Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 May, 2016 | 09:30

Highlights

The Basel Committee wants banks to store more capital against mortgage loans. Dutch banks could see their capital ratios slide under the proposals.

Dutch banks particularly are in line to suffer pain, Claire McNicol, a credit analyst at Rabobank, said in an interview.

Dutch banks could see their capital ratios significantly eroded under proposed new global rules on estimating the riskiness of mortgage loans, S&P Global Market Intelligence calculations show.

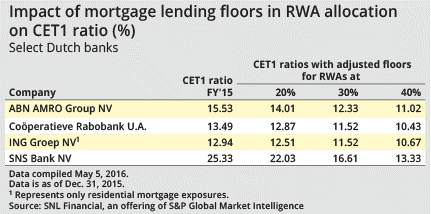

ABN AMRO Group NV would lose more than 450 basis points from its common equity Tier 1 ratio, and ING Groep NV more than 220 basis points, if they are forced to adopt minimum risk weights of at least 40% for their mortgage loan books, according to calculations based on publicly available data. Their ratios would fall to 11.02% and 10.67%, respectively, from 15.53% and 12.94% as at Dec. 31, 2015. Rabobank's would slide to 10.43% from 13.49% in the same scenario. In the case of SNS Bank NV, a much smaller lender, the effect is more dramatic, with its CET1 ratio plummeting to 13.33% from 25.33%.

With the highest loan-to-value ratios in the eurozone, thanks partly to laws making mortgage interest payments fully tax-deductible, Dutch banks are among the most exposed to proposed rule changes by the Basel Committee on Banking Supervision. The top global source of banking standards wants to make mortgage loan-to-value ratios a key part of its standardized models for calculating risk weights — the adjustment made to assets based on the likelihood of potential losses. It also intends to limit the deviation of banks' own in-house models from its standardized approach by imposing capital floors.

Dutch banks particularly are in line to suffer pain, Claire McNicol, a credit analyst at Rabobank, said in an interview.

"They would need to raise capital or reduce the amount of residential mortgages on their balance sheet," McNicol said, adding that any retreat by banks from property lending or remortgaging could open the door to competitors such as insurance companies.

Rabobank in March sold €1 billion in mortgages to insurance company VIVAT NV. The bank said it wanted to reduce its capital charges and took advantage of appetite among institutional investors for investments with long-term duration.

Currently, the Basel Committee's standardized approach to modeling credit risk assigns a risk weight of 35% to residential mortgage loans. Under its proposed changes, these would rise to 45% for loans with LTVs from 80% or above, and to 55% for LTVs of more than 90%. Mortgages with LTVs of more than 100% would require the risk-weight to be calculated on the basis of the borrower's creditworthiness.

At the same time, capital allocations resulting from banks' internal models may have to be at least a minimum percentage of the standard model's recommendations, under Basel's capital floor proposal.

Average loan-to-values for Dutch mortgages are 101%, compared to a 79% average for the eurozone, according to the ECB. Yet despite the extent of borrowing by Dutch house owners, default rates in the country are relatively low, with only 0.7% of mortgage loans in arrears in 2015, compared to 1.4% in Spain and 1.6% in Italy, according to Fitch Ratings.

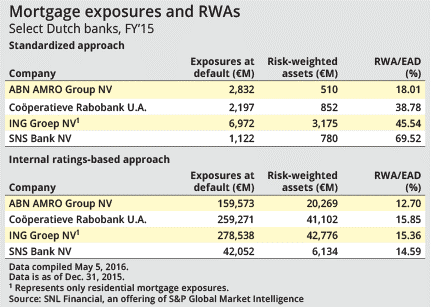

ABN AMRO currently assigns an average risk weight of only 12.7% to the €159.57 billion in mortgage loans which it assesses under its internal models, translating into risk-weighted assets of €20.27 billion. It has another €2.83 billion of loans calculated using the standardized approach, at a risk weight of 18.01%. The loans data does not differentiate between residential and commercial loans, which have a different regulatory treatment.

The disparity between in-house models and the standardized approach is starkest in the case of SNS. The bank's standardized risk weighting of 69.5% for €1.12 billion in loans compares to the 14.6% under the internal models it applies for another €42.05 billion in loans.

Spokespeople for SNS, ABN AMRO and Rabobank made no response to a request for comment on the S&P Global Market Intelligence calculations after phone calls and an emailed request early on May 6. A spokesman for ING said the bank had no comment.