Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 18 Sep, 2024

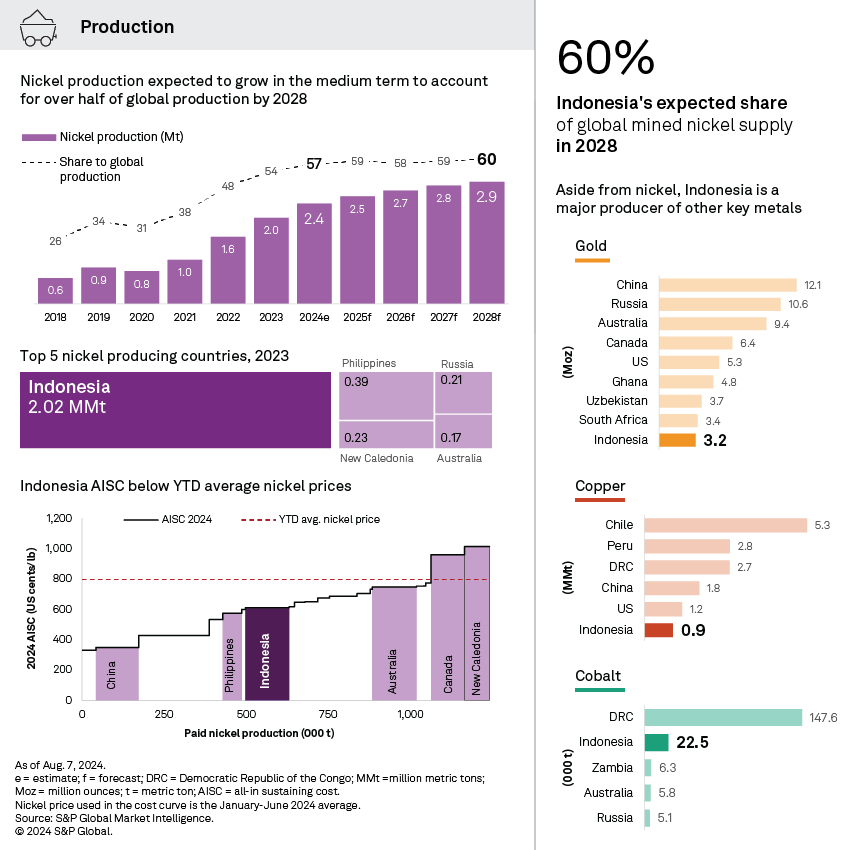

Indonesia remains one of the largest producers globally of metallic commodities such as gold, copper, nickel and cobalt. In 2023, it maintained its rank as the top-producing country of mined nickel, accounting for more than half of global production. The rapid growth of the country's nickel industry and cost-competitive operations have sent ripples across the nickel markets, leading to closures and suspensions of mines at the higher end of the cost curve. Despite a plunge in nickel prices since 2023, Indonesia's nickel production growth remains steady and is expected to drive a surplus in the medium term that threatens to lock prices at about $17,000 per metric ton.

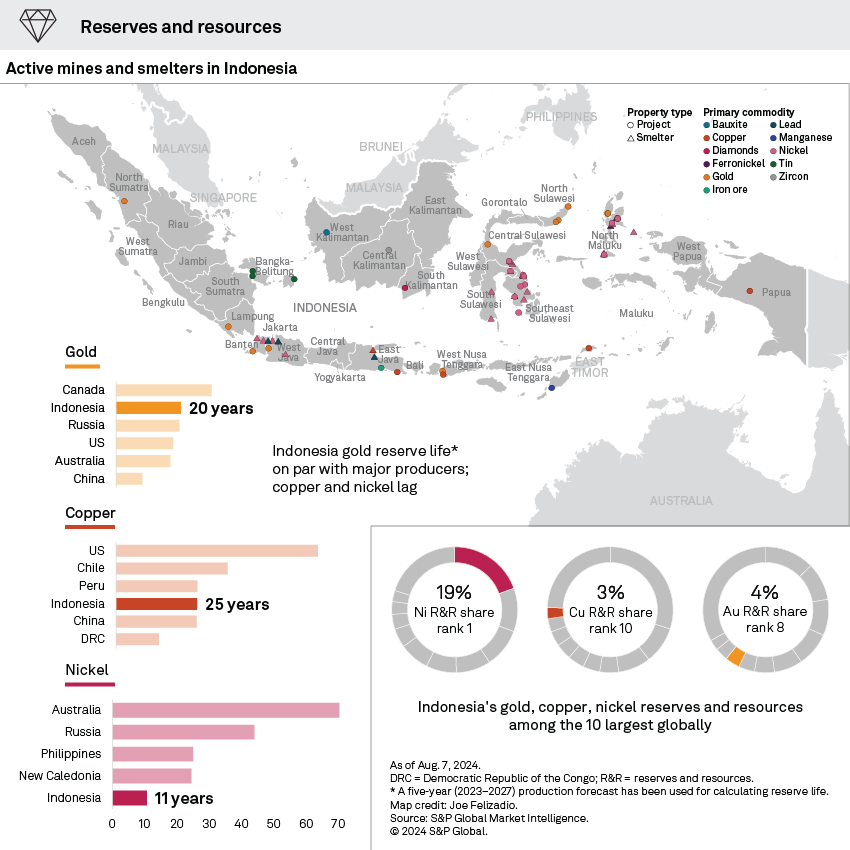

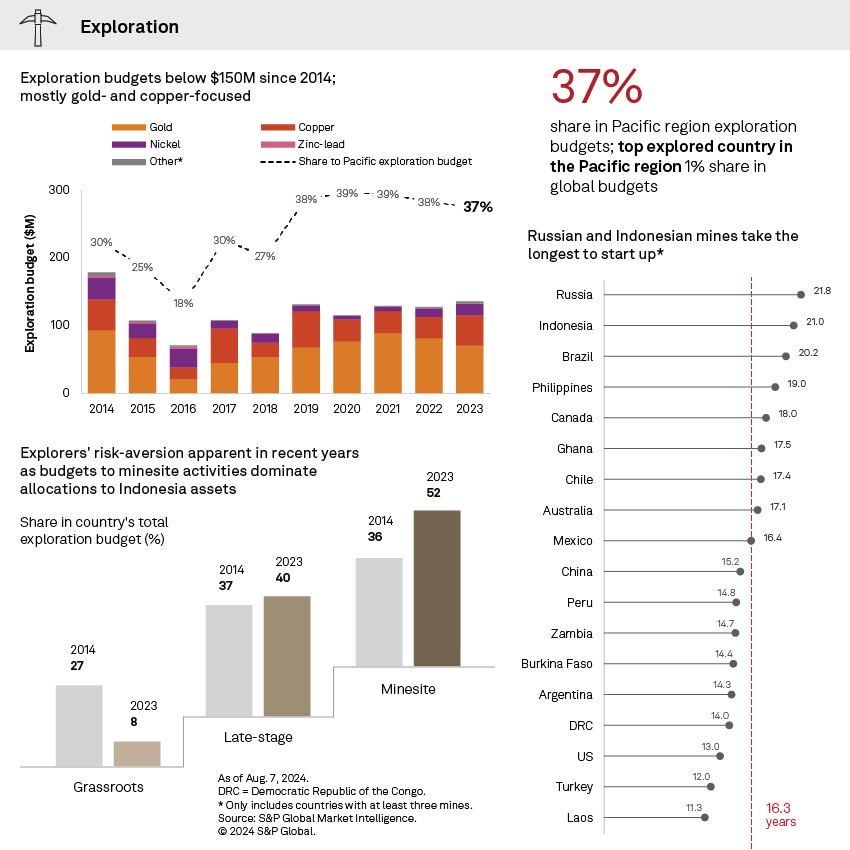

With the country's robust development environment, explorers have attempted to keep pace in supporting the project pipeline. The average allocation to nonferrous exploration activities in the country over the last five years was 16% greater than in the 2014 to 2018 period. However, a significant shift of preference to brownfield assets within the last decade has led to grassroots exploration dropping to all-time lows of less than 10% of budget allocations in the country since 2020. This is reflected in the country's lack of major gold, copper and nickel discoveries in the last decade.

While Indonesia's copper and gold reserves are expected to last for the next 20 years, estimates show it takes 21 years to bring mining assets in the country from first discovery to declaring operations. This then calls for increased focus on generative exploration programs that would add new discoveries and convert existing resources.