Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 11 Jul, 2024

By Nathan Stovall and Ronamil Portes

Banks engaged in fewer restructuring trades and put less cash to work in the bond market in first quarter as rates remained higher for longer and institutions remained focused on maintaining liquidity.

Fewer banks engaged in loss trades to reposition to underwater bond portfolios in the first quarter as intermediate rates increased in the period. Further increases in intermediate rates in the second quarter likely limited additional repositioning activity, particularly as bank managers eye the seasoning of their portfolios and the prospect of lower rates on the horizon. Incremental pruning and repositioning of bond portfolios should continue, with banks selling portions of their portfolios and using proceeds to reinvest in higher-yielding securities. Institutions appear to be approaching restructuring and new investment activity with some trepidation as they remain focused on maintaining strong capital and liquidity.

Higher rates limit repositioning activity

Few banks sought to restructure their bond portfolios and engage in loss trades in the first quarter when increases in rates pushed the value of positions further underwater.

As the yields rose 36 basis points on 2-year Treasurys and 37 basis points on 5-year Treasurys in the first quarter, the values of bonds held by banks declined and accordingly have increased the regulatory capital hit associated with any restructuring.

While banks must mark their available-for-sale (AFS) portfolios to market on a quarterly basis and those marks are captured in accumulated other comprehensive income (AOCI) and impact tangible common equity, they do not impact banks' regulatory capital, save for large banks classified as US global systemically important banks.

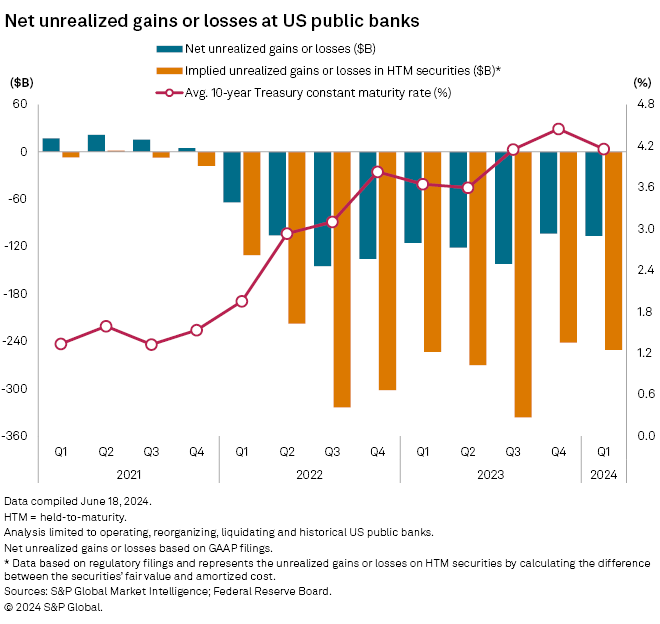

The hit to tangible book value rose modestly at the end of the first quarter, with institutions including US commercial banks, savings banks, and savings and loan associations that file GAAP financials reporting $106.2 billion in unrealized losses in their AFS portfolios, compared to $103.6 billion in unrealized losses in the prior quarter.

Despite hopes for decreases in interest rates, intermediate rates held up in the second quarter, with the yields on 2-year and 5-year Treasurys each rising 12 basis points from the last trading day in the first quarter through the last trading day in the second quarter. Further increases in rates in the second quarter should lead to more pressure on bond portfolios and tangible book values.

Still, some banks announced plans to reposition portions of their AFS portfolios in the second quarter. Synovus Financial Corp. did that in early May, and Commerce Bancshares Inc. announced similar plans around the same time.

Most banks that have engaged in loss trades have selectively pruned their bond portfolios rather than engaged in larger scale restructuring. Some have engaged in larger restructurings, with Bank of Marin Bancorp. most recently announcing that it sold 20% of its securities, or 56% of its AFS portfolio. While recording a loss on the transaction, the bank reinvested the proceeds from the sale into a combination of loans and shorter duration securities, picking up yield in the process.

Liquidity remains at forefront

Bank regulators have focused on the negative impact from AOCI on bank capital and the impact that underwater bond portfolios have on banks' access to liquidity.

After facing outflows in 2022 and much of 2023, deposit growth returned in the fourth quarter of 2023 and first quarter of 2024. While deposit growth has returned, it has not come cheap, keeping liquidity in the spotlight.

Regulators also remain focused on banks' sources of contingent liquidity, particularly since their securities portfolios cannot serve as the same source of liquidity as they have historically due to high levels of unrealized losses. Regulators have said high levels of unrealized losses have led to downgrades on liquidity ratings in some bank exams.

Regulators want to see that banks have plans to handle potential stress and have conducted tabletop liquidity exercises simulating a run on the bank. They also want to see that banks have outlined various levers to pull to access funding in times of stress, including from the Fed's discount window, and see evidence that the institutions have tested those plans.

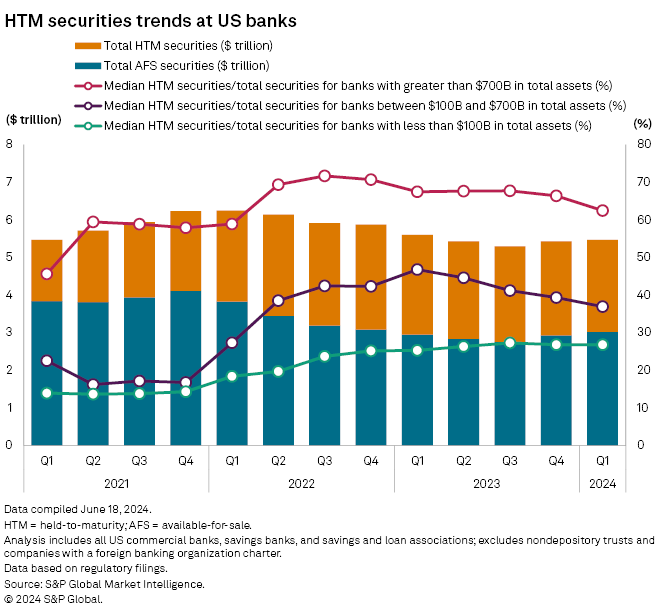

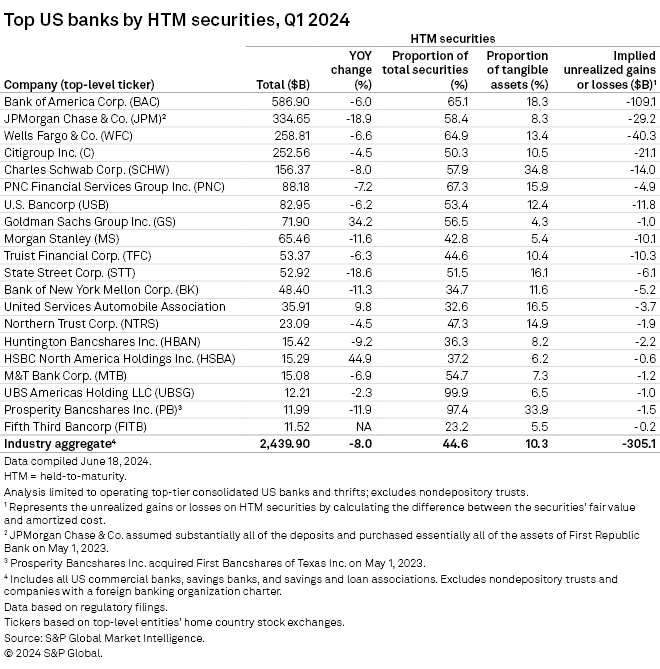

Against that backdrop, banks kept their powder dry in the first quarter and put less cash to work in the bond market in the period. Banks were even more hesitant to grow their held-to-maturity (HTM) securities portfolios, which some institutions had used to mitigate the impact from AOCI by parking larger portions of longer-term bonds, often seen as loan surrogates, in those portfolios. Those positions remained significantly underwater in the first quarter. Some banks, particularly the nation's largest institutions, relied heavily on the HTM designation since changes in AOCI impact tangible book value.

For large banks classified as global systemically important banks — those with more than $700 billion in assets — changes in AOCI also impact regulatory capital. Those institutions had placed more than 62.5% of their bond portfolios in HTM portfolios at the end of the first quarter, on a median basis, down from 66.4% in the fourth quarter of 2023. Under the proposed capital rules, dubbed the Basel III endgame, changes in AOCI will also impact regulatory capital at banks with more than $100 billion in assets.

Unrealized losses in HTM portfolios at institutions that file GAAP financials totaled $250.7 billion in the first quarter of 2024, down from $241.7 billion in the prior quarter.

Since the Fed began its tightening cycle early in 2022, the investment community has examined the ratio of loans plus HTM securities-to-deposits at a given bank to see how many deposits are tied up in less liquid assets. The ratio is also effectively a measure a duration risk on bank balance sheets, given that HTM portfolios built when rates were low have served as a drag on bank earnings streams.

Given the negative view from the investment and regulatory community, banks likely will continue to look at HTM designations with greater skepticism. While some bank managers are thinking about the prospect of lower rates on the horizon and could see opportunities to extend duration at current rates, many others seem to be looking at their investment portfolios more for liquidity than earnings in the current environment.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.