Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Sep, 2024

By Cesar Pastrana

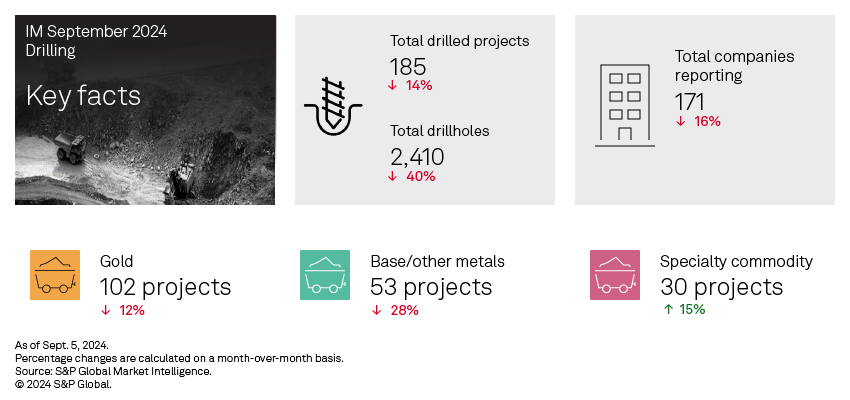

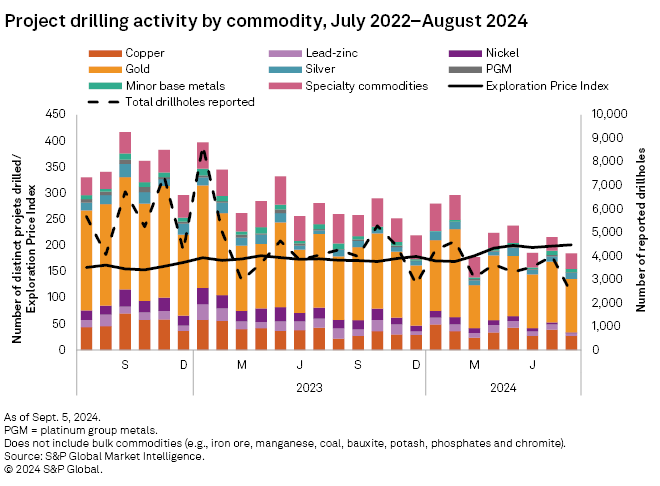

All drilling metrics declined month over month in August. Total drillholes fell to 2,410, the lowest since March 2020, with gold down 39% and specialty metals reporting a decrease of 60%. Total drilled projects fell 14% to a five-month low of 185, while total companies reporting came in at 171, the lowest since June 2020. All drilling stages decreased month over month, with early-stage down 33%, late-stage 3% and minesite 14%.

Drilling activity for almost all commodities decreased month over month in August. Only specialty commodities and silver were up; specialty commodities grew 15% to 30 projects reporting, and silver increased 20% to 12 projects reporting. Leading the decrease were gold, down 12%, and copper, down 31%. Lead-zinc also fell, dropping 50% to five projects, the lowest number since July 2020, while nickel, platinum group metals and minor base metals each recorded minor decreases of two projects reporting. Although total specialty metals projects reporting was up in August, a 60% decrease in drillholes in the category was largely responsible for dragging down the total number of drillholes for the month, aided by the 39% decline in gold reporting. Copper and lead-zinc reported slight increases in drillholes, while minor base metals, silver and platinum group metals drillholes fell.

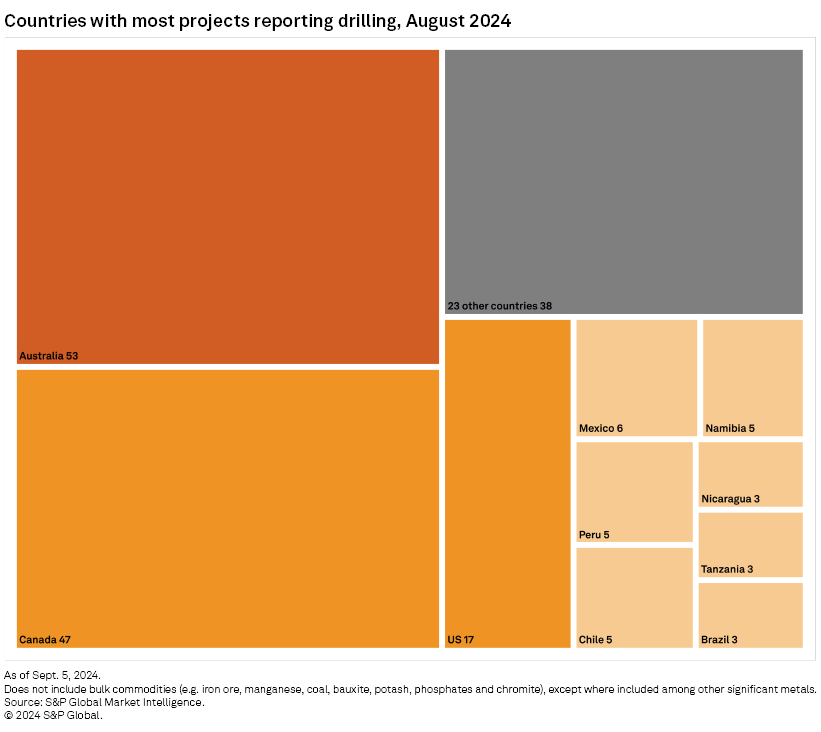

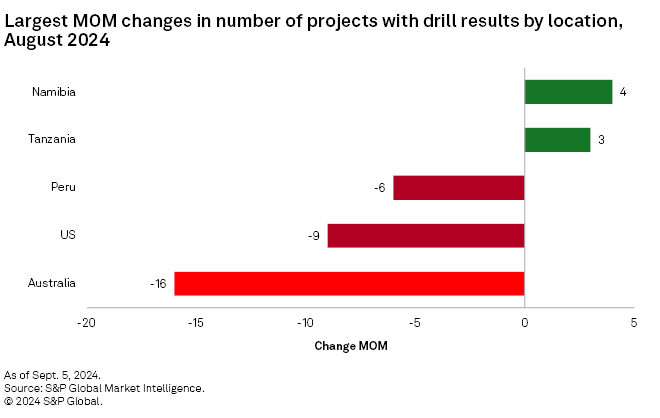

Australia, Canada and the US continued to lead in total drilled projects reported, despite recording decreases of 23% for Australia, 10% in Canada and 35% for the US. Australia and the US saw their lowest numbers year to date, while Canada recorded a five-month low. In contrast, Namibia and Tanzania in Africa posted the largest month-over-month increases; Namibia reached five and Tanzania reached three projects with reported drilling.

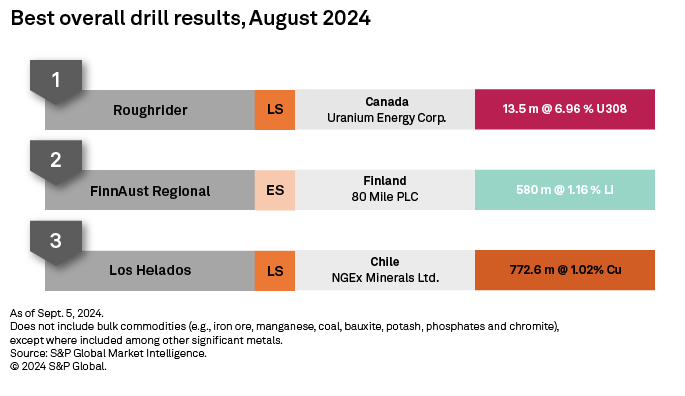

August's top result came from NYSE American-listed Uranium Energy Corp.'s Roughrider project in Saskatchewan with an intersect of 13.5 meters grading 6.96% uranium. The company completed an ambient noise tomography survey program in August and plans a three-pronged approach to advance the Roughrider project.

The second-best result came from Alternative Investment Market-listed 80 Mile PLC's FinnAust Regional project on its Hammaslahti lithium deposit in Finland. The company reported an intersect of 580 meters grading 1.160% lithium and is seeking to raise approximately £1.5 million to further explore and develop its assets in Greenland and Finland.

Toronto Stock Exchange-listed NGEx Minerals Ltd.'s advanced-stage Los Helados project of copper, gold and silver in Chile rounded out August's top three results with an intersect of 772.5 meters grading 1.02% copper, 0.64 grams of gold per metric ton and 14.2 g/t silver. The company reported 17,864 meters of drilling to date at the two projects in the Lunahuasi deposit and is set for a follow-up program consisting of step-out and infill drilling that is expected to begin early in the December quarter.

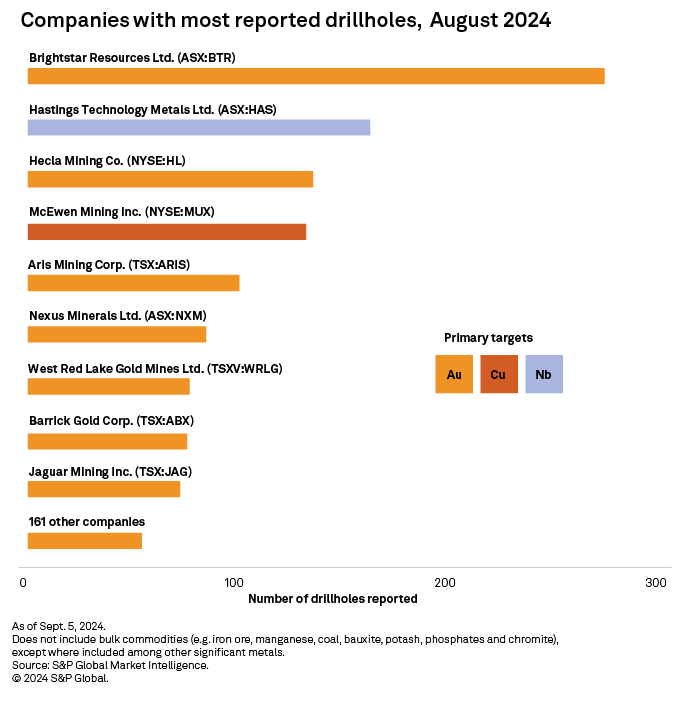

Australian Securities Exchange-listed Brightstar Resources Ltd. reported the most drillholes in August with 260 at its Montague project in Western Australia. Gateway Mining Ltd. recently sold its gold rights at Montague East to Brightstar for $14.0 million. Brightstar reported that the acquisition would consolidate highly prospective exploration ground in the Sandstone region, which will complement the company's existing production, development and exploration asset portfolio as well as its recent merger with Alto Metals Ltd.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.