPY), an ETF passively managed by SSgA Funds Management Inc., the Vanguard Group ETF's 5.37% year-to-date gain through June 9 was stronger. VNQ pulled in $2.56 billion of new money in the first five months of the year.

Meanwhile, the $361.0 million in inflows for BlackRock Inc.'s largest REIT product, iShares US Real Estate ETF (IYR), erased prior outflows. IYR has a higher expense ratio than VNQ — 0.43% versus 0.12% — but trades more shares on a daily basis — 8.6 million versus 3.7 million. However, the top 10 largest positions for both diversified ETFs include Simon Property Group Inc., American Tower Corp., and Public Storage.

BlackRock also offers two more narrowly focused ETFs: iShares Mortgage Real Estate Capped ETF (REM) and iShares Residential Real Estate Capped ETF (REZ). With $185.0 million of inflows, REM — which has risen 9.48% year-to-date — was more popular last month.

REM's largest holdings include Annaly Capital Management Inc., American Capital Agency Corp. and Starwood Property Trust Inc.; the top 10 holdings represented 69.7% of total assets as of June 10.

PowerShares KBW Premium Yield Equity ETF (KBWY) remained the strongest-performing U.S. REIT ETF among the products with more than $100 million in assets. The ETF, offered by Invesco PowerShares Capital Management LLC, rose 10.93% year-to-date as of June 9. While this was down from last month, the ETF pulled in an additional $11.6 million in new assets. KBWY tracks an index that consists of small- and midcap REITs and is weighted based on the constituents' dividend yield.

The ETF's recent top 10 holdings included Government Properties Income Trust and WP Glimcher Inc., which had dividend yields of 8.6% and 9.2%, respectively, as of June 13.