S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 25 May, 2023

By Ruilin Wang

In the monthly Commodity Briefing Service (CBS) report, S&P Global Commodity Insights discusses the copper market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

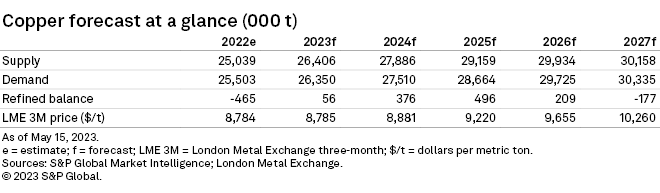

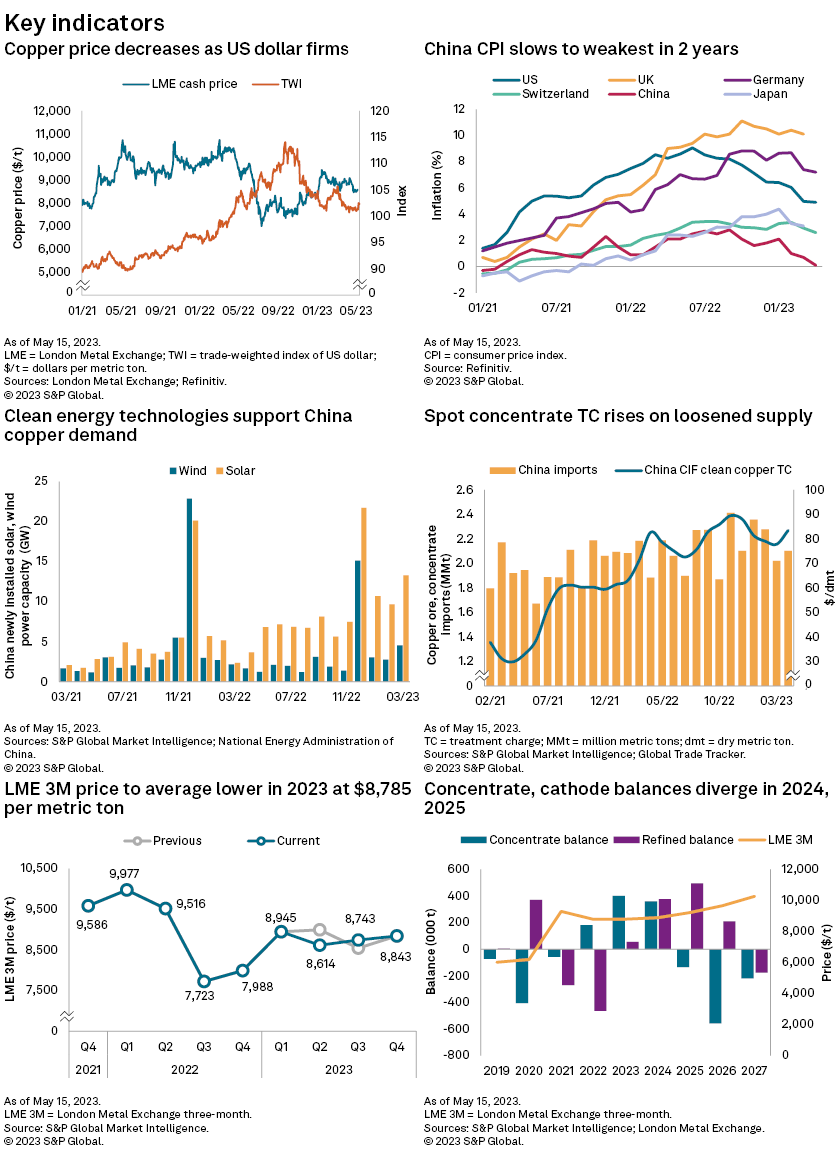

➤ The London Metal Exchange three-month (LME 3M) copper price dropped to $8,275 per metric ton on May 12 from $9,086/t on April 14. This was due to global copper demand weakness and bearish market sentiment amid a further hike in US interest rates in May and the slowest consumer price index in China since the start of 2021.

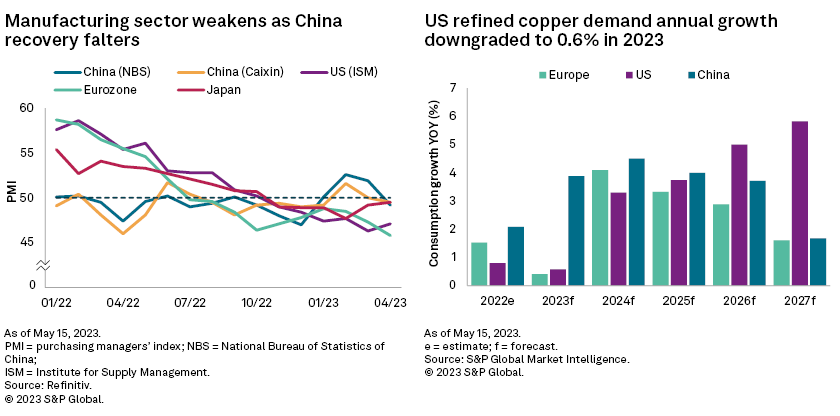

➤ We have downgraded our forecast 2023 US copper consumption year-over-year growth to 0.6% from 1.8%, as higher mortgage rates have cooled property sales, and weak confidence in the real estate sector has continued to depress investment and construction activity.

➤ In China, the real estate sector continues to labor, and demand weakness also came from slowing infrastructure investments in April. There continues to be strong growth in wind and solar power capacity, however, and robust output of air-conditioner units and electric vehicles.

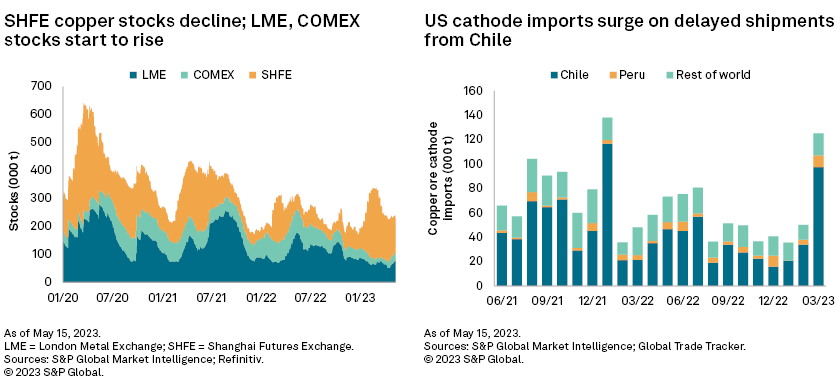

➤ Sufficient global supply of copper cathode has elevated stocks at COMEX and the LME. Although cathode stocks continue to fall at the Shanghai Futures Exchange (SHFE), copper cathode supply remains sufficient for downstream consumers.

➤ Global copper demand is likely to trend higher over the next few months. Meanwhile, we expect a weaker US dollar — affected by the US economic slowdown and the likely pause in US interest rate hikes — to support copper prices in the second half.

➤ We have downgraded our LME 3M average copper price forecast for the June quarter to $8,614/t following the recent price correction, although we have upgraded our September-quarter forecast to $8,743/t. Our LME 3M copper price forecast for full year 2023 has been downgraded to $8,785/t from $8,830/t.

Analyst comment

The LME 3M copper price has been falling from $9,086/t on April 14 on both weaker-than-expected China demand in the peak season for construction activity and subdued consumption in the US and Europe as interest hikes weigh on economic growth. The copper price tumbled to $8,488/t on April 27, weighed down by financial sector turbulence and expectations of the US Federal Reserve further increasing interest rates 25 basis points in May. In China, the slowest consumer price index rise since the start of 2021 has added to concerns over the strength of the country's economic recovery, pushing the LME 3M copper price down to a multimonth low of $8,275/t on May 12.

The European IHS Markit manufacturing purchasing managers' index (PMI) weakened from 47.3 to 45.8 in April. In the US, the Institute for Supply Management manufacturing PMI increased to 47.1 in April from 46.3 in March — the lowest reading since May 2020 — but it was the sixth consecutive month in which the PMI remained in contractionary territory. Higher mortgage rates cooled US property sales, which dropped 2.4% in March from February and were down 22.0% from a year ago, according to the US National Association of Realtors. A lack of confidence in the real estate sector has continued to depress investment and construction activity, with the US Census Bureau reporting new privately owned housing unit starts down 18.9% year over year during the first three months of 2023. We expect that weak copper demand from the real estate sector could almost offset the positive performance from the US power and EV sectors, which has prompted us to downgrade 2023 US copper consumption annual growth to 0.6% from 1.8%.

In China, pent-up demand from the post-COVID-19 recovery contributed to expanding manufacturing activity in the March quarter, but momentum has faltered into the June quarter. Both National Bureau of Statistics (NBS) and Caixin PMIs dropped below 50 in April, with the total new order index falling to 48.8 from 53.6, according to NBS, and the corresponding export index dropping to 47.6 from 50.4. Both short-term loans and medium- and long-term loans fell in April, reflecting lackluster consumer confidence and willingness to buy houses. While the real estate sector remained sluggish, recent weakness also came from infrastructure investment, as indicated by wire and cable producers receiving fewer orders from the projects compared with the March quarter. It is important to note that demand in China remained higher than during the equivalent period of 2022, however, thanks to strong growth in wind and solar power capacity, and robust output of air-conditioner units and EVs. Downstream restocking enthusiasm picked up following a sharp price fall in late April.

Due partly to a weaker-than-expected seasonal demand improvement, global copper cathode supply has been sufficient. This is reflected in cathode stock increases at COMEX and the LME. Cathode exports by smelters in China have continued to arrive at LME warehouses in Asia, where stocks have nearly doubled over the past month. The US market has been well supplied, with increasing cathode imports from Chile and Peru, which totaled 107,171 metric tons in March, up 182% month over month and 54% year over year. Increased cathode supply from the Democratic Republic of the Congo is expected as CMOC Group Ltd.'s Kisanfu project will officially start in the June quarter. It produced 4,375 metric tons of cathode during trial production in the March quarter. Meanwhile, CMOC Group Ltd.'s Tenke Fungurume mine began exporting its cathode stocks at the end of April.

Although cathode stocks continued falling at SHFE, cathode supply remains sufficient for downstream consumers. Strong cathode production from smelters and refineries in China has enabled lower net cathode imports, which dropped 16.6% year over year in the first three months of 2023. The country's imports of unwrought copper and copper products fell 12.5% year over year in April. The second quarter is a heavy period of maintenance activity for smelters, although this tends to impact concentrate consumption more than cathode output, as most smelters have stocked enough anode to compensate for the fall in refined copper production. In addition, Jiangxi Copper Co. Ltd.'s Yantai Guoxing smelter fired up its new side-blown smelting furnace April 28. It has a capacity of 180,000 metric tons per year and replaces the old smelter that was shut down in late 2022.

Outlook

Over the next few months, global copper demand is likely to follow the adage that "demand is not that strong in the peak period, but not so weak in the slack period." We expect that the green energy transition will continue to boost copper consumption in the September quarter. The recent executive meeting of China's State Council focused on accelerating the construction of rural charging infrastructure to support EV usage and also likely sales. Thanks to the real estate sector's recovery being sluggish in the June quarter, copper demand is likely to be pushed back to the second half. On the supply side, the increased production of cathode stocks by Tenke could be partly offset by lower copper scrap availability, as the market has tightened following a sharp fall in the copper price.

With the US inflation rate cooling to 4.9% in April and uncertainties over the US debt ceiling sparking market concerns, further interest-rate hikes seem unlikely in the short term. The dollar could also face downward pressure from the slowing US economy, providing support to copper prices in the second half. We have downgraded our LME 3M average copper price forecast for the June quarter to $8,614/t due to recent price drops but have upgraded our September quarter forecast to $8,743/t. Our average annual LME 3M copper price forecast for full year 2023 has been downgraded to $8,785/t from $8,830/t, with prices for 2024–27 unchanged.

IHS Markit is now a part of S&P Global Inc.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaigns