Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 May, 2016 | 09:30

Highlights

U.S. real estate ETFs gathered $510.4 million in net inflows in April and saw an average 8.54performance gain year-to-date.

U.S. real estate ETFs gathered $510.4 million in net inflows in April and saw an average 8.54% performance gain year-to-date.

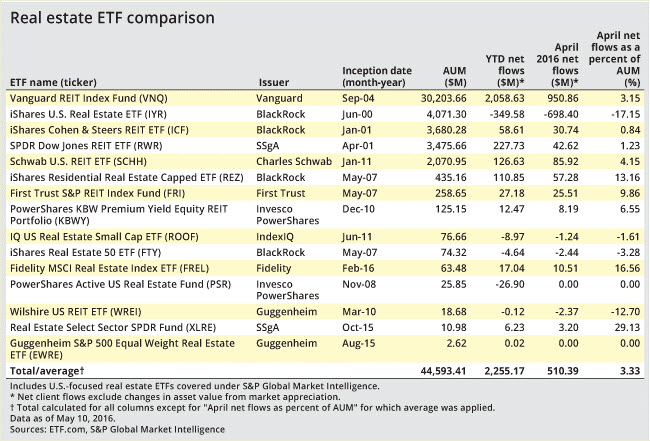

Investors pushed nearly $2.26 billion of fresh money into U.S. real estate exchanged traded funds in the first four months of 2016, making it the fourth-most popular U.S. investment category according to ETF.com data.

While real estate is soon to receive its own GICS classification, demand for the income-oriented subsector was much stronger than many established sectors. For example, clients pulled $3.17 billion and $2.92 billion out of U.S. health care and financials ETFs, respectively, year-to-date through April.

In April alone, U.S. real estate ETFs gathered $510.4 million in net inflows.

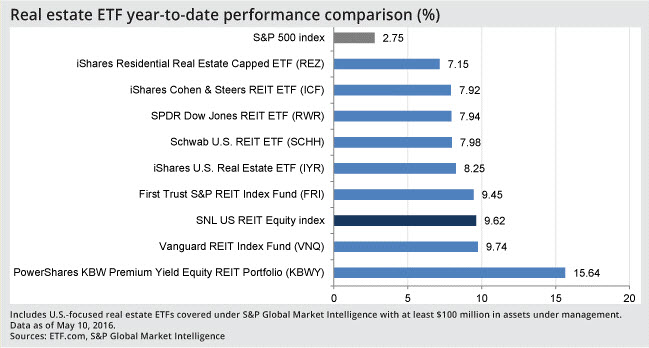

Demand for REITs stems beyond ETFs, which are a basket of securities that can be traded easily and with typically a modest expense ratio. Year-to-date through May 10, the SNL U.S. Equity REIT index rose 9.62%, far exceeding the 2.75% gain for the S&P 500 index.

Ken Leon, S&P Global Market Intelligence REIT equity analyst, said strong cash flows capable of supporting above-average dividend yields add to the appeal of REIT investments. Indeed, in the first four months of 2016, 57 U.S. real estate companies raised their dividends.

U.S. equity products returned to favor in April, collectively, as diversified U.S. large-cap ETFs gathered $3.33 billion of inflows during April.

Vanguard REIT Index Fund (VNQ), the largest real estate focused ETF, gathered $950.9 million in new money in April. With around $2.06 billion net inflow in the first four months, the asset base for the product passively managed by Vanguard Group Inc. swelled to $30.20 billion.

With the addition of $85.9 million, Schwab U.S. REIT ETF (SCHH), which has $2.07 billion in assets, gathered the second-most assets in April among U.S. real estate ETFs. The asset base of SCHH, which is offered by Charles Schwab Corp. rose by 4.2% during the month, excluding performance results.#caption

Among the 10 largest U.S. real estate ETFs, iShares Residential Real Estate Capped ETF (REZ) had the largest April increase in its asset base, 13.2%, driven by $57.3 million of net inflows.

In contrast, the more diversified and larger iShares U.S. Real Estate ETF (IYR) had net withdrawals of $698.4 million in April, shrinking its asset base by 17.2%. According to S&P Global Market Intelligence, investors could have rotated to lower-cost diversified alternatives; IYR's 0.43% expense ratio is higher than SCHH and VNQ, which have 0.07% and 0.12% expense ratios, respectively.

However, IYR's 8.25% gain year-to-date through May 10 was stronger than SCHH's 7.98%, suggesting that investors were not chasing just the top gainers.

Indeed, PowerShares KBW Premium Yield Equity ETF (KBWY) was the strongest-performing U.S. REIT ETF, among the products with more than $100 million in assets. The ETF offered by Invesco PowerShares Capital Management LLC climbed 15.64% year-to-date, but pulled in just $12.5 million in assets. KBWY tracks an index that consists of small- and mid-cap REITs and is weighted based on the constituents' dividend yield. The ETF's recent top-10 holdings included Government Properties Income Trust and WP Glimcher Inc., which had dividend yields of 8.6% and 9%, respectively, as of May 10.