S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Sep, 2024

By Aude Marjolin

In its monthly Gold Commodity Briefing Service report, S&P Global Commodity Insights discusses the gold market within the broader macroeconomic environment and provides rolling five-year supply and price forecasts.

Access the Gold CBS August databook.

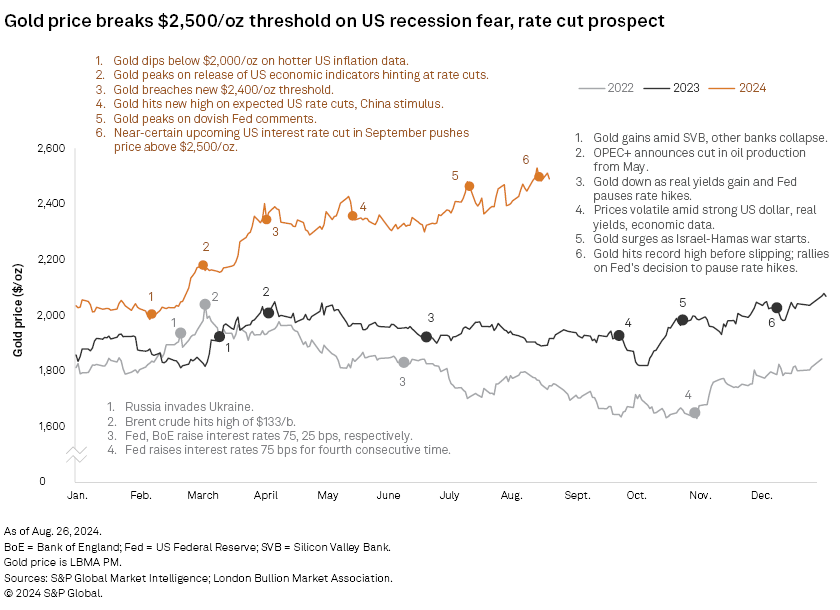

➤ The London Bullion Market Association (LBMA) gold price breached the $2,500/oz threshold in the lead-up to a speech by US Federal Reserve Chairman Jerome Powell at the Aug. 23 Jackson Hole economic symposium, where he all but confirmed the Fed would cut the benchmark interest rate in September.

➤ News of a cooling labor market that triggered fears of recession in the US, coupled with the inflation rate inching below 3.0%, cemented rate cut expectations.

➤ Geopolitics remain a safe-haven demand driver for gold, with the Israel-Hamas conflict intensifying and threatening to spill over into neighboring states.

➤ Physically backed gold exchange-traded funds (ETFs) saw inflows from all regions in July as interest rate cuts materialize in major economies. China took a step back, however, while India led in both ETF demand and central bank purchases.

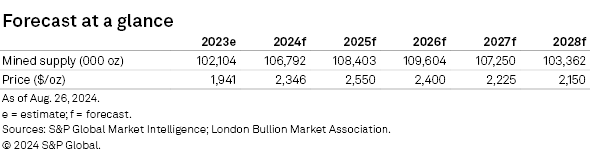

➤ Factoring in a small correction from the new price high, we estimate a September-quarter gold price average of $2,450/oz. We see the uptrend continuing in the final months of the year with the upcoming US presidential election and one-year anniversary of the Israel-Hamas war, yielding an average of $2,525/oz for the last quarter and $2,346/oz for the year.

Analyst comment

A perfect storm of supportive factors for the gold market drove the LBMA price to a new peak of $2,529.75/oz Aug. 20. The uptrend was buoyed by the growing certainty throughout August of the Fed cutting US interest rates at their next scheduled meeting in September. Further, heightening and broadening geopolitical risks and the challenging macroeconomic outlook, globally as well as locally in the US in the lead-up to the presidential election, make for uncertain times during which gold shines as a safe haven.

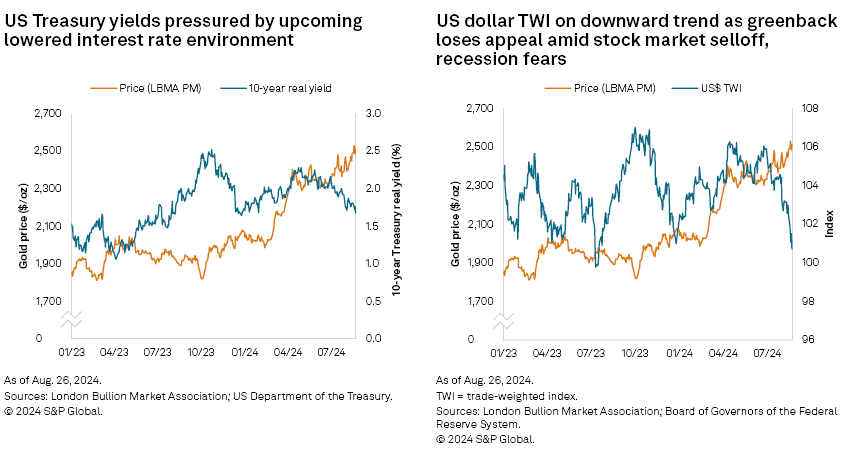

The firming interest rate cut expectations in the US resulted from economic data released Aug. 5, indicating a cooling job market and triggering fears of a recession. The 114,000 nonfarm payroll additions in July were markedly below previous monthly levels, and the unemployment rate had ticked up for a fourth consecutive month. In response, the 10-year Treasury bond yield slipped to a 12-month low of 3.78% the same day, while the US dollar continued on its downward trajectory, with the US dollar trade-weighted index hitting an eight-month low of 100.72 on Aug. 23.

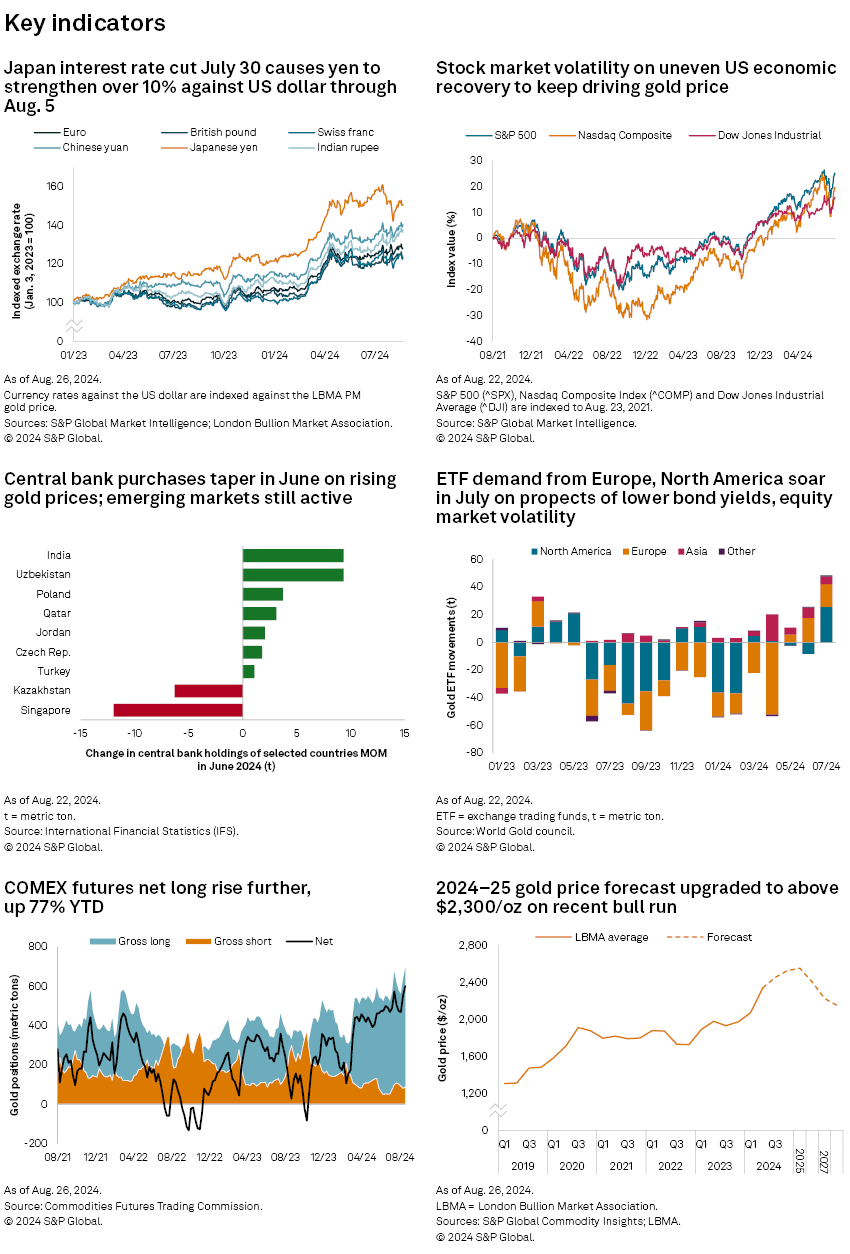

Meanwhile, the Japanese yen increased sharply by over 12% compared with the US dollar following the recent interest rate hike by the Bank of Japan, lowering the "carry trade" value of the currency. This led to a widespread and worldwide equity sell-off on Aug. 5 that caused the S&P 500, tech-heavy Nasdaq Composite and Dow Jones Industrial to plummet 3%, 3.4% and 2.6%, respectively. Gold was not spared, with the price falling 3% over the day as investors scrambled to access liquidity by selling bullion to pay off their losses in the stock market.

The recovery was swift and steep, however, with the gold price gaining 6% between Aug. 5 and its Aug. 20 peak and breaching the $2,500/oz threshold. The not-yet discounted fears of recession paired with the latest US consumer price index inching down to 2.9% made markets wary that the Fed did not act swiftly enough to avoid the threat of a hard landing for the US economy, calling for a first interest rate cut in September — two factors supporting the gold price. With rate cuts now decidedly in the cards, all but confirmed by Powell during his speech at the Jackson Hole economic symposium Aug. 23, speculation has shifted to the frequency and size of upcoming cuts. Namely, expectations of a 50-basis-point cut early in the month have been pared down to a quarter percentage point, as the US economy is still showing signs of resilience through robust consumer spending, retail sales and better-than-expected June-quarter GDP growth. Gold price remained strong, however, closing the week of Aug. 23 at $2,511.20/oz after a slight pullback.

Physically backed gold ETF flows globally were positive again in July, with all regions notably displaying inflows — a first since May 2023 — amounting to collective holdings of 3,154 metric tons. On a regional basis, North America saw the highest demand, with inflows peaking twice in July on news headlines: the attempted assassination of presidential candidate Donald Trump and incumbent President Joe Biden's withdrawal from the race. The reversal from the May and June trends stems from the declining treasury yields and increasing prospects of interest rate cuts, which have been driving the positive inflows in European countries over the past few months. These factors also supported gold futures contracts, with net long positions on the COMEX closing the week ending Aug. 23 at a high of 19.3 million ounces.

In Asia, India has been a major player in the gold market, aided by lowered taxes on capital gains and reduced export duties, which supported ETF inflows and will likely add to jewelry and bar and coin demand in the coming months. The Reserve Bank of India was also the biggest gold buyer in June, adding 9 metric tons to its reserves after moving 100 metric tons of gold from the UK to domestic vaults. China demand is slowing, with net gold imports in June down on both annual and monthly bases, 40% and 50%, respectively, while preliminary World Gold Council data indicates the People's Bank of China suspended gold purchases for a third consecutive month in July.

Outlook

All signs — lower interest rates, strong central bank and investor interest and geopolitics-honed safe-haven appetite — point to robust demand for gold in the coming months, which should support prices at their current levels. Nevertheless, in the near term we could see a short-lived retreat in the gold price, with the influence of the lowered interest rate environment already baked in current levels and any "will they, won't they" conjecture regarding the Fed's next step on rates removed from the equation. Volatility in equity markets and in ex-US economies could also temporarily focus investor attention on different asset classes, which would in turn cause gold prices to retreat slightly. With that in mind, we estimate an average of $2,450/oz for the September quarter, with the price then climbing to $2,525/oz in the December quarter as the presidential election in the US adds uncertainty to already volatile markets and sentiment.

Longer term, the likelihood increases that gold prices will be sustained at an elevated level, with no end in sight for the Russia-Ukraine war, the alarming potential for the Israel-Hamas war to extend into a wider regional conflict and economic outlooks that remain blurry for the major economies. Uncertainty around the outcome of the US election is also likely to be supportive of the gold price given the candidates' differing views on how to bring down inflation and the influence of those measures on the country's medium-term economic trajectory. We see the gold price remaining on its upward trajectory to average $2,550/oz in 2025, boosted by runs above $2,600/oz.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.