Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Jun, 2022

By Sean DeCoff

Introduction

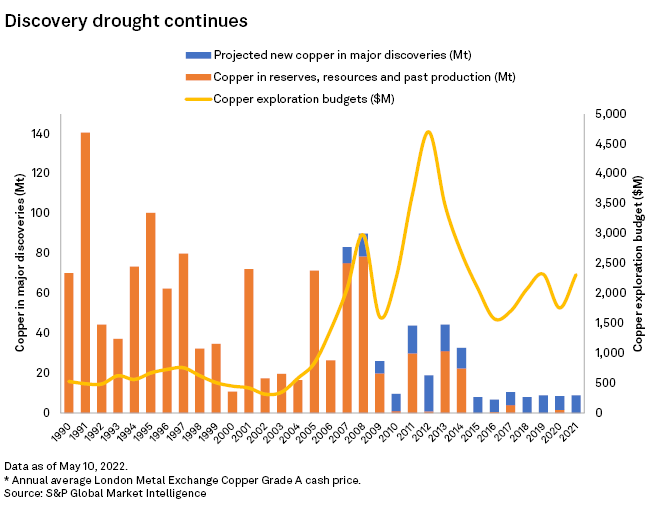

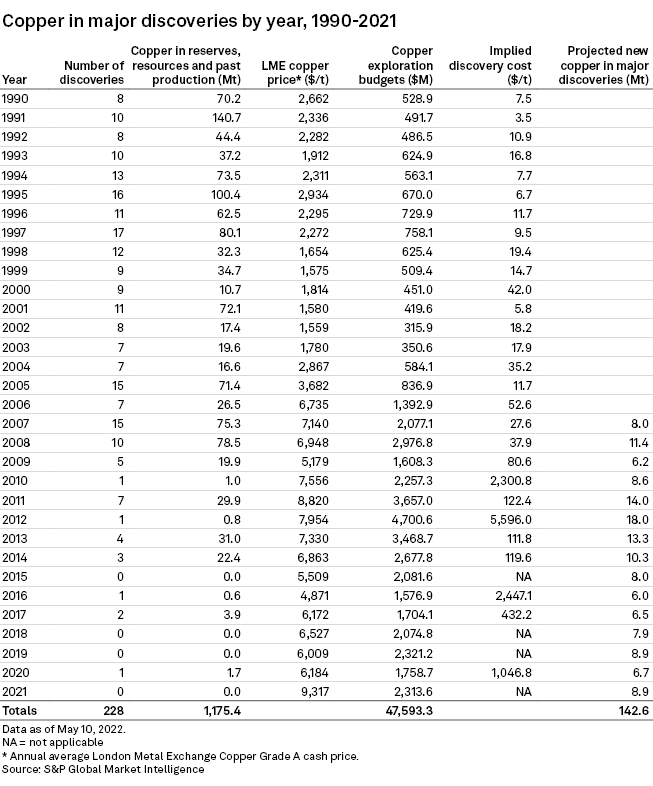

Our annual analysis of major copper discoveries has identified 228 copper deposits discovered between 1990 and 2021, containing 1.18 billion tonnes of copper in reserves, resources and past production. While one discovery dropped off our list as it no longer met our criteria, the overall volume of discovered copper increased more than 50 million tonnes since our 2021 analysis.

Elevated copper exploration budgets over the past several years has not led to a meaningful increase in the number of recent major discoveries. While the volume has increased by 50 million tonnes compared to our analyst last year, most of the increase came from assets that were discovered in the 1990s.

With copper demand expected to outpace refined copper production, the industry is not making enough new, high-quality discoveries to support the long-term pipeline.

Although a significant amount of copper has been added to the 1990-2021 total discovered compared with the period in our 2021 analysis, the downward trend in rate and size of major discoveries over the past decade continues. All the new copper came from older, well-developed discoveries from the 1990s. In fact, we have only been able to identify three additional discoveries over the past five years, which added only 5.6 Mt. This is a direct result of companies shifting more of their exploration budgets toward known deposits and existing mines — a decadelong trend identified in our annual Corporate Exploration Strategies study. Additionally, given the 50.7% increase in the London Metal Exchange average copper price year over year in 2021, it was to be expected that older, producing assets would reflect price-related adjustments to reserves and resources.

The discoveries dataset prepared by S&P Global Market Intelligence includes all deposits containing at least 500,000 tonnes of copper in reserves, resources and past production. The year of discovery corresponds with the year of the initial drill program that identified potentially economic mineralization eventually resulting in a definition of copper in reserves and resources that meets or surpasses our major discovery threshold criteria.

Industry continues to focus on older, known deposits

Since the beginning of our discoveries research series, we have documented a declining number of annual major new copper discoveries, and 2021 proved no exception. Only 12 of the 228 deposits included in this analysis were discovered during the past decade and contain only 60.5 Mt, or 5.2%, of all copper discovered since 1990. While we believe this reflects the current situation, new assets naturally require more time to develop, and several will certainly grow past our threshold to register as major discoveries.

To account for the lag, we estimated the amount of copper in discoveries expected to meet our criteria in the future. We project the amount of discovered copper from the past 15 years to increase by under 143 Mt. By comparison, nearly this much copper was discovered in 1991 alone. Even when further exploration efforts are completed over the coming years, our view remains that the current decade will be the poorest for copper discoveries that we have recorded since our data set began in 1990.

The other contributing factor to the lack of major discoveries is a key shift in focus within the exploration sector. Since the 1990s, the industry has halved its share of annual copper budgets devoted to grassroots exploration, with the 34.0% allocated in 2021 near the low of 32.2% set in 2009. Compare this with the late 1990s and early 2000s, when grassroots budgets ranged between 50% and 60% of exploration allocations.

Companies are focusing more on established assets: juniors at projects with existing resources and majors at and around their mine sites. Although some new major discoveries have been found at late-stage projects and existing mining camps, the probability of finding new major discoveries at such projects is lower than at riskier, early-stage prospects.

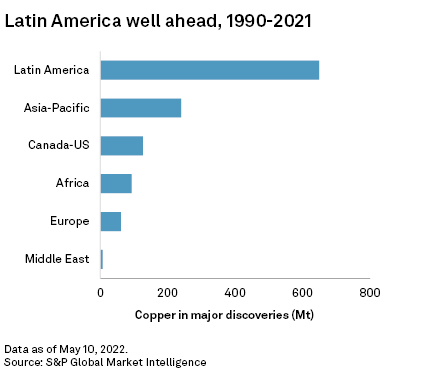

Latin America remains top region for discoveries

Latin America remains the top region for copper discoveries. As detailed in our CES data set, this is unsurprising, as the region has attracted nearly 40% of annual copper exploration budgets over the past two decades. Chile and Peru alone account for 78.3% of the 648.7 Mt discovered in Latin America and 43.2% of the global total found since 1990.

Major discoveries in Chile include Norte and Pampa, both adjacent to Escondida . BHP Group Ltd. (57.5%) and Rio Tinto Group (30%) discovered them in 1991 and 2008, respectively. Cyprus Amax Minerals Group (91.5%) discovered Cerro Verde in Peru in 1995. The largest discovery in our data set was — and still is — Collahuasi in Chile. Collahuasi is currently the world's second-largest producing copper mine. Interestingly, the deposit was discovered by oil giants Shell PLC and Chevron Corp., along with miner Falconbridge (Australia) Pty. Ltd., in 1991.

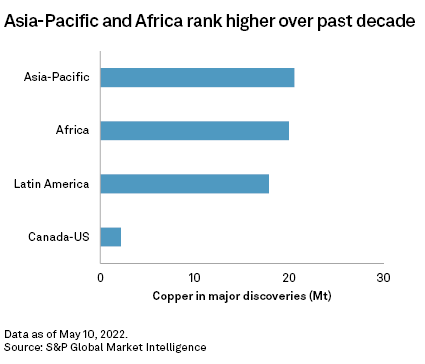

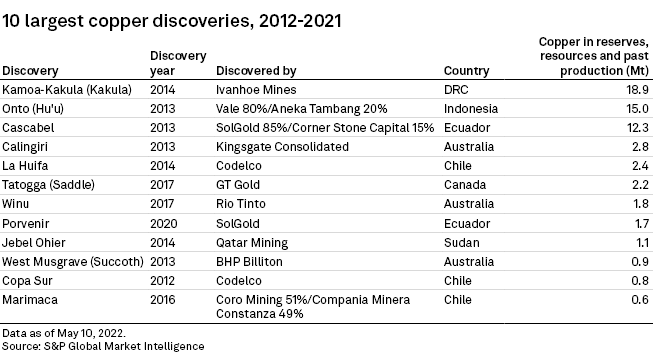

While we believe Latin America will remain the top region for discovered copper in the foreseeable future — especially since the region continues to attract the lion's share of global copper exploration budgets — there have been major discoveries elsewhere in recent years. In fact, in the past decade most copper was discovered in the Africa and Asia-Pacific regions. This is due to several major discoveries: Ivanhoe Mines Ltd. 's discovery of the 18.9-Mt Kakula deposit at Kamoa-Kakula in Democratic Republic of Congo in 2014, and the 15.0-Mt Onto (also known as Hu'u) deposit in Indonesia, discovered in 2013 by PT Sumbawa Timur, a joint venture between Vale SA (80%) and PT Aneka Tambang Tbk (20%).

Impact to pipeline

Our recent research shows that, in the short term, the currently strong copper demand is expected to be met as several high-quality assets are set to come online or expand, such as Quebrada Blanca , Quellaveco and Grasberg , in Chile, Peru and Indonesia, respectively. The project pipeline in the medium-to-long term, however, has thinned out considerably. Given that the declining discoveries trend is showing no signs of reversing, copper demand will nevertheless exceed production by 2025-26, even if low-probability projects reach production.

Of the 228 major discoveries included in this analysis, 145 are not yet in production, and 114 of those have yet to complete feasibility studies. Just nine have finalized construction plans and begun development. A significant amount of work will be required to advance the world's major deposits to production in the coming years.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.