Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Oct, 2023

By Tony Lenoir

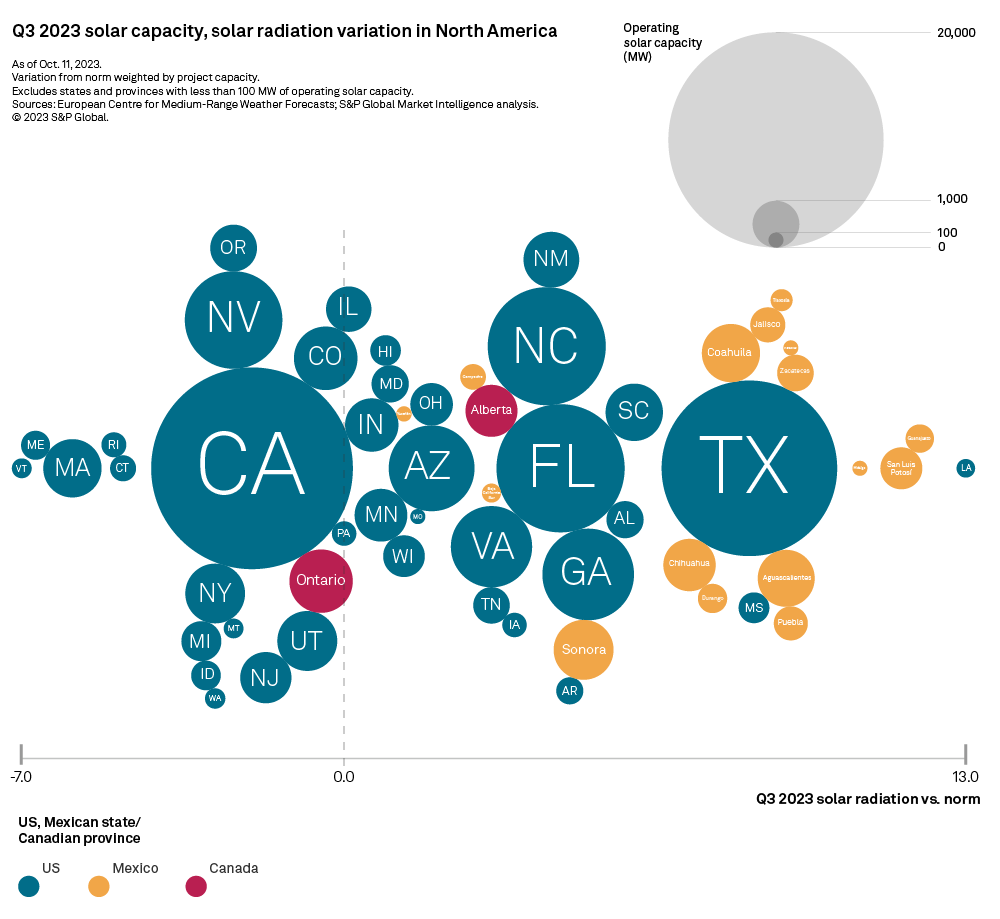

Radiation 2.5% above the norm sun-kissed North America's nearly 100-GW grid-scale solar generation fleet in the third quarter of 2023, pointing to boosted solar generation amid higher energy demand on summer-taxed air-conditioning systems during the three-month period — a potential earnings boon for the top owners of solar projects in the region.

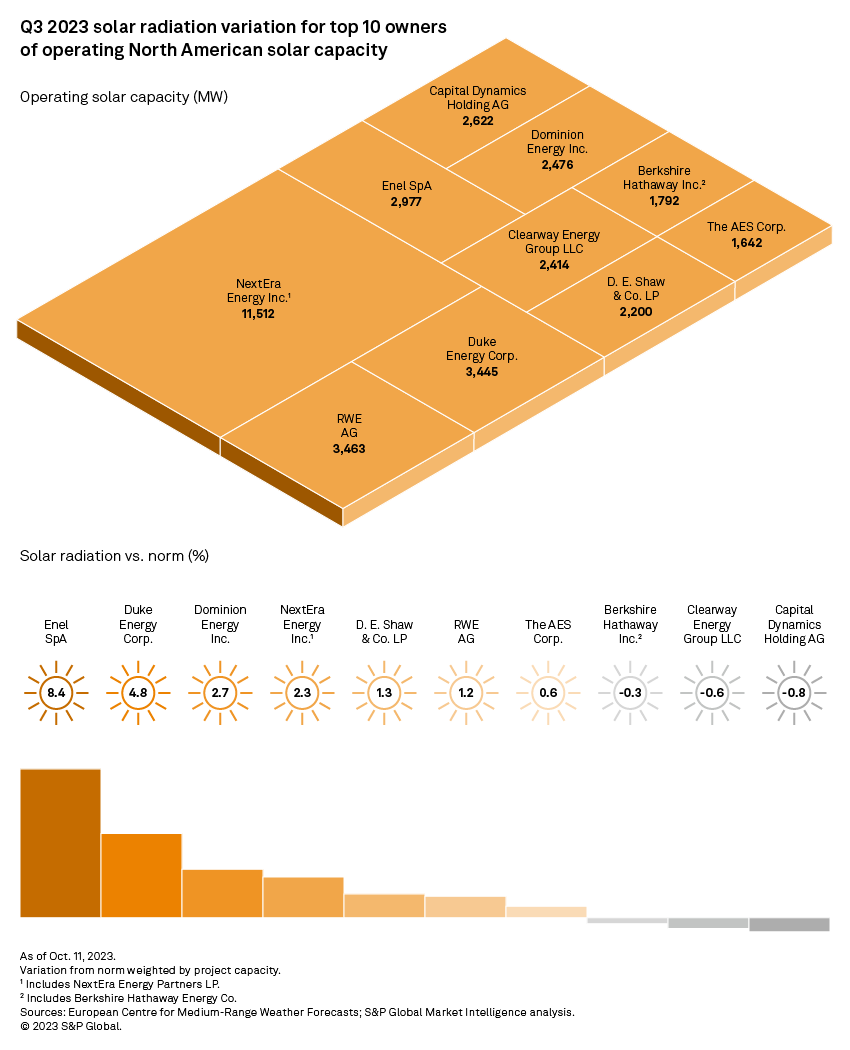

Sixteen of the top 20 holders of North American solar capacity experienced above-average radiation levels in the third quarter, likely resulting in a boost to solar earnings on higher photovoltaic generation output.

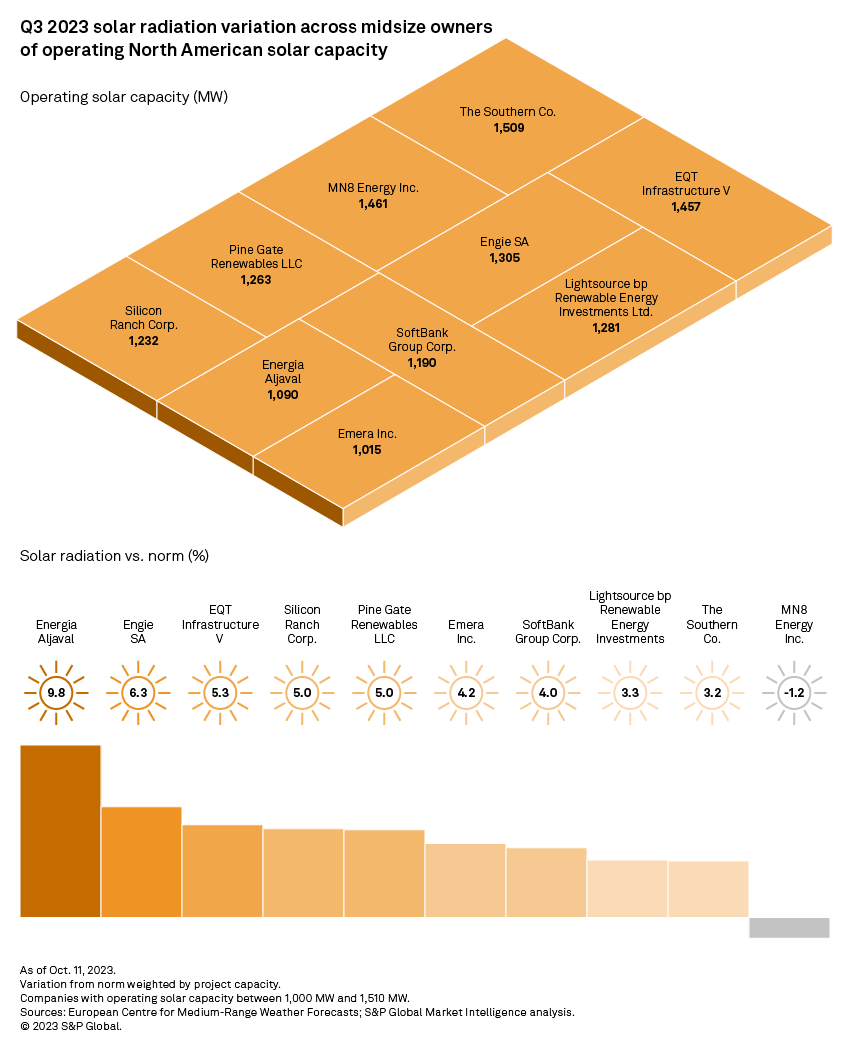

With particularly dramatic departures from the norm in the southern half of the US and in Mexico, including high single- to low double-digit jumps in more than a dozen states, companies with portfolios heavily concentrated in the region stand out. This includes Enel SpA, Energia Aljaval and Engie SA, with deviations ranging from 6.3% to 9.8%.

Breaking out the geography along national borders shows Mexico leading the pack, with the 10.4-GW Latin American market experiencing an 8.2% insolation surge. The US, up 1.9%, and Canada, up 1.1%, though both in positive territory, are far behind. Overall, more than 62 GW of utility-scale solar across two-thirds of the states and provinces making up the North American territory soaked up above-average sunshine.

Double-digit deviations were recorded in Louisiana and in half a dozen Mexican states. Most of the southern half of the US, where the top US solar portfolios are heavily concentrated, logged sizable jumps. Texas, home of the second-largest US solar generation park, saw radiation soar nearly 9% above the norm. The US northeast faced much cloudier skies. New England notably reeled from mid- to high single-digit retreats from the norm. That said, the region hosts only 2.7 GW of large-scale solar capacity — 3.2% of the US total.

Across the northern border of the US, New England neighbor Québec, home of just 19 MW of grid-scale solar capacity, also saw less sun, down 4.7%. Manitoba and Ontario accompanied the French-speaking province into negative territory, though at much more palatable levels, while the rest of Canada basked in extra sunlight. Alberta, which hosts about 40% of Canada's grid-scale solar capacity, benefited from radiation 3.2% above the 20-year average. Canada had a 3.1-GW solar generation fleet in the third quarter.

Among the top 10 owners of North American utility-scale solar, seven profited from excess sun. Enel SpA tops the leaderboard with an 8.4% departure from the norm. Nearly 94% of the North American solar portfolio of the Rome-headquartered multinational is based in Texas and in the Mexican states of Coahuila, Guanajuato and Tlaxcala. The 500-MW Roseland Solar Project in Texas experienced the largest deviation across Enel's solar assets, with third-quarter radiation 9.7% higher than normal.

US grid-scale solar capacity leader NextEra Energy Inc. registered a 2.3% average radiation uptick, with the company's 25% portfolio exposure to California and Nevada, both in the red this quarter, offsetting a 4.7% deviation from the norm in Florida, where 43% of NextEra's pool of photovoltaic generators are situated. NextEra projects in the US Northeast did not help. For example, the 77 MW Farmington Solar Project in Maine — NextEra's largest in the region — saw radiation plunge 7.1% below normal.

Farmington Solar has long-term, firm power purchase agreements with Cape Light Compact, The Narragansett Electric Co., NSTAR LLC, Nantucket Electric Co. The United Illuminating Co. The Connecticut Light and Power Co. and Fitchburg Gas and Electric Light Company Inc. The project has around-the-clock, fixed monthly average energy transaction rates ranging from $53.95/MWh to $84.85/MWh, according to second-quarter 2023 S&P Global Market Intelligence quarterly transaction data.

That said, NextEra's geographically diversified US solar generation fleet, though relying on a fairly consequential agglomeration in some of the most isolated states in the US, generally precludes wide radiation divergences from the historical norm. In the third quarter of 2023, NextEra had solar projects in 29 US states. The company had no solar generation assets in either Canada or Mexico, however.

Aside from Enel SpA, most of the utility-scale solar capacity based in Mexico is held in smaller-to-midsize portfolios. Among companies holding between 1,000 MW and 1,510 MW of North American solar capacity, Spanish, privately held Energia Aljaval and French Engie SA had a combined large-scale Mexico-based photovoltaic generation fleet of 1.4 GW in the second quarter. Mexican projects made up the entirety of Energia Aljaval's North American solar portfolio and 20% of Engie's.

In the three months to Sept. 30, 2023, Energia Aljaval saw average radiation across its North American projects shoot up 9.8% above normal. With more than 54% of its solar capacity in Texas, Engie SA experienced a 6.3% radiation deviation from the norm during the period, including flares at some of its largest projects. Engie's 250 MW Sun Valley Solar Project in Texas notably benefited from sunlight exceeding the 20-year average by 9%. The Procter & Gamble Co. has a 200-MW power purchase agreement with Sun Valley Solar.

Solar radiation is the mean surface downward short-wave radiation flux measured from the fifth-generation European Centre for Medium-Range Weather Forecasts reanalysis. This variable includes direct and diffuse solar radiation and is the model equivalent of global horizontal irradiance, the value measured by a pyranometer, a solar radiation measuring instrument. The data is available at quarter-degree latitudes and longitudes, with a spacing of slightly over 27.5 km. This analysis compares third-quarter 2023 radiation values with the 20-year solar radiation average for the corresponding period.

Data visualization by Rameez Ali and Joseph Reyes.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Monesa Carpon and Kristin Larson contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.