Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Jun, 2023

By Jessica Fuk

Despite heated competition, executives attending the 2023 Taiwan in View conference held May 4 in Taipei, Taiwan, expressed optimism about the future of the over-the-top industry in the market. Most speakers view the industry as being in a growth stage, seven years after the sector took off in 2016 with major players such as Baidu Inc.'s iQIYI Inc. and Netflix Inc. entering the market.

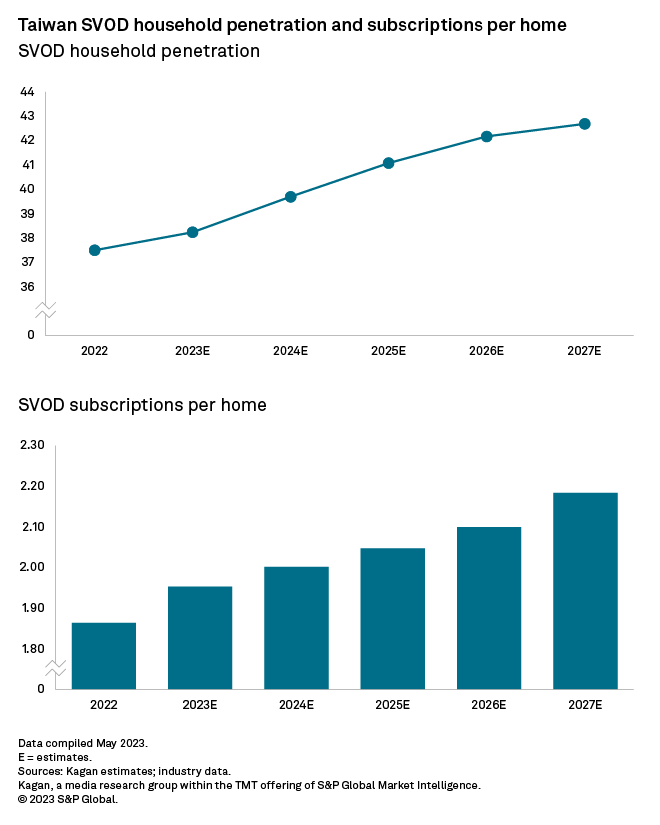

In the opening remarks, Deputy Minister of Culture Sue Wang shared the latest data that over 90% of the Taiwanese population watches online videos. The recent success of a number of original series on streaming services including "Light the Night" and "Copycat Killer" boosted subscription and revenue figures in recent years. Kagan estimates 37.5% of Taiwanese households subscribe to at least one subscription video-on-demand service and the number of SVOD subscriptions per SVOD household averages 1.9 as of year-end 2022. SVOD household penetration could exceed 40% by 2025, with each SVOD household subscribing to an estimated average of 2.1 services.

According to Chien Ta-Wei, chairman of the Taiwan OTT Association and founder and president of LiTV, there are over 30 streaming services in Taiwan and the hybrid freemium model is the most widely adopted. Taiwan is one of the most affordable SVOD markets in the Asia-Pacific with average revenue per subscription (ARPS) estimated at $5.66 per month in 2022. Our model indicates monthly SVOD ARPS could rise at a compound annual growth rate of 2.9% to $6.55 by 2027 as competition constrains substantial price hikes. Daphne Yang, CEO of Catchplay Inc., commented that it is not a comfortable position as streamers compete through content and pricing strategies.

Apart from offering original content, local OTT services tend to adopt the role of being a content aggregator and this highlights the importance of collaboration and partnerships. Gary Tsai, COO of digital entertainment at Far EasTone Telecommunications Co. Ltd., and Daphne Lee, chairperson of the Taiwan New Media and Entertainment Association and vice president of new media service business at Taiwan Mobile Co. Ltd., agreed that such partnerships do not harm but instead complement their own OTT services.

It is an exciting time for Taiwanese content as original series "Copycat Killer" quickly reached second place on Netflix's Global Top 10 chart for non-English TV within a week of its release. It is the first Taiwanese title that has secured a place in the chart, overshadowing the popularity of previous Taiwanese dramas such as "Light the Night" and "The Victims' Game." Phil Tang, co-producer of "Copycat Killer" and president of Greener Grass Culture, is grateful for the unprecedented achievements of the series, which has traveled well not just in Chinese-speaking markets and in Asia-Pacific, but also in other regions including Europe, the Middle East and Africa, and Latin America.

Tang trusts that streaming expedites the distribution of local content internationally. While success in the local market does not guarantee the same overseas, Tang believes content well-received locally stands a higher chance for success globally. Therefore, focusing on content that engages the local audience is always the way. It is also true that original content on OTT services is distributed to linear platforms including local terrestrial channels to maximize revenue. Speaking from the perspectives of production and content owners, Maxine Lu, founder and managing director of Fun Job Studio, and Jay Lin, founder and CEO of Portico Media and GagaOOLala, echoed that distribution to multiple platforms establishes a stronger presence for content and that the industry has been tactical about it.

Another benefit brought by the rise of streaming is the enhanced investment in content despite more recent attempts to cut budgets. Global streaming giants are still willing to pay more as their services spread across different territories. This explains how projects being commissioned by these streamers could have access to better resources that could be essential given the rising costs of content production.

Looking up to the global fame of South Korean content, Deputy Minister of Culture Sue Wang said that Taiwan plans to devote more resources to the content and media industry and considers the development of the industry as a strategic priority as crucial as the market's semiconductor sector.

Research

Research