Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 29 Feb, 2024

By Sean DeCoff

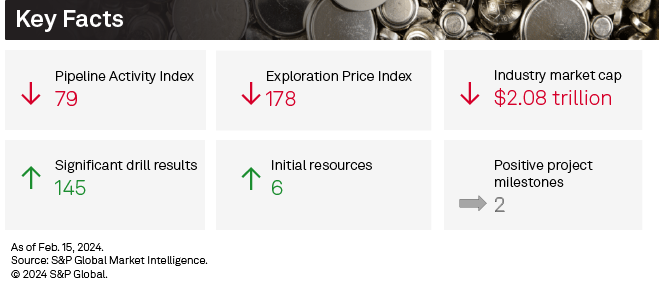

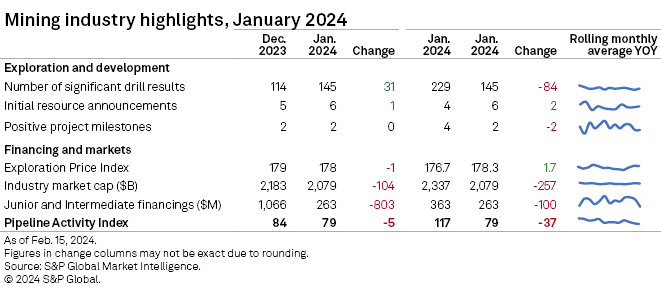

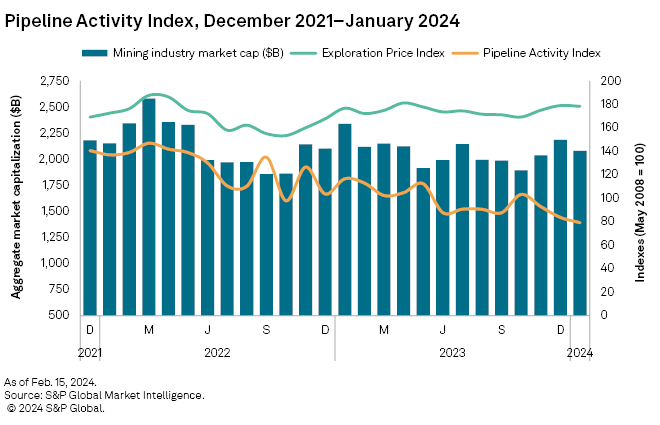

S&P Global Market Intelligence's Pipeline Activity Index (PAI) slipped in January 2024, falling 5% to 79, as it again tested the pandemic lows. The gold PAI was responsible for the overall monthly decline, dropping 19% month over month, from 117 to just 94 — the lowest since March 2020. The base/other PAI, however, posted a slight increase in the month, from 57 to 64.

Metrics used in our PAI calculation were mixed in January. There was an increase in significant drill results and initial resource announcements, while financings cratered and positive milestones stayed flat. Gold prices remained strong, which kept the Exploration Price Index (EPI) relatively strong, but a selloff in miners pressured the industry market cap.

\

\

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

Detailed data on the PAI metrics is available in the accompanying Excel spreadsheet.

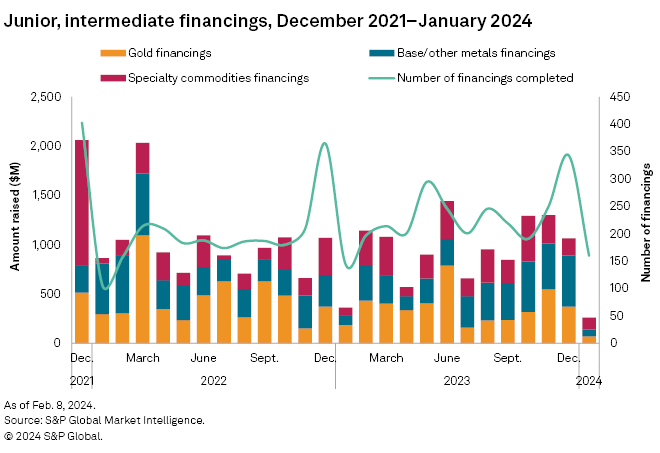

Funds raised fall by three-quarters in January

Funds raised by junior and intermediate mining companies fell during the first month of 2024, down 75% to $263 million, dragged down by steep declines across all commodity groups. The number of transactions was down by more than half to 160 — the lowest in 12 months — while that of significant financings fell to 31 from 79 in December 2023. No transaction valued at more than $30 million was recorded in January compared to seven in December.

Gold financings fell 81% to $72 million, the lowest since January 2019, while the number of gold transactions fell by nearly two-thirds to 60. The three transactions valued at more than $30 million in December 2023 fell to zero in January.

The C$22 million private placement to Toronto-based G2 Goldfields Inc. by AngloGold Ashanti PLC was the largest gold financing and the second-largest overall during the month. G2 Goldfields has earmarked the proceeds to advance exploration activities at its Aremu-Oko project in Guyana and has recently completed drilling 325 holes totaling 74,000 meters to update the project's resource estimate.

The base/other metals group fell to its lowest in January since March 2020, with lower copper, nickel, silver and cobalt financings dragging down funds raised to $69 million, or 87%. The number of transactions fell 42% to 63 after a record high of 109 reported in December 2023. There were no transactions valued at more than $30 million in January, down from three in December.

The largest base/other metals financing and the fourth-largest overall was the C$14 million follow-on private placement of Vancouver-based FPX Nickel Corp. from Japan-based Sumitomo Metal Mining Co. Ltd. From the first tranche of the transaction, Sumitomo has acquired 9.9% stake in FPX Nickel, a company that is focused on the preliminary feasibility study of its Decar nickel project in British Columbia.

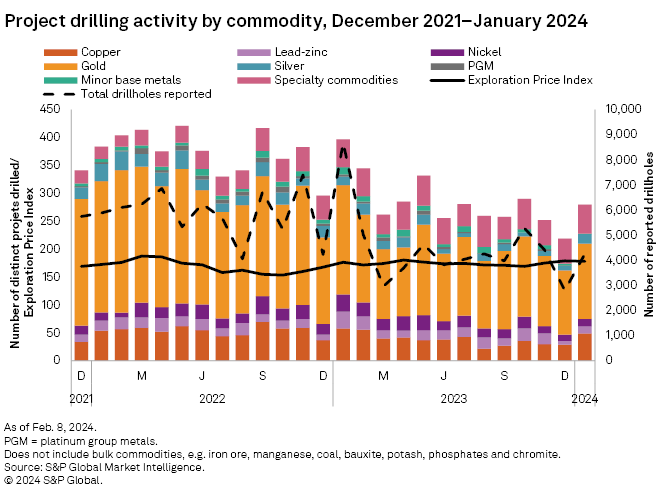

Drilling metrics rebound for a strong start to 2024

After a slow end to 2023, the new year started with a significant boost across all drilling metrics in January. Drilling increased among all project stages, with late-stage increasing 44% to 121 projects, minesite up 40% to 49 and early-stage up 10% to 110. Projects drilled and drillholes also increased month over month, but were down year over year, falling 29% and 51%, respectively, compared to January 2023.

January's top result came from Australian Securities Exchange-listed BHP Group Ltd.'s Olympic Dam copper mine in South Australia, which reported an intersect of 580 meters grading 2.22% copper. Results from recent exploration activity at the mine show that mineralization above 1% copper grade continues 2 km along strike and more than 1 km in depth. The extent of mineralization has not yet been discovered, and further drilling will be required for an updated estimate of mineral resources.

Toronto Stock Exchange-listed Aya Gold & Silver Inc. reported the most drillholes, with 156 holes between its Zgounder mine and Boumadine project, both in Morocco. Aya is based in Canada and operates solely in Morocco, where its Zgounder mine is under expansion and its Boumadine project is in the prefeasibility stage of development.

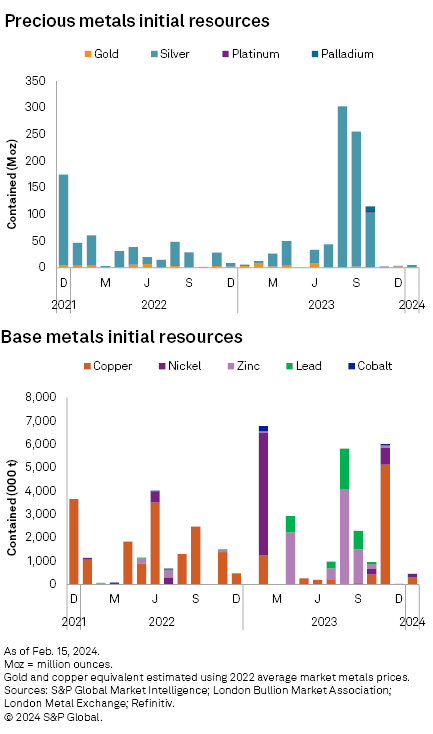

Initial resource announcements increase by one

There were six initial resource announcements in January — three each for base/other projects and gold primary projects — one more month over month. The ounces and metric tons contained in those announcements improved slightly compared to December.

The largest base metals announcement came from SPC Nickel Corp. reporting an inferred and indicated resource for its Lockerby East deposit in Ontario. The total resource came in at 22.6 million metric tons, containing 93,000 metric tons of nickel and 19,000 metric tons of copper.

The next largest announcement came from American West Metals Ltd. which announced a maiden mineral resource estimate for the Storm project in Nunavut, Canada. Total inferred and indicated resource came in at 17.5 MMt, grading 1.174% copper and 3.38 grams of silver per metric ton, equating to a contained volume of 205,000 metric tons of copper and 1.9 million ounces of silver.

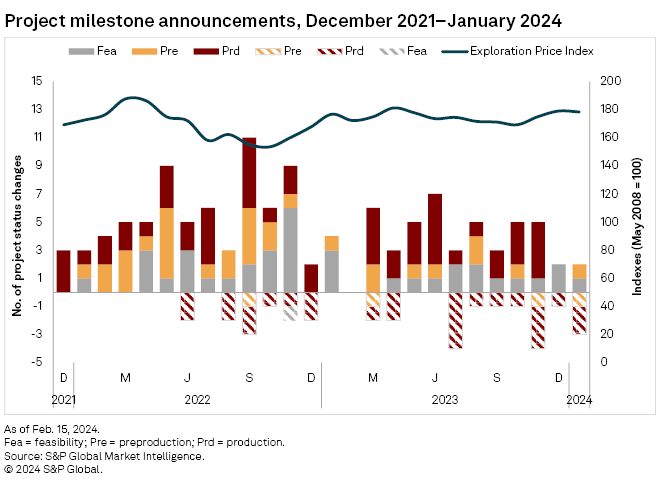

Two positive milestones, three negative

The number of positive milestones for January was the same month over month, at just two. Both were precious metals focused, one being production-related and the other feasibility-related. Most notably, however, there were three negative milestones, all production-related for nickel projects.

The first positive milestone came from Halifax, Nova Scotia-based GoGold Resources Inc., which announced an underway feasibility study at Los Ricos South, a gold-silver project in Jalisco, Mexico. The study is expected to be completed in the early second half of 2024.

Interestingly, the second positive milestone announcement also came from another Halifax-based mining company, Erdene Resource Development Corp., which announced construction beginning at its Khundii gold project in Mongolia.

January's three negative milestones were all related to Australian nickel projects in the country's western region, as the price for the base metal has come under pressure, given the ever-expanding supply outlook. The operating mines Ravensthorpe and Savannah, majority-owned by First Quantum Minerals Ltd. and Panoramic Resources Ltd. respectively, were temporarily suspended. The third negative milestone came from IGO Ltd., which reassessed the viability of the Cosmos project that was under construction and decided to place the operation into care and maintenance.

Exploration Price Index flat

While Market Intelligence's EPI registered a minor decline in January, dropping to 178, the index remained relatively strong. Holding the index up was gold — which carries the most weight in our calculation — that maintained its strong price to start the year. Molybdenum and zinc prices increased, while copper, nickel, silver, platinum and cobalt all pulled back.

EPI measures the relative change in precious and base metals prices, weighted by the overall exploration spending percentage for each metal as a proxy of its relative importance to the industry at a given time.

Equities pull back with year-start

Mining equities ran out of steam in January after strongly appreciating the month before. Market Intelligence's aggregate market cap of the 2,689 listed mining companies decreased 4.8% to $2.08 trillion, compared to $2.18 trillion in December.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.