Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 15 Jun, 2023

By Frank Zhao and Mengmeng Ao

For the first time, natural language processing algorithms get to tell the earnings call story. This recurring series reviews an earnings season exclusively using texts from call transcripts.

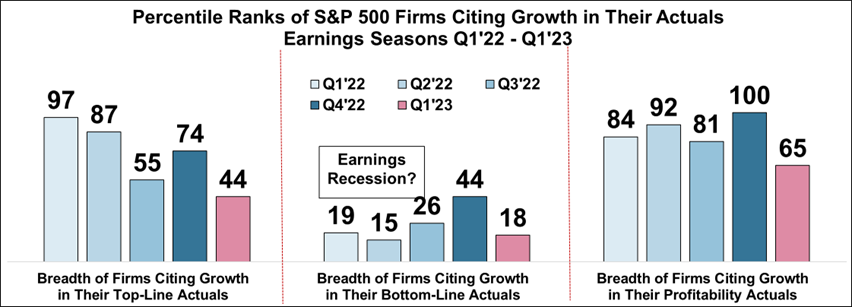

A bullish sentiment during the Q1’23 season has taken hold. The excitement surrounding the ‘iPhone Moment’ of AI, the resiliency in the labor market, the receding likelihood of a banking crisis and the end of the current rate hike cycle have all uplifted the prospects of the U.S. economy. However, the exuded level of sentiment may not be supported by the financials. The breadth of firms citing growth deteriorated on a quarterly and yearly basis. Forecasts for the next season have come down materially from their bullish Q1’23 levels. Ominous clouds are on the horizon as banks’ commercial loan portfolios come under scrutiny. Vacancy rates for office buildings have hit all-time highs.[1] For the first time in the past five seasons, banks are prominently discussing their exposures to the commercial real estate market.

Source: S&P Global Market Intelligence Quantamental Research. Data as of May 19, 2023

This recurring series demonstrates the richness and intuitiveness of insights that could be surfaced algorithmically from textual data. Takeaways for the Q1’23 season are:

Sentiment and Financials Diverge: The overall sentiment improved in Q1’23 on a quarterly and yearly basis and is now among the best 12 earnings seasons in the past 15 years, while conversely financial growth deteriorated. The breadth of firms citing earnings growth regressed to a level that is now among the worst 12 earnings seasons since Q4’07.

Defensives Lead and Cyclicals Struggle: Utilities led the defensives with the largest sentiment improvement year-over-year on the back of strong demand despite a warmer than usual winter. Financials, followed by other cyclicals, had the largest sentiment deterioration year-over-year. Banks’ profitability continues to be under pressure from elevated funding costs and their commercial loan portfolios are under scrutiny.

TDA is an off-the-shelf NLP solution that tailors to our Machine-Readable Transcripts and outputs 800+ predictive and descriptive analytics for equity investing and various data science workflows.

NLP-friendly data from earnings calls, with metadata tagging and investor relations details. Keep track of company events and analyze data from earnings, M&A, guidance, and more. Benefit from intraday updates and 11,600+ covered entities with history dating back to 2004.

READ THE FULL REPORT

READ THE FULL REPORT

Location