S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Mar, 2024

By Jim O'Reilly

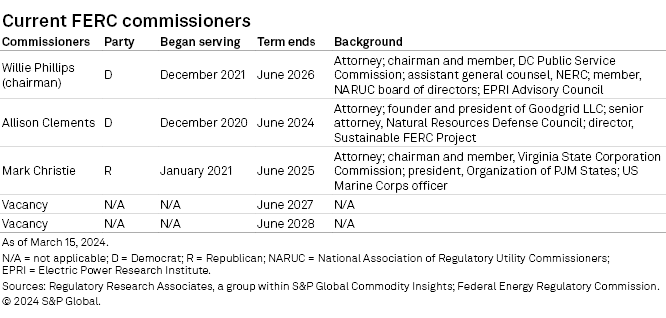

The Federal Energy Regulatory Commission is poised for a major makeover in the coming months as the term of one sitting commissioner expires and three new nominees await confirmation hearings in the US Senate.

Along with managing the membership transition, the commission is considering final action on several major policy issues, including transmission planning and cost allocation, return on equity policy for electric utilities and two draft policy statements issued in February 2022 that proposed significant changes to the commission's policies for certifying natural gas pipeline projects.

➤ A FERC rulemaking initially launched in July 2021 that would significantly modify the commission's 13-year-old policies governing transmission planning and cost allocation appears to be nearing the finish line. The proposed rules would build on the commission's landmark Order 1000 issued in 2011, which, among other things, required that regional transmission plans evaluate transmission needs driven by public policy requirements and provided that the costs of transmission projects selected to meet regional transmission needs are to be allocated "roughly commensurate" with project benefits.

➤ While the proposed rules are still awaiting final action, allocating the costs of large transmission projects in New Jersey and Colorado was featured in two recent cases at the commission. In the first case, FERC approved certain incentives for a transmission project in New Jersey that highlighted a collaborative approach between the PJM Interconnection LLC and the state of New Jersey by allocating the costs of the project solely to New Jersey customers. In the second case, a group of cities in Colorado filed a complaint against Xcel Energy Inc. subsidiary Public Service Co. of Colorado (PSCo) over the utility's plan to construct a nearly $2 billion transmission project to connect approximately 5,500 MW of new wind, solar and other resources PSCo plans to add through 2030 and allocate a portion of the project costs to the cities.

➤ Two other recent FERC proceedings focused on claims that wildfire risks, unfavorable state laws and other factors in California increase risk and warrant a higher return on equity (ROE). In the first proceeding, a request for a 12.48% ROE in a proposed transmission formula rate filed by a newly formed affiliate of Blackstone Inc. prompted protests by multiple parties in California. In the second proceeding, formal settlement discussions began among the parties in PG&E Corp. subsidiary Pacific Gas and Electric Co.'s (PG&E's) transmission formula rate case to consider PG&E's request for a 12.37% ROE while litigation continued over FERC's recent rejection of a 50-basis-point ROE adder for the utility.

A more detailed discussion of recent developments that Regulatory Research Associates is following is provided below.

The commission

The commission was reduced to three members, the minimum required for a quorum, when James Danly departed on Jan. 3, 2024. Danly's term expired on June 30, 2023, and he left the commission when the new Congressional session began. Next to depart will be Commissioner Allison Clements, whose term will expire on June 30, 2024. Clements has indicated she will not seek another term, but she may remain at the commission until the end of the current Congressional term if the US Senate does not confirm a nominee for her seat before then.

On Feb. 29, President Joe Biden nominated two Democrats and one Republican to fill the two currently vacant seats and the third vacancy that Clements' departure will create: White House nominates 3 to fill FERC seats. The US Senate committee charged with reviewing FERC nominees moved quickly on the nominations and scheduled a confirmation hearing on March 21: US Senate energy committee moves quickly to set hearing for 3 FERC nominees.

Despite the uncertainty around the upcoming changes to the commission's makeup, FERC could soon finalize the pending modifications to the commission's transmission planning and cost allocation rules: FERC nears final rule on power grid reforms as potential new makeup takes shape. The proposed rules, issued on April 21, 2022, would implement a series of reforms, including an increased role for state regulators: FERC's transmission planning, cost allocation proposal elevates state regulators.

Transmission cost allocation — New Jersey State Agreement Approach

On Feb. 15, FERC approved transmission incentives for a $200 million substation project designed to facilitate New Jersey's public policy goal of expanding the transmission system to accommodate a buildout of 7,500 MW of offshore wind generation by 2035: FERC approves 4 rate incentives for offshore wind grid connector in New Jersey.

The project was awarded to Mid-Atlantic Offshore Development LLC (MAOD) by the New Jersey Board of Public Utilities through a competitive solicitation and involves the construction of a new 230-kV substation next to an existing substation owned by FirstEnergy Corp. subsidiary Jersey Central Power & Light Co. The project also includes adjacent land required for future high voltage direct current converter stations and has an expected in-service date of Dec. 31, 2027.

Part of a larger project called the Larrabee Tri-Collector Solution, the project was awarded to MAOD in connection with New Jersey's State Agreement Approach (SAA) with PJM. According to FERC's order approving the incentives for the project, the SAA is "a supplementary transmission planning and cost allocation mechanism ... through which one or more state governmental entities authorized by their respective states, individually or jointly, may agree to be responsible for the allocation of all costs of a proposed transmission expansion or enhancement that addresses state public policy requirements identified or accepted by the state(s)."

In a concurring statement to FERC's order, Commissioner Mark Christie emphasized that "the order itself accurately notes that the project was never evaluated by PJM as a reliability or economic project that would merit inclusion in [PJM's] Regional Transmission Expansion Plan and thus would automatically trigger regional cost allocation. The commission has previously explained that if a transmission project is designated under the [SAA], all costs related to that transmission project 'shall be recovered from customers in a state(s) in the PJM region that agrees to be responsible for the projects.'"

Christie added, "New Jersey customers will appropriately pay for this project because this project is necessary to implement New Jersey's public policies. It would be unjust and unreasonable under the [Federal Power Act] — not to mention just grossly unfair — for the commission to impose regional cost allocation on consumers in Ohio, Pennsylvania, West Virginia and the other PJM states without their express agreement to bear the costs of projects such as this one."

MAOD is a 50/50 joint venture between EDF-RE Offshore Development LLC and Shell New Energies US LLC.

Transmission cost allocation — Public Service Co. of Colorado

On Feb. 15, the Municipal Energy Agency of Nebraska, the City of Aspen, Colorado, the City of Glenwood Springs, Colorado, and the Town of Center, Colorado (Colorado cities) filed a complaint against PSCo regarding the utility's proposal to build the Colorado Power Pathway (CPP), an approximately $2 billion transmission project spanning 12 counties, primarily in eastern Colorado.

The Colorado cities noted that PSCo will recover a portion of the costs of the CPP project from its wholesale transmission customers, including the Colorado cities, as part of transmission rates recovered through the utility's transmission tariff. The Colorado cities asserted that those costs would significantly impact their customer's rates. According to the Colorado cities, at the end of 2027, they "will be paying more than double (114% based upon [PSCo's] projections) for the same transmission service they have today, serving the same load they have today, using the same generation resources they have today, and using no renewable resources enabled by the [CPP project]."

The Colorado cities also argued that the CPP project is located in the eastern half of Colorado, while the Colorado cities are located in west and south Colorado, in the area of Colorado known as the Western Slope, "a significant distance from the [CPP project]." The Colorado cities asserted that they "do not anticipate having any direct connections with the [CPP project] and as they are served by lower voltage transmission facilities, are unlikely to see any benefits from the addition of the [CPP project] to the grid."

The Colorado cities note that PSCo filed an application with the Colorado Public Utilities Commission for the CPP project and the potential May Valley-Longhorn (MVL) Extension in 2021. The original project cost estimates for the two projects were $1.7 billion and $250 million, respectively. The Colorado cities stated that PSCo asserted in its application that the CPP project will provide a "backbone network transmission system" in eastern Colorado for an area that does "not currently have a backbone transmission system that can integrate new renewable energy resources needed to meet Colorado's clean energy goals."

As proposed, the CPP is a 560-mile, 345-kV double circuit network transmission system between four existing substations and three new substations, plus the MVL Extension, which will include an additional 90 miles of 345-kV line between new substations. PSCo plans to construct the project in three major phases with in-service dates between 2025 and 2027.

Transmission formula rate and ROE — Viridon California

On Feb. 26, 2024, FERC issued an order granting certain transmission incentives for Blackstone affiliate Viridon California LLC (VCA) and establishing hearing and settlement judge procedures to consider the company's proposed transmission formula rate that incorporates a base ROE of 12.48%.

VCA stated that it was formed to pursue competitive transmission development projects in the California ISO (CAISO) region and that the company's proposed formula rate filing is intended to put in place rate structures to allow VCA to participate in competitive solicitations within CAISO. VCA noted that it does not currently own any transmission assets.

VCA is one of six Blackstone affiliates that were formed to pursue new transmission projects selected through competitive solicitations conducted by regional transmission organizations and independent system operators (RTOs/ISOs) in the US.

FERC's Feb. 26 order granted VCA's request for three incentives: authorization to include in a regulatory asset account its prudently incurred pre-commercial and formation costs for later recovery; its request to use a hypothetical capital structure of 60% equity and 40% debt; and a 50-basis-point ROE adder for participation in an RTO/ISO.

In late 2023, Viridon Mid-Atlantic LLC, Viridon New York Inc., and Viridon Southwest LLC also filed proposed formula rates for FERC approval. On Feb. 22, 2024, the commission's chief law judge issued an order consolidating the proceedings for the Mid-Atlantic, New York and Southwest companies. In FERC's Feb. 26 order in the VCA proceeding, the commission also authorized the chief law judge to consider whether to consolidate the VCA proceeding with those three proceedings.

On Feb. 29, VCA opposed consolidating its proceeding with the other Viridon proceedings. VCA argued that "consolidation would create difficulties for several reasons. First, the base ROE to be reviewed in [the VCA proceeding], and the supporting testimony, are different than the base ROE and testimony to be considered and reviewed in [the other Viridon proceedings]. Second, unlike the [other Viridon proceedings] in which there were no intervenors or protests, there were five intervenors and two protests filed in [the proceeding] relating to [VCA's] formula rate." VCA concluded that "with different issues and different parties, consolidation of [VCA's proceeding] would complicate settlement discussions, rather than leading to efficiencies."

On March 1, the Transmission Agency of Northern California, the Northern California Power Agency, the California Department of Water Resources State Water Project and the Cities of Anaheim, Azusa, Banning, Colton, Pasadena, and Riverside, California (California parties) filed a joint statement also objecting to consolidating the VCA proceeding with the other Viridon proceedings.

The California parties argued the chief law judge "should consider the return on equity issue — perhaps the issue that has the highest dollar value and is the most contentious issue in any rate proceeding." The California parties noted that while Viridon's Mid-Atlantic, New York and Southwest formula rate filings each incorporate a proposed base ROE of 11.7%, VCA's proposed formula rate incorporates a base ROE of 12.48% based on VCA's claim that "VCA's location within the California region creates a unique risk profile due to increasing wildfire challenges."

Among the other California-specific factors that VCA relied upon in its ROE analysis are "the applicability or non-applicability of California state laws mitigating such [wildfire] risks, and the California-specific doctrine of inverse condemnation." The California parties argued that "settling and/or adjudicating this [ROE] issue will necessarily raise distinct issues of law and fact that are not present" in the other Viridon proceedings.

Transmission ROE — PG&E

On March 6, 2024, FERC accepted a compliance filing submitted by PG&E to remove the 50-basis-point ROE adder for continued participation in the CAISO from the company's formula transmission rate. PG&E's filing noted the impact of removing the adder results in a decrease of approximately $41.2 million in the company's annual wholesale transmission revenue requirement.

PG&E submitted the compliance filing after FERC issued an order on Dec. 29, 2023 rejecting the company's request for the adder. FERC's order also established hearing and settlement procedures to consider PG&E's proposed formula rate, annual revenue requirement and 12.37% ROE.

In rejecting PG&E's request for the adder, FERC noted that a California law enacted in 2022 requires that PG&E and certain other utilities participate in CAISO and concluded, "by virtue of the recently enacted California statute, PG&E is required to participate in CAISO and cannot unilaterally withdraw from CAISO. As such, PG&E's participation in CAISO is no longer voluntary. Thus, we find that PG&E is no longer eligible for the [50 basis point adder]."

PG&E stated in its compliance filing that it would likely seek rehearing of FERC's order rejecting the adder, and if its rehearing request is denied, the company may seek judicial review in federal court. PG&E subsequently did seek rehearing of the commission's order on Jan. 29, 2024, as did Edison International subsidiary Southern California Edison Co. and Sempra subsidiary San Diego Gas & Electric Co.

Among other things, the three utilities argued that PG&E can still voluntarily withdraw from the CAISO, subject to approval by the California Public Utilities Commission (CPUC). The three utilities argued that "there is no support in the [Federal Power Act] or commission precedent for interpreting 'voluntary participation' to exclude circumstances where a utility must first obtain regulatory approval in order to withdraw from a transmission organization."

On Feb. 29, FERC issued a notice of denial of rehearing by operation of law and provided for further consideration in the proceeding, adding that the requests for rehearing will be addressed in a future order. In the meantime, the parties in the formula transmission rate proceeding convened for the first settlement conference on March 4, with a second settlement conference scheduled for April 30.

Protests of PG&E's initial filing requesting the 12.37% base ROE were submitted by the CPUC and the same California parties that objected to consolidating the Viridon proceedings above. With respect to PG&E's ROE analysis, the CPUC argued that PG&E applied "inappropriate or rejected methodologies and the misapplication of methodologies in the calculation of an ROE that vastly overstates a reasonable estimate of PG&E's cost of equity." The CPUC added that "PG&E's expert witness alleges that PG&E is subject to extraordinary risk without consideration of the various CPUC proceedings and California statutes that have been implemented to improve PG&E's financial integrity and mitigate wildfire risk."

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.