Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Jan, 2023

By Sean DeCoff

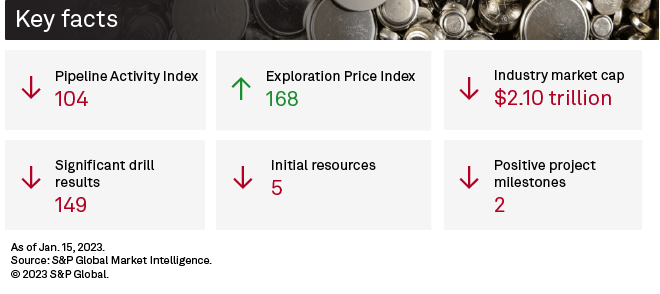

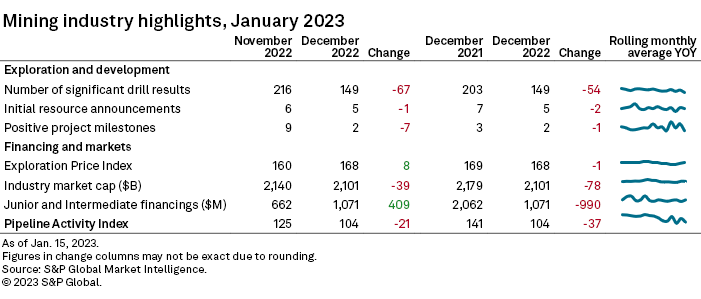

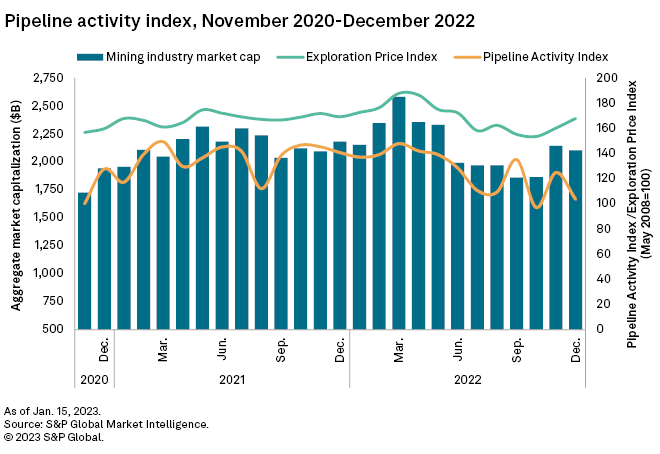

S&P Global Market Intelligence's Pipeline Activity Index, or PAI, was the second lowest for the year in December 2022, falling 17% to 104, from 125 in November 2022. The gold PAI decreased to 141 from 158, while the base/other metals PAI decreased to 74 from 94.

Four of the metrics used in our PAI — significant drill results, initial resources, positive milestones, and industry market capitalization — declined month over month; however, there were increases in junior and intermediate financings and our exploration price index.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

Detailed data on the PAI metrics is available in the accompanying Excel spreadsheet.

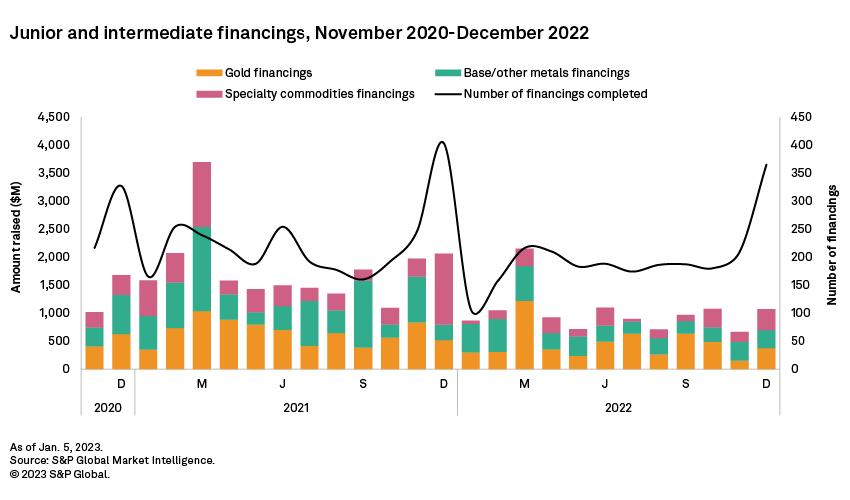

Financing rebounds to $1 billion after November 2022 low

Funds raised by junior and intermediate mining companies jumped 62% to $1.07 billion in December 2022, after registering a two-and-a-half year low in November. The December 2022 total was from 365 transactions — a 75% increase month over month and a 12-month high. Significant financings, valued at $2 million or more, increased to 90, from 58 in November 2022, and accounted for 88% of the funds raised. There was a single transaction in December 2022 valued at more than $100 million, compared with none in October and November.

Gold financings jumped 146% month over month to US$374 million, after the lowest total since February 2019 in November. The number of gold financings doubled to 223, and the number of significant financings nearly tripled to 50.

December 2022's largest gold financing, and the fourth largest overall, was a A$60 million (US$40 million) fully underwritten private placement by Australian Securities Exchange-listed Bellevue Gold Ltd. The company is constructing its namesake Bellevue in Western Australia and expects to achieve commercial production in December. The most recent estimate shows that the mine contains 3.1 million ounces of gold grading 9.9 grams per tonne.

Funds raised for the base/other metals group dipped 4% month over month to $321 million, showing increases for most commodities in the group but weighed down by cobalt. The number of transactions increased to 97 — a 28-month high — from 65 in November 2022, with significant financings increasing by three, to 29.

December 2022's largest base/other metals financing, and the fifth largest overall, was a A$55 million (US$38 million) private placement by ASX-listed Mincor Resources NL to fund underground development at its northern operations and resource definition drilling at South Kambalda in Western Australia.

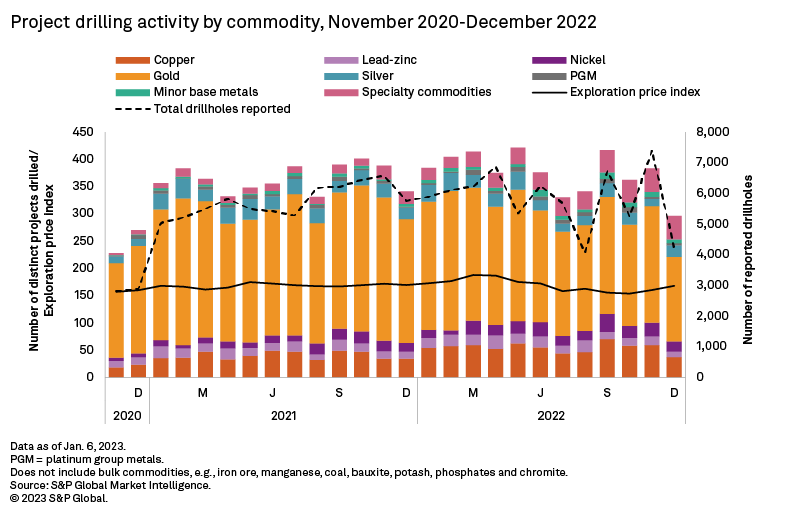

Gold projects drilling decreased 28% month over month to 155, the lowest total for the precious metal since September 2020. Other precious metals resisted the downtrend, with silver increasing 62% month over month to 21 and platinum group metals unchanged at four. Base metals projects were down 33%, mostly due to the 37% decrease in copper projects to a year low of 37. Lead-zinc projects were down 38% to 10, the fewest since August 2021; nickel projects decreased 24% to 19, and minor base metals declined 22% to seven. Specialty commodities projects remained unchanged month over month with 43 reporting drilling.

Australia had the most projects drilled for the 11th consecutive month, despite the December 2022 total of 97 projects being 16% lower than in November, pulled down by decreases in gold and copper projects, and the lowest monthly total since May 2021. Canada remained second with 78 projects, despite its total receding the most among all countries to a 16-month low as gold projects drilled in the country fell to 41, from 63 in November 2022. Total projects drilled in the U.S. decreased to 38 from 44, also mostly from a decline in gold to 20 from 31.

The top result for December 2022 came from Red 5 Ltd.'s King of the Hills/Darlot gold mine in Western Australia, with a 3-meter intersection grading 2,999 grams of gold per tonne. The result was from grade-control drilling at the St George open pit deposit completed in April 2021. As of December 2022, the company had completed a 2,050-meter extensional drilling program at the Middle Walters South deposit with further infill drilling planned.

The second-best result came from West African Resources Ltd.'s Sanbrado gold mine in Burkina Faso with a 25-meter intercept grading 90 g/t gold. The result was from resource-definition drilling at the M1 South deposit, where an updated mineral resource estimate is expected in the March 2023 quarter, after the ongoing drilling program is completed.

SSR Mining Inc. reported the most drillholes in December 2022, with 330 completed at its Seabee gold mine in Saskatchewan. In December 2022, the company reported that additional drilling and geotechnical and metallurgical analyses were planned at the project. As of December 2021, the project contained 1.5 million ounces of gold in reserves and resources.

Red 5 Ltd. was second with 274 drillholes at the King of the Hills/Darlot mine, which also had December 2022's best drill result.

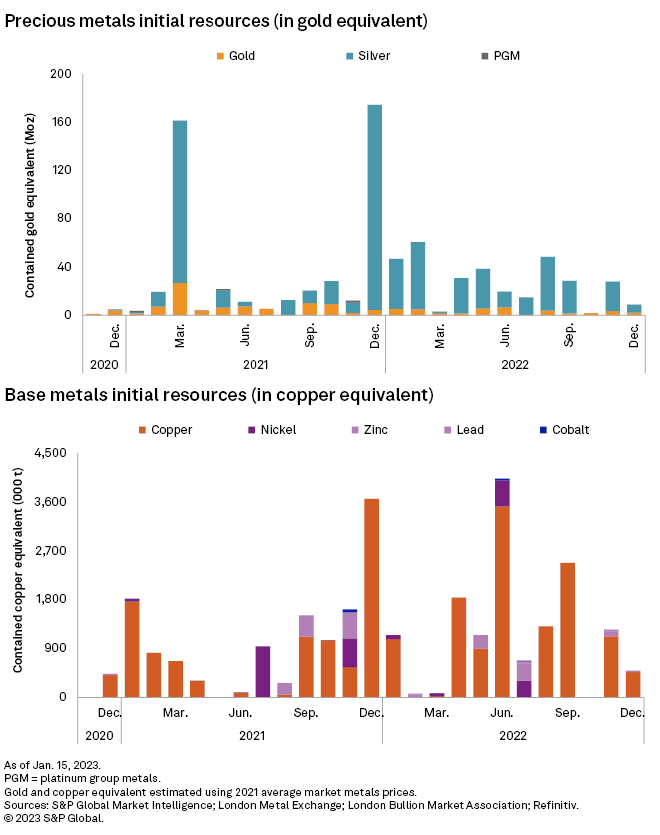

New resources slip

The number of initial resource announcements decreased in December 2022 to five, from six in November. Three announcements were for gold-focused projects, and two were for copper.

December 2022's largest new resource was announced by Sunstone Metals Ltd. for its late-stage Bramaderos gold-copper project in southern Ecuador. The indicated resource totals 156 million tonnes grading 0.53 g/t of gold equivalent, containing 2.7 Moz of gold equivalent.

The month's second-largest new resource was announced by Cazaly Resources Ltd. for its Halls Creek copper porphyry project in Western Australia. Indicated and inferred resources total 95.6 Mt grading 0.27% copper, containing 262,000 tonnes of copper.

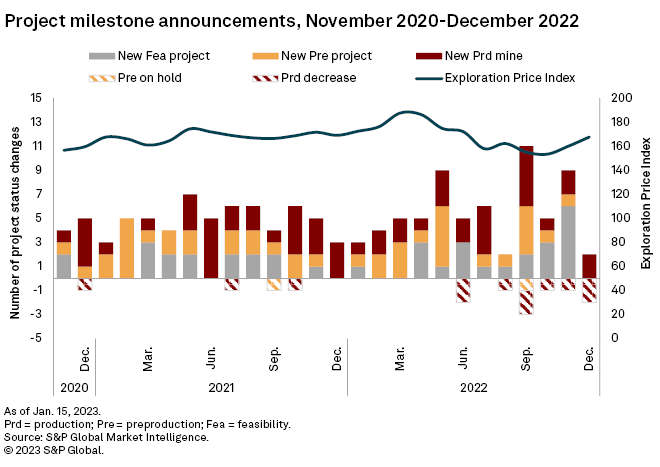

Project milestones disappoint

Positive project milestone activity in December 2022 matched the year's low in August, dropping to two announcements, from nine in November. Additionally, there were two negative milestones.

One of the positive milestones was Wesdome Gold Mines Ltd. announcing the start of commercial production at its Kiena mine in Val-d'Or, Quebec. With total reserves and resources grading 7.2 g/t Au, Kiena production is expected to average just over 80,000 ounces of gold per year over a seven-year mine life.

The second milestone was Orezone Gold Corp. declaring commercial production at Bombore, its flagship gold mine in Burkina Faso. According to the latest feasibility study, Bomboré will have a mine life of approximately 13 years, and production is expected to average 115,000-120,000 ounces per year.

In the two negative milestones, two copper mines were placed on hold: First Quantum Minerals Ltd.'s Cobre Panama and Codelco's Salvador in Chile. The situation regarding First Quantum is the most significant, given that the mine ranks as one of the world's 10 largest. Negotiations are ongoing, although Bloomberg reported Dec. 15 that the government is working with a financial adviser to identify potential new partners for Cobre.

Exploration price index rebounds

Metals prices increased slightly in December 2022, building on November's rebound. As a result, Market Intelligence's Exploration Price Index, or EPI, rose to 168 from 160. The indexed price increased month over month for seven of the eight constituents of the index — gold, copper, nickel, silver, platinum, molybdenum and zinc — and decreased for cobalt.

The EPI measures the relative change in precious and base metals prices, weighted by the percentage of overall exploration spending for each metal as a proxy of its relative importance to the industry at a given time.

Equities rise

Despite rising prices, mining equities pulled back 2% month over month in December 2022 to US$2.10 trillion. Market Intelligence's aggregate market cap of 2,456 listed mining companies was, however, still well above midyear lows.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.