Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Mar, 2023

By Robert Clark

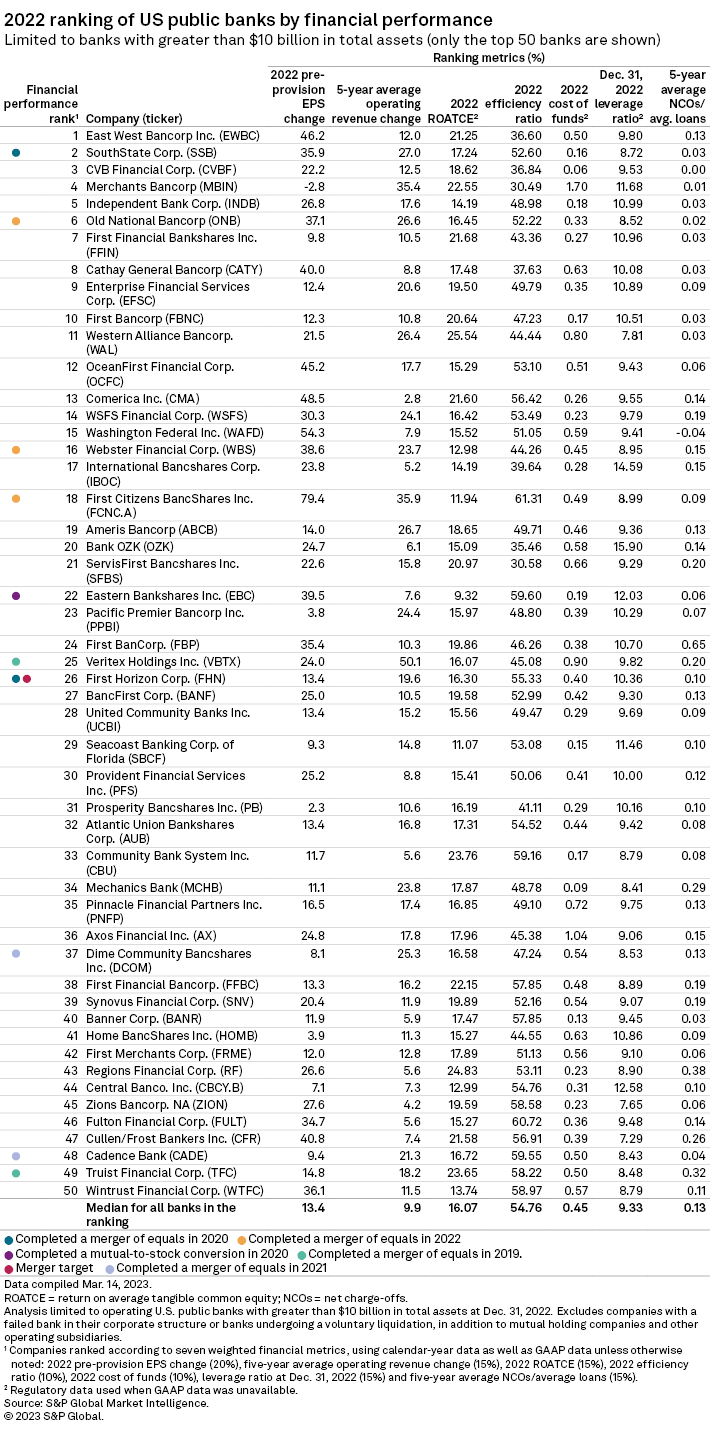

Pasadena, Calif.-based East West Bancorp Inc. earned the top ranking in a 2022 S&P Global Market Intelligence analysis of financial performance at the largest US public banks.

Winter Haven, Fla.-based SouthState Corp. placed second in the analysis, which included banks with greater than $10 billion in total assets as of the end of 2022. Ontario, Calif.-based CVB Financial Corp. placed third.

The top performers faced more of a challenge distancing themselves from their peers in the 2022 ranking, compared to the previous year. Rising interest rates lifted net interest margins for most banks in the industry, which fueled net interest income growth and in turn translated into higher earnings and revenue growth rates, as well as elevated profitability. The medians for all comparable ranking metrics improved in 2022, except for net charge-offs to average loans, which was unchanged on a rounded basis.

As a result, the financial performance scores for the top-ranked banks were significantly compressed relative to 2021. Companies in the top three for 2022 scored between 74.9 and 85.5, with limits of -200 and 200. In 2021, the scores had ranged from 105.1 to 151.4.

Top of the list

East West Bancorp rose 10 spots from the 2021 rankings to the top position in 2022. The bank was clearly superior to the industry median for five of the ranking metrics and was incrementally better for the net charge-off ratio when using exact values instead of on a rounded basis. It was just 5 basis points worse than the median for cost of funds.

East West Bancorp's net interest margin soared to 3.45% from 2.72% a year earlier. The bank excelled in efficiency ratio and pre-provision EPS change, in large part because of that margin expansion. Its efficiency ratio of 36.60% ranked fourth-best of the 103 banks in the analysis, while its earnings growth of 46.2% was seventh-best.

East West Bancorp focuses on Asian American communities across the US, with the majority of its deposits in the Los Angeles-Long Beach-Anaheim, Calif., metropolitan statistical area. Another top performer in the space is Los Angeles-based Cathay General Bancorp, ranked eighth.

The second-ranked bank, SouthState, was formed via a merger of equals between South State Corp. and CenterState Bank Corp. that was completed in June 2020. The combined company completed the acquisition of Atlanta-based Atlantic Capital Bancshares Inc. in March 2022. SouthState operates a branch network across six Southeastern states, with more than one-third of its deposits in Florida.

SouthState enjoyed substantial margin expansion in 2022, albeit not at the magnitude of East West Bancorp. The company scored better than the industry median for all metrics except its 8.72% leverage ratio. Its greatest strengths were operating revenue growth and cost of funds, which were fourth-best and sixth-best, respectively, in the analysis.

CVB Financial, which ranked third, was the only bank in the analysis to score better than the industry median for all seven metrics. CVB Financial particularly stood out for its funding base. Its cost of funds was best in class at a mere 0.06% in 2022. About 64% of the bank's deposit base was non-interest-bearing at the end of 2022. It is also concentrated on the asset side of the balance sheet, including about 13% in the office sector. More than two-thirds of its loan portfolio is in commercial real estate, excluding multifamily.

CVB Financial operates 64 branches in California, half of them in the Los Angeles-Long Beach-Anaheim, Calif., metropolitan statistical area. It expanded its presence outside of southern California with the acquisition of Visalia, Calif.-based Suncrest Bank in January 2022.

S&P Global Market Intelligence ranked the 2022 financial performance of operating US public banks, as of March 14, with total assets exceeding $10 billion as of Dec. 31, 2022. Companies with a failed bank in their corporate structure or banks undergoing a voluntary liquidation, in addition to mutual holding companies and other operating subsidiaries, were excluded. Industries were classified according to the Global Industry Classification Standard of S&P Global Market Intelligence.

Companies were ranked based on three major categories, using calendar-year data as well as GAAP data unless otherwise noted: growth, weighted at 35%; profitability, weighted at 35%; and safety and soundness, weighted at 30%.

The two growth metrics were 2022 pre-provision EPS change (20%) and five-year average operating revenue change (15%).

The three profitability metrics were 2022 return on average tangible common equity (ROATCE) (15%), 2022 efficiency ratio (10%) and 2022 cost of funds (10%). For ROATCE and cost of funds, GAAP data was used when available; otherwise, regulatory data was used.

The two safety and soundness metrics were leverage ratio at Dec. 31, 2022, (15%) and five-year average net charge-offs-to-average loans (15%). For leverage ratio, GAAP data was used when available; otherwise, regulatory data was used.

S&P Global Market Intelligence measured each company's standard deviation from the mean value for the seven financial metrics. Ceilings and floors were implemented for those standard deviations so that significant outliers would not skew the analysis. The capped standard deviations then were weighted according to the above percentages and aggregated to determine a relative performance score on a scale from -200 to 200.

Beyond the top 3

Carmel, Ind.-based Merchants Bancorp, which had been the No. 1 bank for 2021, fell back three spots in 2022 because of a high-cost funding base and gain on sale of loan revenue tumbling 42.3%. Its cost of funds, a new ranking metric using regulatory data, spiked to 1.70%, worse than all other banks in the analysis.

Higher funding costs also affected other profitability metrics besides the growth metrics, as Merchants Bancorp received less of a net interest income bump from margin expansion compared to East West Bancorp and SouthState. Still, Merchants Bancorp claimed the top efficiency ratio in the analysis at 30.49% and the fifth-best return on average tangible common equity.

The Big Four US banks brought up the rear of the list. Citigroup Inc. ranked last at No. 103 and was the lone bank to score worse than the industry median for each metric. JPMorgan Chase & Co., No. 101, bested the industry median just for ROATCE. Both Bank of America Corp., No. 99, and Wells Fargo & Co., No. 95, topped the industry median only for earnings growth.

West Reading, Pa.-based Customers Bancorp Inc. experienced the most dramatic slide in the rankings, falling to No. 94 from No. 3 in 2021. It was one of just nine banks in the analysis to record a lower net interest margin in 2022, and its margin compression of 51 basis points was the most severe in the group.

At the other end of the spectrum, Dallas-based Comerica Inc. had the biggest ranking rise, climbing 70 slots to No. 13. The bank's asset sensitivity worked in its favor with margin expansion of 92 basis points, second-best in the analysis.

Of the 10 new entrants to the 2022 analysis, the top financial performers were No. 25 Dallas-based Veritex Holdings Inc., which completed a merger of equals in January 2019; No. 27 Oklahoma City-based BancFirst Corp., which completed a small deal in Texas in February 2022; and No. 29 Stuart, Fla.-based Seacoast Banking Corp. of Florida, which completed four deals in 2022.

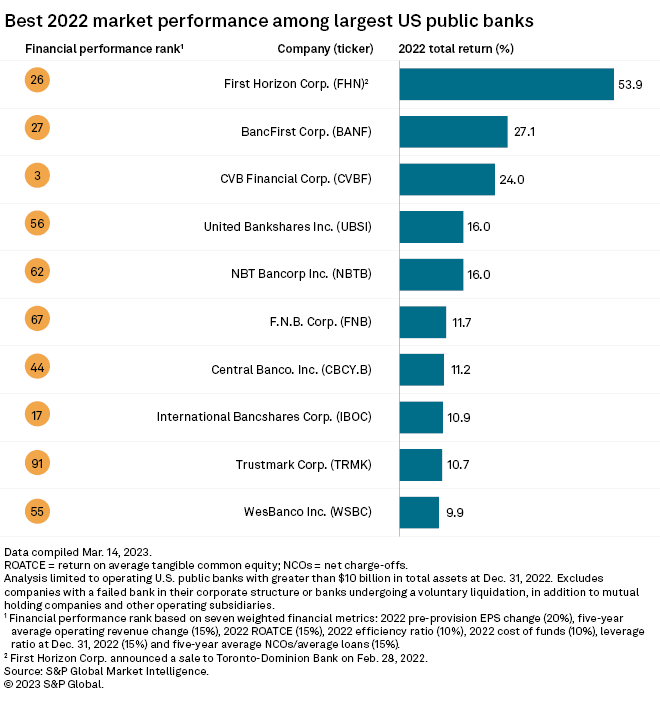

Market performance

Generally, there was a weak inverse relationship between financial performance and market performance in 2022, with a correlation coefficient of negative 0.23. Two of the top four financial performers ended the year with a lower total return than the industry median of negative 5.6%: negative 14.4% for East West Bancorp and negative 22.1% for Merchants Bancorp. On the other hand, several of the top market performers, such as Charleston, W.Va.-based United Bankshares Inc. and Norwich, N.Y.-based NBT Bancorp Inc., finished in the bottom half for financial performance.

Memphis, Tenn.-based First Horizon Corp., which was No. 26 in the financial performance ranking, was the top market performer in the analysis, with a total return of 53.9%. It announced a sale to Toronto-Dominion Bank in February 2022. The closing date for the deal is uncertain as the banks wait for regulatory approval.

Methodology changes

There were a few methodology changes for the 2022 analysis. Cost of funds was added as a seventh financial metric and was weighted at 10%. As a result, the weights for return on average tangible common equity and efficiency ratio were reduced by 5 percentage points each. Additionally, the operating revenue growth metric was calculated differently. The average of the last five years was used instead of the lower value between the most recent year and the median of the last five years.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.