S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 14 Jun, 2023

After two years of disruption that resulted in player defections and widespread acrimony within the golf community, the PGA Tour, the DP World Tour and the LIV Golf League agreed to unify as a larger commercial entity.

Under the framework of the deal, the Public Investment Fund of Saudi Arabia , which backs the startup LIV circuit, will combine its golf-related commercial businesses and rights with those of the PGA Tour and DP World Tour, the European circuit, beginning next year. The PIF will make a significant investment toward a minority equity position in the new combined entity.

The announcement came almost one year after LIV teed off its inaugural, eight-event season on June 9–10, 2022, at Centurion Club in Hertfordshire, England, outside of London. LIV has attracted a number of golf's top players to its favored 54-hole team play using huge signing bonuses to lure talent.

➤ The Public Investment Fund of Saudi Arabia, the financial supporter of LIV Golf League, will team with the PGA Tour and European circuit, DP World Tour, uniting the commercial businesses and rights of the three.

➤ Looking to tee off in 2024, the new, collectively owned business will be structured as a for-profit entity aimed at ensuring competition among golf's best players.

➤ The agreement also calls for the end of all pending litigation among the parties.

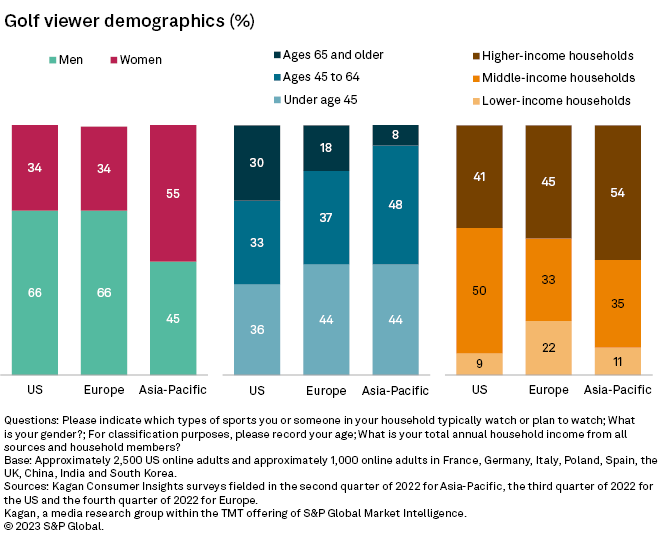

Golf's audience historically lags other professional sports leagues, including the NFL, MLB and NBA, but sponsors and advertisers find golf appealing due to its upscale audience.

The vast majority of golf viewers in the US, Europe and Asia-Pacific reside in middle- and higher-income households, according to findings from Kagan's Consumer Insight surveys. Specifically, the US survey showed that 50% of golf viewers live in middle-income households, while 41% are upper income. In Europe, 33% of golf viewers come from middle-income households, with 45% from upper-income homes, while the Asia-Pacific ratios ranked at 35% and 54%, respectively.

Although golf's audience tends to be affluent, it is also older in the US, where the Kagan survey found that 30% are age 65 or above. Internationally, 17% of golf watchers in Europe were 65 or older, and that age group represents 8% of golf viewers in Asia-Pacific, according to the Kagan surveys.

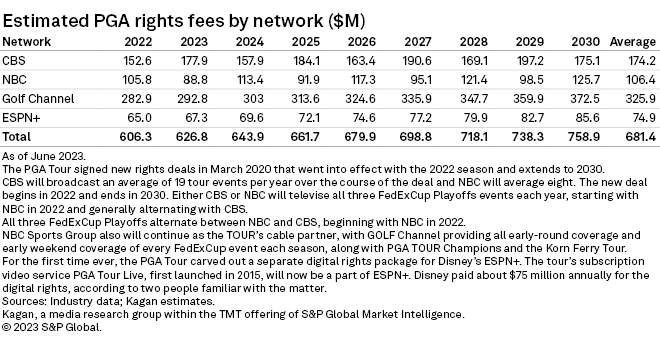

In 2022, the first year of the current PGA Tour rights contracts , Kagan estimated that the PGA collected $606.3 million in total rights fees from Paramount Global 's CBS (US) , Comcast Corp. 's NBC (US) and Golf Channel (US) , and Walt Disney Co. 's streaming service ESPN+. The PGA's rights fee total from this group is expected to hit $626.8 million in 2023 and $758.9 million in 2030, the contract's final year. Over its course, Kagan estimated the PGA Tour's collective annual average rights fee under the contract will be $681.4 million, lagging average rights fees for the NFL, NBA, MLB and NHL.

LIV Golf's legal battles, player competition

The LIV Golf League sued the PGA Tour in federal court last year, alleging the latter had used its monopoly power to squash competition and influence vendors, media companies and others to avoid working with it. The PGA Tour countersued asserting that LIV Golf had interfered with its contracts with players.

The Saudi fund's financial support of LIV Golf has drawn ire in some circles that cite human rights concerns with the Saudi government.

Fronted by two-time Open Championship winner Greg Norman, LIV Golf has added 48 PGA Tour players to its ranks, including such notables and major tournament winners as Phil Mickelson, Dustin Johnson, Bryson DeChambeau, Sergio Garcia and Brooks Koepka. In May, Koepka captured golf's most recent major, the PGA Championship.

Officials with the merging golf tours said they will work together to determine a "fair and objective process" for LIV players that want to reapply for PGA and DP World membership following the completion of the 2023 seasons.

LIV audience limited by distribution

During its first season, LIV Golf was streamed live by YouTube to relatively small audiences after it failed to attract a major rights deal in the US. For its second season, LIV in January reached a deal with The CW (US) , now 75%-owned by Nexstar Media Group Inc.

The CW deal, which is said to cover two years as a revenue-sharing arrangement, marked the US network's first venture into national sports coverage. The CW app is carrying LIV play on Fridays, while the network itself is presenting the action on Saturdays and Sundays.

The remaining seven LIV events in 2023 will unfold as scheduled by The CW. Next up: the event at Real Club Valderrama in Spain, June 30–July 2, followed by the tournament at the Centurion Club in England on July 7–9.

LIV Golf holed an average audience of 406,875 across the 12 second- and third-round telecasts on The CW over six tournaments from February through May, according to Comscore Inc. data. This season's initial broadcast on Feb. 25 from El Camaleon Golf Club, Playa Del Carmen, Mexico, was its most watched, with an average audience of 552,318.

In the US, the PGA Tour secured deals with 52 sponsors for the 2022-23 season. LIV, looking to build its base, has deals with EasyPost, Resorts World Sentosa and Akron Oil Company.

While national advertising support for LIV on The CW has been a slow build, demand for LIV is stronger with local affiliates, said Nexstar President and COO Tom Carter, speaking at an investor presentation in May. Nexstar was able to gain 100% clearance for LIV within a week of announcing the rights deal, Carter said. The company had to fill in some gaps as CBS-owned stations affiliated with The CW opted not to carry LIV Golf.

The integration of team golf

PGA Tour commissioner Jay Monahan, in a memo sent to its players June 6, indicated that the PIF would become a premier corporate sponsor of PGA Tour, DP World Tour and other international circuits. PIF is committed to "significant financial support toward causes that positively impact the game on a global basis," Monahan wrote.

The commissioner also wrote that the PGA Tour would evaluate how "best to integrate team golf into the professional game."

At press time it was unclear as to how team golf, which also manifests in international competitions, the biennial Ryder Cup and President Cup events, would be integrated into the PGA and DP Tours.

Moreover, it was uncertain whether The CW retains any first-refusal rights, or whether it would be part of a bidding process with the PGA Tour's current rights holders to obtain any of these competitions.

On a call with reporters, Monahan said he could not see a scenario where a LIV event would run concurrent to a PGA tournament. That suggests future LIV competitions or golf team play could occur in the fall, following the conclusion of the PGA playoffs.

Player reaction, board formation

Monahan, according to print and broadcast reports, noted that the PGA Tour had been in talks with PIF officials for about seven weeks, through four in-person meetings, video and phone calls.

Players, at the meeting, were reported to be upset that they were not apprised of the developments, with most only learning about the agreement via social media the morning of June 6.

Monahan will also serve as the CEO of the new entity, with Yasir Al-Rumayyan, the governor of the Saudi fund, its chairman. Al-Rumayyan, who said the agreement should be finalized in the coming weeks, will join the PGA Tour's policy board.

A board of directors will oversee the new entity, with the groups working to establish a cohesive schedule. PIF will be the exclusive investor in the new entity and holds the exclusive right for further investment, including "a right of first refusal on any capital invested."

The PGA Tour expects to remain a 501(c)(6) tax-exempt organization, retaining oversight of the sanctioning of events, administration of competition and rules.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.