Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 12 Sep, 2024

By Anna Duquiatan

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

See Commodity Insights' most recent market outlooks for copper, gold, iron ore, lithium and cobalt, nickel and zinc.

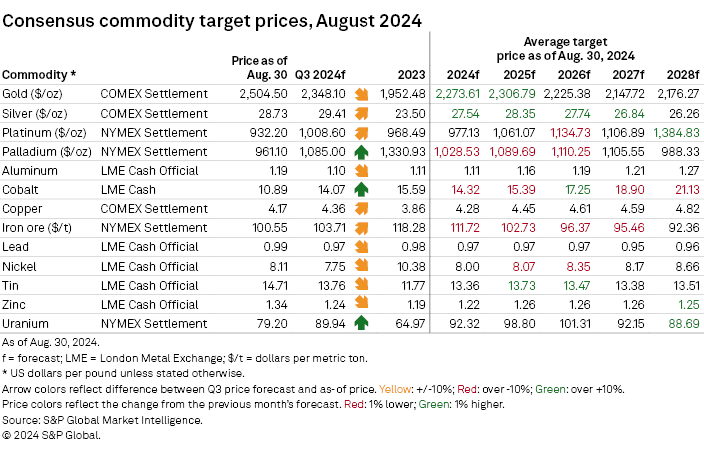

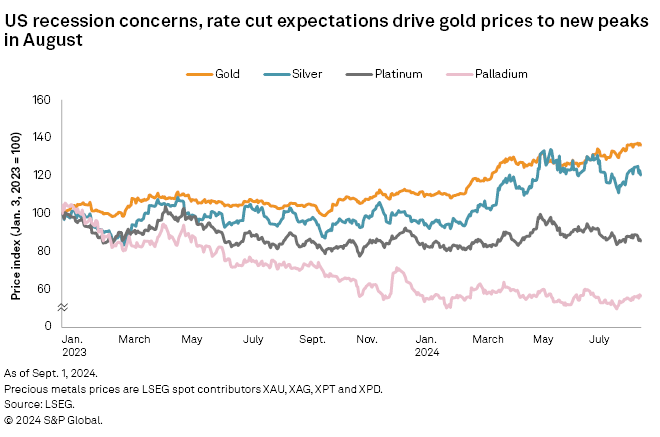

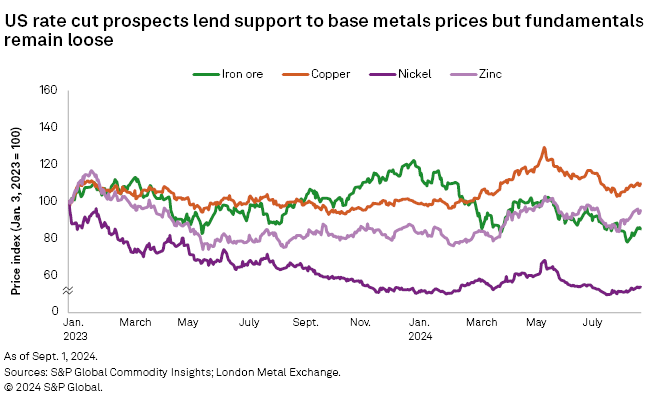

Gold prices reached a new peak in August, with US interest rate cuts all but guaranteed for September while intensifying geopolitical risks continued to drive safe-haven interest. While demand optimism fueled upgrades to consensus price outlooks for gold, industrial metals prices struggled to sustain upside influence from rate cut expectations. Prevailing weakness across the manufacturing and property sectors stifled demand expectations and, alongside China's faltering economic recovery, encouraged a downside bias across most price expectations in 2024–25.

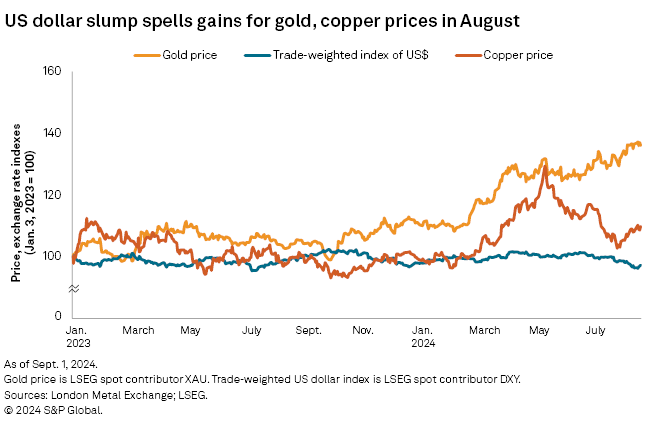

Metals prices found upside momentum in August from firming hopes of US interest rate cuts after US Federal Reserve chairman Jerome Powell gave the strongest signal yet. In a keynote address at a symposium in Jackson Hole, Wyo., on Aug. 23, Powell announced "[t]he time has come for policy to adjust," citing slowing inflation and a cooling labor market. Mixed macroeconomic indicators globally have triggered loosening fundamentals across industrial metals markets, however. Strong central bank appetite and continued safe-haven buying bolstered gold demand, but manufacturing weakness and loosening market balances kept downside risks intact for industrial metals prices.

Supportive macroeconomics and demand-side fundamentals drove the London Bullion Market Association gold price to a new record-high of $2,529.75 per ounce Aug. 20. US nonfarm payroll additions in July came in below previous monthly levels, and the unemployment rate rose for the fourth consecutive month, triggering concerns for an upcoming recession. Meanwhile, US inflation slipped to its lowest level in over three years at 2.9%, fueling expectations for interest rate cuts starting in September.

In response, the 10-year US Treasury bond yield and the US dollar trade-weighted index fell to multi-month lows. With rate cuts all but confirmed, speculation shifted to the frequency and magnitude of the upcoming cuts. On the demand side, physically backed gold exchange-traded funds (ETF) saw inflows across all regions in July for the first time since May 2023, while emerging markets remain active in central bank purchases of gold. Ongoing and heightening geopolitical risks posed by the Ukraine-Russia war, Israel-Hamas conflict and US-China tensions also continue to drive safe-haven appetite. Consensus price forecasts for gold have been upgraded by 1.5% on average across 2024–25 and by a more moderate 0.4% in the 2026–28 period.

Silver prices averaged below $29/oz in August after breaching the $30/oz threshold over several days in the preceding months. Despite the slight pullback, consensus price expectations remain bullish, reflecting upgrades of 2.0% on average for the 2024–27 period. Renewed ETF interest and strong industrial demand combine with macroeconomics and investors' flight-to-safety to drive demand support for silver. Given its application in solar panels, automotive and electronics manufacturing, demand is expected to continue outstripping supply.

Platinum and palladium prices continued to trade sideways on either side of $900/oz in August, but consensus price targets for the 2024–28 period diverge for the two metals, with forecasts upgraded 0.4% on average for platinum but lowered 2.2% for palladium. The downgraded outlook for palladium prices is linked to the expected gradual phaseout of internal combustion engine vehicles in favor of electric vehicles and the rising substitution by platinum in catalytic converters, which lowers palladium demand. Meanwhile, expectations for market deficits to persist for platinum support the forecast upward price trend.

The London Metal Exchange three-month (LME 3M) copper price fell to a near five-month low at $8,757 per metric ton Aug. 5 before rebounding to $9,376/t on Aug. 27. Price falls that incentivized physical purchases in China along with hopes for a seasonal demand recovery after August, and the imminent US rate cut provide a fillip for demand, but accumulating inventories continue to cap the upside for price. Copper stocks on Aug. 15 were 139.7% higher month over month at COMEX and at their highest level since September 2019 at LME, with inventories in the latter bolstered by record-high China refined copper exports into the LME warehouses in Asia in June. Manufacturing purchasing managers' indexes (PMI) across major economies slid further into contractionary territory in July, likely helped by a seasonal activity lull as several mills in the US and Europe went offline for the summer. The underlying tightness in the concentrate market continues to carry sway, with copper consensus price forecasts upgraded 0.4% on average for the 2024–28 period.

The LME 3M nickel price reached a six-week high at $17,035/t Aug. 20 on speculator short-covering but pulled back to $16,603/t Aug. 22 as investors turned their attention to rising LME stocks. Investment fund net short positions at the LME fell from a near six-month high in mid-August after reports of moderating US inflation emboldened speculators to close their nickel short positions. However, the supply side of the nickel market remains bearish, with the LME nickel open tonnage in July reflecting the largest monthly increase thus far in 2024, driven by inflows from China and the arrival of the first-ever delivery of Indonesia-origin nickel. LME nickel inventories were at a near three-year high at 116,616 metric tons Aug. 22.

While there are reports of top nickel producer Indonesia considering plans to reduce China-based ownership of new nickel projects to qualify for US tax credits, environmental, social and governance concerns, alongside rapidly evolving nickel mining and trade policies remain significant obstacles to attracting investment from companies outside China. With the nickel market expected to remain in a surplus, consensus price outlooks have been downgraded 0.9% on average over the five-year forecast period.

Prospects of sluggish demand drove down the LME 3M zinc price to an average of $2,680/t in the first half of August, but a weakening US dollar and expectations of a US rate cut led to the price rallying to $2,883/t on Aug. 27. Manufacturing PMIs in July across major economies were in contractionary territory. US manufacturing output was down in July amid a decline in the index for motor vehicles and parts, while new car registrations in the eurozone in the first half of the year remained below pre-pandemic levels. In China, the property sector remained subdued, while lower output from the steel and automotive manufacturing sectors drove a slowdown in year-over-year industrial production growth. Although a tight concentrate market prevails, as signaled by sinking treatment charges, tepid demand and refined market surpluses cap the upside for zinc price. Hence, consensus price expectations for zinc have been adjusted higher by a modest 0.4% on average in the 2024–28 period.

The Platts IODEX 62% Fe iron ore price fell to a 21-month low of $95.25 per dry metric ton Aug. 14 on anticipation of lagging China demand and climbing seaborne iron ore supply. Platts is a part of S&P Global Commodity Insights.

The China steel industry remains in the doldrums, with a seasonal lull in manufacturing activity, reduced domestic vehicle sales and a weakening property sector stifling steel demand and weighing down prices. China domestic hot-rolled coil prices fell to their lowest level since April 2020, which was impacted by COVID-19. In response to tepid demand, China steel mills have begun to scale back production more aggressively, with data from the World Steel Association showing China steel output dropping 9.0% year over year in July. With steel cuts expected to temper China's iron ore imports, this will coincide with a seasonal upturn in global seaborne iron ore exports in the latter half of the year. Against a backdrop of a more sobering demand outlook in China, consensus price targets for iron ore have been downgraded 1.3% on average over the five-year forecast horizon.

Demand headwinds drove the Platts-assessed European cobalt metal price to a seven-year low of $12.75/lb Aug. 19. Cobalt sulfate use in traction batteries continued to wane in July, while passenger plug-in electric vehicle (PEV) sales across top markets declined due to weakening consumer confidence, a summer demand slowdown and the imposition of higher tariffs. The top-performing PEV market, China, also saw the share of battery electric vehicles — which use larger batteries and consume more metals — shrink in July. US recession worries, lagging recovery of the Chinese economy and rising tariffs combine to dampen appetite for PEVs, while the slowing uptake has led battery manufacturers such as General Motors Co. and Umicore SA to suspend construction of battery manufacturing plants. Although major cobalt producer Glencore PLC trimmed output in the first half of the year as it reduced activity at Mutanda and Kamoto mines in the Democratic Republic of Congo, oversupply remains a concern. Copper byproduct production growth is poised to add to the overhang as cobalt-copper miners leverage strong copper prices to ramp up production, as in the case of CMOC Group Ltd. Cobalt consensus price expectations have been lowered 0.7% on average in the 2024–28 period.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.