Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 12 Aug, 2024

For trade compliance teams concerned with Russian trade sanctions, new regulation and guidance in the last few years has pushed into focus two key issues. First, the potential for goods being transshipped or transited to a third country prior to reaching Russia and second, the items being used for unintended purposes. Understanding and identifying the instances when these two examples of export risk occur has become a major challenge.

At the end of February 2024, the Group of 7 (G7) and the Global Export Controls Coalition (GECC) added a new subcategory of goods to the existing 45 HS Codes which make up the common high-priority goods list [1]. This new category, Tier 4.B, identifies 5 HS Codes specified as “Computer Numerically Controlled (CNC) machine tools and components.” The product sets covered in Tier 4.B range from horizontal lathes, grinders, milling machines, and their individual parts and components. Machine tools of this nature are also found within dual-use goods regulation under license of the US Export Control Classification Numbers 2B001, 2B002 and 2B003. Those with specific dual-use properties possess advanced features, such as a certain number of axis travelled by the machine, allowing them to produce highly intricate parts. Items now on the common high-priority goods list can be of less sophistication in terms of output or design but are of equal importance when it comes to an understanding of their end-use and end-usage.

Tier 1 or Tier 2 items of the common high-priority goods list, such as integrated circuits and chips, are those with the most extensive use by Russia on the battlefield in Ukraine. Tier 4 items, such as machine tools, are of a lower priority but still carry weight as they are actively procured by Russia for military-related purposes. With the addition of machine tools to the list, it is of interest to note who is currently trading these items with Russia, has there been a change in trading patterns between February 2024 (when they were first added to the list) and the latest customs data released in May 2024 and what affect the inclusion of Tier 4.B had on trade in these goods to date.

Major manufacturers and exporters

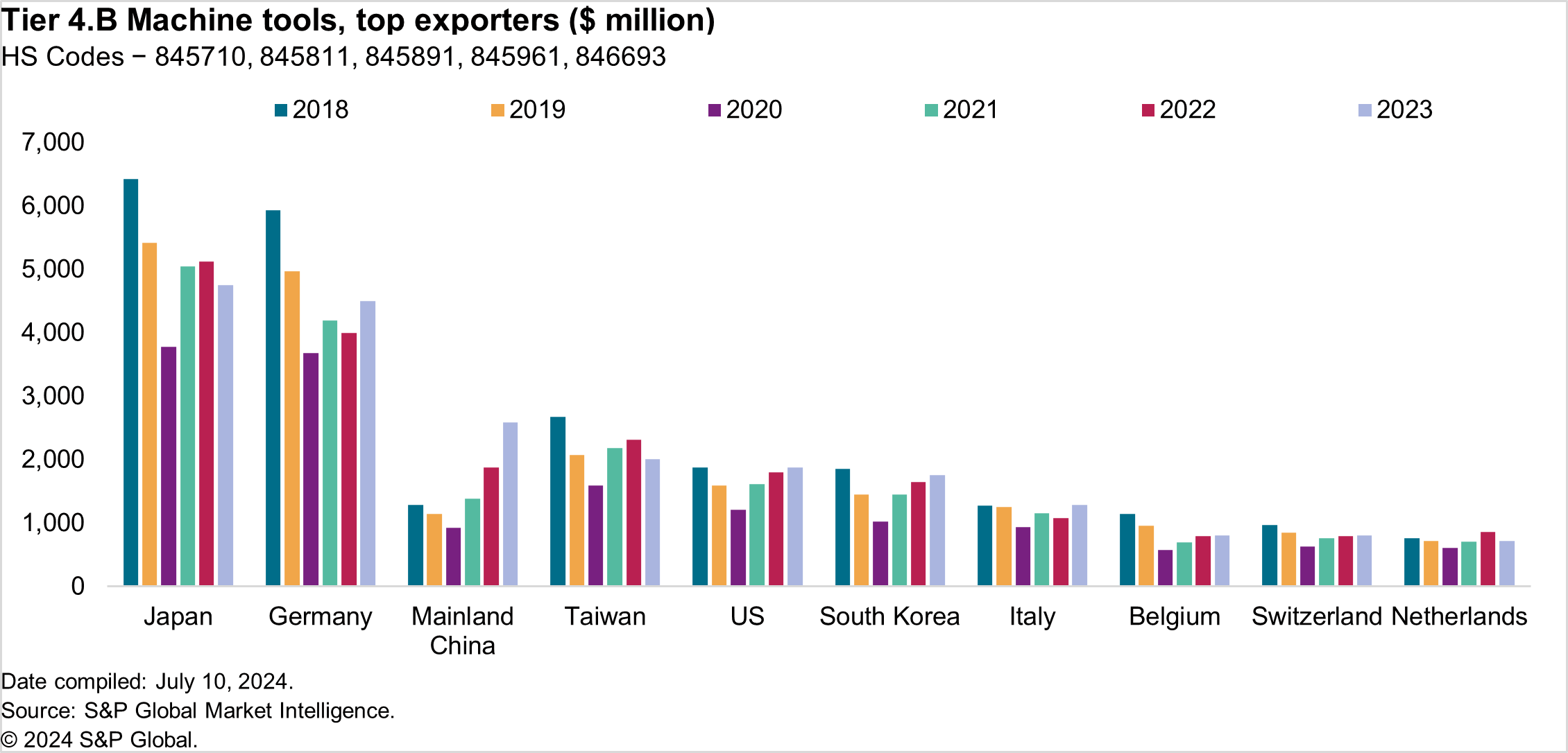

Trade in the export of machine tools by US dollar value is largely dominated by Japan and Germany, with mainland China also making significant progress in the last four years with increasing trade export values. The majority of machine tools manufactured and ultimately exported originate from Asia-Pacific and Europe.

Russian trade in machine tools — Direct and indirect

Russian direct imports from the top exporting countries for machine tools are negligible, except for mainland China. As expected, European direct trade with Russia of these goods has slowed to a trickle. For example, German exports to Russia for machine tools were reported at $107 million in 2021 and $4 million in 2023. Through May of 2024, the total trade value was $1,000.

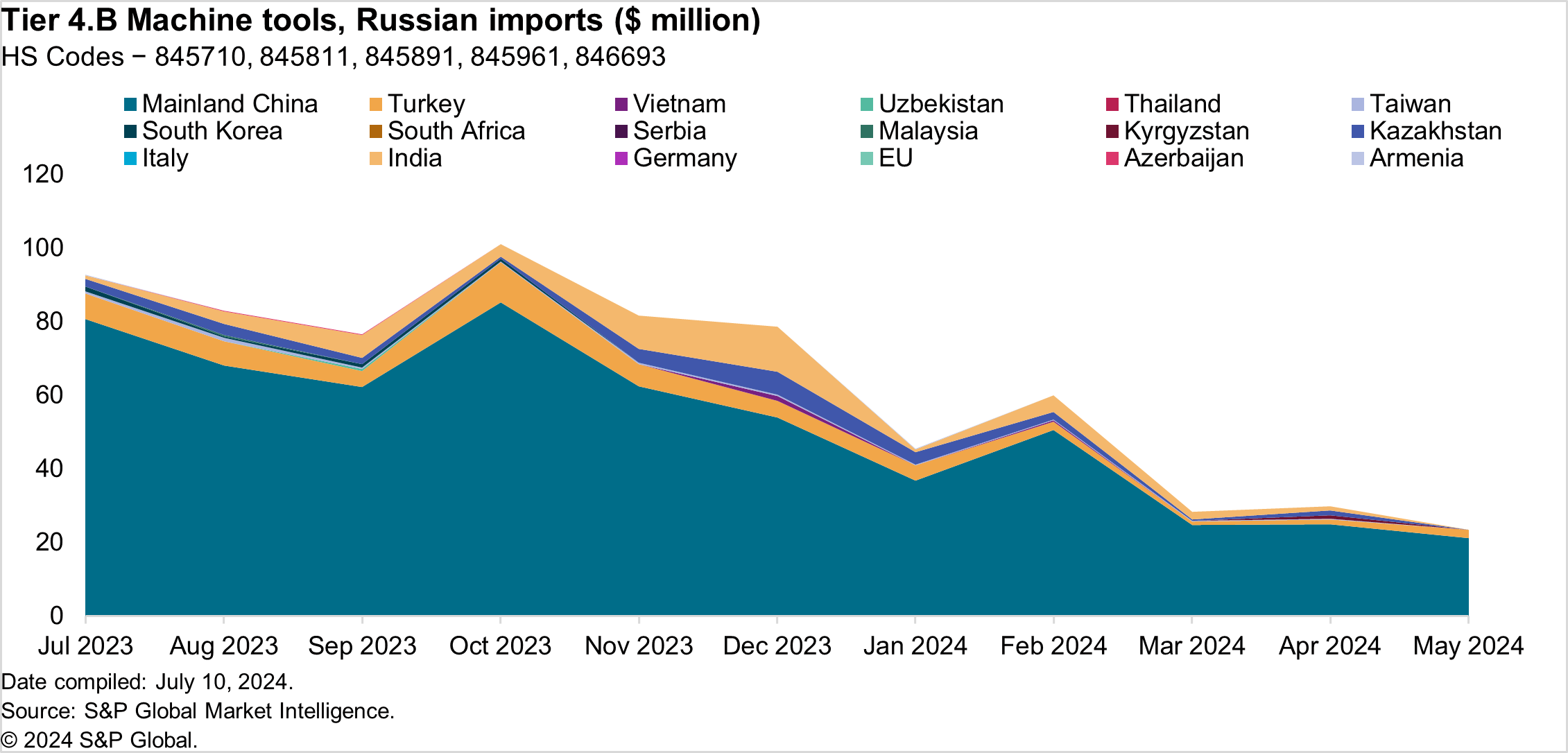

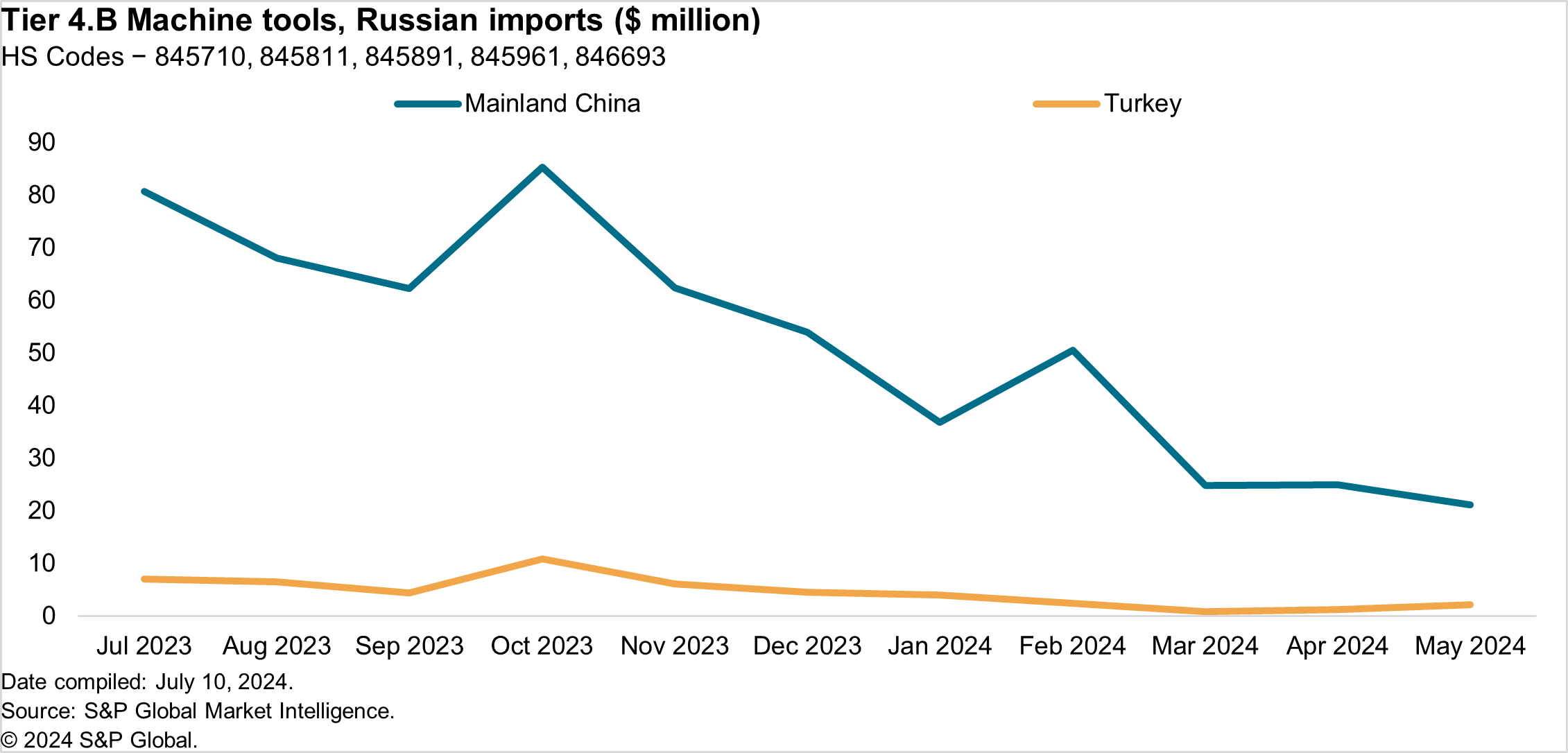

Chinese trade with Russia of these goods has made up a large share of Russian imports. In 2023, the value of trade averaged between $50 million-$80 million. From July 2023 to May 2024, data indicated a general decrease by nearly $60 million. Other countries trading machine tools with Russia, such as Kazakhstan, Turkey and India, are continuing to maintain their longstanding trading relationships in 2024. Additionally, it is interesting to note the drop in Russian imports in machine tools from these countries between February and May 2024. This suggests a reduction in the value of trade owing to the GECC’s addition of machine tools to the common high-priority goods List.

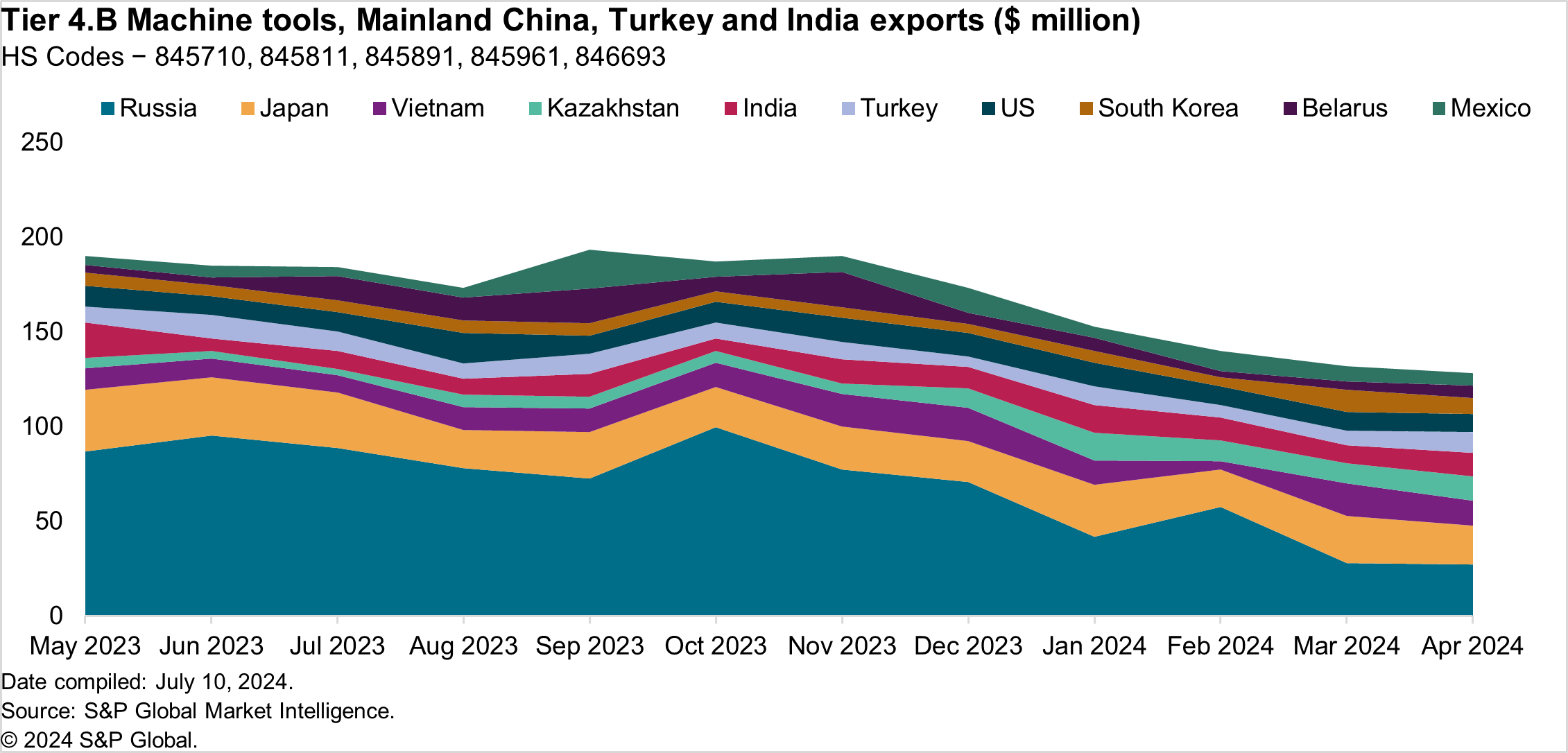

A significant majority of Chinese, Turkish and Indian exports of machine tools are directly shipped to Russia. We see a tail-off during March–April 2024 that suggests a potential consequence of the GECC restrictions on this category of items. Other notable destinations of these goods are Belarus, Vietnam, Kazakhstan and Mexico — all with the potential for transshipment and transit of goods to Russia. Nearly 20% of all exports from mainland China, India and Turkey in April 2024 were shipped to Russia and Belarus.

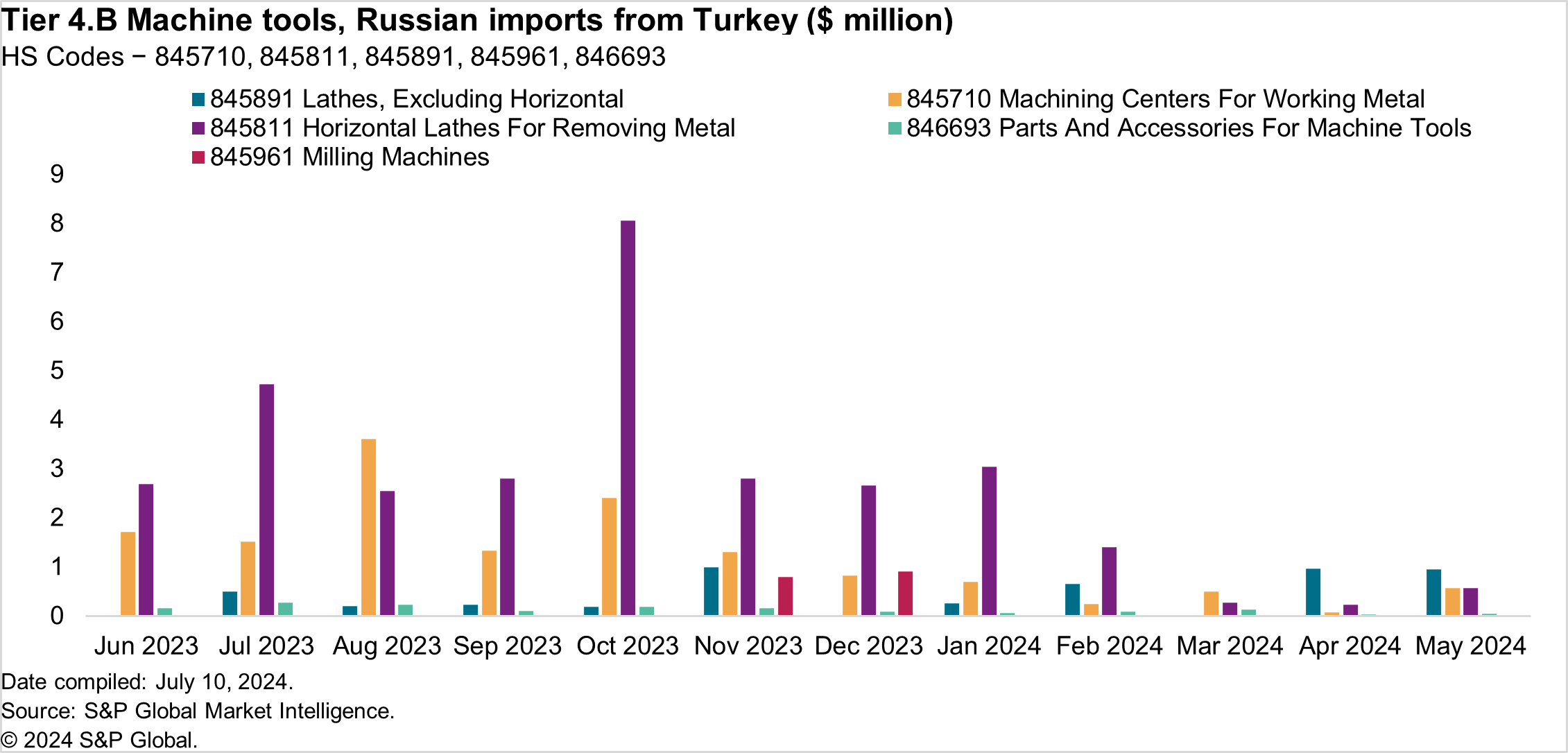

While trade from mainland China to Russia for machine tools has fallen, especially after the introduction of the new GECC control on these goods, Turkish exports to Russia have not. Exports increased by $1.3 million between March and May 2024. This long-term trend has decreased since June 2023. Since February 2024, the type of products Turkey shipped to Russia has changed. For example, Lathes covered by the HS Code 845891 — “Lathes, excluding horizontal, for removing metal, numerically controlled,” have been the most commonly traded item.

Kazakhstan-Russia trade relations

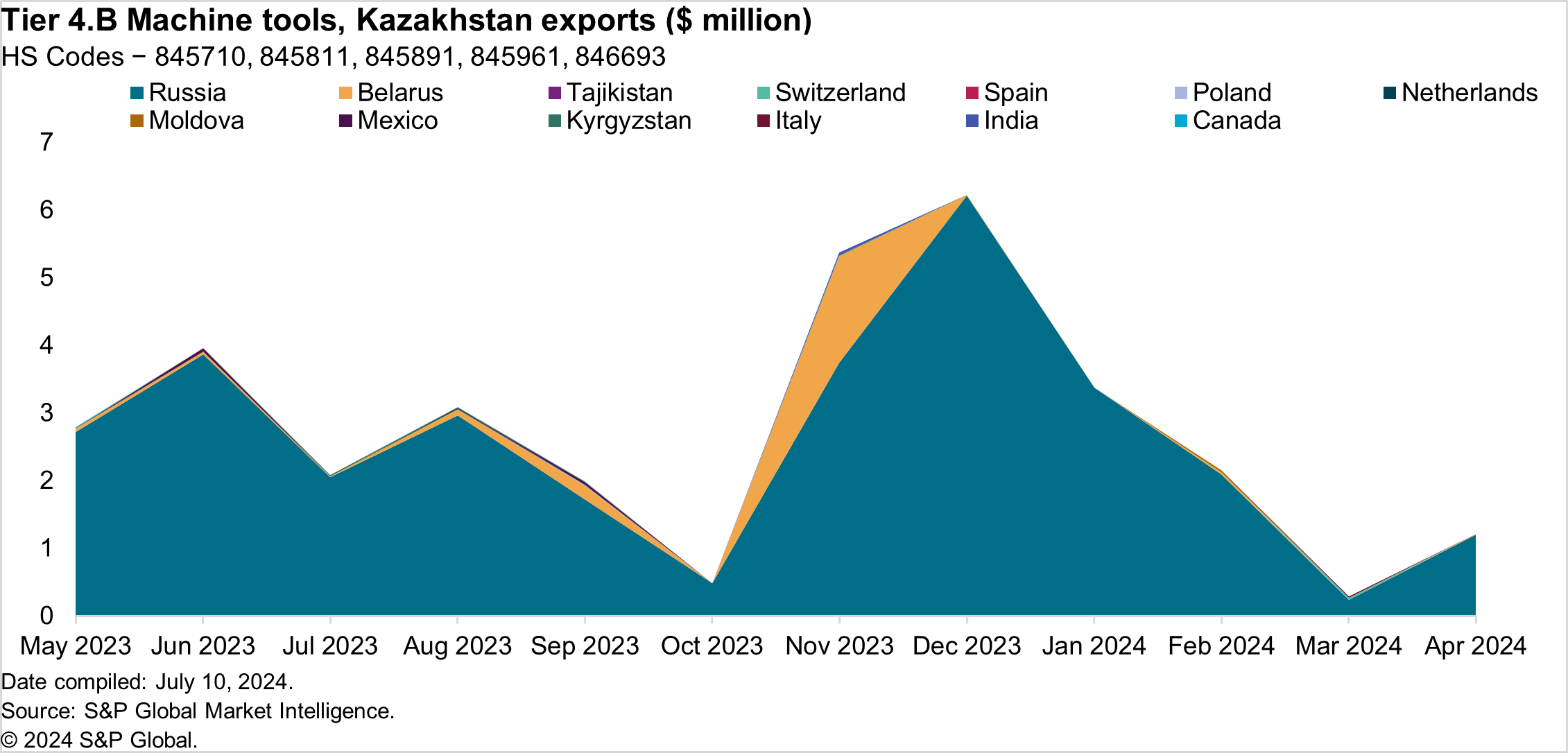

The data from Turkish exports demonstrates a minimal but consistent trade with Russia. Kazakhstan has often been scrutinized for its trading relationship with Russia, especially for high-risk dual-use items. The trade in machine tools from Kazakhstan to Russia accounts for nearly 100% of Kazakh origin shipments, according to customs data. Only Belarus appears in the export data as a significant other partner.

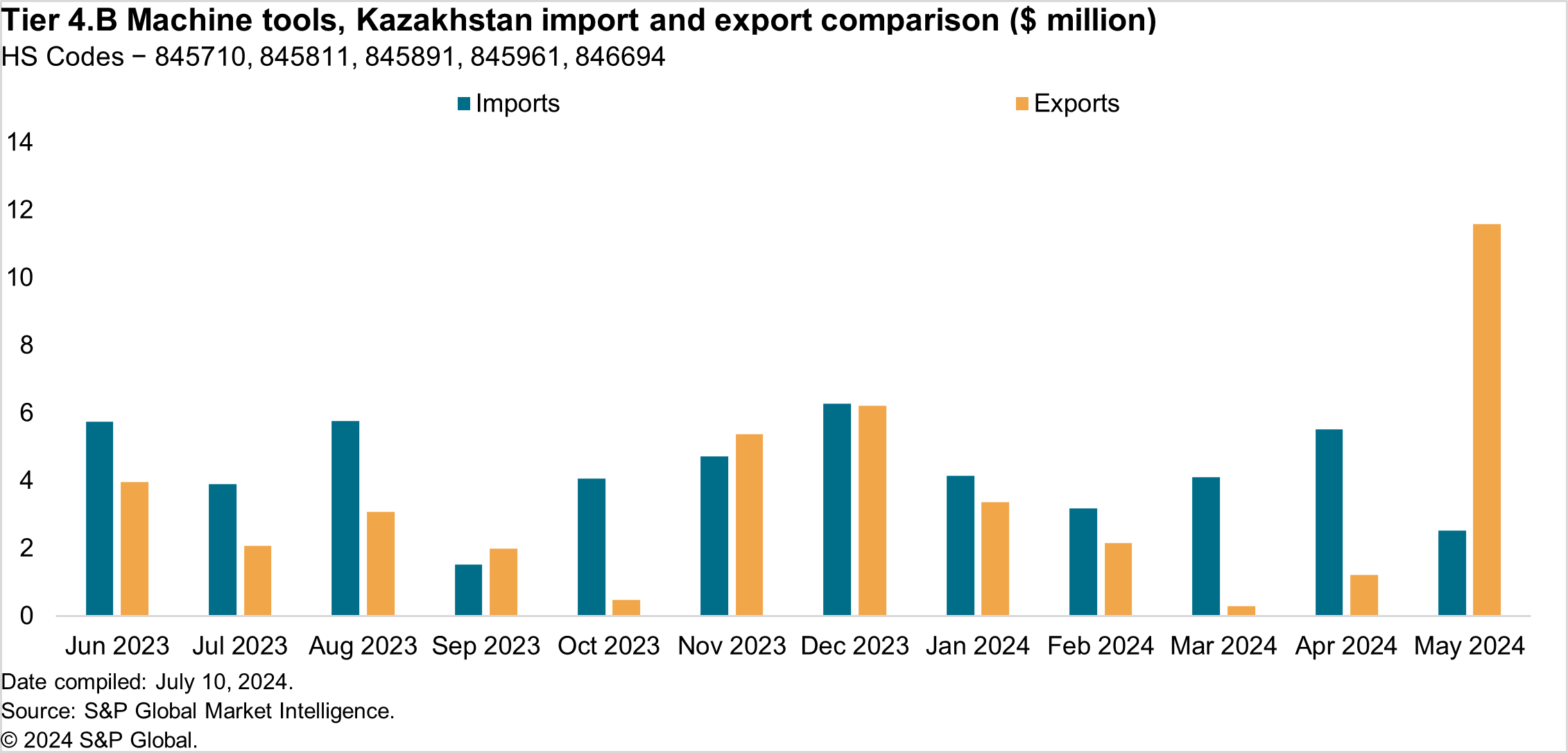

Kazakhstan’s machine tool industry is not a significant part of the country’s economy and the large amount of goods imported into Kazakhstan either transit or transship through the country before reaching their final destination in Russia. An analysis of Kazakhstan’s import and export data for HS Codes in Tier 4.B of the common high-priority goods list, highlight in December 2023 and January 2024, the US dollar value of goods traded in both directions is very similar. For example, in January 2024, Kazakhstan imported $4.1 million of machine tools and exported $3.3 million; 99% of the value of these exports were shipped directly to Russia.

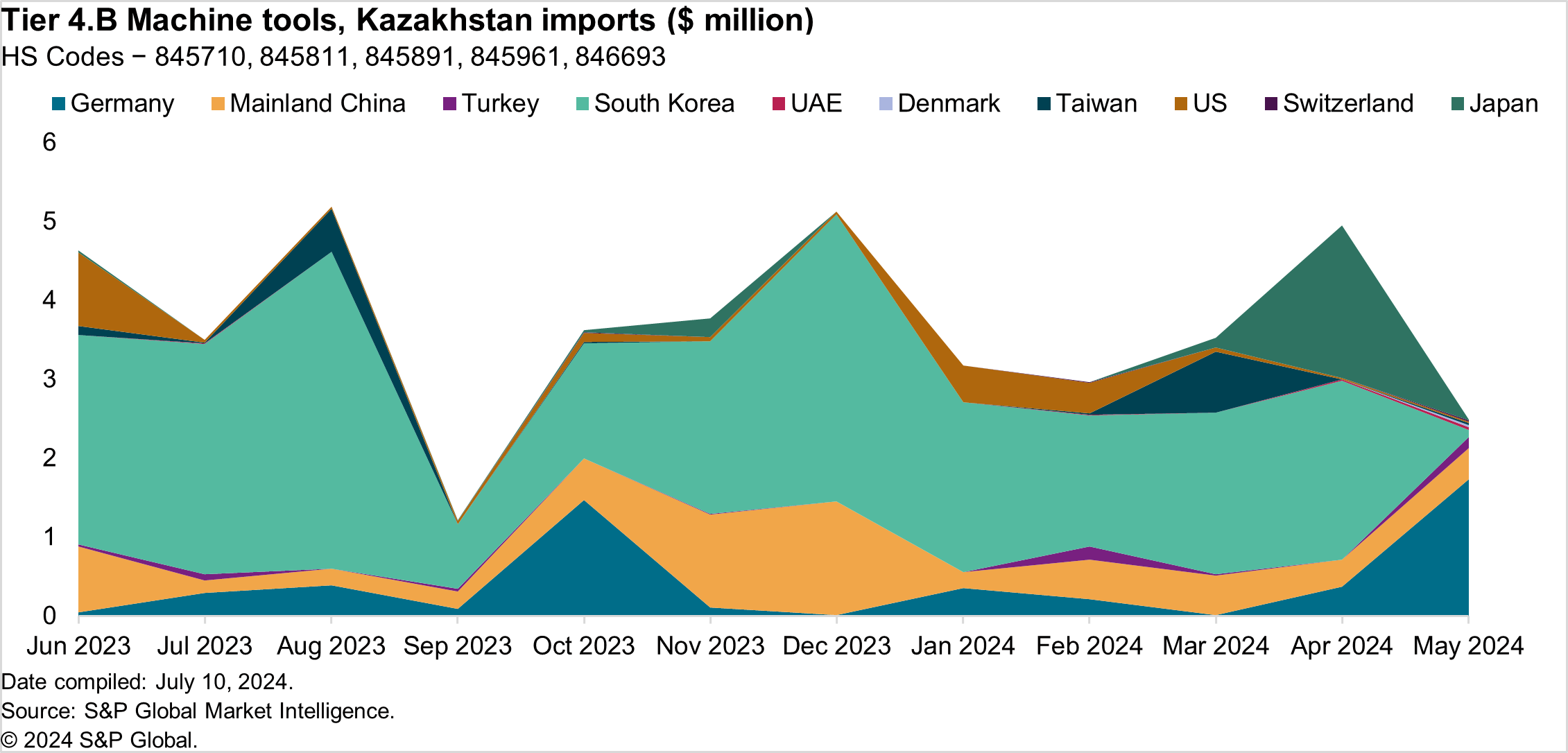

Ultimate source and origin

Kazakhstan acts as a strong transshipment point for Russian goods while not having a significant local machine tool manufacturing base. This implies that products and goods are sourced from other locations. Primarily, the items are procured from within the GECC countries. South Korea, Germany, Japan and, to a lesser extent, Taiwan hold prominent spots on the list. All have introduced regulation and advised corporates of their commitment to trade within the parameters of the common high-priority goods list and broader Russian trade sanctions. South Korean exports to Kazakhstan of machine tools average $3 million of trade value per month from June 2023 to April 2024 but we see a contraction in the latest data for the month of May 2024. The publication and subsequent heightened scrutiny by the Korean Security Agency of Trade and Industry (KSATI) in April 2024 of an extensive document outlining the obligations of firms shipping items on the common high-priority goods list has potentially contributed to the fall in the trade of South Korean machine tools to Russia.

South Korea, Germany, Japan and Taiwan are the world’s biggest manufacturers and exporters of sophisticated machine tools, and while they are not engaged in direct trade with Russia for these particular goods, the process of transshipment via third countries facilities their movement. Ultimately, they are often the original source of machine tools entering Russia.

The transshipment of machine tools to Russia is largely promoted by Kazakhstan. Transshipments from other countries involved in Russian transshipment, such as Turkey, Vietnam, Uzbekistan and Thailand, occur less frequently and in reduced quantities. The pattern of trade between Russia and Kazakhstan is cyclical but the route remains an important conduit for the movement of machine tools to Russia.

Other countries, such as India, Turkey and mainland China, have been closely documented in international media as having a more considerable direct trading relationship with Russia in goods deemed to be high-risk[2]. This is also the case in the context of machine tools, with all three countries continuing to ship these items to Russia. Equally, it is important to highlight that while there is a willingness to transport machine tools, they are being done so in reduced quantity and value. In May 2023, the value of machine tools exported to Russia from mainland China, Turkey and India totaled $90 million; in May 2024, it reduced to $25 million.

With only three months of trade data to analyze since the G7 and GECC countries implemented restrictions on the shipment of machine tools to Russia, trade value has reduced in all circumstances, both via transshipment and direct journey. The key indicator for risk remains Kazakhstan as the prime transit country for the movement of machine tools to Russia from their original source and manufacturing locations in Germany, Taiwan, Japan and South Korea. Mainland China, India and Turkey are still shipping machine tools to Russia but in increasingly smaller quantities, suggesting that restrictions in the trading of these goods by the GECC is having its desired effect. Within the latest trade data, machine tools have not been shipped to Russia from a new partner country since restrictions were placed on the export of machine tools. Russian import of these goods remains concentrated across a handful of known locations.

Overall, it appears that the G7 and GECC restrictions on machine tools in Tier 4.B is influencing the size and value of trade in these items to Russia. The trade in goods from mainland China to Russia is down during February–May 2024 when the new restrictions were announced, and the general trend is downward over the prior 12 months from June 2023. An emphasis on restricting the export of machine tools from South Korea to Russia has also reduced the value of goods to $88,000 in May 2024 from previous monthly figures of $3 million in February and March. While South Korea’s latest trade data shows a major difference during January–May 2024, Germany has moved in a different direction and mostly, via transshipment, has exported $1.7 million of machine tools to Kazakhstan. This is Germany’s largest export total for these goods to Kazakhstan in a single month since June 2023.

Subscribe to our complimentary Global Risk & Maritime quarterly newsletter for the latest insight and opinion on trends shaping the compliance and shipping industry from trusted experts.

[1] See US Department of Commerce. “Common High Priority List, 2024,” https://www.bis.doc.gov/index.php/all-articles/13-policy-guidance/country-guidance/2172-russia-export-controls-list-of-common-high-priority-items

[2] See Nikkei Asia. “Cracks in G20 let Russia grow trade with China and India, 2024,” https://asia.nikkei.com/Politics/International-relations/Cracks-in-G20-let-Russia-grow-trade-with-China-and-India.

Download Whitepaper