Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Sep, 2022

Highlights

A Scoring Model Specializing in the Analysis of China LRGs - Tailored for the China Domestic Market

Disclaimers

S&P Global (China) Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global (China) Ratings.

Overview

Local & regional governments (LRGs) play a critical role in provision of public services and development of regional economy. They are often the only or dominant shareholders of many state-owned enterprises (SOE), including local government financing vehicles (LGFV), one of the major debt issuers in the China domestic market.[1] Assessment of an LRG’s credit quality is not only important for market participants to understand related local government bond market, but also a key component to gauge the credit risk of entities in the China SOE sector.

CreditModelTM China Local & Regional Governments, developed by S&P Global Market Intelligence, is a statistical model that offers an automated and scalable solution to assess the credit quality of LRGs in China. It aims to generate credit scores that are largely aligned with S&P Global (China) Ratings’ rating criteria and to provide credit risk assessments on a scale that is tailored to the China domestic market.

Model Features

Entity Coverage

The model covers the majority of LRGs in China, including provincial governments, autonomous region governments, municipal governments, cities under state planning, prefecture level city, districts, counties, etc.[2]

Model Outputs

The model’s primary output is a lower-case credit score. The score excludes any extraordinary support consideration from upper-level governments, and is reported on a standalone basis.

Financial and Systematic Credit Factors

The model utilizes both fiscal data of LRGs and the most relevant systematic credit risk factors to generate a quantitative credit score that aims to statistically match S&P Global (China) Ratings’ ratings.

LRG Support Overlay

S&P Global Market Intelligence has developed statistical overlay frameworks that use quantifiable inputs to assess the impact of government support or burden. The model score from CM China LRG is used as one of the critical inputs in these overlay frameworks. Two separate white papers describe the underlying methodology in more detail.[3]

Sensitivity Analysis

For each input, the model reports a sensitivity measure that indicates the change of the model output (i.e., its sensitivity) when an input is perturbed by a small amount (typically 10% of the initial value for financial ratios and one notch for non-financials).

Contribution Analysis

In addition to the sensitivity measures, clients can assess the “weight” or importance of the contribution of a risk factor to the current credit score, through the Absolute Contribution.

The Absolute Contribution is obtained by first calculating the “Marginal Contribution”, i.e., the percentage change of the (numerical unrounded) credit score when, among the actual inputs, one variable at a time is set to its best possible value, thus effectively removing or switching off the effect due to that variable. Next, the Absolute Contribution of a variable can be simply expressed as marginal contribution of the variable divided by the summation of all marginal contributions of all variables. Thus, Absolute Contributions of all input factors add to 100% and provide a straightforward means to identify the main input(s) that drives a model output away from the best score (usually ‘aaa’). The higher the contribution value, the more the input contributes to the model output.

Imputation

The model can still generate the outputs when only partial information for a company is available by utilizing a sophisticated imputation methodology to estimate missing inputs.

A Tailored Framework for China LRGs

CM China LRG is trained on the S&P Global (China) Ratings data that are customized for the China domestic credit market. The model produces a widely dispersed credit score distribution with granularity and offers a differentiated credit risk assessment for China LRGs. The score grades are based on the China local scale that is in line with the underlying ratings data. The model incorporates unique local market features, e.g., adjusted total debt that considers both direct debt and adjusted indirect debt.

Vigorous Variable Selection Process

To select the final set of inputs and variables, we used both statistical analysis and business judgment and weighed the following considerations.

Availability of Factors – All factors included in the model must be widely available on a consistent basis over time for LRGs. Some factors have a high predictive power, but are seldom reported by LRGs; while these factors may help boost a model’s performance, such a model would be irrelevant for LRGs that do not report similar information.

Correlation – Highly correlated factors do not provide additional insights and could distort model performance. We use correlation analysis to identify and remove correlated variables.

Representation of All Relevant Risk Dimensions – In order to capture the variety of factors that influence the creditworthiness of LRGs, we referred to the list of risk dimensions that S&P Global (China) Ratings uses for the analysis of LRGs and classified each candidate variable into its corresponding risk dimension. Then, we selected the variables that would comprise these risk dimensions from a range of categories, similar to how S&P Global (China) Ratings would analyze an LRG.

Sophisticated Methodology

The underlying modeling framework belongs to the family of exponential density models. It uses the prior distribution of all S&P Global (China) Ratings’ ratings data in the training dataset as an “anchor distribution” and modifies it in proportion to how much the financials of a specific entity deviate from those of entities used in the anchor distribution. The statistical analysis of variable selection is based on the k-fold Greedy Forward Approach, a widely used statistical method that ensures a good fit out-of-sample.

The model maximizes the maximum likelihood function within a Maximum Expected Utility, adapted to a multi-state case, and uses the Akaike Information Criterion (AIC) to limit the maximum number of variables that are included (model parsimony). This optimization process ensures the model exhibits greater stability and out-of-time performance. Moreover, monotonicity constraints are applied to ensure that the model produces outputs that follow economic intuition.

Model Performance

CM China LRG was trained on S&P Global (China) Ratings’ SACP data, aiming to generate a credit score that statistically matches the SACP. Thus, the model’s performance can be best measured by looking at the agreement of model scores with S&P Global (China) Ratings’ SACPs, as shown in Table 1. The overall model performance is good, as suggested by the high matching ratios.

Table 1. Model Performance

|

|

Exact Match |

+-1 Notch |

+-2 Notches |

+-3 Notches |

Observations |

|

In sample |

47.6% |

87.7% |

96.5% |

100% |

227 |

|

Out of sample |

43.4% |

86.2% |

95.1% |

99.1% |

45 |

Source: S&P GlobaI Market Intelligence (As of June 2022). For illustrative purposes.

Case Study

Located in southeast of China, Fujian has 4.1 million permanent population, and its GDP reaches 4.3 trillion at the end of 2020. The table below shows the rating agreement of 9 prefecture-level cities in the province.

Table 2. Case Study Performance

|

CM China LRG vs. S&P Global (China) Ratings |

Exact Match |

+-1 Notch |

+-2 Notches |

+-3 Notches |

|

Prefecture-level Cities in Fujian |

33.4% |

100% |

100% |

100% |

Source: S&P GlobaI Market Intelligence (As of June 2022). For illustrative purposes.

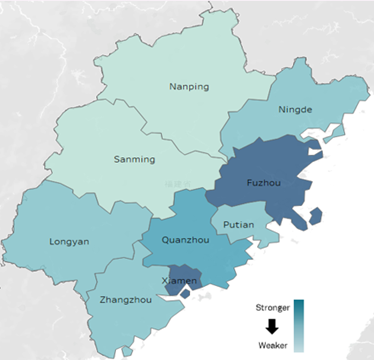

The figure below shows the ranking order of credit qualities of these cities based on model outputs. The relative order is well aligned with S&P Global (China) Ratings’ SACP data

Figure 1. Case Study Performance

Source: S&P GlobaI Market Intelligence (As of June 2022). For illustrative purposes.

Conclusion

Credit risk assessments of LRGs in China are particularly challenging due to the uniqueness of the fiscal system and the limited availability of granular LRG data. Risk managers have few alternatives other than using scorecard approaches that can be time-consuming and unscalable. CM China LRG, trained on S&P Global (China) Ratings data, offers an automated and scalable solution for gauging the credit risk of LRGs in China. The model is specifically tailored to the China domestic market and calibrated to produce differentiated credit scores that are statistically aligned with S&P Global (China) Ratings’ rating criteria and scale. It can be applied to assess the credit risk of rated and unrated LRGs in China, providing a quantified measure of an LRG’s ability to extend extraordinary government support to related LGFV and non-LGFV SOE entities.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. Accurate, deep, and insightful. We integrate financial and industry data, research, and news into tools that help track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations, and assess credit risk. Investment professionals, government agencies, corporations, and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit www.spglobal.com/marketintelligence.

[1] LGFVs account for about 50% of the corporate credit market by issuer number. See “Charting China’s LGFVs”, S&P Global (China) Ratings, December 9, 2020 for more details.

[2] This does not include the central government and village/town governments that are not under municipal governments or state planning cities.

[3] See S&P Global Market Intelligence’s “Quantitative Government Support Overlay China Corporate” (2021) and “Quantitative Government Support Overlay for China LGFV” (2022) for more details.

Theme