Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Jun, 2022

Introduction

Banks in Southeast Asia can stay relevant in payments by leveraging low-cost national payment rails to move money instantly. But there is a catch: real-time payments using a shared public infrastructure cannot drive fee income.

In Southeast Asia's real-time payments, or RTP, markets, banks are driving greater customer engagement but losing fee income. Moving payment flows from proprietary channels to a shared infrastructure causes banks to lose control over pricing. The decline in fee income earned on money transfers for banks in Thailand illustrates the threat of cannibalization RTPs pose to payment revenues.

However, by making faster payments the centerpiece of their retail strategies, banks can level the field with financial technology companies. Consumers and businesses will continue to gravitate toward instant payments offered by banks, thanks to the appeal of real-time visibility to their cashflows.

Instant payments booming in Southeast Asia

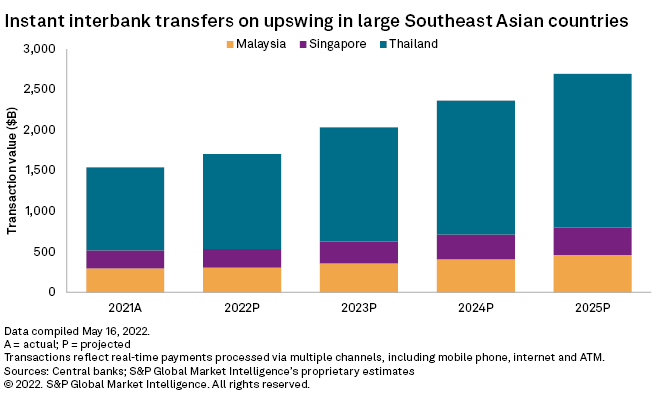

Aggregate instant interbank transfers reached $1.540 trillion in 2021 in three of the four large economies in our payments review: Malaysia, Singapore and Thailand. S&P Global Market Intelligence estimates aggregate RTP value in the three markets to grow at a compound annual growth rate of 15% to $2.695 trillion in 2025. Indonesia, the fourth country covered in our research, launched its real-time payments scheme in late 2021.

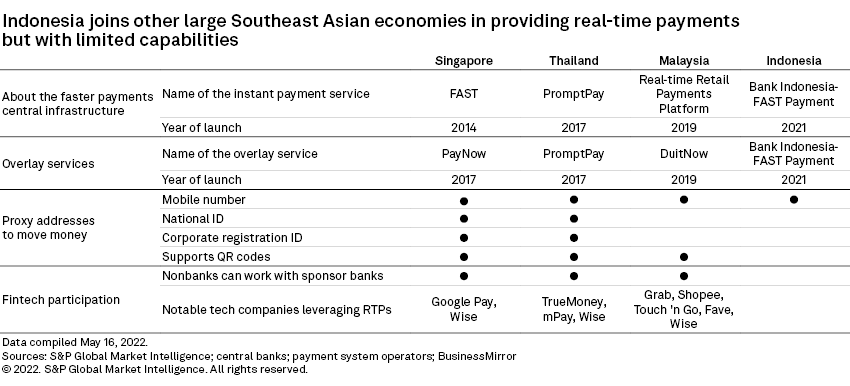

Thailand is the largest RTP market in the region, with the transaction value processed through the country's PromptPay scheme surpassing $1 trillion in 2021. Malaysia's real-time retail payments platform saw $297 billion, and Singapore's FAST scheme registered $221 billion.

Banks providing instant payments leverage rails built by banking consortiums, which allow participants to use shared digital authentication, communication, clearing and settlement services. The participation of major banks in RTP schemes, often mandated by governments, created a critical mass for others to follow. The real-time visibility eliminates uncertainty in the payment process, making RTPs popular among consumers and businesses.

The use of proxy lookup functionalities to send money using mobile numbers of recipients enables mobile payments. But the infrastructure extends to analog channels as well, supporting transfers through ATMs and merchant acceptance at the point of sale through Quick-Response codes.

RTPs pose threat to fee income

While banks in theory own the RTP infrastructure, the schemes operate at the behest of the central banks with a broad agenda to create a low-cost, interoperable digital payments ecosystem. Financial institutions benefit from economies of scale as the network gains wide adoption and the faster settlement cycles reduce their overall credit risk related to payments. Still, banks lack interchange-like incentives typically available in a card framework to recoup investments in RTP products.

Fee waivers and curbs on pricing make it harder to monetize RTP transactions and sharing a public utility diminishes their ability to differentiate. Adding to the challenge, rerouting payment flows to RTP rails from legacy payments channels could lead to cannibalization of revenues.

In Thailand, for example, banks saw their fee income earned on money transfers and bill payments decline since the introduction of PromptPay, even as mobile banking transactions aided by the RTP scheme exploded in the country.

Kasikornbank PCL, which estimated that about 8% of its noninterest income generated in 2017 was exposed to disruption from the RTP scheme, saw fee income on transaction services fall every year through 2021. At Bangkok Bank PCL, transaction services as a percentage of fees and service income fell to 15% in 2021 from 22% in 2017. During the period, Kasikornbank grew its mobile banking transactions to 4.6 billion from 660 million transactions. Overall, Thai banks saw mobile banking transactions grow to 15.50 billion in 2021 from 1.31 billion in 2017.

Similarly, Indonesia's rollout of BI-FAST in late 2021 could put pressure on fee income for banks. The historically fragmented payments landscape in the country created opportunities for large banks to create proprietary, closed-loop solutions where they could control pricing. However, as the use cases for BI-FAST rails rise in number, customer demand for the affordable RTP rails would make it difficult for banks to promote their legacy payments channels.

RTP schemes in the region currently pose little threat as direct substitutes for cards at the point of sale, online and offline. They tend to support peer-to-peer transactions and bill payments among consumers. Corporates and small businesses use them to make payroll and vendor payments. Other use cases include insurance claim disbursements, tax refunds and direct welfare subsidy transfers.

But as RTPs mature, they could directly compete with cards and eat into the lucrative interchange revenue. Merchants' aversion to high fees on card transactions could cause them to tilt toward RTP schemes, which also improve their cash operating cycles.

RTPs give banks competitive edge over fintechs

Despite the revenue uncertainty in the near term, banks cannot overlook the potential strategic gains in building product sets around faster payments.

RTPs help banks gain compelling advantages over fintechs and allow them to enhance their service offerings and improve customer loyalty. Fintechs have limited access to RTP infrastructures in the region and often need bank sponsors. While they might be able to lower processing costs when consumers fund their closed-loop wallets, the costs outweigh gains for fintechs. With regulators promoting the use of interoperable Quick-Response codes, fintechs will struggle to build closed-loop networks that discourage the use of competitors' payments products.

The richness of data in instant payment messages, especially in schemes using the ISO 20022 standard, lends to enhanced reconciliation, making banks natural partners for corporates and merchants. By combining instant payments capabilities and traditional banking services, banks can set themselves up for future innovation and monetization.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.