Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 27 Sep, 2022

Introduction

Consumers generally consider debit a trustworthy payment method and often default to it during economic uncertainty or when credit is costly. Debit offers consumers several advantages over credit: lower or no fees for debit card use, faster settlement, the additional security feature of a PIN for card-present transactions and no interest charges. Some consumers see debit as a way to prevent overspending and better manage their finances. However, debit cards typically lack the caliber of rewards that credit cards can offer and are subject to overdraft fees, which some banks are beginning to remove or cap.

Debit use has generally been trending upward, but this year, we saw it significantly outpace credit cards as consumers' most preferred payment card. While various factors drive debit preference, younger consumers are using debit more than in the past, with security/privacy as major factors influencing card choice. Financial institutions looking to capitalize on this opportunity should focus their efforts on younger consumers and double down on security/privacy protections. Incorporating flexible installment options with debit cards may help further cement debit preference among younger consumers as they grow older and continue to see installments as a viable alternative to credit.

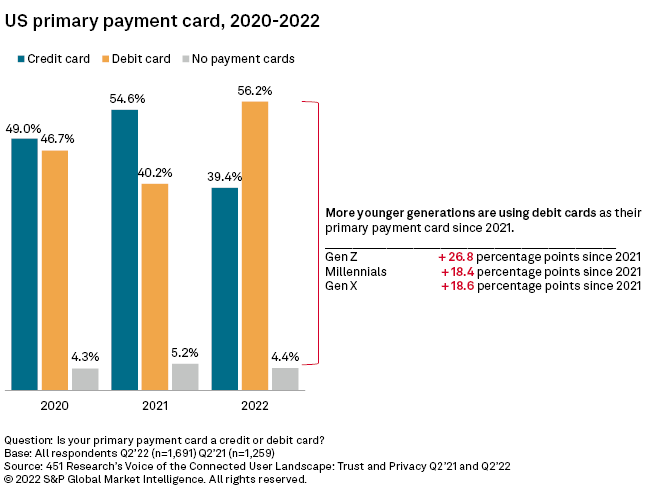

While debit use has been trending upward over the years, we saw it surpass credit as consumers' most preferred payment card this year. In fact, it was nearly a direct flip from last year: 56.2% of consumers preferred debit as their primary payment card (39.5% preferred credit) according to our Voice of the Connected User Landscape second-quarter 2022 survey.

Last year, 40.2% of consumers preferred debit as their primary payment card (54.6% preferred credit), according to our Voice of the Connected User Landscape second-quarter 2021 survey. In this report, we will highlight key drivers behind the increase in debit preference and what this could mean for merchants and financial institutions.

COVID-19 and the shift from in-store to online shopping

Although increased debit use was already underway, the pandemic prompted consumers to cut back on restricted experiences such as travel and dining and focus their expenses on everyday necessities, where debit has traditionally been strongest.

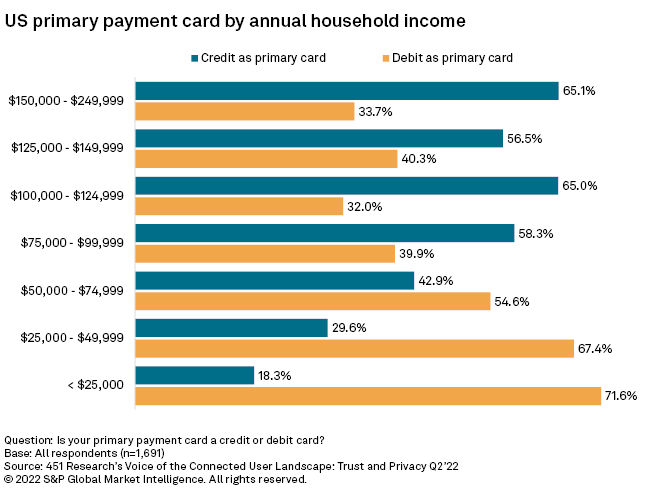

As that nondiscretionary spending moved online (e.g., online grocery delivery) due to lockdowns, we think more consumers began reaching for debit over credit cards in other e-commerce categories and likely stored their debit cards as default payment options in various digital wallets. We've found that lower-income households use debit more than higher-income households. This suggests debit may be used more for necessities, while credit may be used more for discretionary spending (see Figure 1).

Cash displacement and stimulus payments distributed through prepaid debit cards also helped fuel debit usage. We expected consumers to have a much higher preference for credit when travel resumed and stores reopened. However, we've found that consumers prefer debit more today than they did at the height of the pandemic.

Gen Zers, millennials use debit more

We observed a large jump in the percentages of Gen Zers, millennials and Gen Xers using debit cards as their primary payment card from the previous year. Gen Zers had a 26.8 percentage point increase in debit usage since 2021, and millennials and Gen Xers had 18.4 and 18.6 percentage point increases, respectively. Younger generations may favor debit over credit for several reasons.

First, they may lack the credit history to make them eligible for a credit card. Second, historically, they've been warier of taking on debt associated with credit than their older counterparts. Third, they tend to be the strongest buy-now, pay-later, or BNPL, users, which typically is positioned as a credit card replacement and relies heavily on debit for repayments.

Consider that over a quarter of consumers (26%) have used BNPL to make a purchase in the past six months, rising to 51% of Gen Zers and 42% of millennials, according to our Voice of the Connected User Landscape third-quarter 2021 survey. Older generations continue to prefer credit cards as their primary card, as they have in past surveys.

We also found that more millennials have cards (debit or credit) than in the past, with the percentage of Gen Zers without a payment card (debit or credit) decreasing 10.7 percentage points since 2021. This could be due to neobanks targeting a younger demographic and lowering or removing account fees, a trend we have seen with neobanks such as Chime Financial Inc. and Varo Money Inc.

Gen Zers and millennials are using neobanks much more than their older counterparts. Twenty-three percent of Gen Zers and 28% of millennials use an online bank as their primary financial institution compared with the 17% average among all respondents, according to our Voice of the Connected User Landscape second-quarter 2022 survey.

An additional explanation for the large shift in preference between 2021 and 2022 may be the differences in consumer mentality between the time periods. As consumers came out of lockdown going into 2021, they had pent-up demand and spent in categories where credit often performs better like travel and entertainment, while in 2022, consumers are facing increased macroeconomic pressures, which often lead to greater debit usage.

Contactless card issuance is increasing

According to our Connected Customer, Disruptive Technologies 2022 survey, nearly three in five (59%) U.S. consumers have a contactless card. Moreover, over a third of consumers (34%) that use their contactless card say they are using it more often due to its tap-to-pay functionality. As we have seen in markets like Australia and the U.K., contactless debit cards tend to displace cash for smaller ticket purchases, leading to an increase in card utilization.

Debit may be seen as more secure

In the past 12 months, nearly one-third (32%) of consumers have experienced fraud with their credit or debit cards, and over three in four (76%) consumers are concerned or very concerned about becoming a victim of fraud when shopping online, according to our Trust and Privacy second-quarter 2022 survey. It is no surprise that 71% of payment card users indicated that privacy and security are major factors influencing their payment card choice. While debit and credit are both subject to security/fraud protections, consumers might view debit as a more secure payment method since it offers an additional layer of authentication via a PIN.

Considerations

With elevated debit spending, merchants could benefit from lower interchange fees, provided they are not on a blended rate pricing plan (e.g., a flat rate for all card types). However, cost can vary by debit authorization factor. Debit cards with a PIN will typically have a lower interchange rate than PIN-less cards or cards requiring a signature for authorization since the payment is processed through a PIN debit network as opposed to a card network (e.g., Visa or Mastercard). While PIN cards have lower percentage fees, they can have higher fixed fees than signature cards. Merchants should work with their payment processors on PIN debit routing options and PIN prompting to realize bottom-line improvements.

Financial institutions benefit from increased debit volume in the form of debit interchange revenue, customer engagement and cross-sell opportunities. Banks looking to drive debit use will want to focus on privacy/security features and messaging.

When we asked consumers what privacy/security features influenced their decision to use their primary card, SMS/email alerts for suspicious activity (53%), the ability to visit a branch (46%) and push notifications for every transaction (33%) were privacy/security features that were significantly more influential for those that preferred debit cards, according to our Voice of the Connected User Landscape, second-quarter 2022 survey.

Additionally, banks may want to consider incorporating flexible installment options with debit cards, which could help further cement debit preference among younger consumers as they grow older and continue to view installments as a viable alternative to credit.

Credit issuers may want to consider doubling down on security/fraud prevention and educating consumers on how they are protecting their data. Access to 24/7 fraud support in desired channels (55%) and robust fraud protection (48%) were the leading privacy/security features that influenced consumers to prefer credit cards as their primary card, according to our Voice of the Connected User Landscape, second-quarter 2022 survey. Credit issuers may also want to consider driving more spending through customized rewards programs such as tailored rewards categories and the ability to pay with points at checkout.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.