Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 18, 2023

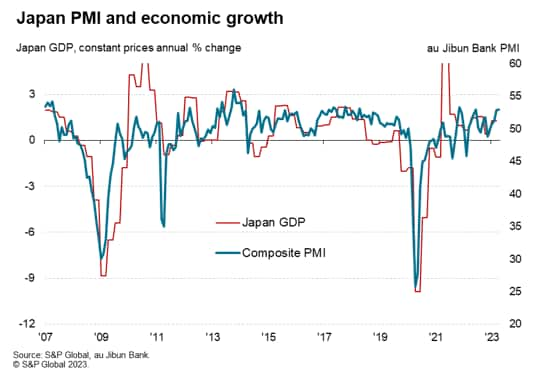

Japan's first quarter official GDP data surprised to the upside, signalling a stronger than anticipated revival of economic growth. However, such a robust acceleration of growth had been signalled ahead by the PMI surveys, which correctly revealed a resurgence of consumer spending to have been the driving force behind the upturn. The survey data also bode well for a solid economic performance in the second quarter, but the picture will become clearer with the upcoming release of flash PMI data for May. The revival of demand is also leading to higher inflationary pressures, further insights into which will also be available with the flash PMI.

Japan's economy returned to growth in the first quarter, according to official statistics which closely echo the economic picture portrayed in recent months by the au Jibun Bank PMI, compiled by S&P Global.

The preliminary estimate of GDP points to the economy growing 0.4% in the first three months of the year, or 1.6% on an annual basis. This represents an improvement on the revised negative annual growth of -0.1% seen in the fourth quarter of last year.

Economists had been expecting a more modest 0.1% return to growth, but the more impressive performance tallied with the PMI data. The average output index reading measured across manufacturing and services from the au Jibin Bank PMI rose to 51.6 in the first three months of 2023, up from 50.1 in the closing three months of 2022, signalling a revival of growth.

Moreover, the April PMI reading of 52.9 points to sustained robust growth at the start of the second quarter. The latest reading is broadly consistent with GDP growing at an annual rate of just under 2%.

Flash PMI numbers for May, due on 23rd May, will provide further insights into the performance of the economy in the second quarter.

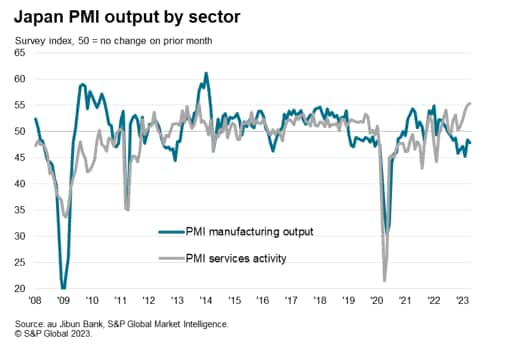

The official GDP data also corroborated the PMI story of an economy showing marked variations in performance by sector. The PMI data have seen service sector growth accelerating in recent months to reach one of the fastest rates on record in March, with a further impressive expansion seen in April. This growth has been driven to a large extent by resurgent spending on services thanks to the reopening of the global economy, notably among consumers. Activity such as travel, recreation and transportation have fared especially well.

Manufacturing output, in contrast, has declined at a marked pace in recent months, dropping for a tenth successive month in April. Production has come under pressure as spending has switched away towards services, and demand has been further weakened by a shift towards inventory reduction. Exports have been particularly hard hit.

The GDP data have subsequently also shown the first quarter recovery to have been led by consumer spending. Domestic private consumption rose 0.6%, though a surprise 0.9% rise in capital expenditures added to the overall expansion. Exports slumped by 4.2%, however, acting as a major drag.

While the robust PMI data for April raises the likelihood of persistent growth in the second quarter, the data also hint at a continued diverging sector trend. New order inflows fell again in manufacturing during April, down for the tenth successive month, albeit declining only modestly.

In contrast, inflows of work into the service sector rose at a rate unprecedented since services survey data were first compiled in 2007.

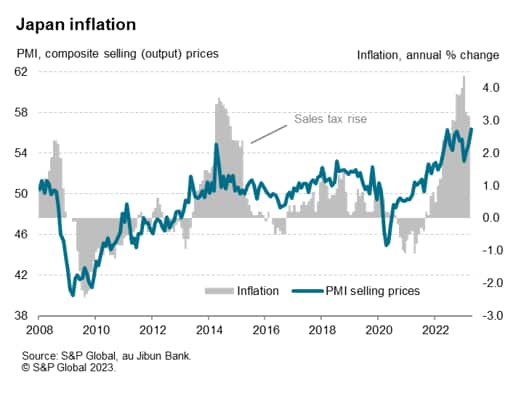

Pent-up demand from consumers, stored up during the pandemic, therefore looks to be providing a nice tailwind for the Japanese economy, but it remains to be seen how long this stimulus can persist for. Flash PMI data for May will add further clarity to the near-term outlook in this respect, as well as providing an update on the inflation outlook. Selling price inflation hit a record high in the April PMI survey, as surging demand - notably for consumer services - boosted firms' pricing power. Any further upward price trends will suggest that CPI inflation could reaccelerate.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.